Changes in Bitcoin On-Chain Data from January 1, 2025, to January 1, 2026 (Part One)

The new year has begun, and everyone has heard enough blessings and auspicious words. Let's look at the actual data to see the changes in several key metrics of $BTC over the entire year and what these changes mean.

First and foremost is the exchange inventory, which is the data I focused on the most in 2025, without exception. The exchange inventory can be seen as a reflection of Bitcoin investors' sentiment. When more BTC is transferred to exchanges, it indicates strong selling sentiment among investors. Conversely, when the inventory of BTC on exchanges gradually decreases, it suggests that investors are maintaining long-term holdings and have a positive outlook on BTC's future.

Recent Year BTC Inventory on All Exchanges

From the data, at the beginning of 2025, there were a total of 3,083,712 BTC on exchanges, and as of now, there are 2,930,005 BTC remaining on exchanges. Over the course of the year, 153,707 BTC have been withdrawn from exchanges.

In terms of detailed data, Coinbase has the highest known inventory of $BTC and also the most withdrawals, starting with over 1 million BTC at the beginning of the year and withdrawing more than 110,000 BTC over the year. This indicates that investors primarily from the U.S. or U.S. time zones are the strongest buyers in the spot Bitcoin market.

Although Binance has the highest trading volume, its BTC inventory has seen significant fluctuations, with over 4,000 BTC withdrawn throughout the year.

Among exchanges with over 100,000 BTC in inventory, only Bitfinex, OKX, and Upbit have seen increases in BTC inventory, with Bitfinex experiencing the largest increase, with just over 20,000 BTC inflow.

Regarding spot ETFs, on December 30, 2024, all U.S. institutions held a total of 1,195,854 BTC, and by December 30, 2025, this number had increased to 1,301,006 BTC, indicating a net inflow of 105,152 BTC from traditional U.S. investors into ETFs over the year.

Among them, BlackRock's investors hold the most BTC assets, totaling 771,926 BTC. On October 28, 2025, BlackRock investors had the highest holdings, with a total of 806,329 BTC, meaning that BlackRock's investments saw a net outflow of 34,403 BTC over approximately two months. BlackRock's investors hold nearly 60% of the total U.S. BTC spot ETF, followed by Grayscale at 16.48% and Fidelity at 15.24%, with other data being negligible.

Recent Year BTC On-Chain Holding Distribution

From the BTC holding data, high-net-worth investors holding more than 10 BTC have been in a state of accumulation throughout 2025, increasing from 16,325,508 BTC at the beginning of the year to 16,533,234 BTC currently, with a total increase of 207,726 Bitcoin over the year.

In contrast, small-scale investors holding less than 10 BTC have mostly been in a state of reduction throughout 2025, decreasing from 3,457,673 BTC to 3,433,815 BTC, a net decrease of 23,858 BTC. Although this is not a large amount, it still reflects the investors' attitude.

Throughout 2025, BTC has gradually flowed into long-term holdings, particularly among high-net-worth users, who are less sensitive to price changes. Regardless of whether prices rise or fall, they exhibit clear buying behavior, while small-scale investors are more sensitive to price fluctuations.

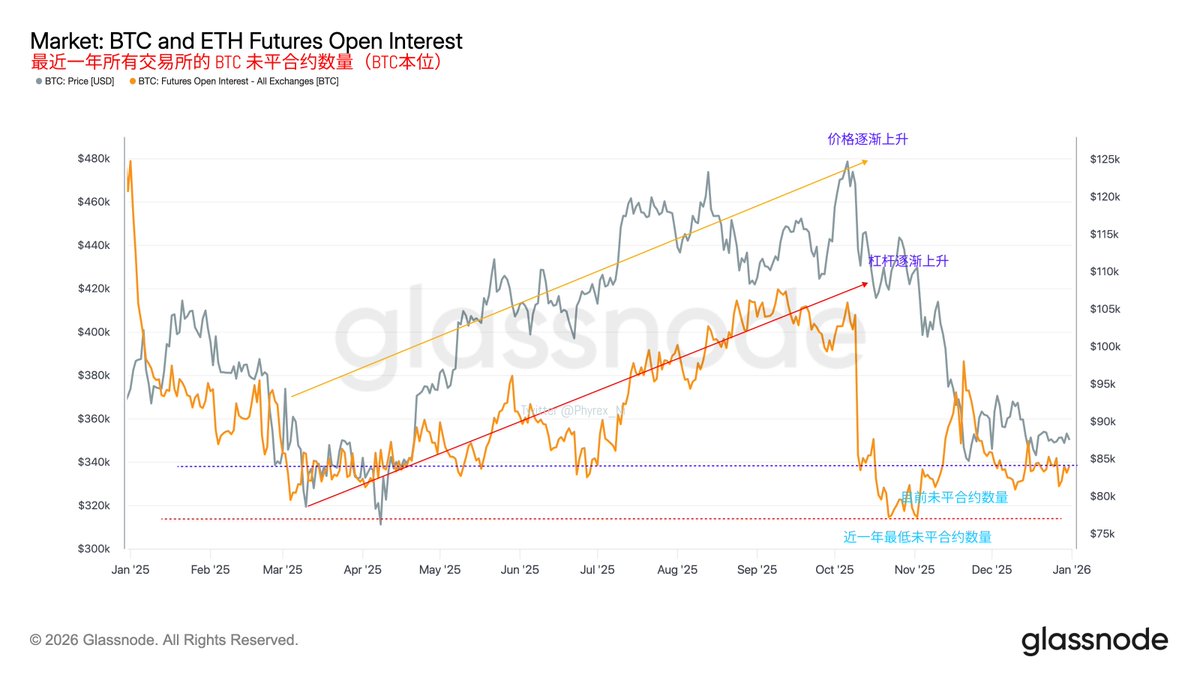

Recent Year BTC Open Interest on All Exchanges

Next is the open interest data for Bitcoin. Although this data does not directly indicate the future trend of $BTC, it clearly shows us that the current leverage level for BTC is very low. Considering the deleveraging in October as a cascading factor, the current leverage level is indeed among the lowest of the year.

A lower leverage level indicates that investor sentiment is not high. On the other hand, repeated fluctuations can lead leveraged investors to lose confidence. However, it is evident that there is currently a trend of increasing open interest. If we extend the timeframe to the last five years of leverage data, the picture becomes clearer.

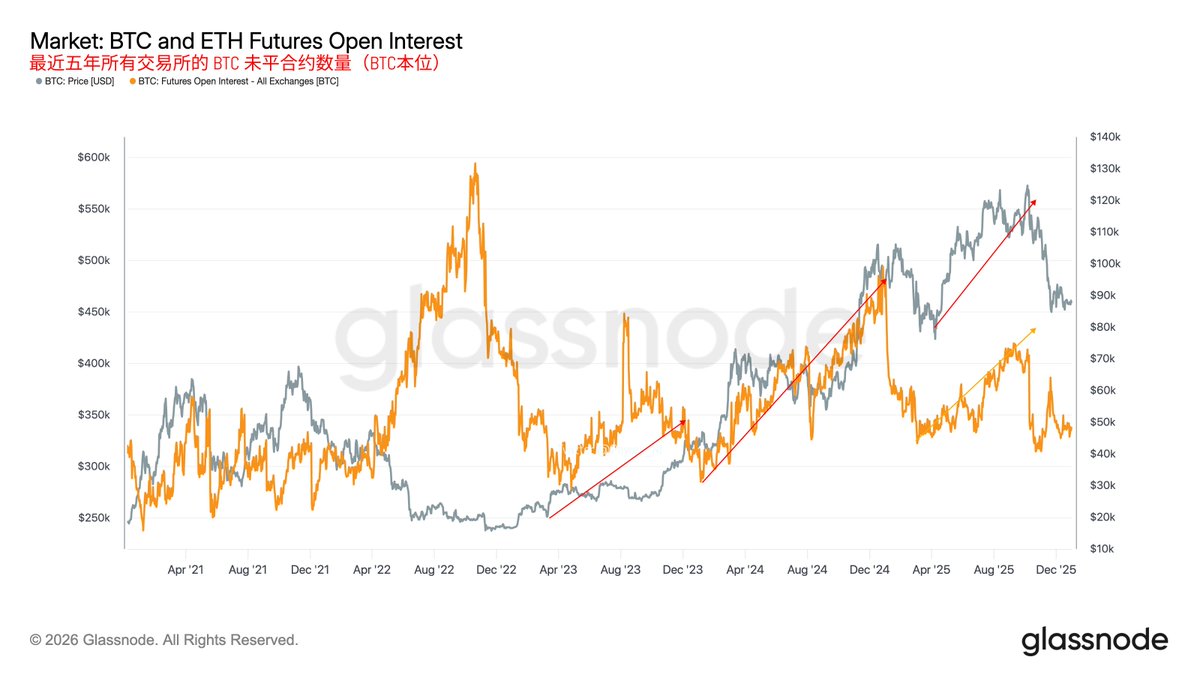

Recent Five-Year BTC Open Interest on Exchanges

It is clear that while high open interest does not necessarily indicate a price surge, it often represents extreme market sentiment. Conversely, low open interest typically occurs during periods of consolidation while searching for a breakout direction. In most cases, deleveraging will inevitably lead to a new wave of growth.

Currently, the open interest is not only at a low level for 2025 but also historically low over the past five years. The gradual buildup of open interest indicates that risk appetite is not high, and the market seems to be testing the waters for new positions after clearing out leverage. Additionally, the funding rate for BTC has remained positive for an extended period, indicating that investors are not entering a fully bearish trend like in 2022.

Therefore, from the current data primarily based on "volume," we can still see signs of investors reacting to the current Bitcoin situation and entering a "bear market."

The inventory on exchanges continues to decrease, with the number of holdings clearly exceeding sell-offs. This means that at least there are still more investors optimistic about BTC's future. From the holding data, high-net-worth investors tend to hold the most, and they are less affected by price changes. Even traditional investors have not shown signs of completely abandoning cryptocurrencies in favor of U.S. stocks.

This group of high-net-worth and traditional investors is still primarily composed of U.S. and U.S. time zone investors. Therefore, U.S. politics, economics, and monetary policy will still have a significant impact on cryptocurrencies and Bitcoin. Although currently constrained by liquidity, with low leverage levels and investor sentiment, it is evident that we are in a position-building phase. Once liquidity or policies provide better stimulation, it will significantly impact the strength of $BTC prices.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。