Strategy Inc. (Nasdaq: MSTR) stands as the most aggressive public-market vehicle for bitcoin accumulation, pairing unprecedented balance-sheet exposure with equity-market leverage. While short-term volatility, dilution, and regulatory overhangs have pressured the stock, the company’s scale, liquidity, and index relevance continue to position it at the center of institutional bitcoin allocation debates.

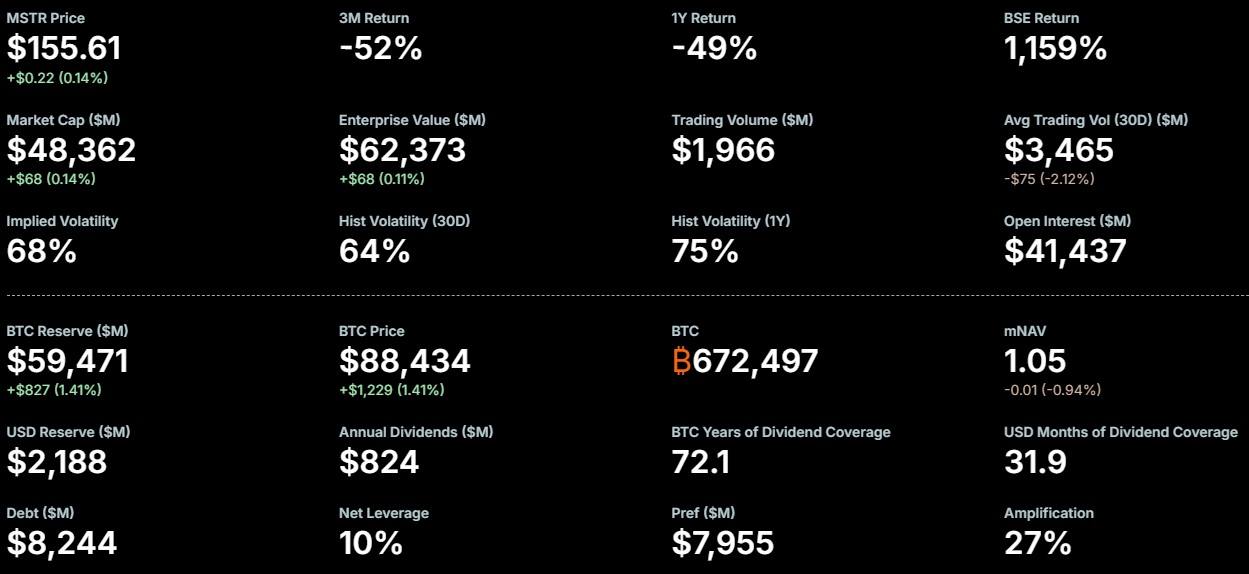

As of Dec. 30, Strategy held approximately 672,497 BTC, valued near $59.5 billion at a bitcoin price of $88,413, making bitcoin the dominant driver of enterprise value. Shares traded at $155.61, giving the company a market capitalization of about $48.4 billion and an enterprise value of roughly $62.4 billion.

Strategy’s stats as of Dec. 30. Source: Strategy Inc.

Performance remains volatile, with the stock down 52% over three months and 49% over one year. Implied volatility stands near 68%, while historical volatility measured roughly 64% over 30 days and 75% over one year, reinforcing MSTR’s role as a high-beta, option-like proxy for bitcoin rather than a conventional operating equity. Despite drawdowns, the stock trades around 1.05x market net asset value, reflecting a persistent premium tied to leverage and capital markets access. Liquidity remains a defining feature, with daily trading volume near $2.0 billion, average 30-day volume above $3.4 billion, and options open interest totaling roughly $41.4 billion.

Read more: Michael Saylor Pitches ‘Digital Credit’ Stack as Strategy’s Fixed-Income Engine

Balance-sheet metrics highlight both resilience and dependence on market confidence. Strategy reported about $2.2 billion in cash reserves against $8.2 billion in debt, translating to net leverage near 10%, alongside roughly $8.0 billion in preferred equity outstanding. Management emphasizes that current bitcoin holdings equate to more than 70 years of dividend coverage in BTC terms, framing the asset as long-duration collateral.

Index dynamics now dominate the forward outlook. Retention in the Nasdaq 100 preserves passive and derivatives-driven demand, yet proposed MSCI index-rule changes targeting companies whose digital assets exceed 50% of total assets remain a material overhang, given BTC represents close to 90% of Strategy’s balance sheet. Executive Chairman Michael Saylor continues to advocate continuous accumulation and the expansion of digital credit issuance, betting that sustained access to equity and credit markets, combined with long-term bitcoin appreciation, will outweigh dilution risk, volatility, and evolving index mechanics.

- Why is Strategy Inc. viewed as the most leveraged public proxy for bitcoin exposure?

Strategy holds roughly 672,497 BTC—about 90% of its balance sheet—using equity, debt, and preferred capital to amplify bitcoin exposure beyond spot ownership. - How does Strategy’s valuation compare to the underlying value of its bitcoin holdings?

The stock trades near 1.05x market net asset value, reflecting a modest premium driven by leverage, liquidity, and sustained access to capital markets. - What are the key financial risks investors should monitor?

High volatility, ongoing dilution, $8.2 billion in debt, and potential exclusion from major indexes due to asset concentration remain the primary downside risks. - Why do index inclusion and liquidity matter so much for Strategy’s stock?

Nasdaq 100 inclusion and multi-billion-dollar daily trading volume support persistent institutional, passive, and derivatives-based demand for MSTR shares.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。