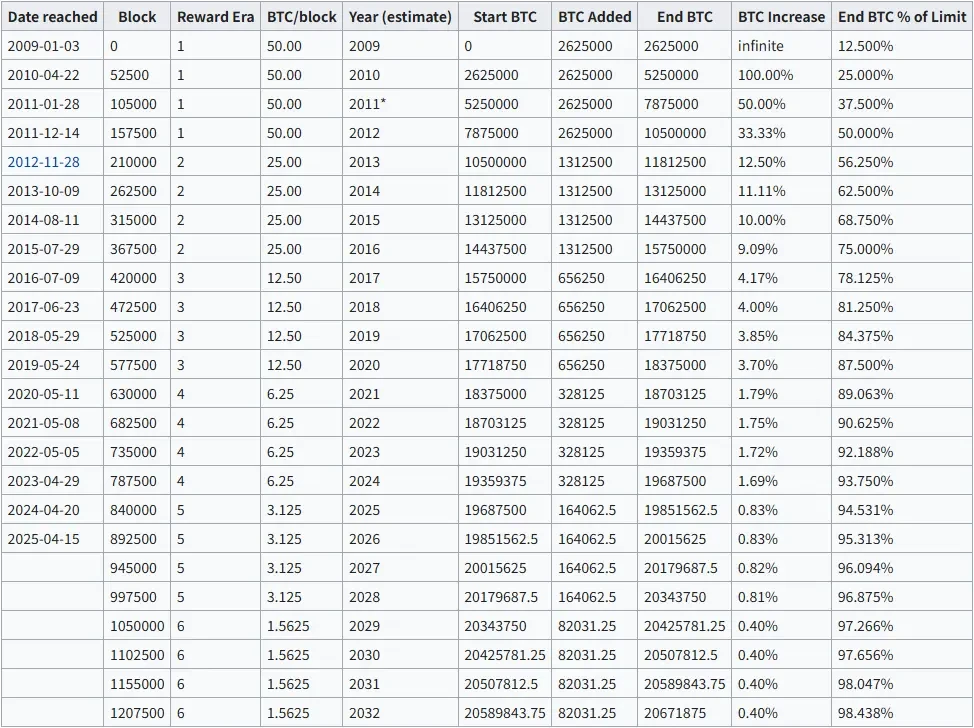

The Fourth Bitcoin Halving Occurred on April 20, 2024

The fourth Bitcoin block reward halving took place on April 20, 2024, corresponding to a block height of 840,000, reducing the block reward from 6.25 BTC to 3.125 BTC. This process fully adheres to the issuance mechanism predetermined in the Bitcoin protocol, automatically triggering a halving every 210,000 blocks.

This supply adjustment is executed automatically by Bitcoin's consensus rules, requiring no governance votes or human intervention, further reinforcing the certainty, transparency, and immutability of Bitcoin's monetary policy.

Daily New Issuance of Bitcoin Reduced by 50%

After the halving in April 2024, Bitcoin's daily new issuance mathematically decreased from approximately 900 BTC/day to about 450 BTC/day, based on the fixed block reward of 3.125 BTC and an average block time of around 10 minutes.

On an annualized basis, Bitcoin's yearly new issuance dropped from about 328,500 BTC/year to approximately 164,250 BTC/year. This supply contraction is permanent and entirely independent of market demand, miner behavior, or macroeconomic conditions.

Annual Supply Inflation Rate Falls Below 1%

As a direct result of the April 2024 halving, Bitcoin's annual supply inflation rate decreased to about 0.83%, calculated based on the circulating supply at that time and the new issuance rate post-halving.

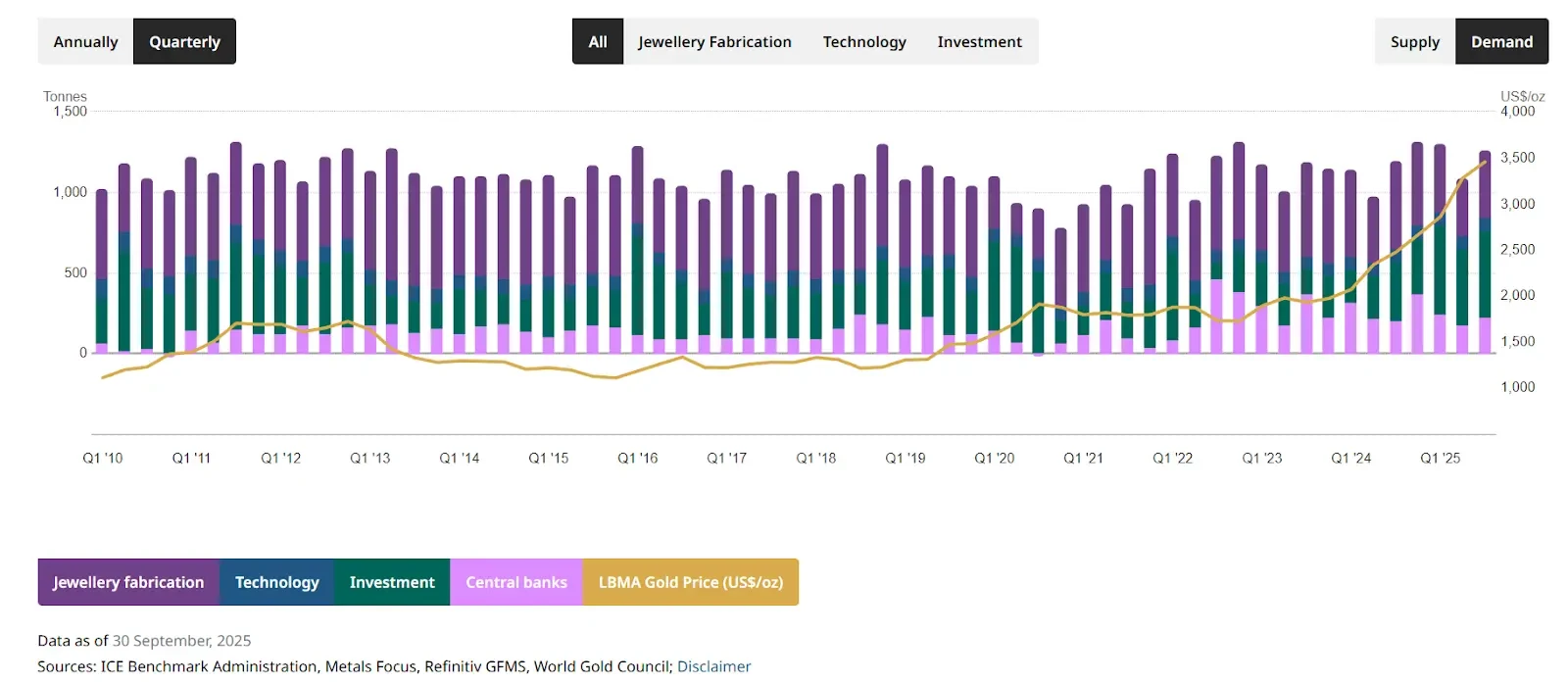

In comparison, the annual supply growth rate of gold is typically estimated to be in the range of 1%–2%, while the currency expansion rate in fiat systems depends on central bank policies rather than fixed rules written into code.

By the End of 2024, Bitcoin's Circulating Supply is Approximately 19.7 Million Coins

Blockchain data shows that as of December 31, 2024, Bitcoin's circulating supply is approximately 19.7 million BTC, leaving less than 1.3 million BTC yet to be mined, just shy of the protocol's maximum supply cap of 21 million BTC.

At this stage, over 93.8% of Bitcoin has been issued, meaning the impact of future halvings on the absolute supply quantity will continue to diminish, while its significance in proportional terms becomes even more pronounced.

Post-Halving, Miner Revenue Structure Changes

The halving event overnight cut miners' block subsidy income in half, significantly increasing the relative share of transaction fees in miners' total revenue.

In the months following the halving, the proportion of transaction fees in miners' income showed a noticeable increase compared to the pre-halving phase. This change aligns with Bitcoin's original long-term design expectation, where network security will gradually transition from being driven by block subsidies to an economic model primarily based on transaction fees.

Supply is Fixed, Adjustments are Complete

Unlike the monetary policies in traditional financial systems that can be adjusted based on economic conditions, the supply changes in Bitcoin after the April 2024 halving are final and irreversible. There is no mechanism to accelerate issuance when demand rises or to slow it down during market downturns.

By the end of 2024, the market is no longer facing an "upcoming halving event," but rather a low issuance baseline that has already been adjusted and will continue to operate until the next halving, which is expected to occur around 2028, at which point the block reward will again be reduced to 1.5625 BTC.

This chart shows the number of bitcoins that will exist in the near future. The Year is a forecast and may be slightly off.

From Events to Baseline Conditions

With the fourth halving fully implemented, Bitcoin's low issuance rate is no longer a short-term narrative driver but has become a long-term foundational condition, reshaping its supply structure in a transparent, predictable manner that can be independently verified by any participant running a full node.

This change does not rely on market sentiment, policy signals, or institutional adoption rhythms, but is directly written into Bitcoin's code and enforced by global consensus, making the post-halving supply mechanism one of the few variables in the global financial system that can be precisely described mathematically.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。