Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

With the opening of the second 25 years of the 21st century (Q2), the global macro situation faced a significant geopolitical shock at the beginning of 2026. The United States launched a military operation against Venezuela, codenamed "Absolute Resolve," and arrested President Maduro. This event quickly escalated geopolitical risks. Although the market worried about supply disruptions, given the global oversupply of crude oil and Venezuela's production accounting for only about 1% of the world, oil prices reacted relatively mildly, gold returned to $4,400, and precious metals like silver and platinum also rose over 3%.

Additionally, CITIC Construction Investment released a 2026 outlook report indicating that 2026 is a year for solidifying foundations and strategic counterattacks during the "14th Five-Year Plan." Driven by "dual easing" in fiscal and monetary policy and boosting domestic demand, GDP is expected to grow around 5%. For the capital market, the A-share bull market is expected to continue but with slower growth. Resource products (copper, aluminum) are likely to take over from the outstanding performance of gold and silver in 2025, becoming the most eye-catching assets for global pricing in 2026. However, caution is advised regarding a potential phase adjustment in the technology sector, with a focus on new energy, military industry, and non-ferrous metals. In the Hong Kong stock market, driven by the power of the "new four bulls" and the evolution of the Federal Reserve's interest rate cut cycle, market activity is expected to further stimulate. Globally, although U.S. Treasury yields and inflation are expected to remain high, the U.S.-China competition is shifting from tariff confrontations to a technology security race, making the AI industry chain still worth long-term tracking.

Bitcoin showed strong resilience at the start of 2026, despite facing geopolitical turmoil, with prices rising for five consecutive days, remaining stable above $90,000. The ETF recorded a net inflow of $471.3 million on its first trading day. On-chain analyst Murphy pointed out that the concentration of chips within a 5% range of the BTC spot price decreased from 14.9% to 14.5% while the price gradually increased. URPD data shows that there are 820,000 BTC forming effective support at $87,000, with an expected reasonable fluctuation range between $92,000 and $104,000. On the technical side, Ted noted that the SMA200 is at $106,751, with a high probability of breaking $100,000 in Q1 2026, and there is a gap at $88,200 on the CME; Crypto Auris warned that if it falls below $87,000, it may retract to the $84,000 range. Although CryptoQuant's research director Julio Moreno warned that based on moving averages, a bear market may have been entered, with a bottom possibly at $56,000 to $60,000, institutional sentiment remains generally optimistic. Charles Schwab is bullish on 2026 performance, and Ark Invest's Zach Pandl predicts a historical high in the first half of the year. A Forbes article also pointed out that the predicted price for 2026 is concentrated between $120,000 and $170,000. Traders Phyrex and Lennaert Snyder both believe that as the holiday ends and institutions return, market liquidity will rebound.

Regarding Ethereum, on the first day of the year, the ETF recorded a net inflow of $174.5 million, with prices maintaining around $3,150. Analyst Killa pointed out that ETH is currently in a stable zone, with January and February more likely to consolidate or close positively; Daan Crypto Trades believes that $3,300 is a key resistance level for a bullish reversal, with major support at $2,600. Man of Bitcoin analyzed that ETH faces resistance in the $3,094 to $3,291 range, with the trend following Bitcoin's "orange route." Despite market recovery expectations, some early optimistic predictions have not materialized. Synthetix founder Kain Warwick lost a $50,000 bet because ETH failed to reach $25,000 in 2025 and has lowered the 2026 target to $10,000, while the previous $10,000 targets predicted by Tom Lee and Arthur Hayes were also not achieved.

In the crypto market, the situation in Venezuela triggered significant volatility and regulatory attention in the prediction market Polymarket. According to Lookonchain tracking, three mysterious wallets placed heavy bets on Maduro's ousting hours before his arrest, profiting over $630,000, with one address investing only $34,000 and gaining nearly $410,000, raising suspicions of insider trading. In response, U.S. Congressman Ritchie Torres plans to propose the "2026 Financial Prediction Market Public Integrity Act," prohibiting officials from participating in such trades using non-public information. Meanwhile, Bitcoin Treasuries data shows that Venezuela has held Bitcoin since December 31, 2022, with a current balance of 240 BTC, valued at approximately $22.33 million. However, other analysts estimate that it has about $60 billion in Bitcoin and USDT "shadow reserves," with key figure Alex Saab, who holds the private keys, becoming the focus as the regime changes.

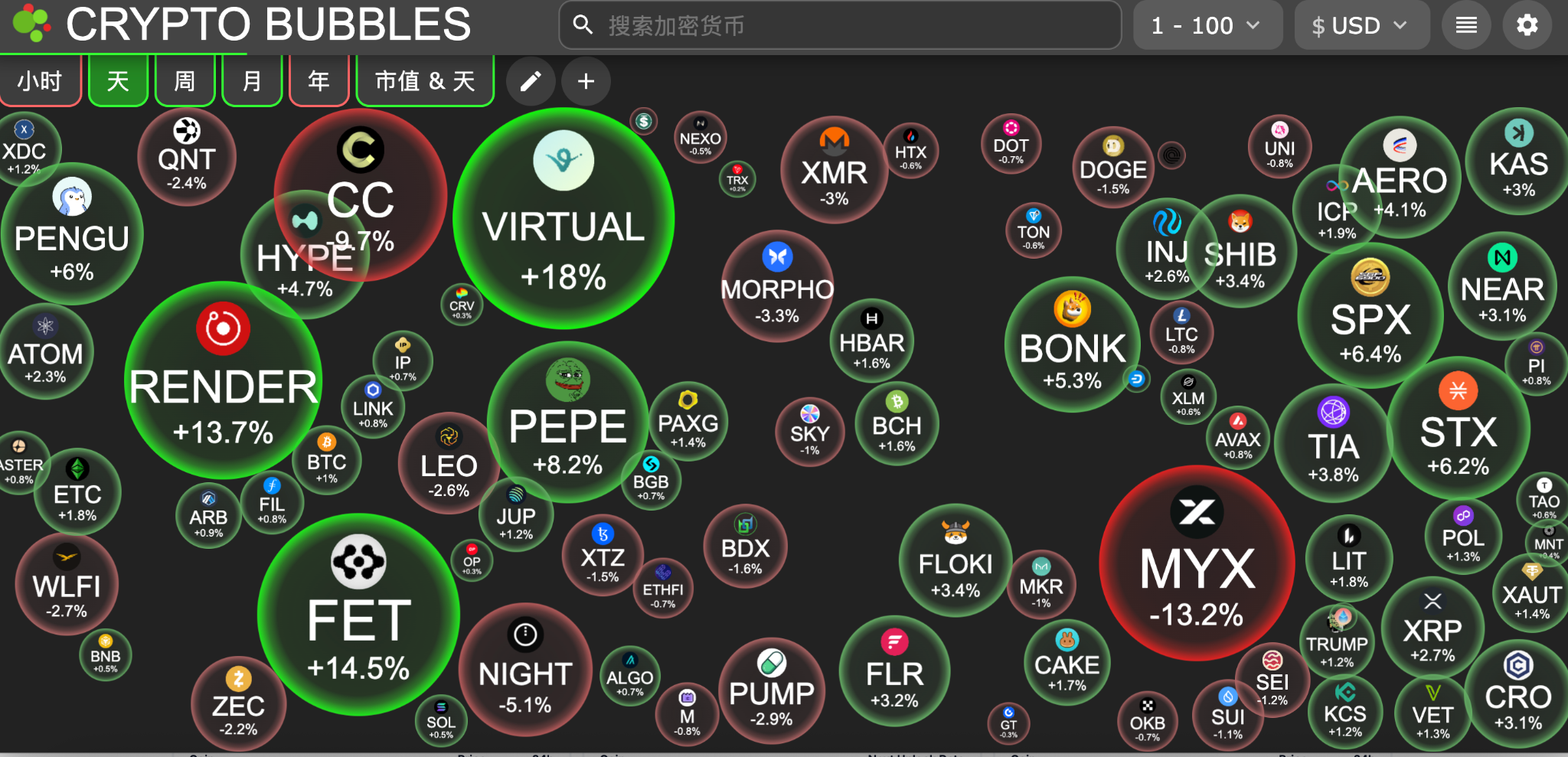

The altcoin market is also active, with most altcoins rising alongside Bitcoin, among which PEPE has risen over 70% this year, prompting whale James Wynn to recently open a 10x leveraged long position. Additionally, old meme coins like BONK, BOME, FLOKI, WIF, and NEIRO have also surged, with Ponke and CZ's Dog rising over 70% in the past 24 hours.

Perhaps due to the annual "Tech Spring Festival" CES, where Nvidia CEO Jensen Huang, AMD head Lisa Su, and other tech veterans will speak, AI sector tokens have generally risen, with VIRTUAL, FET, and RENDER tokens increasing over 10%.

2. Key Data (as of January 5, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

- Bitcoin: $92,454 (YTD +5.5%), daily spot trading volume $38.79 billion

- Ethereum: $3,152 (YTD +6.2%), daily spot trading volume $17.45 billion

- Fear and Greed Index: 26 (Fear)

- Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

- Market share: BTC 58.7%, ETH 12.1%

- Upbit 24-hour trading volume ranking: XRP, BTC, ETH, SOL, BONK

- 24-hour BTC long-short ratio: 50.66% / 49.34%

- Sector performance: Most crypto sectors rose, meme sector up 6.2%, AI sector up 5.7%

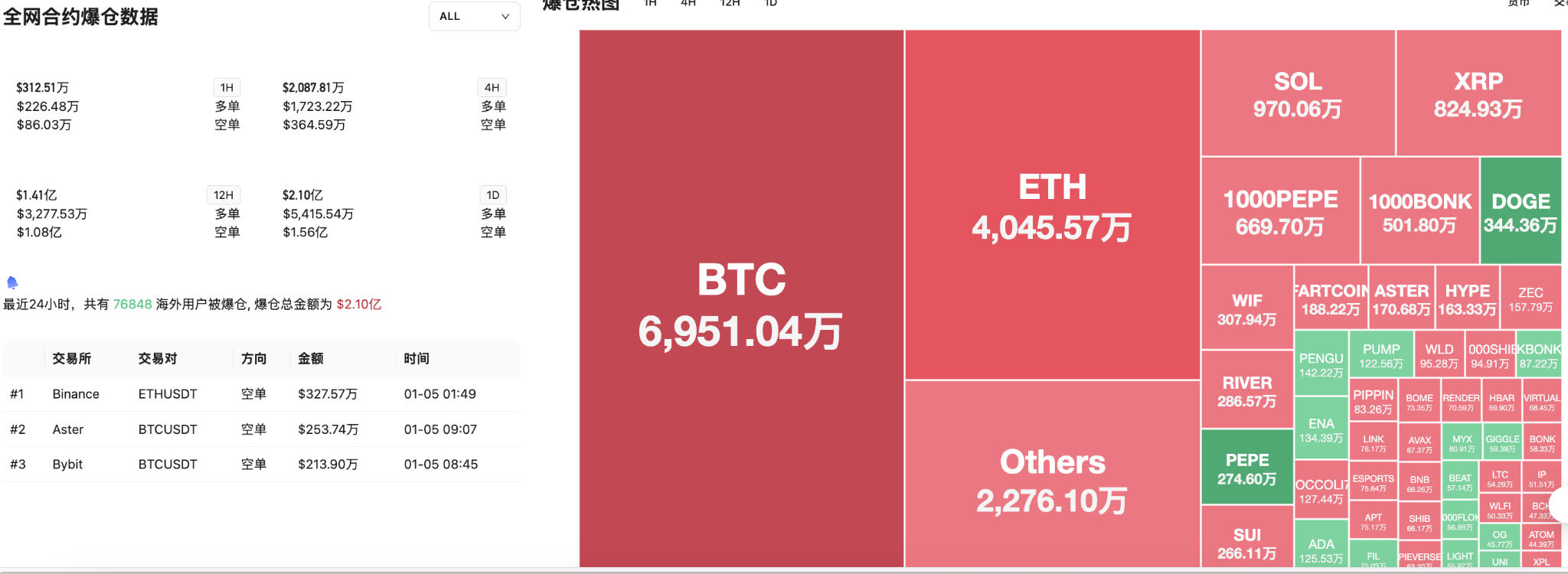

- 24-hour liquidation data: A total of 76,848 people were liquidated globally, with a total liquidation amount of $210 million, including $65.91 million in BTC, $40.45 million in ETH, and $9.7 million in SOL.

3. ETF Flows (as of January 2)

- Bitcoin ETF: +$471 million, with BlackRock's IBIT net inflow of $287 million leading

- Ethereum ETF: +$174.5 million, with Grayscale's ETHE net inflow of $53.6861 million leading

- XRP ETF: +$13.59 million

4. Today's Outlook

- Zama OG NFT claim portal opens on January 5

- Trump to attend policy meeting at 4:30 AM on January 6

- Binance Alpha to list Brevis (BREV)

- Hyperliquid co-founder: 1.2 million HYPE tokens will be distributed to team members after unlocking on January 6

- South Korean President Lee Jae-myung to visit China from January 4 to 7

- U.S. court confirms Maduro will appear in New York at 1 AM Beijing time on January 6

- "Tech Spring Festival" CES media day, Nvidia CEO to speak (January 6, 5:00 AM)

- Ethena (ENA) will unlock approximately 171 million tokens at 3 PM Beijing time on January 5, with a circulation ratio of 2.37%, valued at approximately $42 million;

- Hyperliquid (HYPE) will unlock approximately 12.46 million tokens at 8 AM Beijing time on January 6, with a circulation ratio of 3.61%, valued at approximately $313 million;

The largest gains among the top 100 cryptocurrencies today: Virtuals Protocol up 18%, ASI Alliance up 14.5%, Render up 13.7%, Pepe up 8.2%, SPX6900 up 6.4%.

5. Hot News

- Data: HYPE, ENA, APT and other tokens will see large unlocks, with HYPE unlocking approximately $313 million

- This Week's Preview | Solana ecosystem crypto derivatives exchange Ranger launches public fundraising; U.S. Bureau of Labor Statistics releases December employment data

- Venezuela holds 240 Bitcoins, analysts estimate its Bitcoin "shadow reserves" may exceed 600,000

- Memecoin sector market cap rises 23% this week, trading volume surges 300%

- Spot gold returns above $4,400, silver breaks through $76/ounce

- Infinex public fundraising currently raised only $491,000, with 90.17% left to reach the target

- U.S. lawmakers propose legislation to prohibit officials from using prediction markets for "insider trading"

- The total amount of six contracts betting on "Maduro's ousting" in the prediction market reaches $56.6 million

- SpaceX, OpenAI, and Anthropic plan to launch IPOs in 2026, potentially becoming one of the most significant listing waves in history

- Bitmine adds over 49,000 ETH in staking, total staking exceeds 590,000

- Digital RMB tops Baidu's hot search list: interest on current balance, fundamentally different from WeChat and Alipay wallets

- James Wynn opens a 10x leveraged long position on PEPE

- Ethereum treasury company Quantum Solutions discloses ETH holdings increased to approximately 5,418

- Helium founder: Due to lukewarm market response, will stop repurchasing HNT tokens

- A whale holding ETH for four years exchanges 14,145 ETH for 492 WBTC

- Grayscale research director: Four reasons may drive Bitcoin to new highs in the first half of 2026

- Binance will add observation tags for ACA, D, DATA, and FLOW

- Data: Gold rises about 65% throughout 2025 and sets over 50 new highs, silver rises about 150%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。