Highlights of This Issue

This week's newsletter covers the statistical period from December 27, 2025, to January 2, 2026.

This week, the total on-chain market value of RWA has steadily increased to $19.21 billion, with the number of holders approaching 600,000. However, the growth rate is moderate, suggesting that traditional assets on-chain may face demand bottlenecks. The total market value of stablecoins has slightly decreased to $297.08 billion, while the monthly transfer volume has significantly increased by 13.77%. The divergence between market value and transfer volume highlights that the market has entered a "stock efficiency-driven" phase, with improved capital turnover efficiency becoming a new focus. Notably, the TVL of RWA protocols has surpassed DEX, becoming the fifth largest category in DeFi.

The regulatory framework for China's digital yuan continues to deepen: the central bank has clarified that it will introduce a management service system for the digital yuan, and the six major banks have announced that they will pay interest on digital yuan wallet balances, promoting its evolution towards M1 functionality. In terms of application: the cross-border implementation of the digital yuan is accelerating, with the Bank of China completing the first cross-border QR code payment between China and Laos.

On the project level: tokenized assets continue to expand, with BlackRock's BUIDL fund having distributed over $100 million in dividends, and Ondo's tokenized silver market cap surging over 155% this month, indicating that RWA is penetrating from government bonds and money market funds into a broader range of hard asset categories, with the ecosystem maturing and diversifying.

Data Insights

RWA Track Overview

According to the latest data from RWA.xyz, as of January 2, 2026, the total on-chain market value of RWA reached $19.21 billion, a slight increase of 3.71% compared to the same period last month, maintaining steady growth. The total number of asset holders has increased to approximately 599,400, up 7.65% from the same period last month, indicating that the investor base is still rapidly expanding. The divergence between these two metrics represents "scale contraction but user expansion," suggesting that the continuous decline in assets may reflect demand bottlenecks for traditional assets on-chain.

However, as bond tokenization products, private credit products, and commodities rapidly become core components of on-chain finance, the total locked value (TVL) of real-world asset (RWA) protocols has surpassed decentralized exchanges (DEX), becoming the fifth largest category in DeFi.

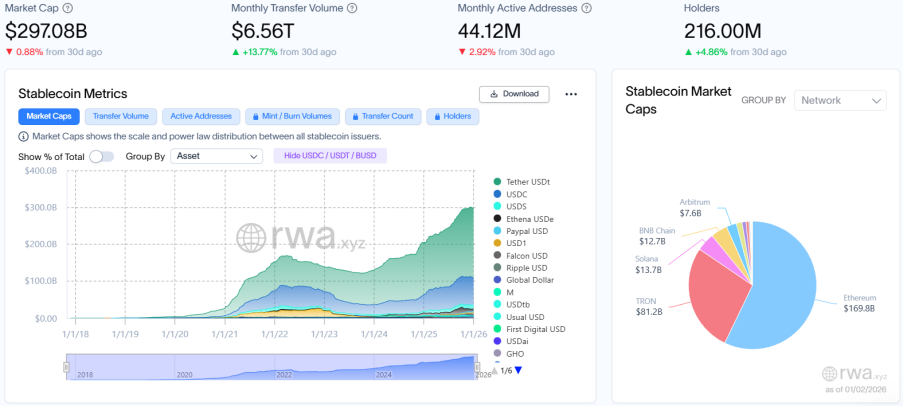

Stablecoin Market

The total market value of stablecoins reached $297.08 billion, a slight decrease of 0.88% compared to the same period last month, with overall scale remaining stable; the monthly transfer volume significantly increased to $6.56 trillion, up 13.77% from the same period last month; the total number of active addresses decreased to 44.12 million, down 2.92% from the same period last month; the total number of holders steadily increased to approximately 216 million, a slight increase of 4.86% from the same period last month. The data indicates that the market may have entered a "stock efficiency-driven" phase, with the divergence between market value contraction and transfer volume growth highlighting the improvement in capital usage efficiency. The leading stablecoins are USDT, USDC, and USDS, with USDT's market value slightly increasing by 1.34% compared to the same period last month; USDC's market value decreased by 5.24%; and USDS's market value declined by 3.14%.

Regulatory News

According to the China Financial News, Lu Lei, Deputy Governor of the People's Bank of China, stated that the People's Bank of China will introduce the "Action Plan for Further Strengthening the Management Service System of Digital Renminbi and Related Financial Infrastructure Construction." The new generation of digital renminbi measurement framework, management system, operational mechanism, and ecosystem will officially start implementation on January 1, 2026.

The U.S. Financial Accounting Standards Board (FASB) plans to study in 2026 whether certain crypto assets can be classified as cash equivalents and how to handle the accounting issues related to the transfer of crypto assets. This decision comes against the backdrop of the Trump administration's push for crypto investment.

FASB has recently added these two crypto projects to its agenda, mainly focusing on the accounting treatment of stablecoins pegged to fiat currencies and "wrapped tokens." Previously, in 2023, FASB required companies to use fair value accounting for crypto assets like Bitcoin, but this did not cover NFTs and some stablecoins.

The GENIUS Act passed by the Trump administration established a regulatory framework for stablecoins but did not clarify whether they could be considered cash equivalents. FASB Chairman Rich Jones stated that it is equally important to clarify which assets do not meet the cash equivalent criteria.

Additionally, FASB plans to explore accounting rules for the transfer of crypto assets to fill gaps in existing standards. Although currently only a few companies (such as Tesla and Block) hold Bitcoin on their balance sheets, demand for stablecoins is expected to increase with the implementation of the GENIUS Act.

This series of initiatives indicates that the U.S. is attempting to support the crypto industry by improving accounting standards while responding to feedback from the industry and the public. FASB expects to finalize its agenda priorities by the summer of 2026.

The Reserve Bank of India Suggests Countries Prioritize the Development of CBDCs Over Stablecoins

According to Cointelegraph, the Reserve Bank of India (RBI) urged countries to prioritize the development of central bank digital currencies (CBDCs) over privately issued stablecoins, citing concerns that the latter could impact financial stability.

In its December Financial Stability Report, the RBI stated that CBDCs can maintain "the singularity of currency and the integrity of the financial system" and should continue to serve as "the ultimate settlement asset" and "the cornerstone of monetary trust." "Therefore, the Reserve Bank of India strongly recommends that countries prioritize the development of CBDCs over privately issued stablecoins to maintain monetary trust, ensure financial stability, and build a faster, cheaper, and safer next-generation payment infrastructure."

The RBI also pointed out that the introduction of stablecoins could create new channels for financial stability risks, especially during periods of market stress. Therefore, "countries must seriously assess the associated risks and develop policy responses suitable for their financial systems."

According to a report from the Cyberspace Administration of China, based on clues provided by internet users, this year, relevant departments coordinated to verify and promptly handle 1,418 illegal counterfeit websites, an increase of 1.7 times compared to last year. Among them: 323 websites impersonating state-owned enterprises such as the State Grid and Sinopec published false investment and recharge information, inducing internet users to purchase virtual goods and fake recharge fuel cards, leading to scams; 61 websites impersonating financial institutions such as China Merchants Securities and CITIC Bank induced internet users to download apps for stock trading or purchasing so-called "stablecoins" and other financial products, resulting in property losses.

Local Developments

The Bank of China has completed the first cross-border QR code consumption payment business between China and Laos. Under the guidance of relevant departments from the People's Bank of China and the Lao central bank, the Bank of China participated in the cross-border pilot project for digital payment and central bank digital currency cooperation between the two countries.

At the same time, the Bank of China's Vientiane branch has become one of the first to access the People's Bank of China's cross-border digital payment platform for the digital renminbi. The Bank of China successfully completed the production verification of QR code payments for merchants in Laos by providing real-time exchange rate quotes and efficient clearing services. This service will significantly lower the threshold for cross-border settlement between China and Laos, achieving a seamless experience for the entire process of "payment-exchange-clearing."

The six major state-owned banks, including the Bank of China, Industrial and Commercial Bank of China, Agricultural Bank of China, China Construction Bank, Bank of Communications, and Postal Savings Bank, announced today that starting January 1, 2026, they will pay interest on digital renminbi real-name wallet balances at the bank's current deposit interest rate, with the interest calculation rules consistent with current deposits. The current interest rate for current deposits is 0.05%. Currently, digital renminbi is divided into four types of wallets. Types one, two, and three are real-name wallets, while type four is an anonymous wallet. Type four wallets do not fall under the "real-name wallets" category for interest payment by the banks.

The Industrial and Commercial Bank of China stated that the wallet operating institution will withhold and pay interest tax (if any) in accordance with the law. The bank reminds that interest will be calculated at the end of each quarter on the 20th of the month, with the amount credited on the 21st. If the account is cleared before the interest calculation date, interest will be calculated at the current deposit interest rate announced on the clearing date up to the day before the clearing.

Project Progress

JPMorgan Freezes Accounts of Several Stablecoin Startups Operating in High-Risk Countries

According to The Information, in recent months, JPMorgan has frozen the accounts of at least two rapidly growing stablecoin startups that operate in high-risk countries such as Venezuela. This action by the bank highlights the risks that crypto transactions pose to banks, as they must understand their business counterparts and the sources of funds.

BlackRock's First Tokenized Money Market Fund BUIDL Has Distributed Over $100 Million in Dividends

According to Finance Feeds, since its launch, BlackRock's first tokenized money market fund BUIDL has distributed over $100 million in dividends, indicating that tokenized securities have surpassed the pilot and concept verification stages and are being practically applied. It is reported that the fund invests in short-term U.S. dollar-denominated instruments, such as U.S. Treasury bonds, repurchase agreements, and cash equivalents.

Ondo's Tokenized Silver SLV Surges Over 155% in Market Value to Nearly $18 Million in 30 Days

According to RWA XYZ data, Ondo's tokenized silver SLV has surged over 155% in market value to nearly $18 million in 30 days.

It is reported that SLV is a tokenized version of the iShares Silver Trust on the Ondo platform, allowing token holders to receive economic benefits similar to holding SLV and reinvest dividends.

RWA Trading Platform MSX Launches Multiple Commodity Assets

According to official news, the RWA trading platform MSX has launched commodity assets such as $CPER.M (Copper), $URA.M (Uranium), $LIT.M (Lithium), $AA.M (Aluminum), $PALL.M (Palladium), and $USO.M (Crude Oil).

Insights

After the Surge in Gold and Silver Prices, On-Chain Commodity Trading Heats Up

PANews Overview: Recently, gold and silver prices have surged significantly, with gold breaking through $4,500 per ounce and silver surpassing $75. This is mainly due to the Federal Reserve's interest rate cuts, concerns over the dollar's credit, and geopolitical conflicts. This upward trend has not only affected traditional markets but has also spread to the cryptocurrency sector, driving rapid growth in the "tokenized commodities" market (such as using blockchain to represent real gold and silver), with a total market value approaching $4 billion. Among them, Tether Gold and Paxos Gold are the two main tokenized gold products. At the same time, Perp DEX has also started to list gold and silver trading pairs, allowing users to trade these commodities directly with cryptocurrencies, with platforms like Ostium performing exceptionally well and having a high proportion of commodity trading. This reflects that users in the crypto market are expanding from mere cryptocurrency speculators to a more diverse group that includes "macro traders," indicating that an on-chain commodity trading market driven by smart contracts is forming in parallel with traditional finance.

At the End of 2025: Code, Power, and Stablecoins

PANews Overview: By 2025, the stablecoin market has surpassed $300 billion, with mainstream institutions like JPMorgan and Citigroup predicting it will grow to trillions of dollars in the coming years, marking it as an important financial infrastructure. Its fundamental advantage lies in the transparency based on blockchain, where users trust publicly verifiable code and reserves rather than opaque intermediary promises in traditional finance, as evidenced by the failures of traditional fintech companies like Synapse. However, stablecoins still face issuer risks (such as issues with the issuing company), but these are more monitorable and manageable compared to the "black box" risks of traditional banks. Stablecoins inherently have global reach, but the "last mile" of converting to local fiat currency still requires local compliance cooperation. The article also discusses the controversy of building new blockchains specifically for payments, pointing out that new chains face challenges in trust accumulation; it envisions the prospects of "agent finance," where AI agents automate financial processes like payments within strict permissions through smart contracts, which is safer than granting AI traditional banking permissions. At the same time, the article warns that security cannot be overlooked during rapid expansion and notes that when real business operations are on-chain, financial privacy (such as selective disclosure) will become a key demand. Ultimately, the author believes that the potential of stablecoins far exceeds "more efficient old finance," and their true value lies in unlocking new possibilities such as programmable money, internet-native capital markets, and agent finance.

PANews Overview: The development of the digital renminbi has seemed "tepid," not due to a wrong path, but because it has been strictly limited to M0 (digital cash), primarily addressing cash digitization and extreme scenario payments (such as dual offline), which belong to low-frequency demand and are difficult to attract users for daily use. Transitioning to M1 means that the digital renminbi will have holding value (such as earning interest), thus for the first time entering the asset selection range of users, transforming from a mere payment tool to a currency that can be actively held. The article emphasizes that this is not a denial of stablecoins or a fundamental change in the central bank's issuance of sovereign currency, but a necessary development stage switch aimed at enhancing the market flexibility and usability of the digital renminbi without sacrificing financial stability and sovereign credit. The real challenge lies not in technology or compliance, but in whether regulators can provide the market with enough exploratory space under controllable risks, allowing the digital renminbi to form network effects through real demand rather than administrative push. It also proposes a dual-track design concept of "strict control onshore, flexibility offshore" to assist its internationalization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。