Ether ETFs entered 2025 without the fanfare of bitcoin, but they ended the year as one of crypto’s most actively traded institutional vehicles. The path between those points, however, was anything but smooth.

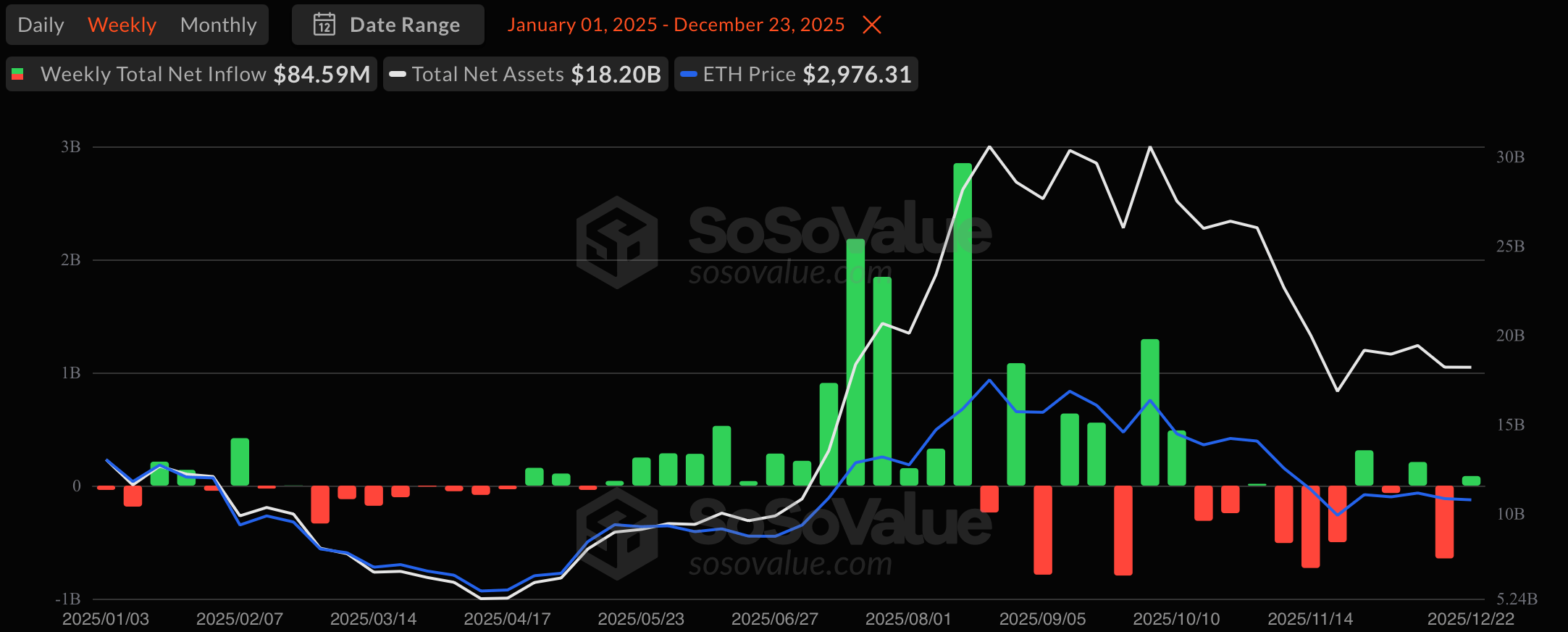

The year began cautiously. January and February were choppy, marked by small inflows and persistent outflows that kept net assets hovering between $11 billion and $13 billion. Several early-week drawdowns, including a $185.9 million exit in mid-January and a $335 million outflow in late February, underscored lingering uncertainty around ether’s near-term catalysts.

Spring brought stabilization, not fireworks. March and April remained net negative overall, but outflows steadily narrowed. By May, sentiment shifted. Ether ETFs posted a string of modest but consistent inflows, lifting net assets toward $9.5 billion. Liquidity was improving, and participation was broadening.

The real turning point came in the summer. From June through August, ether ETFs entered a powerful accumulation phase. July alone delivered three major inflow weeks, including $2.18 billion and $1.85 billion additions, while August peaked with a massive $2.85 billion inflow. By early August, net assets surged past $30 billion for the first time, while weekly trading volumes regularly exceeded $15 billion. Ether ETFs had arrived.

Ether ETFs weekly performance throughout 2025

That momentum proved fragile. September and October brought sharp reversals, with consecutive weeks of $700–800 million outflows wiping out a meaningful portion of summer gains. Despite the drawdown, trading volumes remained elevated, signaling rotation rather than abandonment. Investors were actively managing exposure, not exiting the asset class.

November was the most punishing stretch of the year. Ether ETFs recorded three consecutive weeks of heavy outflows, including a $728.6 million exit mid-month and a $500.3 million drawdown the following week. Net assets slid from above $22 billion to under $17 billion in a matter of weeks, exposing ether ETFs’ sensitivity to broader risk sentiment.

December delivered a split verdict. After another sharp $644 million weekly outflow, flows turned positive again into year-end, capped by an $84.6 million inflow in the final full week. Net assets stabilized around $18–19 billion, while weekly trading volumes remained robust near $9–10 billion.

Read more: Ether ETFs Outflow Streak Hits 6th Day as Bitcoin Bleeds Again

The takeaway from 2025 is clear. Ether ETFs proved they can scale quickly, absorb volatility, and sustain deep liquidity. But they also behaved like a high-beta institutional instrument, amplifying both conviction and caution.

Looking to 2026, ether ETFs appear positioned for more selective accumulation. With infrastructure mature and participation entrenched, future flows may hinge less on novelty and more on Ethereum’s ability to deliver sustained network growth, staking economics, and real-world adoption.

- What characterized Ether ETF performance in 2025?

Ether ETFs saw rapid asset growth followed by sharp drawdowns, highlighting a volatile but maturing market. - When did Ether ETFs experience peak inflows?

The strongest accumulation occurred in summer, with multi-billion-dollar weekly inflows pushing assets above $30 billion. - Did late-year outflows signal structural weakness?

No, trading volumes stayed high, indicating active rotation rather than investors exiting ether exposure. - What will drive Ether ETF flows in 2026?

Future demand will likely depend on Ethereum’s network growth, staking economics, and real-world adoption rather than novelty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。