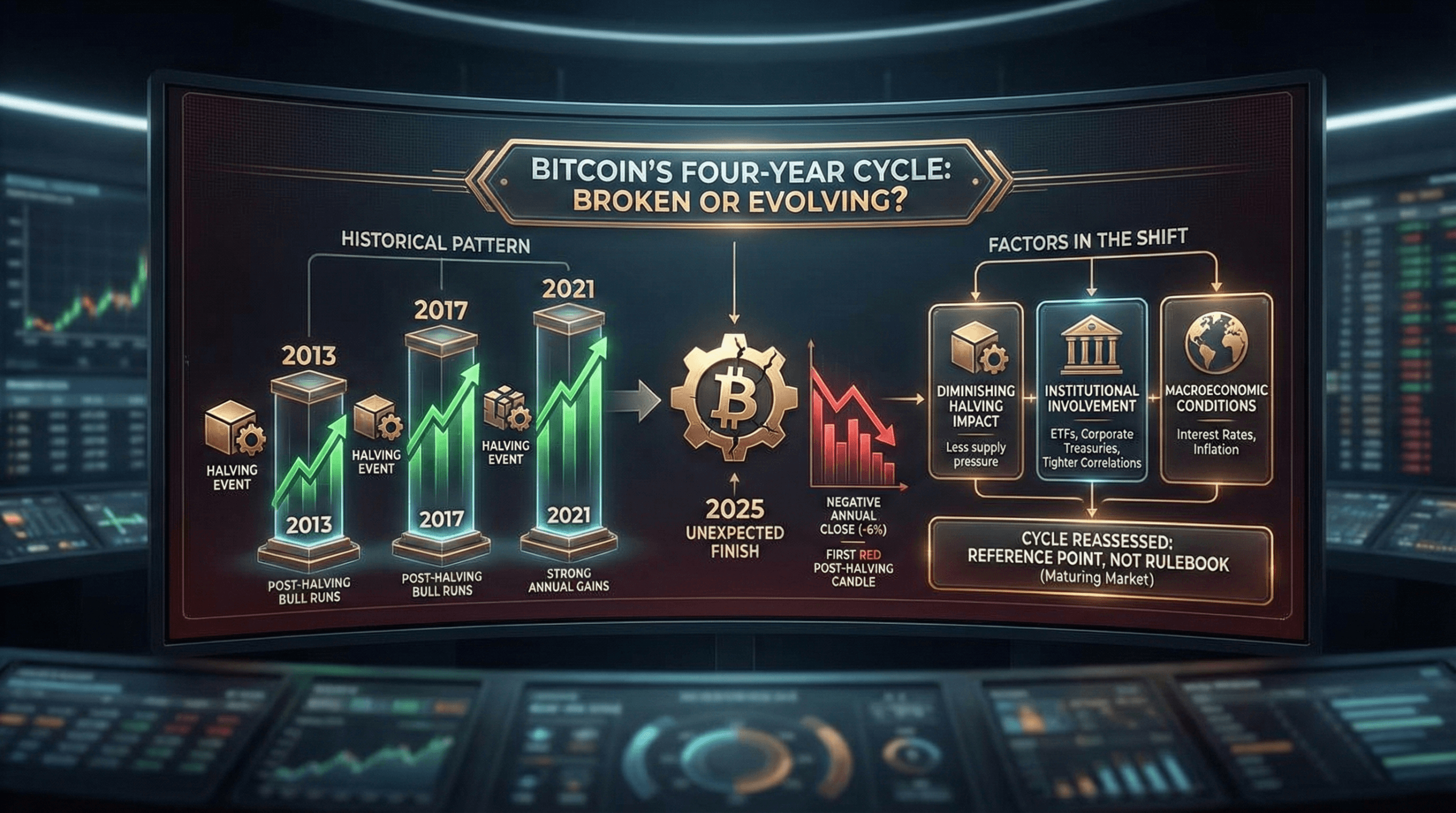

The four-year cycle refers to a recurring pattern tied to Bitcoin’s halving events, which reduce mining rewards roughly every four years and have historically preceded large price advances. In past cycles, the halving year was followed by a strong rally, with 2013, 2017, and 2021 each closing with sizable annual gains.

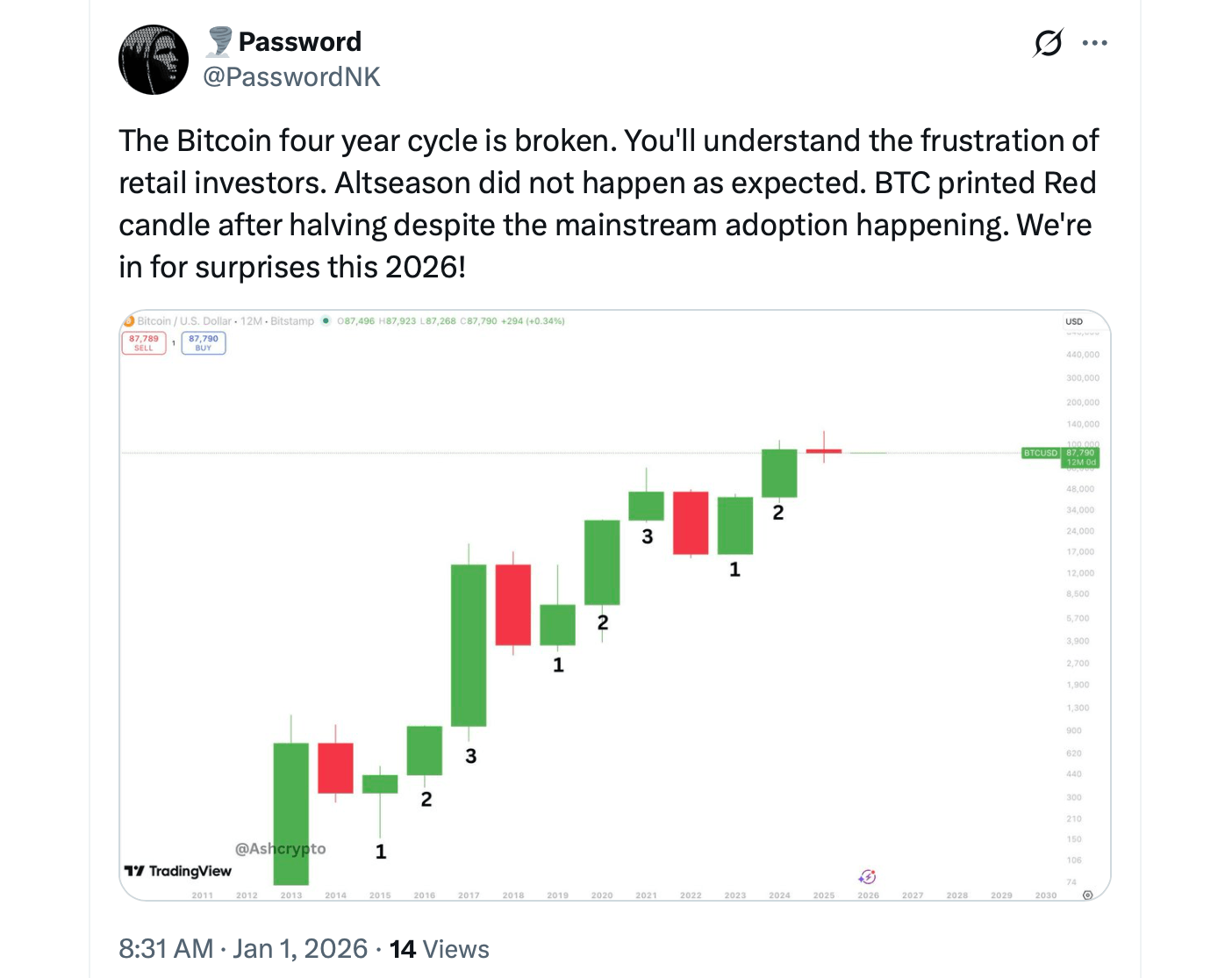

That pattern faltered in 2025. Despite reaching intraday highs earlier in the year, bitcoin ended December down about 6% from its January opening price, marking the first red post-halving candle on record. The close followed a broader digital-asset downturn late in the year that erased earlier advances.

The deviation has fueled claims across crypto-focused forums, social media platforms, and market commentary that the four-year cycle is “dead” or no longer reliable. Charts highlighting yearly returns show that previous post-halving years delivered strong positive results, making 2025 an outlier by comparison.

“For the first time in 14 years, Bitcoin has closed a post-halving yearly candle as red,” crypto influencer Lark Davis wrote on X. “Can we finally agree on the fact that the 4-year cycle is dead?”

Several explanations are commonly cited by critics. One is the diminishing impact of halvings as bitcoin’s issuance rate declines and total supply approaches its 21 million cap. The reduction from 6.25 BTC per block in 2020 to 3.125 BTC in 2024 introduced less new supply pressure than earlier halvings, weakening expectations of a sharp follow-on rally.

Also read: Ripple Sees Institutional Acceleration: ‘We’ve Never Been in a Better Position Heading Into a New Year’

Institutional involvement has also reshaped market behavior. The launch of U.S.-listed spot bitcoin exchange-traded funds (ETFs) in 2024, combined with corporate treasury exposure from firms such as Strategy, has broadened ownership while tightening correlations with traditional financial markets.

Macroeconomic conditions further complicated the picture. Elevated interest rates, persistent inflation concerns, and slowing economic growth weighed on risk assets throughout 2025. Even policy rhetoric supportive of digital assets under President Trump failed to offset broader global pressures by year’s end.

Others argue that bitcoin’s growth has simply changed the rhythm of its market cycles. With a market capitalization exceeding $1.7 trillion, price movements may unfold over longer time frames, leading some analysts to suggest extended or overlapping cycles rather than a fixed four-year cadence.

Still, not all observers see the 2025 close as a definitive break. Some point to prior periods when bitcoin was declared finished following unexpected downturns, only to recover in subsequent years. Others note that delayed responses to halving supply reductions have occurred before, particularly when macroeconomic conditions dominate short-term price action.

The data shows that 2025 stands alone historically, but whether it marks a permanent shift or a temporary anomaly remains unresolved. What is clear is that bitcoin’s price behavior is increasingly influenced by factors beyond halving schedules alone.

As debate continues, the four-year cycle may be less a rulebook than a reference point—one now being reassessed as bitcoin matures within global financial markets.

- What is the bitcoin four-year cycle?

It is a historical pattern linking bitcoin price movements to halving events that occur roughly every four years. - Why is 2025 significant for bitcoin?

It marked the first time a post-halving year closed with a negative annual return. - Did bitcoin reach new highs in 2025?

Bitcoin hit intraday highs during the year but failed to hold gains through year-end. - Is the four-year cycle officially over?

There is no consensus, with some viewing 2025 as a structural shift and others as an anomaly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。