Highlights of This Issue

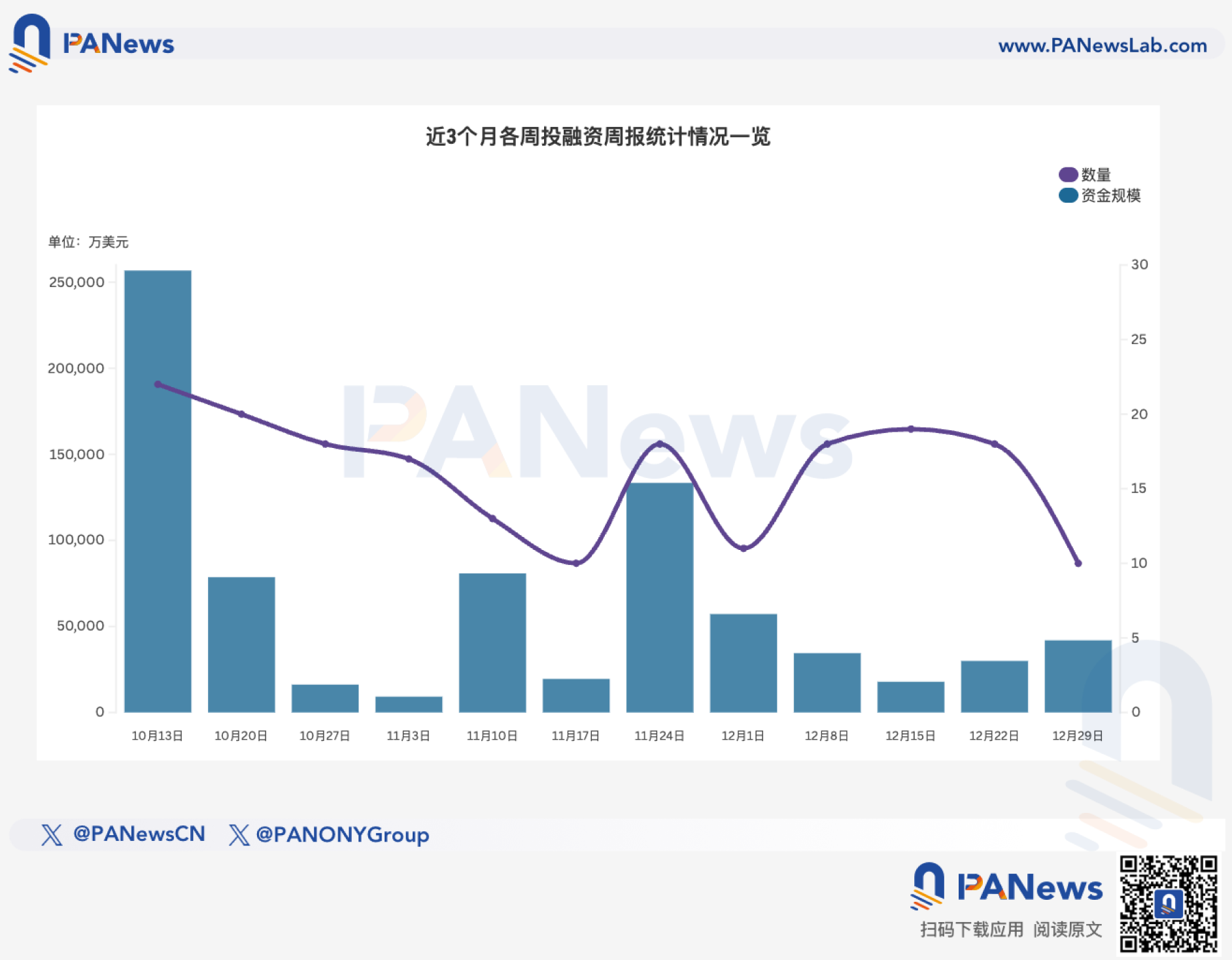

According to incomplete statistics from PANews, there were 10 financing events in the global blockchain sector last week (12.22-12.28), with a total funding scale exceeding $419 million. The overview is as follows:

- DeFi announced 2 financing events, including the on-chain trading platform easy.fun based on Hyperliquid, which completed a $2 million seed round financing;

- Web3+AI announced 2 financing events, including the decentralized AI video generation platform HPVideo, which completed $3 million in financing led by Helios Prime Capital;

- Infrastructure & Tools announced 1 financing event, with the programmable trust layer for stablecoin payments, Coinbax, completing $4.2 million in seed round financing;

- Centralized Finance announced 2 financing events, including the digital bank Erebor, which completed $350 million in financing led by Lux Capital;

- Other Web3 applications announced 3 financing events, including the Web3.0 social platform Crypto Life, which completed $20 million in financing.

DeFi

On-chain trading platform easy.fun based on Hyperliquid completes $2 million seed round financing

The on-chain trading competition platform easy.fun announced the completion of a $2 million seed round financing led by Mirana Ventures. The funds will be used for product development, team expansion, and the upcoming global official trading championship. easy.fun is built on Hyperliquid, focusing on creating an open, fair, and transparent on-chain competitive environment through gamification, aiming to transform trading into a playable, learnable, and winnable skill-based competition experience.

Hyperliquid ecosystem automated trading protocol Otomato completes $2 million strategic round financing

The Hyperliquid ecosystem automated trading protocol Otomato Protocol announced the completion of a $2 million strategic round financing, with an investor being a deep tech company from the UK, though the name has not yet been disclosed. The new funds will support Otomato in launching autonomous agent services, allowing users without coding expertise to create agents to execute and manage on-chain and off-chain trading tasks.

AI

Wallet-based AI video generation platform HPVideo announced that it has completed $3 million in strategic financing, led by Helios Prime Capital. HPVideo is based on the BNB Chain, supporting wallet login and multi-model AI video generation, focusing on no email registration and personal information, providing a low-cost video creation solution. The funds will be used for product R&D, infrastructure expansion, and ecosystem development.

HodlHer announced the completion of $1.5 million in strategic financing, with investors including Chain Capital, Bitrise Capital, and CGV. HodlHer is the first AI-driven Web3 operating system developed based on the L1 project Injective, with its core technology "HodlOS" integrating emotional perception, long-term memory, and decentralized execution functions, aiming to provide users with a unified experience from information interaction to on-chain operations.

Currently, HodlHer has launched the emotional trading assistant "Sola" and plans to accelerate the development of the multi-agent assistant system "Super InternX" and the decentralized intelligent agent market "Agent Market," supporting users in creating and trading personalized AI agents. HodlHer's long-term vision is to become the core operating system of the "personality economy" in the Web3 era, promoting the collaborative coexistence of humans and AI agents.

Infrastructure & Tools

Programmable trust layer for stablecoin payments Coinbax completes $4.2 million seed round financing

The programmable trust layer for stablecoin payments, Coinbax, has completed $4.2 million in seed round financing, aiming to bring custody, strategy execution, and programmable settlement functions to digital assets. This round of financing was led by BankTech Ventures, with participation from Connecticut Innovations, Paxos, SpringTime Ventures, and companies from the banking, payment, and digital asset infrastructure sectors.

Centralized Finance

Digital bank Erebor, supported by Palantir co-founder Peter Thiel and Anduril CEO Palmer Luckey, has completed $350 million in financing led by Lux Capital, with existing investors Founders Fund, 8VC, and Haun Ventures also participating in this round. The latest valuation has reached $4.35 billion. Erebor is positioned as a new type of bank serving crypto and tech clients, having recently received FDIC deposit insurance approval and obtained a preliminary banking license, with plans to officially launch in 2026.

Brett Harrison, former president of FTX US, has completed $35 million in financing for his newly established fintech company Architect Financial Technologies, with the company valued at approximately $187 million. The exchange AX launched by the company focuses on perpetual contract trading of traditional assets, including stocks and foreign exchange, rather than cryptocurrency perpetual contracts. The AX platform is regulated in Bermuda and is only open to non-U.S. institutional investors, as perpetual futures products have not yet been approved in the U.S.

DAT

NASDAQ-listed iPower reaches $30 million convertible note financing agreement to launch DAT strategy

NASDAQ-listed e-commerce and supply chain platform iPower announced that it has reached a $30 million convertible note financing agreement to launch its Digital Asset Treasury (DAT) strategy. The company disclosed that the initial phase of this financing will invest $9 million, of which $4.4 million is intended for purchasing Bitcoin and Ethereum, while other funds will increase working capital to strengthen the balance sheet, with 80% of subsequent funds allocated for ongoing digital asset acquisitions. Previously, iPower announced a strategic shift towards crypto finance and blockchain infrastructure services in June of this year.

Others

Web3 Social:

Web3.0 social platform Crypto Life completes $20 million financing, aiming to reshape data sovereignty and social value distribution

The next-generation decentralized social ecosystem Crypto Life announced the completion of $20 million in institutional round financing. This round of financing was participated in by multiple investment institutions, including Bluemount Foundation, VEGA-Ventures, Infinite Alliance, ChainPulse Capital, and UZ Capital. Crypto Life aims to build a global, decentralized social network centered on user privacy through blockchain technology, breaking the monopoly and control of traditional social giants over user data, and reshaping the social trust system and value distribution model.

Prediction Market:

Prediction market aggregator Rocket announced the completion of $1.5 million in Pre-seed round financing, led by Electric Capital, with follow-on investments from Jsquare, bodhi ventures, Tangent, Amber group, and others.

Rocket is the first prediction market based on the correctness of judgment for continuous profit distribution. It features a non-binary betting structure, no liquidation mechanism, and the profit ceiling is completely opened at the protocol level. Users can reuse the same capital to deploy in multiple predictions simultaneously.

Coinbase has reached an agreement to acquire the prediction market startup The Clearing Company. Coinbase stated that the transaction is subject to customary closing conditions and is expected to be completed in January. The Clearing Company was founded earlier this year by Toni Gemayel, who previously served as the growth lead at Polymarket and Kalshi. This startup completed a $15 million seed round financing in August, with investors including Coinbase Ventures, aiming to build an on-chain, regulated prediction market platform.

Investment Institutions

HashKey Capital's fourth fund completes $250 million first round of fundraising

HashKey Capital announced that its fourth multi-strategy fund, Fund IV, has completed its first round of fundraising, raising a total of $250 million, exceeding expectations. The fund's ultimate asset management target is $500 million. The fund will invest in global blockchain infrastructure and large-scale application projects, with strategies covering both primary and secondary markets. The general partner of the fourth fund is HashKey Capital Investment (affiliated with HashKey Capital). HashKey Capital currently manages over $1 billion in client assets, and the first fund achieved over 10x DPI returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。