Author: Huobi Growth Academy

Abstract

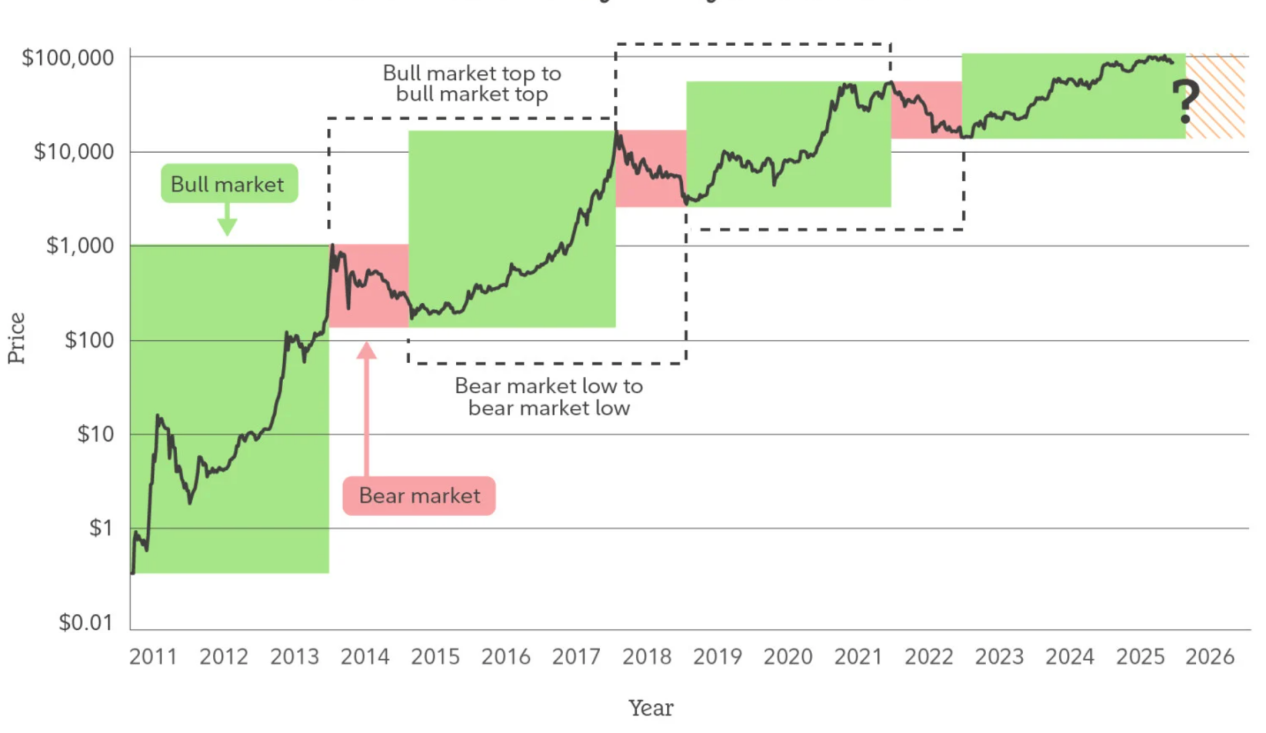

As we enter 2026, the cryptocurrency market is undergoing a profound structural transformation. The long-validated "four-year bull-bear cycle" is losing its explanatory power over the market, replaced by a structural evolution process characterized by parallel asset logics, differentiated funding behaviors, and a slowing price rhythm. The market no longer rises and falls around a single narrative; instead, different types of assets are independently priced at their respective stages, with cycles degrading from core variables that determine direction to background factors that influence rhythm.

I. The Cycle is Failing: Why We No Longer Use "Bull and Bear" to Understand the 2026 Cryptocurrency Market

For a considerable period, the cryptocurrency market has been dominated by the single narrative of the "four-year bull-bear cycle." Halving points, liquidity turning points, emotional bubbles, and price collapses have been repeatedly validated as effective analytical tools, shaping the cognitive inertia of a generation of market participants. However, as the market moves into 2025, this once highly effective cyclical model is beginning to show systematic decay in its explanatory power: market sentiment has not polarized at key time nodes, corrections no longer accompany widespread liquidity crunches, and the so-called "bull market initiation signals" frequently fail, while price trends exhibit a state of range-bound fluctuations, structural differentiation, and slow upward movement. This is not a sign that the market has "become boring," but rather that its operational mechanisms are undergoing deep changes.

The essence of the cyclical model relies on highly homogeneous funding behaviors: similar risk preferences, comparable holding periods, and high sensitivity to price itself. However, the cryptocurrency market around 2026 is gradually departing from this premise. With the opening of compliant channels, the maturation of institutional-level custody and auditing systems, and the inclusion of crypto assets in broader asset allocation discussions, the marginal pricing forces in the market have changed. An increasing amount of capital is entering the market not with "timing trades" as the core goal, but rather with long-term allocation, risk hedging, or functional use as the starting point. This type of capital does not chase extreme volatility; instead, it absorbs liquidity during downturns and reduces turnover during upswings, thereby weakening the emotional feedback loops that traditional bull-bear cycles rely on.

More importantly, the increasing complexity of the internal structure of the cryptocurrency market is also dismantling the assumption of "overall simultaneous rise and fall." The logical differences between Bitcoin, stablecoins, RWA, public chain assets, and application tokens are continuously amplifying, making it difficult for their corresponding funding sources, use cases, and value anchoring methods to be covered by the same cyclical language. As Bitcoin increasingly resembles a medium- to long-term value reserve tool, stablecoins become the infrastructure for cross-border settlement and on-chain finance, and some application assets begin to be priced based on cash flow and real demand, the so-called "bull market" or "bear market" itself loses its significance as a unified descriptive framework.

Therefore, a more reasonable way to understand the cryptocurrency market in 2026 is not "whether the next bull market has begun," but rather "whether the structural stages of different assets have changed." The cycle has not disappeared; instead, it is degrading from a core variable that determines direction to a background factor that influences rhythm. The market no longer resonates rapidly around a central narrative but evolves slowly under multiple logics in parallel. This means that future risks are no longer concentrated on a single top collapse but are more reflected in structural mismatches and cognitive lags; similarly, opportunities no longer arise from betting on the overall market but from early recognition of long-term trends and role differentiation.

From this perspective, the "failure" of the cycle is not the cost of the cryptocurrency market maturing, but rather a sign that it is beginning to detach from early speculative attributes and move towards a systematic asset stage. The cryptocurrency market in 2026 no longer needs to define direction with bulls and bears but should be understood through structure, function, and time to grasp its true operational state.

II. The Role Shift of Bitcoin: From High Volatility Asset to Structural Reserve Tool

If the cyclical logic is failing, then the shift in Bitcoin's role is the most direct and explanatory manifestation of this change. For a long time, Bitcoin has been viewed as the most volatile asset in the cryptocurrency market, with its price fluctuations driven more by sentiment, liquidity, and narratives than by stable usage demand or asset-liability structures. However, entering 2025, this perception is gradually being corrected: Bitcoin's price volatility is continuously declining, its retracement structure is becoming flatter, the stability of key support levels is significantly enhanced, and the market's sensitivity to short-term price fluctuations is decreasing. This is not a decline in speculative enthusiasm but rather a re-integration of Bitcoin into a pricing framework that leans more towards "reserve-type assets."

The core of this transformation lies not in whether Bitcoin is "more expensive," but in "who holds it and for what purpose." As Bitcoin gradually becomes part of the balance sheets of publicly listed companies, long-term capital portfolios, and the asset allocation discussions of certain sovereign or quasi-sovereign entities, its holding logic has shifted from seeking price elasticity to combating macro uncertainty, diversifying fiat currency risks, and gaining exposure to non-sovereign assets. Unlike the early market dominated by retail investors, these holders have a higher tolerance for price retracements and greater patience over time, and their behavior itself compresses Bitcoin's circulating supply and reduces the overall market's selling pressure elasticity.

At the same time, the financialization path of Bitcoin is also undergoing structural changes. Spot ETFs, compliant custody, and a mature derivatives system have provided Bitcoin with the foundational infrastructure conditions for large-scale integration into the traditional financial system for the first time. This does not mean that Bitcoin is completely "tamed," but rather that its risks are being re-priced: price discovery no longer occurs entirely in the most extreme emotional on-chain or offshore markets but is gradually shifting to trading environments with greater depth and constraints. In this process, Bitcoin's volatility has not disappeared; instead, it has transformed from chaotic and violent fluctuations to structural volatility around macro variables and funding rhythms.

More importantly, Bitcoin's "reserve property" does not stem from any external credit endorsement but is the result of its supply mechanism, immutability, and decentralized consensus being repeatedly validated over the long term. Against the backdrop of a continuously expanding global debt scale and increasing fragmentation of geopolitical and financial systems, the market's demand for "neutral assets" is rising. Bitcoin does not need to assume the traditional functions of currency; instead, it is gradually becoming a value carrier that does not require counterparty credit, policy commitments, and can be transferred across systems. This property positions it closer to a structural reserve tool in asset allocation rather than merely a high-risk speculative target.

Therefore, Bitcoin in 2026 should no longer be measured by "how fast it rises," but should be placed under a longer-term perspective of allocation and strategy. Its core significance lies not in replacing any existing asset but in providing a new, decentralized reserve option for the global asset system. It is in this role shift that Bitcoin's influence on the cryptocurrency market is also changing: it is no longer just the engine of market movements but is becoming the anchor point for the stability of the entire system. As this transformation deepens, Bitcoin's existence itself may be more important for the cryptocurrency market in 2026 and beyond than its short-term price performance.

III. Stablecoins and RWA: The First True Integration of the Cryptocurrency Market into Real Financial Structures

If Bitcoin represents the "self-affirmation" of the cryptocurrency market at the asset level, then the rise of stablecoins and RWA marks the first systematic integration of the cryptocurrency market into the financial structures of the real world. Unlike past growth driven by narratives, leverage, or token incentives, the core of this change lies not in emotional expansion but in the continuous entry of real assets, real cash flows, and real settlement needs into the on-chain system, pushing the cryptocurrency market from a relatively closed self-circulating system to an open structure deeply coupled with real finance.

The role of stablecoins has gone far beyond being merely a "medium of exchange" or "hedging tool." As their scale continues to expand and use cases spill over, stablecoins have effectively become a "chain-based reflection" of the global dollar system: they undertake functions such as cross-border payments, on-chain clearing, fund management, and liquidity allocation with lower settlement costs, higher programmability, and cross-regional accessibility. Especially in emerging markets, foreign trade settlements, and high-frequency cross-border capital flows, stablecoins do not replace the existing financial system but rather complement its structural shortcomings in efficiency and accessibility. This demand for use does not rely on bull-bear cycles but is highly correlated with global trade, capital flows, and upgrades in financial infrastructure, with its stability and stickiness far exceeding traditional cryptocurrency trading demands. On top of stablecoins, the emergence of RWA further alters the asset composition logic of the cryptocurrency market. By mapping real assets such as U.S. Treasury bonds, money market instruments, accounts receivable, and precious metals into on-chain tokens, RWA effectively introduces a long-missing element to the cryptocurrency market—sustainable, entity-linked sources of income. This means that for the first time, the cryptocurrency market no longer relies entirely on "price increases" to support asset value but can construct value anchors closer to traditional finance through interest, rent, or operational cash flows. This change not only enhances the pricing transparency of assets but also allows on-chain funds to be reallocated around "risk-return" rather than a single narrative.

Deeper changes are occurring as stablecoins and RWA reshape the financial division of labor structure in the cryptocurrency market. Stablecoins provide the underlying settlement and liquidity foundation, RWA offers exposure to real assets that can be split, combined, and reused, while smart contracts are responsible for automated execution and risk control. Within this framework, the cryptocurrency market is no longer just a "shadow market" of traditional finance but is beginning to possess the capability to independently carry out financial activities. The formation of this capability has not happened overnight but has been slowly and steadily accumulated through the gradual improvement of compliance, custody, auditing, and technical standards. Therefore, stablecoins and RWA in 2026 should not be simply understood as "new tracks" or "thematic investments," but rather as key nodes in the structural upgrade of the cryptocurrency market. They enable the cryptocurrency system for the first time to coexist with real finance in the long term and to mutually penetrate, shifting the growth logic of the cryptocurrency market from being cycle-driven to demand-driven, and from closed games to open collaboration. In this process, what truly matters is not the short-term performance of individual projects but the formation of a new financial infrastructure in the cryptocurrency market, whose impact will far exceed price levels and profoundly change the way global finance operates over the next decade.

IV. From Narrative-Driven to Efficiency-Driven: Collective Repricing at the Application Layer

After experiencing multiple cycles of narrative rotation, the application layer of the cryptocurrency market is entering a critical turning point: the valuation system driven solely by grand visions, technical labels, or emotional consensus is systematically failing. The phase-out of DeFi, NFTs, GameFi, and even some AI narratives does not mean that these directions lack value; rather, the market's tolerance for "future imagination premiums" has significantly decreased. The application layer around 2026 is transitioning from a pricing system centered on stories to a new pricing logic focused on efficiency, sustainability, and real usage intensity.

The essence of this transformation lies in the change in the structure of participants in the cryptocurrency market. As the proportion of institutional funds, industrial capital, and hedge funds increases, the market is no longer solely focused on "whether a sufficiently large story can be told," but rather on "whether it truly solves a real problem, whether it has cost or efficiency advantages, and whether it can operate sustainably without relying on subsidies." Within this framework of examination, many previously overvalued applications are being repriced, while a few protocols that possess advantages in efficiency, experience, and cost structure are gaining more stable capital support.

The core manifestation of efficiency-driven competition is that the application layer is beginning to compete around "output per unit of capital" and "contribution per unit of user." Whether in decentralized trading, lending, payments, or basic middleware, the market's focus is shifting from coarse metrics like TVL and registered user numbers to transaction depth, retention rates, fee income, and capital turnover efficiency. This means that applications are no longer merely "narrative decorations" of the underlying public chain ecosystem but are becoming independent economic entities that need to generate their own revenue and possess clear business logic. For applications that cannot generate positive cash flow or are highly dependent on incentive subsidies, the weight of "future expectations" in their valuations is being rapidly compressed.

At the same time, technological advancements are amplifying efficiency differences and accelerating differentiation at the application layer. The maturity of account abstraction, modular architecture, cross-chain communication, and high-performance Layer 2 solutions has made user experience and development costs quantifiable and comparable metrics. In this context, the migration costs for users and developers are continuously decreasing, and applications no longer possess "natural moats." Only products that achieve significant advantages in performance, cost, or experience can retain traffic and capital. This competitive environment is inherently unfavorable for projects that rely on "narratives to maintain premiums," but it provides long-term survival space for truly efficient infrastructure and applications.

More importantly, the repricing at the application layer is not occurring in isolation but resonates with the role shifts of stablecoins, RWA, and Bitcoin. As more real economic activities begin to be carried on-chain, the value of applications no longer derives from "internal cyclical games within crypto," but from their ability to efficiently accommodate real capital flows and real demands. This leads to applications that serve payments, settlements, asset management, risk hedging, and data coordination gradually replacing purely speculative applications, becoming the core of market attention. This change does not mean that market risk appetite has completely disappeared; rather, the distribution of risk premiums has shifted from narrative diffusion to efficiency realization.

Therefore, the "collective repricing" of the application layer in 2026 is not a short-term style switch but a structural revaluation of value. It signifies that the cryptocurrency market is gradually breaking free from its heavy reliance on emotions and stories, turning instead to efficiency, sustainability, and real-world adaptability as core evaluation criteria. In this process, the application layer will no longer be the most volatile part of the cycle but may become a key bridge connecting the cryptocurrency market with the real economy, with its long-term value increasingly dependent on whether it truly integrates into the operational system of the global digital economy.

V. Conclusion: 2026 is Not the Start of a New Bull Market, but the Beginning of the Next Decade

If one still attempts to understand the cryptocurrency market in 2026 by asking "when will the next bull market come," it signifies standing within an analysis framework that is failing. The more important significance of 2026 lies not in whether prices will reach new highs, but in the cryptocurrency market completing a fundamental shift in understanding and structure: it is transitioning from a marginal market that heavily relies on cyclical narratives, emotional diffusion, and liquidity games to a long-term infrastructure system embedded in the real financial system, serving real economic needs, and gradually forming institutionalized operational logic.

This change is first reflected in the shift in market objectives. Over the past decade, the core issue of the cryptocurrency market was "how to prove the rationality of its existence," whereas after 2026, this question is being replaced by "how to operate more efficiently, how to collaborate with real systems, and how to accommodate larger scales of capital and users." Bitcoin is no longer just a high-volatility risk asset but is beginning to be integrated into structural reserves and macro allocation frameworks; stablecoins are evolving from transaction mediums to key outlets for digital dollars and digital liquidity; RWA is allowing the crypto system to truly connect with global debt, commodities, and settlement networks for the first time. These changes will not bring about dramatic price frenzies in the short term, but they will determine the boundaries and ceilings of the cryptocurrency market for the next decade.

More importantly, 2026 marks the completion of a "paradigm shift," rather than its beginning. From cyclical games to structural games, from narrative pricing to efficiency pricing, from a closed internal cycle of crypto to deep coupling with the real economy, the cryptocurrency market is forming a new value assessment system. In this system, whether an asset has long-term allocation value, whether a protocol can continuously generate cash flow, and whether an application truly enhances financial and collaborative efficiency are becoming more important than "whether the narrative is compelling enough." This means that future increases will be more differentiated, slower, and more path-dependent, but it also indicates that the probability of systemic collapse is decreasing.

From a historical perspective, what truly determines the fate of an asset class is not the height of a single bull market but whether it successfully completes the transition from a speculative product to infrastructure. The cryptocurrency market in 2026 is at such a critical turning point. Prices will still fluctuate, narratives will still change, but the underlying structure has already changed: crypto is no longer just a "substitute fantasy" for traditional finance but is becoming a part of its extension, complement, and even reconstruction. This transformation determines that the cryptocurrency market in the next decade will resemble a slowly but steadily expanding main line, rather than a series of emotionally driven pulse-like market movements.

Therefore, rather than asking whether 2026 is the starting point of a new bull market, it is better to acknowledge that it resembles a "coming of age ceremony"—the cryptocurrency market has, for the first time, redefined its role, boundaries, and mission in a way that is closer to the real financial system. The real opportunities may no longer belong to those best at chasing cycles, but to those who can understand structural changes, adapt to new paradigms in advance, and grow together with this system over the long term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。