Solana's internet capital market total market value will soar to $2 billion (currently about $750 million).

Author: Galaxy

Translation: Deep Tide TechFlow

Introduction

It is somewhat bland that Bitcoin seems poised to end 2025 at roughly the same price level as at the beginning of the year.

In the first ten months of this year, the cryptocurrency market experienced a genuine bull market wave. Regulatory reforms made progress, ETFs continued to attract capital inflows, and on-chain activity increased. Bitcoin (BTC) hit an all-time high of $126,080 on October 6.

However, the market's euphoric sentiment did not lead to the desired breakthroughs, but was instead defined by rotation, repricing, and readjustment. A combination of macroeconomic disappointments, shifts in investment narratives, leveraged liquidations, and significant whale sell-offs caused market imbalances. Prices fell, confidence cooled, and by December, BTC had retreated to just over $90,000, although this process was far from smooth.

While 2025 may end with a price decline, the year still witnessed genuine institutional adoption and laid the groundwork for the next phase of actual implementation in 2026. We expect that in the upcoming year, stablecoins will surpass traditional payment networks, asset tokenization will emerge in mainstream capital and collateral markets, and enterprise-grade Layer-1 (L1) chains will move from pilot phases to actual settlements. Additionally, we anticipate that public chains will rethink their value capture methods, DeFi and prediction markets will continue to expand, and AI-driven payments will finally be realized on-chain.

Here are Galaxy Research's 26 predictions for the 2026 crypto market, along with a review of last year's predictions.

2026 Predictions

Bitcoin Price

By the end of 2027, the price of Bitcoin will reach $250,000.

The market in 2026 is too chaotic to predict, but there remains a possibility that Bitcoin will set a new all-time high in 2026. Current options markets show that the probabilities of Bitcoin reaching $70,000 or $130,000 by the end of June 2026 are roughly equal, as are the probabilities of reaching $50,000 or $250,000 by the end of 2026. These broad price ranges reflect uncertainty about the market in the short term. As of the time of writing, the entire crypto market is deep in a bear market, and Bitcoin has not yet reestablished its bullish momentum. We believe there is still downside risk in the short term until Bitcoin's price stabilizes in the $100,000 to $105,000 range. Other factors in the broader financial markets also add to the uncertainty, such as the pace of AI capital expenditure deployment, monetary policy conditions, and the U.S. midterm elections in November.

Over the past year, we have observed a structural decline in Bitcoin's long-term volatility levels—partly due to the introduction of larger-scale covered options/Bitcoin yield generation programs. Notably, the Bitcoin volatility curve now prices the implied volatility of put options higher than that of call options, which was not the case six months ago. In other words, we are evolving from the skew typically seen in developing, growth-oriented markets to a market that is closer to traditional macro assets.

This trend of maturation may continue, regardless of whether Bitcoin further declines near the 200-week moving average, as the maturity and institutional adoption of this asset class continue to rise. 2026 may be a lackluster year for Bitcoin, whether its year-end price is $70,000 or $150,000, our bullish outlook on Bitcoin (long-term) will only strengthen. With increased institutional access, easing monetary policy, and a pressing demand for non-dollar safe-haven assets, Bitcoin is likely to follow gold in the next two years, being widely accepted as a hedge against currency devaluation.

— Alex Thorn

Layer-1 and Layer-2

Solana's internet capital market total market value will soar to $2 billion (currently about $750 million).

Solana's on-chain economy is gradually maturing, evidenced by the successful shift from meme culture-dominated activities to revenue-driven business model launch platforms. This transition is aided by improvements in Solana's market structure and increased demand for tokens with fundamental value. As investors lean towards supporting sustainable on-chain businesses rather than fleeting meme culture cycles, the internet capital market will become a core pillar of Solana's economic activity.

— Lucas Tcheyan

At least one general-purpose Layer-1 blockchain will embed revenue-generating applications that directly bring value to its native tokens.

As more projects rethink how L1 can capture and maintain value, blockchains will evolve towards more clearly functionally designed architectures. The success of Hyperliquid in embedding revenue models in its perpetual contract exchange, along with the trend of economic value capture shifting from the protocol layer to the application layer (i.e., the "fat application theory"), is redefining expectations for neutral underlying chains. An increasing number of chains are beginning to explore whether certain revenue-generating infrastructures should be directly embedded in protocols to strengthen token economic models. Ethereum founder Vitalik Buterin recently called for low-risk and economically meaningful DeFi to prove the value of ETH, further indicating the pressure L1 faces. The MegaEth project plans to launch a native stablecoin that returns revenue to validators, while Ambient's AI-focused L1 plans to internalize reasoning fees. These examples indicate that blockchains are increasingly willing to take control and monetize key applications. In 2026, a major L1 may formally embed revenue-generating applications at the protocol layer and direct its economic benefits to the native token.

— Lucas Tcheyan

Solana's inflation reduction proposal will not pass in 2026, and the existing proposal SIMD-0411 will be withdrawn.

Solana's inflation rate has become a focal point of community debate over the past year. Although a new inflation reduction proposal (SIMD-0411) was introduced in November 2025, there has been no consensus on the best solution, and a viewpoint has gradually formed that the inflation issue has distracted from more important priorities (such as the implementation of Solana market microstructure adjustments). Furthermore, changes to SOL's inflation policy may affect its future market perception as a neutral store of value and monetary asset.

— Lucas Tcheyan

Enterprise-grade L1 will move from pilot phases to real settlement infrastructure.

At least one Fortune 500 bank, cloud service provider, or e-commerce platform will launch a branded enterprise-grade L1 blockchain in 2026, settling over $1 billion in actual economic activity while operating production-grade bridges connected to public DeFi. Previous enterprise chains have mostly been internal experiments or marketing activities, while the next wave of enterprise chains will be closer to application-specific underlying chains designed for specific verticals, with validation layers licensed by regulated issuers and banks, while public chains will be used for liquidity, collateral, and price discovery. This will further highlight the differences between neutral public L1s and enterprise-grade L1s that integrate issuance, settlement, and distribution functions.

— Christopher Rosa

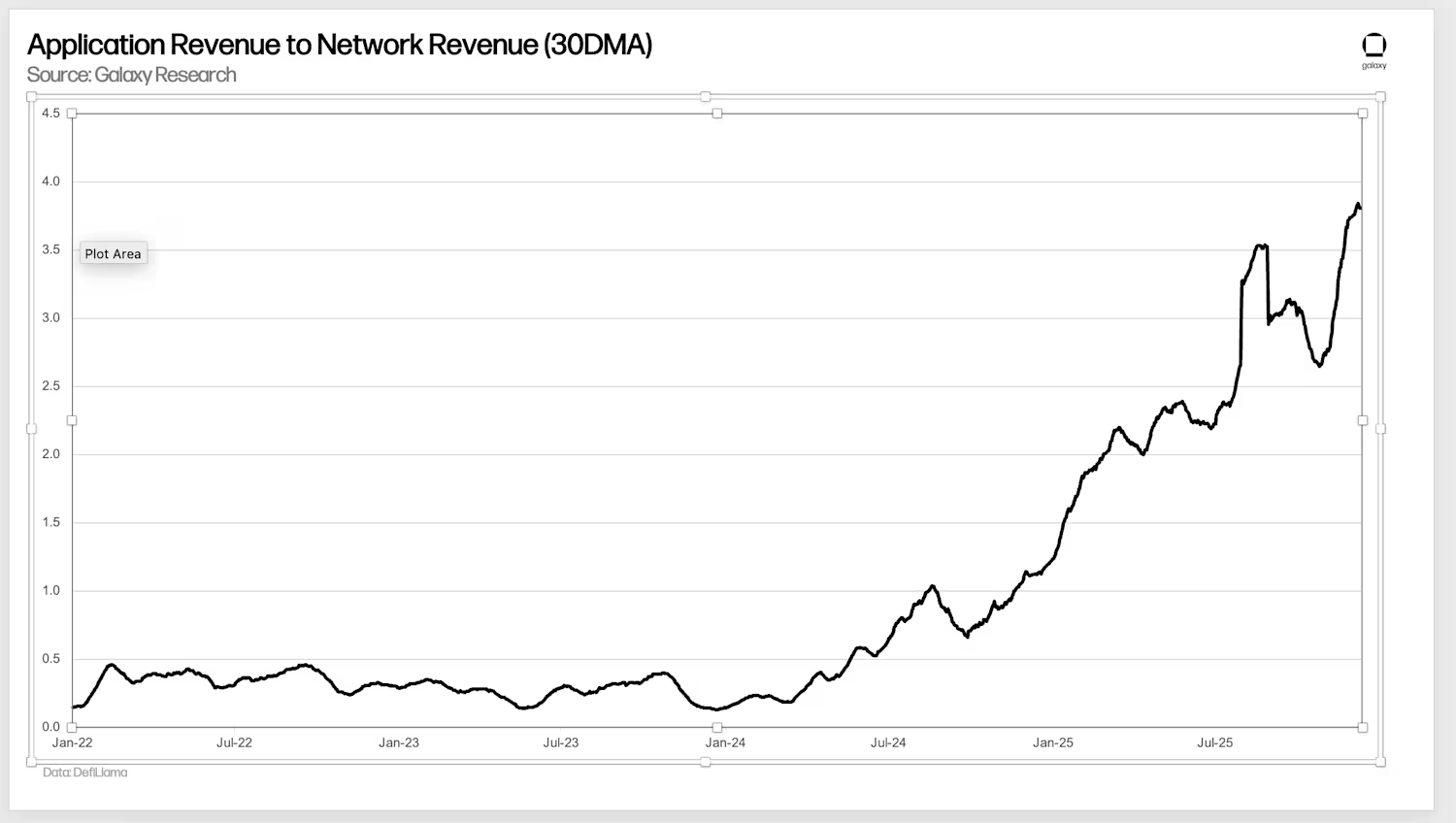

The ratio of application layer revenue to network layer revenue will double in 2026.

As trading, DeFi, wallets, and emerging consumer applications continue to dominate on-chain fee generation, value capture is shifting from the underlying layer to the application layer. At the same time, networks are structurally reducing MEV (miner extractable value) leakage and pursuing fee compression on L1 and L2, leading to a shrinking revenue base at the infrastructure layer. This will accelerate value capture at the application layer, allowing the "fat application theory" to continue to surpass the "fat protocol theory."

— Lucas Tcheyan

Stablecoins and Asset Tokenization

The U.S. Securities and Exchange Commission (SEC) will provide some exemption for the use of tokenized securities in DeFi.

The U.S. Securities and Exchange Commission will provide some exemption to allow the development of on-chain tokenized securities markets. This may take the form of a so-called "no-action letter" or a new "innovation exemption," a concept that SEC Chair Gary Gensler has mentioned multiple times. This will allow legitimate, non-packaged forms of on-chain securities to enter the DeFi market, rather than just using blockchain technology for backend capital market activities as seen in the recent DTCC "no-action letter." The early stages of formal rule-making are expected to begin in the second half of 2026 to establish rules for brokers, dealers, exchanges, and other traditional market participants to use cryptocurrencies or tokenized securities.

— Alex Thorn

The SEC will face lawsuits from traditional market participants or industry organizations over the "innovation exemption" program.

Certain segments of traditional finance or banking, whether trading firms, market infrastructure, or lobbying firms, will challenge the regulatory agency's actions in providing exemptions for DeFi applications or crypto companies, arguing that it has failed to establish comprehensive rules to manage the expansion of tokenized securities.

— Alex Thorn

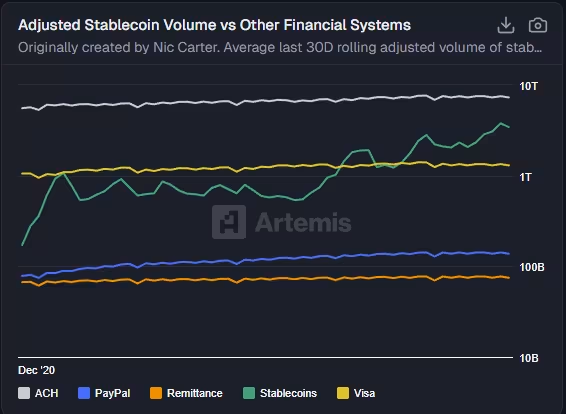

Stablecoin transaction volume will surpass the ACH system.

Stablecoins have a significantly higher velocity of circulation compared to traditional payment systems. We have already seen stablecoin supply continue to grow at a compound annual growth rate (CAGR) of 30%-40%, with transaction volumes increasing accordingly. Stablecoin transaction volumes have already surpassed major credit card networks like Visa, currently processing about half of the Automated Clearing House (ACH) system's transaction volume. As the definition of the GENIUS Act is finalized in early 2026, we may see the growth rate of stablecoins exceed their historical average growth rate, as existing stablecoins continue to grow and new entrants compete for this expanding market share.

— Thad Pinakiewicz

Stablecoins collaborating with traditional finance (TradFi) will accelerate integration.

Despite the launch of many stablecoins in the U.S. in 2025, the market struggles to support a large number of widely used options. Consumers and merchants are unlikely to use multiple digital dollars simultaneously; they will tend to choose one or two of the most widely accepted stablecoins. We have seen this trend of integration from the collaboration of major institutions: nine major banks (including Goldman Sachs, Deutsche Bank, Bank of America, Santander, BNP Paribas, Citibank, MUFG, TD Bank Group, and UBS) are exploring plans to launch stablecoins based on G7 currencies; PayPal and Paxos have teamed up to launch PYUSD, combining a global payment network with a regulated issuer.

These cases indicate that success depends on the scale of distribution, specifically the ability to access banks, payment processors, and enterprise platforms. More stablecoin issuers are expected to collaborate or integrate systems in the future to compete for meaningful market share.

— Jianing Wu

A major bank or broker will accept tokenized stocks as collateral.

So far, tokenized stocks remain on the fringes, limited to DeFi experiments and private blockchains piloted by major banks. However, core infrastructure providers in traditional finance are now accelerating their transition to blockchain-based systems, with increasing support from regulators. In the coming year, we may see a major bank or broker begin to accept tokenized stocks as on-chain deposits, viewing them as assets fully equivalent to traditional securities.

— Thad Pinakiewicz

Card payment networks will connect to public blockchains.

At least one of the top three global card payment networks will settle over 10% of its cross-border transaction volume through public chain stablecoins in 2026, although most end users may not interact with a cryptocurrency interface. Issuers and acquirers will still display balances and liabilities in traditional formats, but in the background, a portion of net settlements between regional entities will be completed using tokenized dollars to reduce settlement cut-off times, pre-funding requirements, and counterparty risks. This development will position stablecoins as a core financial infrastructure of existing payment networks.

— Christopher Rosa

DEFI

Decentralized exchanges (DEXs) will account for over 25% of spot trading volume by the end of 2026.

Although centralized exchanges (CEXs) still dominate liquidity and are responsible for attracting new users, some structural changes are driving an increasing amount of spot trading activity on-chain. The two most obvious advantages of DEXs are the lack of KYC (Know Your Customer) access and a more economically efficient fee structure, which are becoming increasingly attractive to users and market makers seeking lower friction and higher composability. Currently, DEXs account for about 15%-17% of spot trading volume, depending on the data source.

— Will Owens

DAO treasury assets governed by the Futarchy model will exceed $500 million.

Based on our prediction a year ago that the Futarchy (future market) governance mechanism would see broader adoption, we now believe it has demonstrated sufficient effectiveness in real-world applications for decentralized autonomous organizations (DAOs) to begin using it as the sole decision-making system for capital allocation and strategic direction. Therefore, we expect that by the end of 2026, the total assets of DAO treasuries governed by the Futarchy model will exceed $500 million. Currently, about $47 million of DAO treasury assets are fully governed by the Futarchy model. We believe this growth will primarily come from newly established Futarchy DAOs, while the treasury growth of existing Futarchy DAOs will also play a role.

— Zack Pokorny

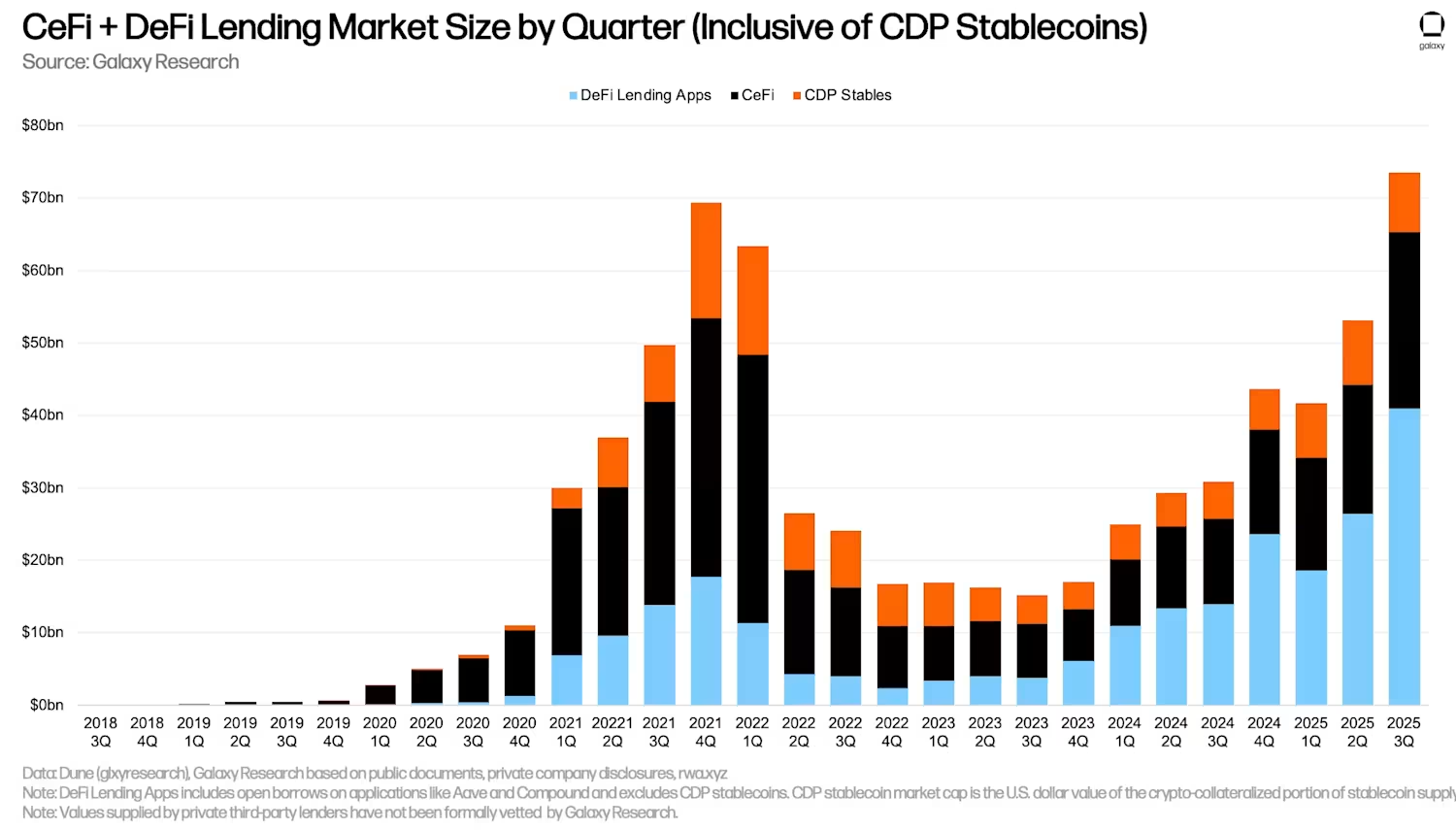

The total balance of crypto loans will exceed $90 billion in quarterly snapshots.

Following the growth momentum in 2025, the total amount of crypto loans in decentralized finance (DeFi) and centralized finance (CeFi) is expected to continue expanding in 2026. The dominance of on-chain lending (i.e., the share of loans issued through decentralized platforms) will continue to rise as institutional participants increasingly rely on DeFi protocols for borrowing activities.

— Zack Pokorny

Stablecoin interest rate fluctuations will remain moderate, and DeFi borrowing costs will not exceed 10%.

With the growth of institutional participation in on-chain lending, we expect deeper liquidity and more stable, lower-cost capital to significantly reduce interest rate fluctuations. At the same time, arbitrage between on-chain and off-chain interest rates is becoming easier, and the barriers to accessing DeFi are rising. It is expected that off-chain interest rates will further decline in 2026, keeping on-chain borrowing rates low—even in a bull market, off-chain rates will serve as an important floor.

Key points are:

(1) Institutional capital brings stability and sustainability to the DeFi market;

(2) The declining off-chain interest rate environment will keep on-chain rates below typical levels during expansion periods.

— Zack Pokorny

The total market capitalization of privacy tokens will exceed $100 billion by the end of 2026.

In Q4 2025, privacy tokens gained significant market attention as investors deposited more funds on-chain, making on-chain privacy a focal point. Among the top three privacy tokens, Zcash rose approximately 800% during the quarter, Railgun increased by about 204%, while Monero saw a more moderate rise of 53%. Early Bitcoin developers, including the pseudonymous founder Satoshi Nakamoto, explored ways to make transactions more private or even completely hidden, but practical zero-knowledge technologies were not widely available or ready for deployment at that time.

As more funds are stored on-chain, users (especially institutions) are beginning to question whether they truly want their crypto asset balances to be fully publicly displayed. Whether completely hidden designs or mixer-style approaches ultimately prevail, we expect the total market capitalization of privacy tokens to exceed $100 billion by the end of 2026, while the current valuation on CoinMarketCap is approximately $63 billion.

— Christopher Rosa

Polymarket's weekly trading volume will stabilize above $1.5 billion in 2026.

Prediction markets have become one of the fastest-growing categories in the crypto space, and Polymarket's weekly nominal trading volume is nearing $1 billion. We expect this figure to stabilize above $1.5 billion in 2026, thanks to new layers of capital efficiency enhancing liquidity, while AI-driven order flow increases trading frequency. Polymarket's distribution capabilities are also continuously improving, accelerating the inflow of funds.

— Will Owens

TradFi

More than 50 spot altcoin ETFs and another 50 crypto ETFs (excluding single spot token products) will be launched in the U.S.

With the U.S. Securities and Exchange Commission (SEC) approving universal listing standards, we expect the pace of spot altcoin ETF launches to accelerate in 2026. In 2025, over 15 spot ETFs for Solana, XRP, Hedera, Dogecoin, Litecoin, and Chainlink were launched. We anticipate that the remaining major assets will also follow suit with spot ETF applications. In addition to single-asset products, we also expect multi-asset crypto ETFs and leveraged crypto ETFs to be launched. With over 100 applications in progress, 2026 is expected to see a continuous influx of new products.

— Jianing Wu

Net inflows into U.S. spot crypto ETFs will exceed $50 billion.

In 2025, U.S. spot crypto ETFs attracted $23 billion in net inflows. With the deepening of institutional adoption, we expect this figure to accelerate in 2026. As financial services firms lift restrictions on advisors recommending crypto products, and major platforms that were previously cautious about crypto (such as Vanguard) join crypto funds, inflows into Bitcoin and Ethereum will surpass 2025 levels and enter more investors' portfolios. Additionally, the launch of a large number of new crypto ETFs, especially spot altcoin products, will unleash pent-up demand and drive additional inflows during the initial distribution phase.

— Jianing Wu

A major asset allocation platform will include Bitcoin in its standard model portfolio.

After three of the four major financial services firms (Wells Fargo, Morgan Stanley, and Bank of America) lifted restrictions on advisors recommending Bitcoin and supported a 1%-4% allocation, the next step is to include Bitcoin products in their recommended lists and formal research coverage, significantly increasing their visibility among clients. The ultimate goal is to incorporate Bitcoin into model portfolios, which typically require higher assets under management (AUM) and ongoing liquidity, but we expect Bitcoin funds to meet these thresholds and enter model portfolios with a strategic weight of 1%-2%.

— Jianing Wu

More than 15 crypto companies will go public or upgrade their listings in the U.S.

In 2025, 10 crypto-related companies (including Galaxy) successfully went public or upgraded their listings in the U.S. Since 2018, over 290 crypto and blockchain companies have completed private financing of over $50 million. With regulatory conditions easing, we believe many companies are now ready to seek U.S. listings to enter the U.S. capital markets. Among the most likely candidates, we expect CoinShares (if not listed in 2025), BitGo (which has submitted an application), Chainalysis, and FalconX to move towards public listings or upgrades in 2026.

— Jianing Wu

More than five digital asset treasury companies (DATs) will be forced to sell assets, be acquired, or shut down completely.

In the second quarter of 2025, Digital Asset Treasury companies (DATs) experienced a surge in establishment. Starting in October, their market net asset value (mNAV) multiples began to compress. As of the writing of this article, DATs for Bitcoin, Ethereum, and Solana were trading at an average mNAV of less than 1. During the initial surge, many companies engaged in different business lines quickly transformed into DATs to take advantage of market financing conditions. The next phase will distinguish between enduring DATs and those lacking coherent strategies or asset management capabilities. To succeed in 2026, DATs need to have a robust capital structure, innovative liquidity management and revenue generation methods, as well as strong synergies with relevant protocols (if not already established). Scale advantages (such as Strategy's large Bitcoin holdings) or geographic advantages (like Japan's Metaplanet) may provide additional competitiveness. However, many DATs that rushed into the market initially did not engage in adequate strategic planning. These DATs will struggle to maintain their mNAV and may be forced to sell assets, be acquired by larger participants, or, in the worst-case scenario, shut down completely.

— Jianing Wu

Policy

Some Democrats will focus on the issue of "de-banking" and gradually accept cryptocurrency as a solution.

Although this scenario is less likely, it is worth noting: by the end of November 2025, the Financial Crimes Enforcement Network (FinCEN) under the U.S. Treasury urged financial institutions to "be vigilant for suspicious activities related to cross-border money transfers involving illegal immigrants." While the warning primarily emphasized risks related to human trafficking and drug smuggling, it also mentioned that money services businesses (MSBs) have a responsibility to submit suspicious activity reports (SARs), including cross-border money transfers related to illegal employment income. This could cover remittances sent back by undocumented immigrants (such as plumbers, farm workers, or restaurant servers), a group of immigrants that, despite their work violating federal law, still receives sympathy from left-leaning voters.

This warning follows an earlier geographic targeting order (GTO) issued by FinCEN, requiring MSBs to automatically report cash transactions in designated border counties, with a threshold as low as $1,000 (far below the statutory $10,000 threshold for currency transaction reports). These measures expand the range of everyday financial behaviors that could trigger federal reporting, increasing the likelihood that immigrants and low-income workers face fund freezes, service denials, or other forms of financial exclusion. Such situations may lead some pro-immigrant Democrats to become more sympathetic to the issue of "de-banking" (a concern primarily raised by the right in recent years) and more willing to accept permissionless, censorship-resistant financial networks.

Conversely, populist, pro-bank Republicans advocating for the rule of law may begin to express dissatisfaction with cryptocurrency for similar reasons, despite the Trump administration and innovative factions within the Republican Party having strongly supported the industry. Ongoing efforts by federal banking regulators to modernize the Bank Secrecy Act and anti-money laundering compliance requirements will only further draw attention to the inherent trade-offs between financial inclusion policy goals and crime reduction—different political factions will prioritize these trade-offs differently. If this political realignment becomes a reality, it will demonstrate that blockchain does not have fixed political camps. Its permissionless design means that acceptance or opposition to it is not based on ideology but rather on how it impacts the political priorities of different groups in different eras.

— Marc Hochstein

The U.S. will launch a federal investigation into insider trading or match-fixing related to prediction markets.

As U.S. regulators have loosened restrictions on on-chain prediction markets, trading volumes and open contract counts have surged. At the same time, several scandals have emerged, including insiders allegedly using private information to gain market advantages and federal agencies conducting raids on match-fixing rings within major sports leagues. Because traders can participate anonymously without going through platforms that require Know Your Customer (KYC) verification, insiders are now more easily tempted to exploit privileged information or manipulate the market. Therefore, we may see investigations triggered by unusual price fluctuations in on-chain prediction markets, rather than the routine monitoring typical of regulated sports betting platforms.

— Thad Pinakiewicz

AI

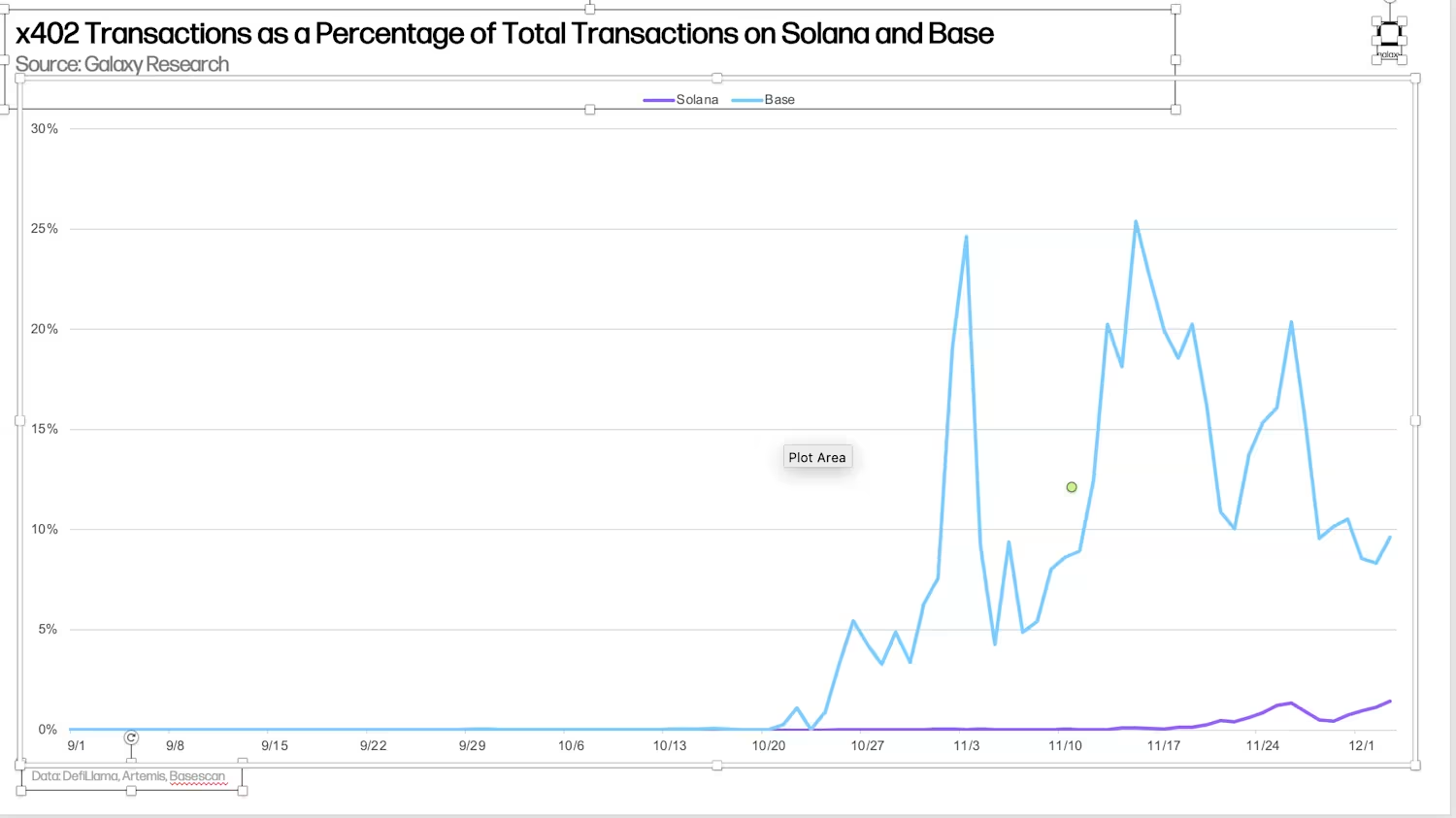

Payments based on the x402 standard will account for 30% of daily transaction volume on the Base chain and 5% of non-voting transaction volume on Solana, marking the widespread application of on-chain agent interactions.

With the intelligent enhancement of AI agents, the continued proliferation of stablecoins, and improvements in developer tools, x402 and other agent-based payment standards will drive on-chain activities to occupy a larger share. As AI agents increasingly conduct transactions autonomously across various services, standardized payment primitives will become a core component of the execution layer.

Base and Solana have emerged as leading blockchains in this field—Base benefiting from Coinbase's significant role in creating and promoting the x402 standard, while Solana stands out due to its large developer community and user base. Additionally, we expect that with the development of agent-driven business models, emerging payment-specific blockchains like Tempo and Arc will also achieve rapid growth.

— Lucas Tcheyan

Review of 2025 Predictions: Gains and Losses for Bitcoin and the Crypto Market

At the end of 2024, there was boundless optimism about the future of Bitcoin and cryptocurrencies. The new presidential administration promised to end the "enforcement-style regulation" of the Biden administration, while the incoming President Trump pledged to make the U.S. the "world's crypto capital." With a month to go before the President's second inauguration, going long on Bitcoin became the hottest trade globally.

On December 31, 2024, we released 23 predictions for 2025, expecting the breadth and narrative of the market to further expand that year. Some of these predictions were spot on, while others were significantly off. For many predictions, our team's direction was correct, but not entirely precise. From the recovery of on-chain revenue sharing to the expanded role of stablecoins and the steady advancement of institutional adoption, the major trends we identified continue to evolve.

In the following sections, we will examine our 23 predictions for 2025 and assess their accuracy. If we underestimated any theme for 2025, it was the surge of Digital Asset Treasury companies (DATs). Although this craze briefly erupted in the summer of 2025, its impact cannot be overlooked. We will apply strict standards to evaluate our successes and failures and provide commentary where appropriate.

Bitcoin

❌ Bitcoin will break $150,000 in the first half of 2025 and test or exceed $185,000 in the fourth quarter.

Outcome: Bitcoin failed to break $150,000 but reached a new high of $126,000. In November, we lowered our year-end target price to $125,000. As of the writing of this article, Bitcoin's trading price is between $80,000 and $90,000, making it seem unlikely to reach our updated year-end target price for 2025.

—— Alex Thorn

❌ In 2025, the assets under management (AUM) of U.S. spot Bitcoin ETPs will exceed $250 billion.

Outcome: As of November 12, AUM reached $141 billion, an increase from $105 billion on January 1, but it did not meet the forecast target.

—— Alex Thorn

❌ In 2025, Bitcoin will once again be one of the best-performing assets globally on a risk-adjusted basis.

Outcome: This prediction was accurate for the first half of 2025. As of July 14, Bitcoin's year-to-date Sharpe ratio was 0.87, higher than that of the S&P 500 index, Nvidia, and Microsoft. However, Bitcoin is expected to end the year with a negative Sharpe ratio, failing to be one of the best-performing assets of the year.

—— Alex Thorn

✅ At least one top wealth management platform will announce a recommended allocation of 2% or more to Bitcoin.

Outcome: Morgan Stanley, one of the four major financial services firms, lifted restrictions on advisors allocating Bitcoin for any account. In the same week, Morgan Stanley released a report suggesting a maximum allocation of 4% to Bitcoin in portfolios. Additionally, the Digital Assets Council of Financial Professionals, led by Ric Edelman, published a report recommending an allocation of 10%-40% to Bitcoin. Ray Dalio, founder of Bridgewater Associates, also suggested allocating 15% of assets to Bitcoin and gold. — Alex Thorn

❌ Five Nasdaq 100 companies and five countries or sovereign wealth funds will announce the inclusion of Bitcoin in their balance sheets.

Outcome: Currently, only three Nasdaq 100 companies hold Bitcoin. However, approximately 180 companies globally hold or have announced plans to purchase cryptocurrencies for their balance sheets, involving over 10 different tokens. More than five countries have invested in Bitcoin by establishing official reserves or sovereign funds, including Bhutan, El Salvador, Kazakhstan, the Czech Republic, and Luxembourg. The trend of Digital Asset Treasury companies (DATs) is one of the main institutional forces buying cryptocurrencies in 2025, especially in the second quarter.

—— Jianing Wu

❌ Bitcoin developers will reach a consensus on the next protocol upgrade in 2025.

Outcome: Not only did they fail to reach a consensus on the next protocol upgrade, but there was also controversy within the Bitcoin developer ecosystem regarding how to handle non-monetary transactions. In October 2025, the most widely used Bitcoin Core software released its 30th version, controversially expanding the OP_RETURN field's limitations.

The expansion of this data field aimed to guide the most destructive arbitrary data transactions to positions that would minimize harm to the blockchain, but this initiative sparked significant opposition within the Bitcoin community. At the end of October, an anonymous developer released a new Bitcoin Improvement Proposal (BIP) suggesting a "temporary soft fork" to "combat spam transactions." Although this proposal gradually lost momentum in the following months, the debate surrounding this issue essentially drained developers' efforts to reach consensus on other more forward-looking upgrades. While proposals like OPCAT and OPCTV received some attention in 2025, unresolved governance issues led developers to fail to reach agreement on the next major protocol upgrade before December.

—— Will Owens

✅ Among the top 20 publicly listed Bitcoin mining companies by market capitalization, more than half will announce a transformation or establish partnerships with large-scale computing, artificial intelligence (AI), or high-performance computing (HPC) companies.

Outcome: Major mining companies are generally shifting towards a hybrid AI/HPC mining model to monetize their infrastructure investments more flexibly. Among the top 20 publicly listed Bitcoin mining companies, 18 have announced plans to transition to AI/HPC as part of their business diversification. The two companies that did not announce a transformation are American Bitcoin (ABTC) and Neptune Digital Assets Corp (NDA.V).

—— Thad Pinakiewicz

❌ The total amount of Bitcoin locked in the Bitcoin DeFi ecosystem, i.e., in DeFi smart contracts and staking protocols, will nearly double in 2025.

Outcome: The amount of Bitcoin locked in DeFi in 2025 only grew by about 30% (from 134,987 BTC on December 31, 2024, to 174,224 BTC on December 3, 2025). This growth was primarily driven by lending activities, with Aave V3 Core adding 21,977 wrapped Bitcoin (wBTC) throughout the year, while Morpho added 29,917 wBTC. However, Bitcoin staking protocols as a major category experienced outflows, losing over 13,000 wrapped Bitcoin.

—— Zack Pokorny

ETH

❌ The native Ethereum token ETH will break $5,500 in 2025.

Outcome: The native Ethereum token ETH briefly reached an all-time high in September 2025 but did not break $5,000. Analysts believe that the price increase from April to autumn 2025 was mainly due to purchases by treasury companies like Bitminer. However, as these treasury companies' activities waned, the price of ETH also declined, struggling to maintain above $3,000 since October.

—— Alex Thorn

❌ The Ethereum staking rate will exceed 50% in 2025.

Outcome: The staking ratio for Ethereum reached a maximum of about 29.7% in 2025, up from 28.3% at the beginning of the year. In recent months, the staking volume of ETH has been constrained due to the unwinding of circular trading and key reorganizations among large validators, interrupting both exit and entry queues.

—— Zack Pokorny

❌ The ETH/BTC ratio will drop below 0.03 in 2025 while also breaking above 0.045.

Outcome: This prediction was close to being correct. The ETH/BTC ratio fell to a low of 0.01765 on April 22, reaching our lower bound prediction; however, it rose to a high of 0.04324 on August 24 but failed to reach the upper bound prediction of 0.045. Although the ETH/BTC ratio had previously rebounded, it is expected to end the year lower year-over-year.

—— Alex Thorn

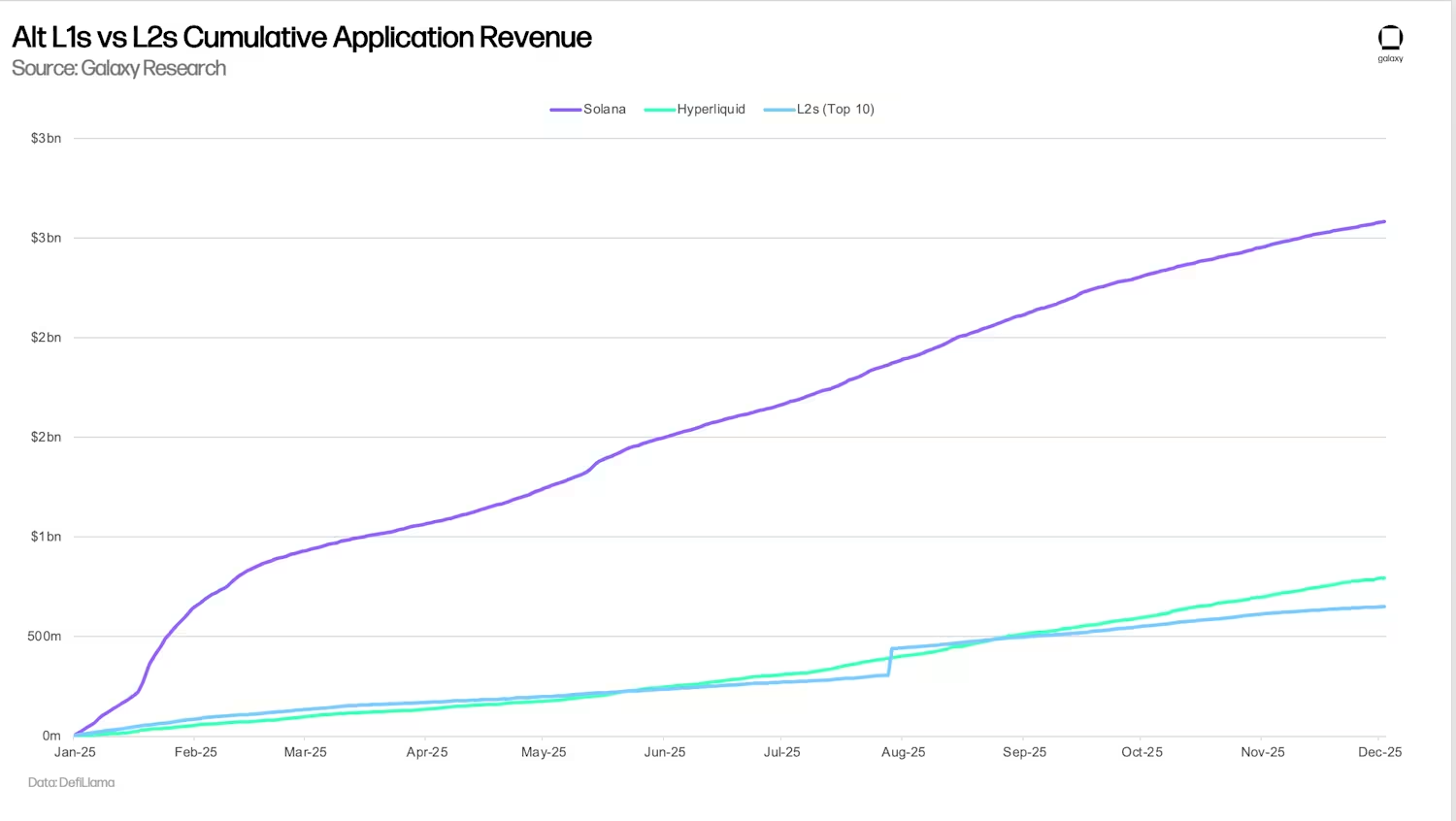

❌ Overall economic activity on Layer 2 (L2) will exceed that of Alt-L1 (alternative Layer 1 blockchains) in 2025.

Outcome: This prediction did not materialize. On both the network and application levels, Layer 2 underperformed compared to major Alt-L1 chains. Solana solidified its position as the de facto retail speculation chain, continuing to capture the largest share of trading volume and fee revenue across the industry. Meanwhile, Hyperliquid became the dominant platform for perpetual contract trading, with its single platform's cumulative application revenue exceeding that of the entire Layer 2 ecosystem. Although Base was the only Layer 2 chain close to Alt-L1 level attractiveness—accounting for nearly 70% of Layer 2 application revenue in 2025—even Base's growth was insufficient to surpass the economic focus of Solana and Hyperliquid.

—— Lucas Tcheyan

DeFi

✅ DeFi will enter a "dividend era," with on-chain applications distributing at least $1 billion in nominal value to users and token holders through treasury funds and revenue sharing.

Outcome: As of November 2025, the amount repurchased through application revenue reached at least $1.042 billion. Hyperliquid and Solana-based applications were the projects that repurchased the most tokens this year. Repurchase activities became a significant narrative this year, widely recognized by the market, and in some cases, projects that did not support such activities were rejected. To date, only top applications have returned $818.8 million to end users. Hyperliquid leads in this area, returning nearly $250 million through token repurchases.

—— Zack Pokorny

✅ On-chain governance will experience a revival, with applications attempting governance models based on futarchy (future markets), and the total number of active voters will increase by at least 20%.

Outcome: In 2025, the use of futarchy models in DAO governance significantly increased. Optimism began experimenting with this concept, while Solana-based MetaDAO introduced 15 DAOs within a year, including well-known organizations like Jito and Drift. Currently, 9 of these DAOs fully adopt the futarchy model to manage strategic decisions and capital allocation. Participation in these decision markets has grown exponentially, with one MetaDAO market reaching a trading volume of $1 million. Additionally, 9 of the top 10 proposals by trading volume in MetaDAO occurred this year. We have witnessed an increasing number of DAOs using futarchy for strategic decision-making, with some DAOs launching purely in the futarchy model. However, the vast majority of experiments with futarchy have taken place on the Solana network, led by MetaDAO.

—— Zack Pokorny

Banks and Stablecoins

❌ The four major global custodial banks (BNY Mellon, JPMorgan Chase, State Street, Citigroup) will offer digital asset custody services in 2025.

Outcome: This prediction was close to being correct. BNY Mellon did launch crypto custody services in 2025. State Street and Citigroup have not yet launched but announced plans to offer related services in 2026. Only JPMorgan Chase remains cautious, with an executive telling CNBC in October, "Custody services are not currently in our plans," but this large bank will participate in digital asset trading. In summary, three of the four major custodial banks have either provided or announced plans to provide crypto custody services.

—— Alex Thorn

✅ At least 10 stablecoins supported by traditional financial (TradFi) partners will be launched.

Outcome: Although some of these stablecoins have not yet officially launched, at least 14 major global financial institutions have announced related plans. For example, in the U.S., JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo formed a U.S. banking alliance to plan a joint stablecoin; there are also brokerages like Interactive Brokers and payment and fintech companies like Fiserv and Stripe. The momentum outside the U.S. is even stronger, including Klarna, Sony Bank, and a global banking alliance composed of 9 major banks. Additionally, crypto-native stablecoin issuers like Ethena have also joined the competition, partnering with federally regulated bank Anchorage to issue their native USDtb stablecoin.

—— Jianing Wu

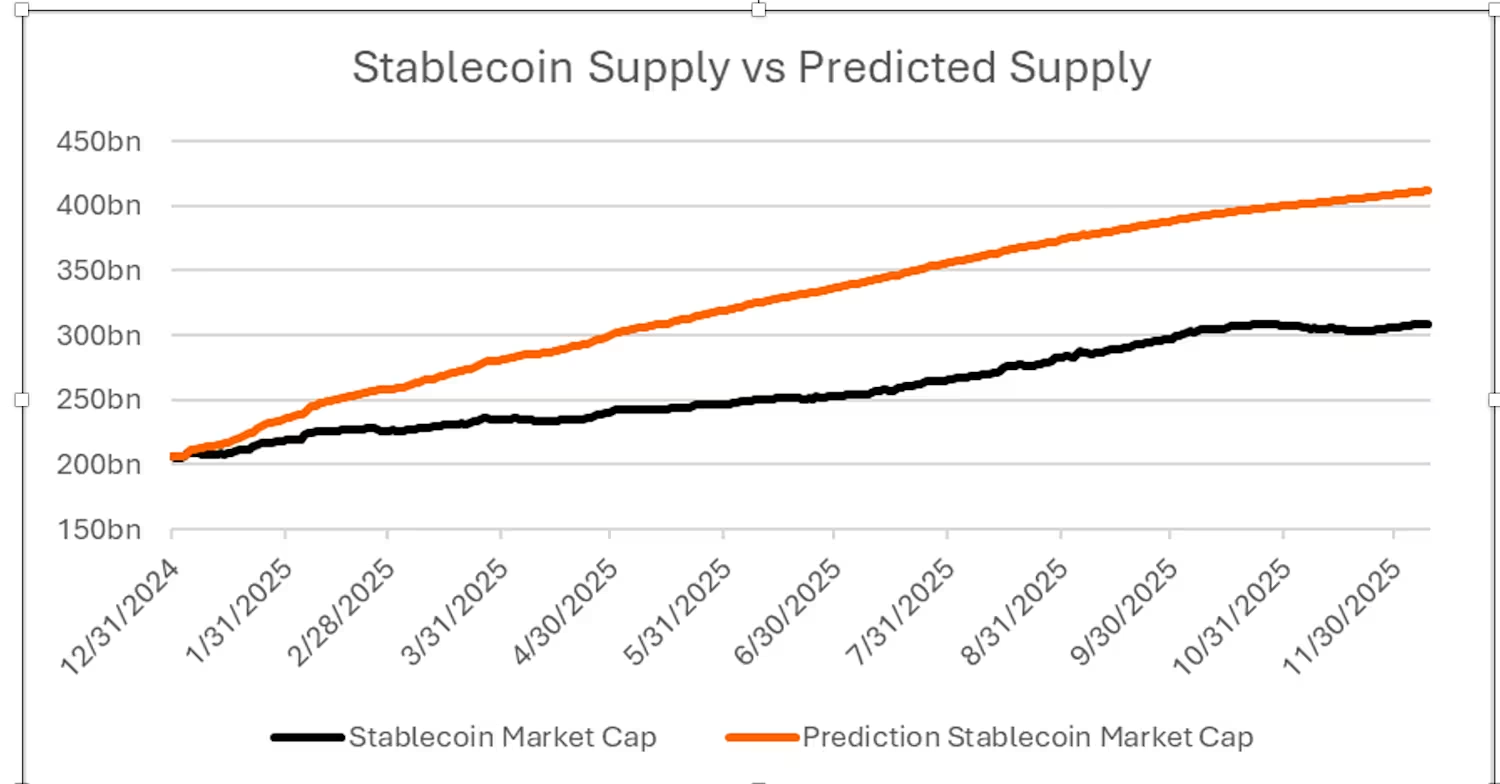

❌ The total supply of stablecoins will double in 2025, exceeding $400 billion.

Outcome: The growth of stablecoins remains strong, having increased by 50% year-to-date to nearly $310 billion, but it did not reach the 100% growth rate predicted at the beginning of the year. With the passage of the GENIUS Act and the establishment of related implementation rules, regulatory clarity for stablecoins is emerging, and strong growth is expected to continue.

—— Thad Pinakiewicz

❌ Tether's long-term dominance in the stablecoin market will fall below 50% in 2025, challenged by Blackrock's BUIDL, Ethena's USDe, and yield-bearing stablecoins like USDC offered by Coinbase/Circle.

Outcome: This narrative seemed likely to materialize at the beginning of the year due to the explosive growth of USDe and yield-bearing stablecoins. However, due to a market downturn in the second half of the year and a slight overall decrease in the total supply of stablecoins, Tether continued to maintain its position as the number one stablecoin issuer in the crypto market. As of the writing of this article, Tether holds nearly 70% of the market supply share. Tether is preparing to launch a new stablecoin, USAT, compliant with the GENIUS Act to complement its flagship token USDT, but it appears not to have adjusted its collateral asset portfolio to comply with the proposed U.S. law. Circle's USDC remains Tether's main competitor, with its market share increasing from 24% of total supply to 28% over the year.

—— Thad Pinakiewicz

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。