Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

At the macroeconomic level, as 2026 begins, global markets are showing strong risk appetite. In the tech sector, Nvidia's CFO Colette Kress stated that the company's revenue will far exceed the expected $500 billion, while the release of its open-source autonomous driving AI model Alpamayo has sparked discussions with Tesla CEO Elon Musk, who believes that solving the "long tail problem" of autonomous driving remains a core challenge. Possibly buoyed by Nvidia CEO Jensen Huang's comments at CES about the explosive growth in data storage needs in the AI era, the storage semiconductor sector surged collectively, pushing the Dow Jones Industrial Average to surpass 49,500 points for the first time. Although gold prices briefly returned to $4,500 per ounce today, this led to an overall pullback in the precious metals market, with spot silver and spot palladium recording declines of over 3% and 5%, respectively. However, the non-ferrous metals market exploded, with LME nickel futures jumping over 10% due to Indonesia's plans to cut production, reaching a 19-month high; LME copper futures broke through $13,000 per ton, setting a new historical high amid supply concerns and growing electrification demand, with Citigroup raising its first-quarter target price to $14,000. The U.S. is about to make a decision on copper tariffs, further intensifying the global supply tightness.

In terms of geopolitics, after effectively controlling Venezuela, Trump announced that the U.S. would receive up to 50 million barrels of oil from the country for sale, causing international oil prices to drop. Analysts believe that lower oil prices will create a deflationary environment, providing more room for the Federal Reserve to cut interest rates, with the market widely expecting Trump to appoint a dovish chair to push rates down to 1%. Additionally, Bridgewater founder Ray Dalio issued a warning, stating that the rise of U.S. stocks in 2025 is largely a "valuation illusion" caused by the depreciation of fiat currency relative to gold; if priced in gold, the S&P 500 index actually declined last year. He pointed out that geopolitical risks and U.S. unilateralism are driving global capital towards non-U.S. markets and physical assets like gold. Looking ahead, Dalio predicts that the U.S. will face severe political conflict over wealth distribution issues between 2027 and 2028, while the market is closely watching upcoming labor data for further clues on the Fed's interest rate path.

Bitcoin experienced a strong rebound at the beginning of 2026, with prices briefly surpassing $94,000, but has since fallen below $93,000. Analyst Lark Davis believes this rally is driven by multiple positive factors: the end of the year-end tax loss selling season in the U.S., massive inflows into spot Bitcoin ETFs, and market expectations for the Fed to soon shift to a loose monetary policy. Key technical levels have become the focus of the market, with analysts generally agreeing that there is significant selling pressure in the $94,000 to $95,000 range, with traders Skew and Exitpump pointing out "passive sellers" and "large sell walls" at that position. If a successful breakout occurs, Daan Crypto Trades believes liquidity could reach $98,000, while Michaël van de Poppe predicts Bitcoin will move towards $100,000 after a brief pullback. On the downside, analysts Tai Bai and Man of Bitcoin have identified support levels around $90,500 and $90,874, respectively. On-chain data and the derivatives market also show positive signals, with Capriole Investments reporting that institutions have purchased 76% more Bitcoin than miners produced over the past eight days, historically indicating an average price increase of 109%.

A Glassnode indicator shows that the market may have bottomed out in November 2025, with significant upside potential remaining. Meanwhile, Bloomberg reports that options market traders are refocusing on call contracts with a strike price of $100,000 expiring at the end of January. Additionally, index giant MSCI has decided to keep companies holding Bitcoin, such as Strategy, in its index, alleviating a major market concern.

Ethereum also performed well, with prices rising 10% in January to reach $3,300, testing the key 200-period EMA. Technical analysis indicates that Ethereum's daily chart is forming a potential "double bottom" pattern, and if confirmed, the target price could point to $3,900, representing about a 20% upside from current levels. Analyst Tai Bai noted that the current price is facing resistance in the $3,275 range, and a pullback to around $3,095 could present a potential buying opportunity, while Man of Bitcoin believes the key support is at $3,040. On-chain data shows that CryptoQuant's cumulative volume delta (CVD) indicates strong buying from retail and leveraged markets, but Hyblock Capital's data reveals a divergence: whales (addresses holding over $100,000) have been net sellers this week, indicating that this rally is primarily driven by retail investors. More importantly, Ethereum's staking dynamics have undergone a fundamental shift. According to Beaconcha.in data, the validator exit queue has dropped to nearly zero for the first time, indicating that potential selling pressure has largely evaporated; meanwhile, institutions led by BitMine are aggressively entering staking, having staked a total of $2.1 billion worth of 659,219 ETH, pushing the staking entry queue to its highest level since mid-November last year. In terms of network fundamentals, Ethereum recently completed its second "Blob-only parameter" hard fork, raising the blob limit to 21, effectively enhancing the scalability of L2 networks and reducing transaction costs, while the "Glamsterdam" hard fork aimed at further increasing network throughput is also on the agenda.

In the altcoin market, the Solana ecosystem is extremely active, with Dune data showing that its Launchpad has created over 25,000 tokens daily for five consecutive days, with Pump.fun dominating. However, the frenzy around meme coins also comes with significant risks, as the recently popular Japanese internet culture meme coin $114514 saw its market cap soar to $57 million before plummeting 94% overnight to $2.7 million, resulting in heavy losses for many latecomers. Behind this wave of enthusiasm may be market expectations for Japan's implementation of cryptocurrency tax reforms in 2026. For Solana itself, analyst Murphy pointed out that despite the price pullback, its chip structure shows that 77% of the circulating supply is concentrated in the $120 to $200 range, forming a solid support base, while whale addresses have actively increased their holdings during this pullback, with an average cost of about $133, establishing an important price floor.

2. Key Data (as of January 7, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap, GMGN)

Bitcoin: $92,811 (YTD +5.8%), daily spot trading volume $6.064 billion

Ethereum: $3,252 (YTD +9.2%), daily spot trading volume $2.863 billion

Fear and Greed Index: 42 (Neutral)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 58.7%, ETH 12.1%

Upbit 24-hour trading volume ranking: BREV, 0G, BTC, ETH, SOL

24-hour BTC long/short ratio: 49.68% / 50.32%

Sector performance: The crypto market slightly pulled back, while DePIN and AI sectors rose against the trend.

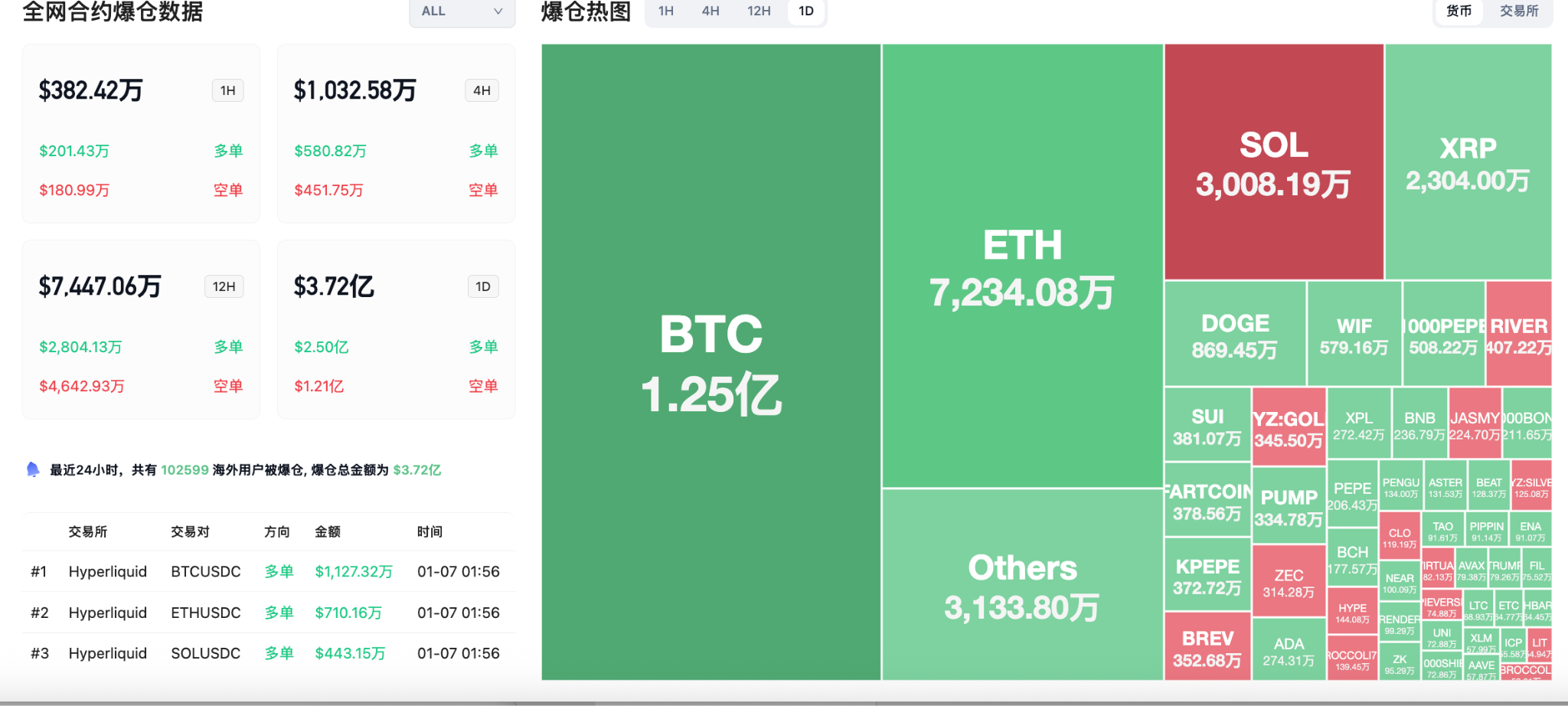

24-hour liquidation data: A total of 102,599 people were liquidated globally, with a total liquidation amount of $372 million, including $125 million in BTC, $72.34 million in ETH, and $30.08 million in SOL.

3. ETF Flows (as of January 6)

Bitcoin ETF: -$243 million, with only BlackRock's IBIT recording net inflows

Ethereum ETF: +$115 million, net inflows for the third consecutive day

XRP ETF: +$19.12 million

SOL ETF: +$9.22 million

4. Today's Outlook

Binance Wallet exclusive TGE 44th issue launches ZenChain (ZTC), subscription opens on January 7

ZKsync will stop supporting Etherscan on January 7, fully transitioning to a native block explorer

U.S. initial jobless claims for the week of January 3 (in ten thousand): expected value 21.2, previous value 19.9 (January 9, 21:30)

Top gainers among the top 100 cryptocurrencies today: Rain up 11.3%, MemeCore up 7.1%, Pump.fun up 2.3%, Virtuals Protocol up 2.2%, Cosmos up 2%.

5. Hot News

WLFI deployment address will recharge 24 million tokens to Binance three weeks later

An address bought the dip during the 114514 crash, evaporating nearly 87% of $250,000 overnight

A long-term holder of 4,165 BTC exposed: mining daily since 2016, never sold a single coin

SharpLink earned 438 ETH in staking rewards last week, totaling over 10,000 ETH

Insiders: Discord secretly submitted an IPO application, valuation may exceed $15 billion

Walmart launches Bitcoin and Ethereum trading services through its OnePay app

Trump token team deposits 400,000 TRUMP into Binance, worth $2.25 million

Bitwise has received SEC approval to list LINK spot ETF on NYSE Arca

Japan has implemented the OECD's cryptocurrency reporting framework since January 1, 2026

Morgan Stanley submits S-1 application documents for Solana trust and Bitcoin trust to the SEC

Virtuals Protocol launches three major agency launch models: Pegasus, Unicorn, and Titan

Coinbase Bitcoin premium index finally turns positive after 22 days, currently at 0.01%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。