Author: Fidelity Investments

Translated by: Nicky, Foresight News

TL;DR:

Investors looking to enter the market for short-term profits should exercise caution. However, those planning to hold long-term may not have missed the opportunity. This year, more governments and companies around the world are incorporating digital assets into their balance sheets. Due to this new demand, some investors believe that the traditional four-year cycle of cryptocurrencies may have come to an end.

In March, President Trump signed an executive order establishing a strategic Bitcoin reserve for the U.S. government. This order officially designates all Bitcoin and several other cryptocurrencies currently held by the government as reserve assets.

While the full impact of this executive order remains to be seen, one thing is clear for 2025: cryptocurrencies are gaining mainstream recognition. They are no longer merely seen as a form of volatile speculation by "degens" (a term used by cryptocurrency traders to describe themselves due to the crazy nature of the crypto market and the mindset required to survive in it), but rather as a recognized store of value by the U.S. government.

What does this mean for the cryptocurrency market as we head into 2026? Does the significant price correction we are currently witnessing indicate that the bull market has ended? Is it too late to invest in cryptocurrencies now? Here are several key trends to watch.

Will more countries adopt cryptocurrency reserves?

Currently, many countries around the world hold a certain amount of cryptocurrency, but few have formally established cryptocurrency reserves — that is, designating their held cryptocurrencies as financial assets serving national strategic interests.

This situation began to change in 2025 (with the most notable example being President Trump's executive order in March) and may continue to advance in 2026.

For example, in September, Kyrgyzstan passed a bill to establish its own cryptocurrency reserves. Elsewhere, more countries are beginning to explore this possibility. The Brazilian Congress recently advanced a bill allowing up to 5% of the country's international reserves to be held in Bitcoin (though whether this bill will become law remains to be seen).

"Fidelity Digital Assets believes that more countries may purchase Bitcoin in the future, driven by game theory," said Chris Kuiper, Vice President of Research at Fidelity Digital Assets. "If more countries adopt Bitcoin as part of their foreign exchange reserves, other countries may feel competitive pressure to follow suit, increasing the pressure to adopt the same approach."

What does this mean for prices? "From a simple supply and demand economics perspective, any additional demand for Bitcoin could drive prices higher," Kuiper said. "Of course, the key is how significant the incremental demand is and whether other investors are selling or holding."

Will companies continue to buy cryptocurrencies?

Governments are not the only potential source of new demand in 2026. Companies may increasingly get involved — some of which began incorporating Bitcoin and other cryptocurrencies into their balance sheets in 2025. As of now, one of the most notable examples is the software and analytics company Strategy (formerly MicroStrategy, ticker MSTR), which has been steadily purchasing Bitcoin since 2020. However, this year, more companies have adopted this practice, making it a trend. As of November, over 100 publicly traded companies (including domestic and international firms) hold cryptocurrencies. About 50 of these companies currently hold over 1 million Bitcoins.

"There are clearly arbitrage opportunities, and some companies can leverage their market position or financing channels to raise funds for purchasing Bitcoin," Kuiper said. "Part of this stems from investment mandates and geographical and regulatory issues. For example, investors who cannot directly purchase Bitcoin may choose to gain exposure through these companies or the securities they issue."

On the surface, corporate purchases of cryptocurrencies would increase market demand, helping to drive asset prices higher. But investors should also be aware of the risks involved. "If these companies choose or are forced to sell part of their digital assets — for example, during a bear market — this could certainly put downward pressure on the prices of the Bitcoin or other digital assets held by these companies," Kuiper stated.

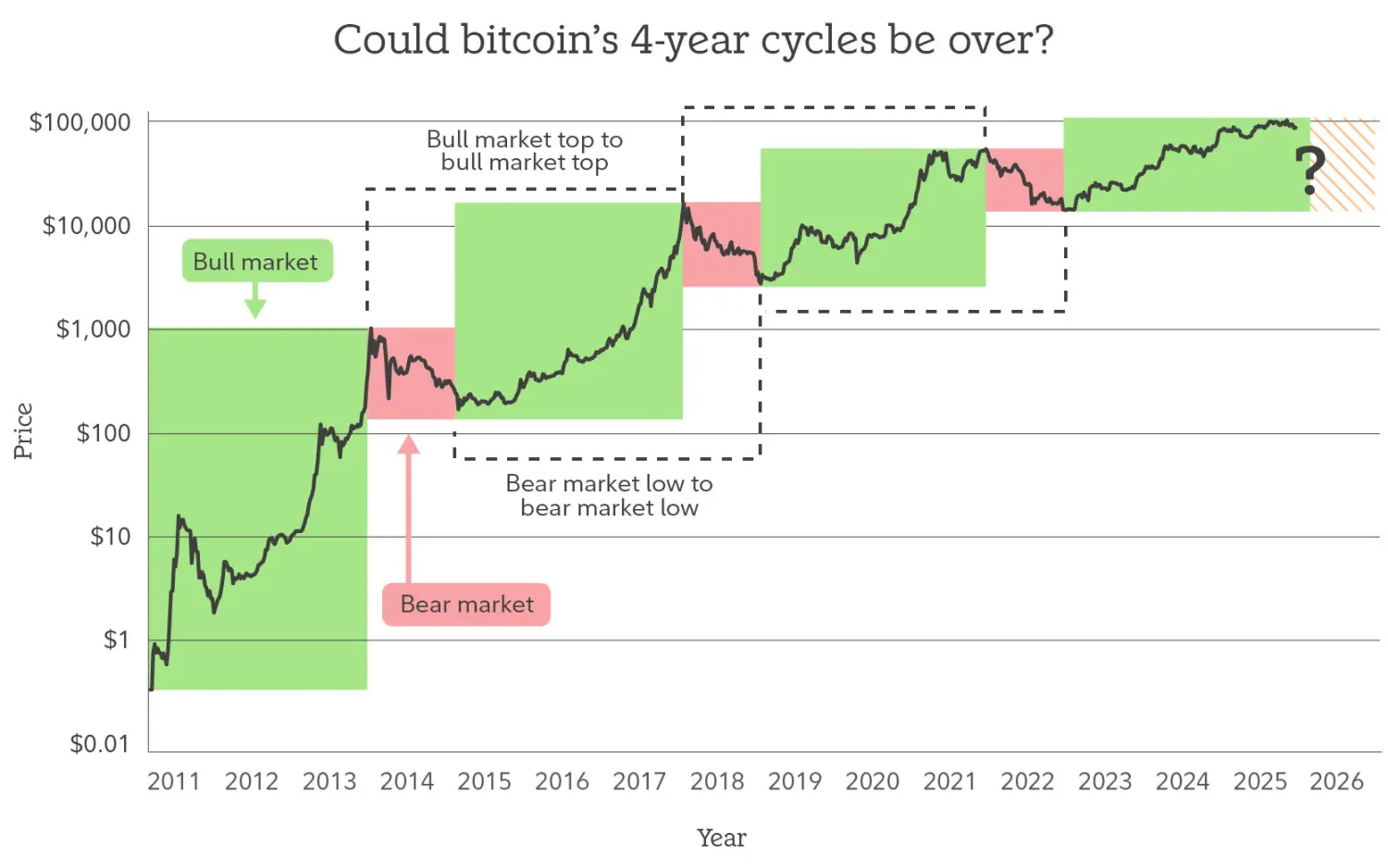

Image source: Fidelity Investments. Past performance is not indicative of future results.

Will the four-year cycle end?

Compared to traditional investments like stocks and bonds, Bitcoin has a relatively short history, but its price generally follows a four-year cycle (from bull market peak to bull market peak, or from bear market bottom to bear market bottom). It formed bull market peaks in November 2013, December 2017, and November 2021, and bear market bottoms in January 2015, December 2018, and November 2022. These cycles are accompanied by significant price volatility: the first cycle dropped from $1,150 to $152, the second from $19,800 to $3,200, and the third from $69,000 to $15,500.

Bitcoin's movements often drive the entire cryptocurrency market — in many cases, with even more volatility.

Currently, we are at about the four-year mark of the current cycle, as the last bull market peaked in November 2021. Over the past month, cryptocurrency prices have continued to decline. So, has this bull market already peaked?

If the four-year cycle repeats, we may be at or near the end of this bull market for Bitcoin. However, some cryptocurrency investors believe that this historical trend is about to end, and the current price correction is merely a temporary pullback before the market resumes its upward trend.

What does this specifically mean? Some investors believe that while price corrections will still occur, the volatility of any declines will be far lower than in the past, and the magnitude may be so small that it won't feel like a complete bear market. Others believe we may be entering a super cycle, where the bull market will last for years. For reference, the super cycle of commodities in the 2000s lasted nearly a decade.

Kuiper does not believe these cycles will completely disappear, as the fear and greed that trigger them have not magically vanished. However, he points out that if the four-year cycle is to repeat, we should have already set a historical peak for this cycle and entered a full bear market. While the correction since November has been quite severe, he states that we may not be able to confirm whether a four-year cycle has truly formed until 2026. The current price drop could be the start of a new bear market or just a pullback within a bull market, potentially reaching new historical highs again in the future — as we have already seen several times in this cycle.

Whether these predictions will come true remains to be seen, and we may not be able to determine this until mid-2026.

Is it still a good time to buy Bitcoin?

Despite the many uncertainties in the cryptocurrency market, one thing has become clearer: the crypto market is entering a new paradigm. "We are seeing a fundamental shift in the structure and categories of investors, and I believe this will continue into 2026," Kuiper said. "Traditional fund managers and investors have begun to purchase Bitcoin and other digital assets, but I believe we have only scratched the surface in terms of the scale of funds they may bring into this space."

In light of this, investors who have not yet entered the market may wonder: is it still a good opportunity to buy Bitcoin now?

For Kuiper, it depends on your investment horizon. If you hope to gain returns in the short or medium term (four to five years or shorter), you may already be late, especially if this cycle ultimately follows historical patterns.

"However, from a very long-term perspective, I personally believe that if you view Bitcoin as a store of value, you can never fundamentally be 'too late,'" Kuiper said. "As long as its hard supply cap remains unchanged, I believe that every time you buy Bitcoin, you are putting your labor or savings into something that will not depreciate due to inflation caused by government monetary policy."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。