The competition between chains has risen to the level of "transaction ordering," which directly affects the bid-ask spread and depth of market makers.

The demand for "universal chains" has been debunked. The current competition between chains focuses on two levels:

1) Building "application chains" on the basis of existing mature businesses, allowing blockchain to supplement existing businesses in areas such as settlement;

2) Competition at the level of "transaction ordering."

This article focuses on the second level.

Ordering directly affects the behavior of market makers. This is the core issue.

What is Transaction Ordering?

On-chain, a user's transaction is not immediately written into a block but first enters the "waiting area" (Mempool). At the same time, there may be thousands of transactions that must be decided by a sequencer, validator, or miner:

1) Which transactions are packed into the next block?

2) In what order are these transactions arranged?

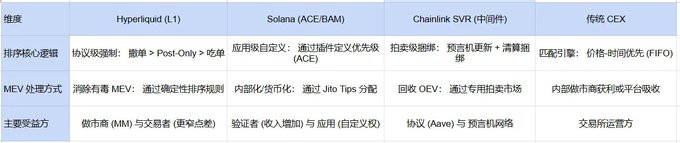

The process of "deciding the order" is transaction ordering, which directly affects the transaction costs, MEV situation, success rate, and fairness for users on the chain.

For example, during network congestion, ordering determines whether a transaction can quickly go on-chain or remain in the memory pool indefinitely.

For high-frequency traders like market makers, whether an order cancellation is effective is more important than the success of a new order. The priority of processing cancellation instructions in ordering directly affects whether market makers dare to provide deep liquidity.

In the last cycle, everyone was pursuing TPS, believing that as long as the speed was fast enough, it could improve on-chain transaction settlement. However, it has been proven that, in addition to speed, the risk pricing of market makers is equally important.

In centralized exchanges, transaction matching strictly follows the "price-time priority" principle. In such a high-certainty environment, market makers can provide deep order book liquidity with extremely narrow slippage.

On-chain, after transactions enter the Mempool waiting area, nodes select transactions based on Gas prices, creating space for high Gas to target existing orders.

Assuming the price of TRUMP is $4.5, a market maker places a buy order at $4.4 and a sell order at $4.6 to provide depth. But suddenly, the price on the TRUMP exchange crashes to $4.

At this point, the on-chain market maker wants to cancel the $4.4 order but is targeted by high-frequency traders who raise Gas—buying at $4 and then selling to the market maker at $4.4.

As a result, the market maker can only widen the spread to reduce risk.

The goal of the new generation of ordering innovation is to transform from "universal ordering" to "application-aware ordering."

The ordering layer can understand transaction intentions and sort based on preset fairness rules rather than solely on Gas fees.

1) Specifying the ordering method at the consensus layer

A typical case is Hyperliquid. It specifies that cancellation and Post-Only transactions take priority at the consensus layer, breaking the Gas priority principle.

For market makers, the ability to escape is the most important. During significant price fluctuations, cancellation requests are always executed before others' fill requests.

Market makers fear being targeted. Hyperliquid ensures that cancellations are always prioritized—when prices drop, market makers cancel orders, and the system enforces priority for cancellations, allowing market makers to successfully hedge.

On the day of the crash on October 11, Hyperliquid market makers remained online, with spreads of 0.01–0.05%. The reason is that market makers know they can escape.

2) Adding new ordering methods at the ordering layer

For example, Solana's Application Controlled Execution (ACE). Jito Labs' BAM (Block Assembly Marketplace) introduces dedicated BAM nodes responsible for collecting, filtering, and ordering transactions.

Nodes operate in a Trusted Execution Environment (TEE), ensuring the privacy of transaction data and the fairness of ordering.

Through ACE, DEXs on Solana (such as Jupiter, Drift, Phoenix) can register custom ordering rules with BAM nodes. For example, market maker priority (similar to Hyperliquid), conditional liquidity, etc.

Additionally, Prop AMM self-market makers represented by HumidiFi are also innovations at the ordering level, utilizing Nozomi to connect directly with major validators, reducing latency and completing transactions.

During specific transactions, HumidiFi's off-chain servers monitor prices across platforms. Oracles communicate with on-chain contracts to inform the situation. Nozomi acts as a VIP channel, allowing effective cancellations before an order is filled.

3) Utilizing MEV facilities and private channels

Chainlink SVR (Smart Value Recapture) focuses on the attribution of value generated by ordering (MEV).

By deeply binding with oracle data, it redefines the ordering rights and value distribution of clearing transactions. After Chainlink nodes generate price updates, they send through two channels:

1) Public channel: Sent to standard on-chain aggregators (as a backup, but there will be slight delays in SVR mode to allow for auction windows).

2) Private channel (Flashbots MEV-Share): Sent to auction markets that support MEV-Share.

In this way, the auction proceeds from liquidation of lending protocols triggered by oracle price changes (i.e., the amount searchers are willing to pay) are no longer solely enjoyed by miners but are mostly captured by the SVR protocol.

Conclusion

If TPS is the entry ticket, then currently having only TPS is completely insufficient. Custom ordering logic may not only be an innovation but also a necessary path for transactions to go on-chain.

Perhaps it is also the beginning of DEX surpassing CEX.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。