In an era where BTC remains the only macro anchor in the crypto market, ETH resembles a financial operating system built on this anchor.

Author: Merkle3s Capital

This article is based on Messari's annual report "The Crypto Theses 2026," published in December 2025. The full report exceeds 100,000 words, with an official reading time of 401 minutes.

This content is supported by Block Analytics Ltd X Merkle 3s Capital. The information in this article is for reference only and does not constitute any investment advice or invitation. We do not take responsibility for the accuracy of the content, nor do we bear any consequences arising from it.

Introduction: When ETH Starts to Underperform, Where Does the Problem Lie?

Over the past year, it has become almost an unquestionable fact that ETH has underperformed BTC.

Whether in price performance, market sentiment, or narrative strength, BTC is continuously reinforced as the "only main asset":

ETFs, institutional allocation, macro hedging, dollar hedging… every narrative is converging towards BTC.

In contrast, ETH's situation appears somewhat awkward.

It remains the most important underlying network for DeFi, stablecoins, RWA, and on-chain finance, yet it continues to lag in asset performance.

This has led to a repeatedly discussed but never seriously dissected question:

Is ETH underperforming BTC because it is being marginalized, or is it because the market is pricing it incorrectly?

Messari's latest 100,000-word annual report provides an answer that is not pleasing to emotions and does not take sides with any chain.

They are more concerned with where the funds are truly landing and what institutions are actually putting on-chain.

From this perspective, ETH's "problem" may not be what most people imagine.

This article will not discuss beliefs, nor will it compare TPS, Gas, or technical routes. We will only do one thing:

Clarify the issue of ETH underperforming BTC based on Messari's data.

Chapter 1: ETH Underperforming BTC is Not Abnormal

If we only look at the price performance from 2024 to 2025, ETH underperforming BTC may lead many to intuitively judge:

Is there something wrong with ETH?

However, from a historical and structural perspective, ETH underperforming BTC is not an "anomalous phenomenon."

BTC is an asset with a highly singular narrative.

Its pricing logic is clear, consensus is concentrated, and variables are minimal.

When the market enters a phase of macro uncertainty, regulatory shifts, and institutions reassessing risk assets, BTC often first absorbs the premium.

ETH, on the other hand, is completely the opposite.

ETH simultaneously assumes three roles:

Decentralized settlement layer

Infrastructure for DeFi and stablecoins

A "production network" with a technological upgrade path and execution risks

This means that ETH's price does not only reflect "macro consensus," but is also forced to absorb multiple variables such as technological rhythm, ecological changes, and value capture structures.

Messari explicitly points out in the report:

The issue with ETH is not "demand disappearing," but rather that "the pricing logic has become more complex."

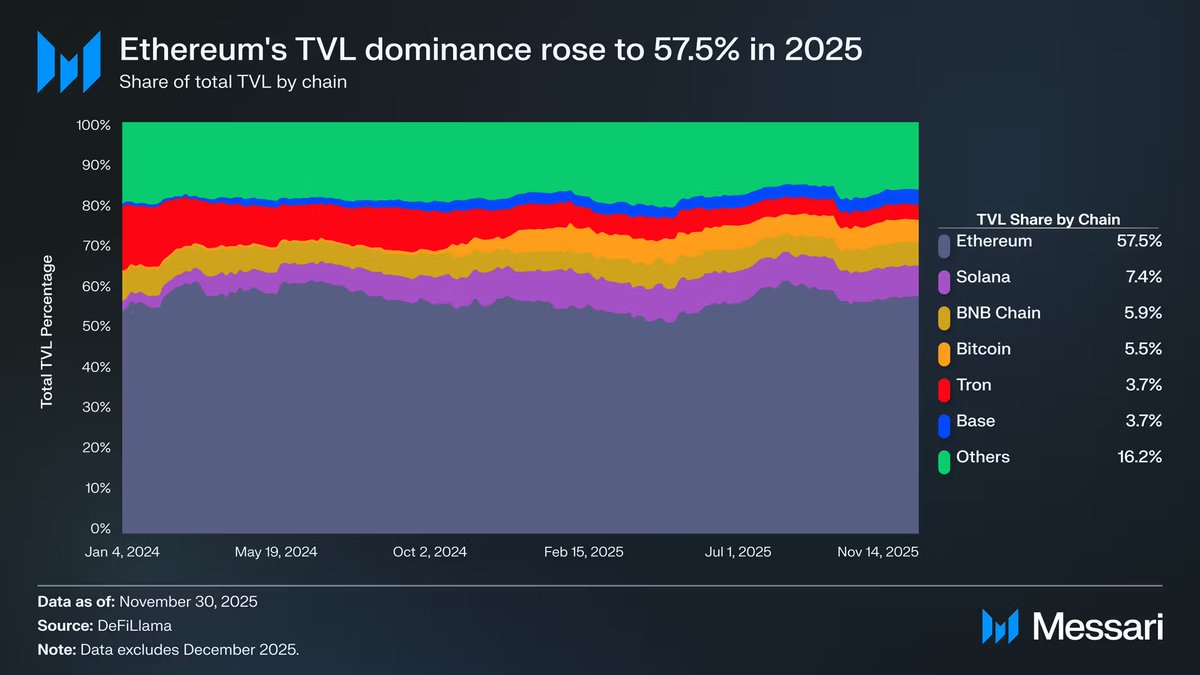

In 2025, ETH still occupies an absolute dominant position in key metrics such as on-chain activity, stablecoin settlement, and RWA hosting.

However, this growth does not immediately translate into asset premiums like BTC's ETFs or macro narratives.

In other words, ETH underperforming BTC does not mean the market denies Ethereum.

It more likely means that the market temporarily does not know how to price it.

What is truly concerning is not the act of "underperforming" itself,

But rather: when ETH is being widely used, whether this usage can still continuously feedback to the ETH asset.

This is the real issue that Messari cares about.

Chapter 2: Usage is Growing, but Value Isn't Keeping Up? The Value Capture Dilemma of ETH

What truly makes the market start to doubt ETH is not the price underperforming BTC,

But a more glaring fact: Ethereum is being widely used, yet ETH itself is not benefiting in sync.

Messari provides a set of key data in the report:

With the rise of competitive L1s, Ethereum's share of L1 transaction fees continues to decline.

Solana regained its position as a high-performance execution layer in 2024,

Hyperliquid rapidly scaled in 2025 with on-chain derivatives,

Both have jointly squeezed Ethereum's share in the dimension of "direct monetization of economic activity."

By 2025, Ethereum's share of L1 transaction fees has dropped to about 17%,

Ranking it fourth among L1s.

Just a year ago, it firmly held the first position.

Transaction fees are not the only metric for measuring network value, but they are an extremely honest signal:

Wherever transaction fees are collected, there lies real trading behavior and risk preference.

This is also where ETH's core contradiction begins to emerge.

Ethereum has not lost users. On the contrary, its position in stablecoins, RWA, and institutional settlements has become more solid. The problem is that these activities are increasingly occurring on L2 or application layers, rather than directly reflecting as L1 fee income.

In other words: Ethereum is becoming increasingly important as a system, while ETH as an asset is increasingly resembling "diluted equity."

This is not a technical failure, but an inevitable result of architectural choices.

The Rollup expansion route has successfully reduced transaction costs and increased throughput, but it has also objectively weakened ETH's ability to directly capture usage value.

When usage is "outsourced" to L2, ETH's income comes more from abstract security premiums and monetary expectations rather than cash flow.

This is why the market has begun to hesitate in pricing ETH:

Is it an asset that will compound with increased usage, or is it becoming more like a "public infrastructure" neutral settlement layer?

This question has been further amplified after the intensification of multi-chain competition.

Chapter 3: Multi-Chain is Not a Threat; the Real Pressure Comes from "Execution Layer Replacement"

If we only look at the narrative level, ETH seems to have more and more competitors.

Solana, various high-performance L1s, application chains, and even dedicated trading chains are emerging one after another,

Easily leading to the conclusion: ETH is being marginalized in the "multi-chain world."

But Messari's judgment is more calm and more brutal.

Multi-chain itself is not a threat to ETH.

The real pressure comes from the continuous replacement of the execution layer, while the value of the settlement layer is difficult to be directly priced by the market.

Taking Solana as an example:

Solana has regained its dominance in high-frequency trading and retail activity in 2024-2025,

It clearly leads in spot trading volume, on-chain activity, and low-latency experience.

However, this growth is more reflected in "trading experience" and "traffic density," rather than stablecoin settlement, RWA custody, or institutional-level settlement.

Messari repeatedly emphasizes a fact in the report:

When institutions truly put money on-chain, they still prefer Ethereum.

Stablecoin issuance, Tokenized T-bills, on-chain fund shares, compliant custody paths—these most "boring" yet most critical financial infrastructures remain highly concentrated in the Ethereum ecosystem.

This also explains a seemingly contradictory phenomenon: ETH's asset performance is under pressure, yet Ethereum has further solidified its leading advantage in the dimension of "blockchain that institutions are willing to use."

The problem is that the market will not automatically give a premium just because "you are important."

When the income of the execution layer is taken away by other chains, and the value of the settlement layer is more reflected in "security" and "compliance credibility," the pricing logic of ETH inevitably becomes abstract.

In other words:

ETH is not facing "replacement," but is being forced to assume a role more like public infrastructure.

And infrastructure often becomes harder to tell a story about asset premiums the higher the usage rate.

This is where the fundamental differences between ETH and BTC begin to diverge completely.

Chapter 4: ETH Still Relies on BTC's "Macro Anchor"

If the first three chapters answer one question—Is ETH being marginalized?

Then this chapter faces a more brutal and realistic judgment:

Even if ETH has not been replaced, it still deeply depends on BTC in terms of asset pricing.

Messari repeatedly emphasizes a fact that many overlook in the report:

The market is not pricing "blockchain networks," but rather pricing things that can be abstracted as macro assets.

In this regard, the differentiation between BTC and ETH is extremely clear.

BTC's narrative has been completely simplified into three things:

Macro hedging asset

Digital gold

"Currency-like asset" that can be accepted by institutions, ETFs, and national balance sheets

In contrast, ETH's narrative is much more complex.

It is both a settlement layer and a technology platform, carrying financial activities while constantly undergoing upgrades and structural adjustments.

This makes it difficult for ETH to be directly included in a "macro asset basket" like BTC.

This difference is particularly evident in the flow of ETF funds.

At the beginning of 2024, when the ETH spot ETF was just launched, the market once believed that institutions had almost no interest in ETH.

In the first six months, the inflow of funds into the ETH ETF was significantly weaker than that of BTC, reinforcing the narrative that "BTC is the only institutional asset."

However, Messari points out that this conclusion is misleading.

As ETH's price and the ETH/BTC ratio synchronized and rebounded in mid-2025, funding behavior began to change.

ETH/BTC rebounded from a low of 0.017 to 0.042, an increase of over 100%

The dollar-denominated price of ETH rose nearly 200% during the same period

The inflow of funds into the ETH ETF began to accelerate significantly

During certain periods, the new inflow into the ETH ETF even temporarily exceeded that of BTC.

This indicates one thing:

Institutions are not unwilling to buy ETH; they are waiting for "narrative certainty."

Even so, Messari still provides a calm conclusion:

The monetary premium of ETH is still a "secondary derivative" of BTC's monetary consensus.

In other words, the market's willingness to embrace ETH again at a certain stage is not because ETH has become an independent macro asset, but because BTC's macro narrative remains valid and spills over into the risk curve.

As long as BTC remains the pricing anchor for the entire crypto market, the strength of ETH will inevitably be measured in the shadow of BTC.

This does not mean that ETH lacks room for growth. On the contrary, under the premise of a valid BTC trend, ETH often possesses higher elasticity and stronger Beta.

But this also means:

The asset narrative of ETH has not yet completed the "de-BTC-ization."

Until ETH can demonstrate lower BTC correlation, more stable independent sources of demand, and clearer value capture paths over a longer period,

It will still be viewed by the market as:

A second-layer belief asset built on BTC.

### Chapter 5: Will ETH Be Threatened? The Real Question Has Never Been Win or Lose

At this point, we can actually answer a repeatedly raised question:

Will ETH be "replaced" by other chains?

Messari's answer is very clear:

No.

At least for the foreseeable future, Ethereum remains the default base for on-chain finance, stablecoins, RWA, and institutional settlements.

It may not be the fastest chain, but it is the first chain allowed to carry real funds.

What is truly concerning is not whether "ETH will lose to Solana, Hyperliquid, or the next new chain,"

But rather a more uncomfortable question:

Can ETH as an asset continue to benefit from Ethereum's success?

This is a structural issue, not a technical one.

Ethereum is becoming increasingly like "public financial infrastructure":

Usage is growing

Systemic importance is increasing

Institutional dependence is deepening

But at the same time, ETH's value capture increasingly relies on:

Monetary premium

Security premium

Spillover of macro risk appetite

Rather than direct cash flow or fee growth.

This is also why ETH's asset performance increasingly resembles a "high Beta BTC derivative asset," rather than a network equity with an independent pricing system.

In a multi-chain world, the execution layer can be competed against, traffic can be diverted, but the settlement layer does not migrate frequently.

Ethereum precisely stands in this most stable position, which is also the hardest to be rewarded by market sentiment.

Therefore, ETH underperforming BTC does not mean failure.

It is more like a result of role division:

BTC bears the macro narrative, monetary consensus, and asset anchoring

ETH bears settlement, financial infrastructure, and system security

The only issue is that the market is more willing to pay a premium for the former while remaining restrained towards the latter.

Messari's conclusion is not radical, but it is honest enough:

ETH's monetary story has been repaired, but it is still incomplete. It can rise significantly when the BTC trend is valid, yet it has not yet proven that it can be independently priced without BTC.

This is not a denial of ETH, but a form of phased positioning.

In an era where BTC remains the only macro anchor in the crypto market,

ETH resembles a financial operating system built on this anchor.

It is important, it is irreplaceable, but for now, it is still not the "asset that is priced first."

At least not for now.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。