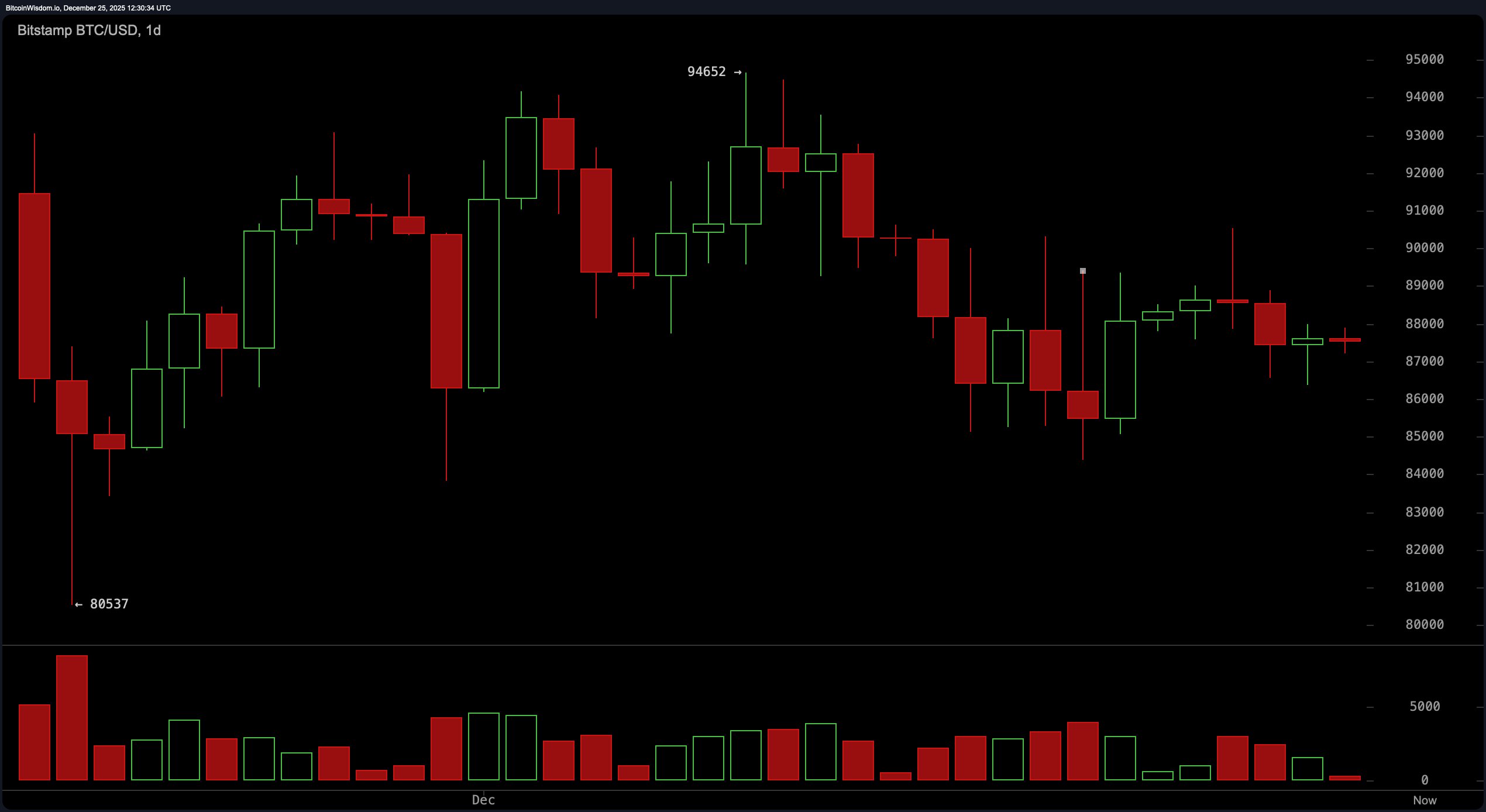

On the daily chart, bitcoin continues to digest its recent highs, retracing sharply from the swing peak of $94,652. Price action has nestled around a repeatedly tested support zone of $86,000–$87,000, offering a cushion for now.

However, the lack of conviction in the candles—think small bodies and Doji types—points to indecision. The trend remains technically corrective following an uptrend, but don’t pop the champagne yet; momentum is muted, and the bulls have yet to make a decisive return.

BTC/USD 1-day chart via Bitstamp on Dec. 25, 2025.

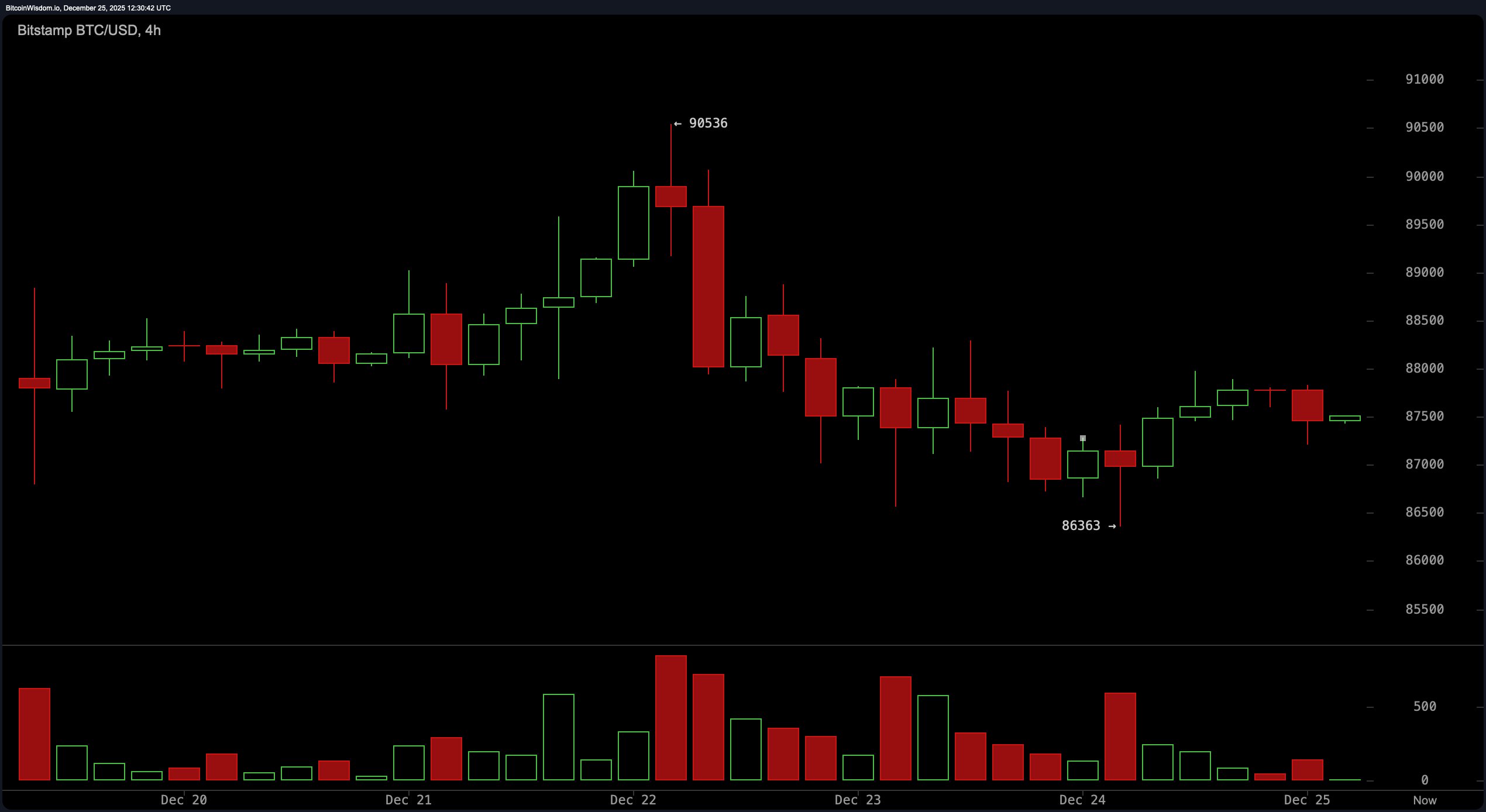

The 4-hour chart echoes the lullaby of consolidation. After surviving a test at $86,363, bitcoin tiptoed upward to hover near $88,000, though with volume dropping like holiday fruitcake interest. A breakout above $88,800 remains elusive, and without it, this sideways shuffle is just a waiting game. Traders may be sipping cocoa on the sidelines, holding out for a volume-driven push to validate any directional bias.

BTC/USD 4-hour chart via Bitstamp on Dec. 25, 2025.

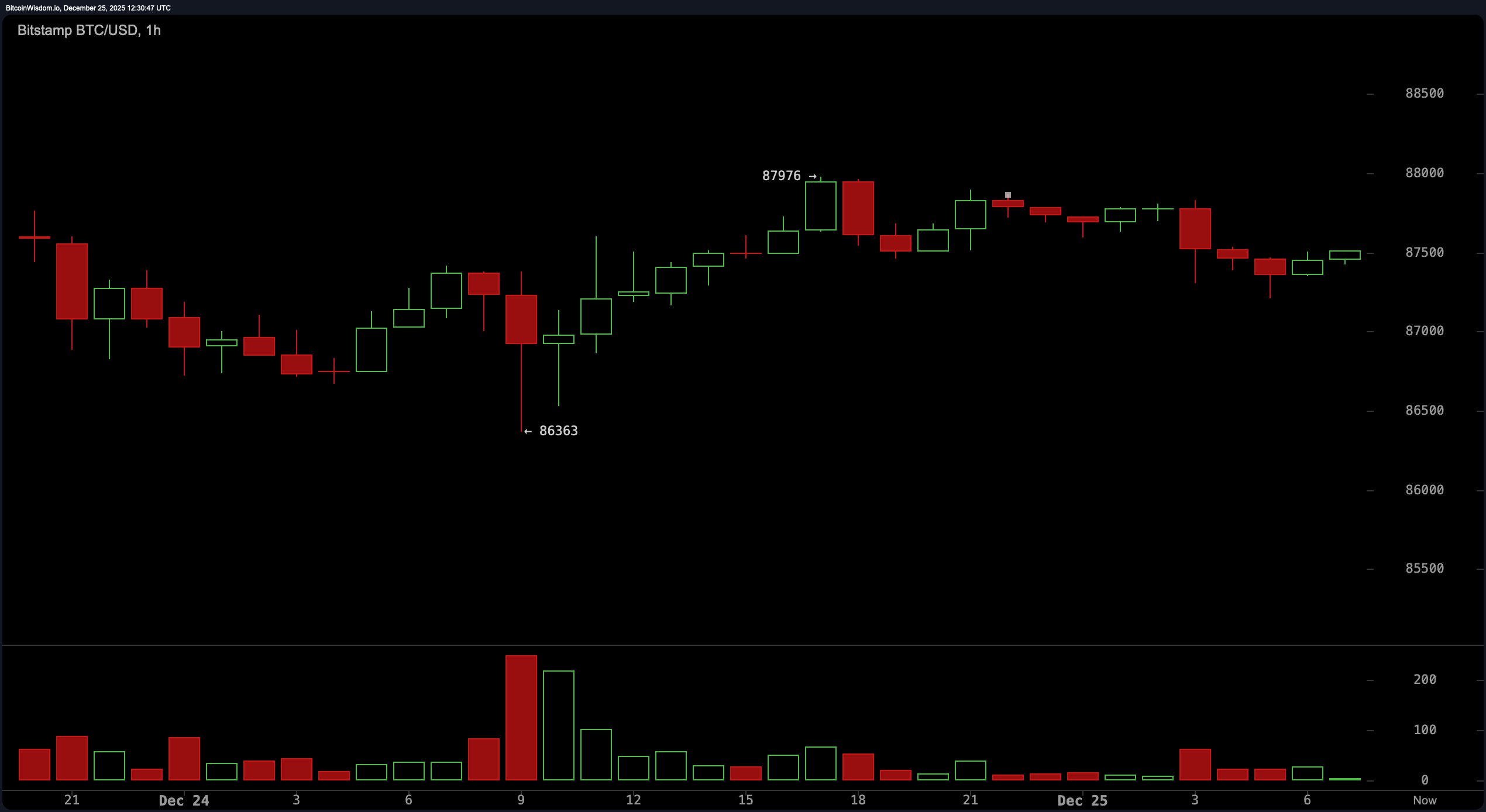

Zooming into the 1-hour chart, bitcoin’s microtrend is swaying between bearish and neutral. A recent bounce from $86,363 to a local top at $87,976 has fizzled into a narrow range between $87,300 and $87,800. With volume thinner than holiday eggnog, short-term participants appear exhausted, leaving bitcoin in a holding pattern. A clear move above $88,000 could hint at upside ambition, while a drop below $87,000 might unravel support quicker than wrapping paper at dawn.

BTC/USD 1-hour chart via Bitstamp on Dec. 25, 2025.

Oscillators aren’t helping Santa’s decision-making either. The relative strength index ( RSI) stands at 43, the stochastic oscillator at 34, and the commodity channel index (CCI) at -62—all calling a neutral stance. Meanwhile, the average directional index (ADX) rests at 23, reflecting a lack of trend strength. The awesome oscillator is in the red at -1,182, momentum is mildly positive at 1,096, and the moving average convergence divergence ( MACD) is also suggesting bullish divergence at -1,327. So yes, there’s a bit of sparkle under the surface, even if it’s not dazzling just yet.

Moving averages (MAs), however, are raining on bitcoin’s sleigh ride. Every major exponential moving average (EMA) and simple moving average (SMA) from the 10-period through the 200-period are above the current price—an unmistakable bearish formation. The 10-period EMA stands at $87,962, and it only gets frostier from there: the 200-period SMA looms far above at $107,611. Until these moving averages bend lower or the price breaks above them, bitcoin’s short-term fate may remain in the hands of its base support zones.

In sum, bitcoin is at a crossroads: range-bound, low- volume, and stuck beneath technical headwinds. Whether it breaks the ceiling or slides down the chimney depends less on sleigh bells and more on sustained volume and macro sentiment. For now, traders might want to keep one eye on the charts—and the other on their holiday desserts.

Bull Verdict:

If bitcoin can reclaim the $88,000 level with conviction and close above it on the 4-hour or daily chart, it could reignite momentum toward the $90,000–$93,000 range. A bounce from the $86,000–$87,000 support zone, backed by volume and oscillator shifts, would affirm the bulls’ readiness to resume their holiday rally.

Bear Verdict:

Should bitcoin falter below the $86,000 support, the next likely stop is $84,000 or even a deeper slide toward $80,500. With all major moving averages stacked above price and momentum indicators largely neutral or negative, the bears remain poised to drag sentiment lower if weakness persists.

- Where is bitcoin trading today?

Bitcoin is hovering around $87,489 with tight price action near key support. - Is bitcoin bullish or bearish right now?

Momentum is mixed, but indicators lean cautiously bearish across timeframes. - What price levels are critical for bitcoin next?

Support sits at $86,000–$87,000, with resistance near $88,000 and $91,000. - Why is bitcoin volume so low this week?

Holiday slowdown and lack of macro catalysts are keeping traders on pause.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。