Zhiyu AI aims for a valuation of 24.377 billion yuan as it rushes to list on the Hong Kong Stock Exchange. As China's largest independent large model company, its technological strength is globally leading, but high R&D investments have led to massive losses, testing the capital market's confidence in the long-term value of AI.

24.377 billion yuan was confirmed in Zhiyu's publicly available prospectus after passing the Hong Kong Stock Exchange hearing on the 17th, marking the first time the valuation of a Chinese large model company has been clearly known.

This is a timely moment, three years after ChatGPT made a significant impact in the industry. After the noise of the hundred model battle, the remaining Chinese large model players, having proven their innovation and technological capabilities are on par with anyone, are now making a push towards the capital market.

During this critical transformation period of "youth to adulthood," the market is eager to see how large model companies can demonstrate the process of transitioning from "novelty and flashy" model technologies to "practical and adaptable" large models that can be implemented end-to-end.

As the first company to successfully "land" in the hundred group battle, Zhiyu's response is somewhat unsatisfactory. The losses disclosed in the prospectus far exceed revenue growth, and R&D expenses continue to rise significantly, showing no signs of stopping the "burning money" trend.

If it were a mature company, such a balance sheet would be quite unsatisfactory, but large models are special.

Zhiyu is one of the earliest established independent large model companies in China, but it has been around for less than six years. The excitement surrounding the AI industry stems from its potential for revolutionary change in the future, which is difficult to derive directly from past history, as transformations often occur suddenly and exponentially at certain moments.

This is Zhiyu's bet, or it can be called a vision. Before many are convinced of the arrival of AGI, Zhiyu hopes to prepare as thoroughly as possible, which includes a series of complex trade-offs and convincing the market to believe.

Convincing people that this is a hopeful gamble.

Core Data Summary

Zhiyu's core commercial revenue mainly consists of localized deployment and cloud deployment. The former refers to the privatized deployment of large models for B-end clients, while the latter provides model API interfaces and token calling services to users through the MaaS platform.

The prospectus shows that based on 2024 revenue, Zhiyu has already become the largest independent large model vendor in China and the second-largest large model vendor in the enterprise LLM field, surpassing Alibaba and SenseTime, with a market share of 6.6%.

From 2022 to 2024, Zhiyu's revenues were 60 million yuan, 120 million yuan, and 310 million yuan, with a CAGR of 130%. The revenues for the first half of 2024 and the first half of 2025 are projected to be 40 million yuan and 190 million yuan, respectively, representing a year-on-year growth of over 300%.

Among these, nearly 85% of Zhiyu's revenue comes from localized deployment business, mainly distributed across vertical industries such as internet technology, public services, telecommunications, traditional enterprises, consumer electronics, retail, media, and consulting.

In the first half of 2025, Zhiyu's overseas revenue share rapidly increased to nearly 12%, mainly from the Malaysian and Singaporean markets. Under the "Belt and Road" strategy, Zhiyu is helping overseas countries establish sovereign large models, achieving a breakthrough in exporting China's large model technology.

From 2022 to 2024 and the first half of 2025, Zhiyu's gross margins were 54.6%, 64.6%, 56.3%, and 50.0%, respectively. In comparison, domestic software outsourcing companies in China generally have margins around 30%, indicating that Zhiyu's localized large model deployment business has a relatively high gross margin.

It is worth noting that the decline in gross margin mainly comes from price fluctuations in the MaaS platform business. Affected by market price wars, Zhiyu has increased its price cuts to attract more customers and applications.

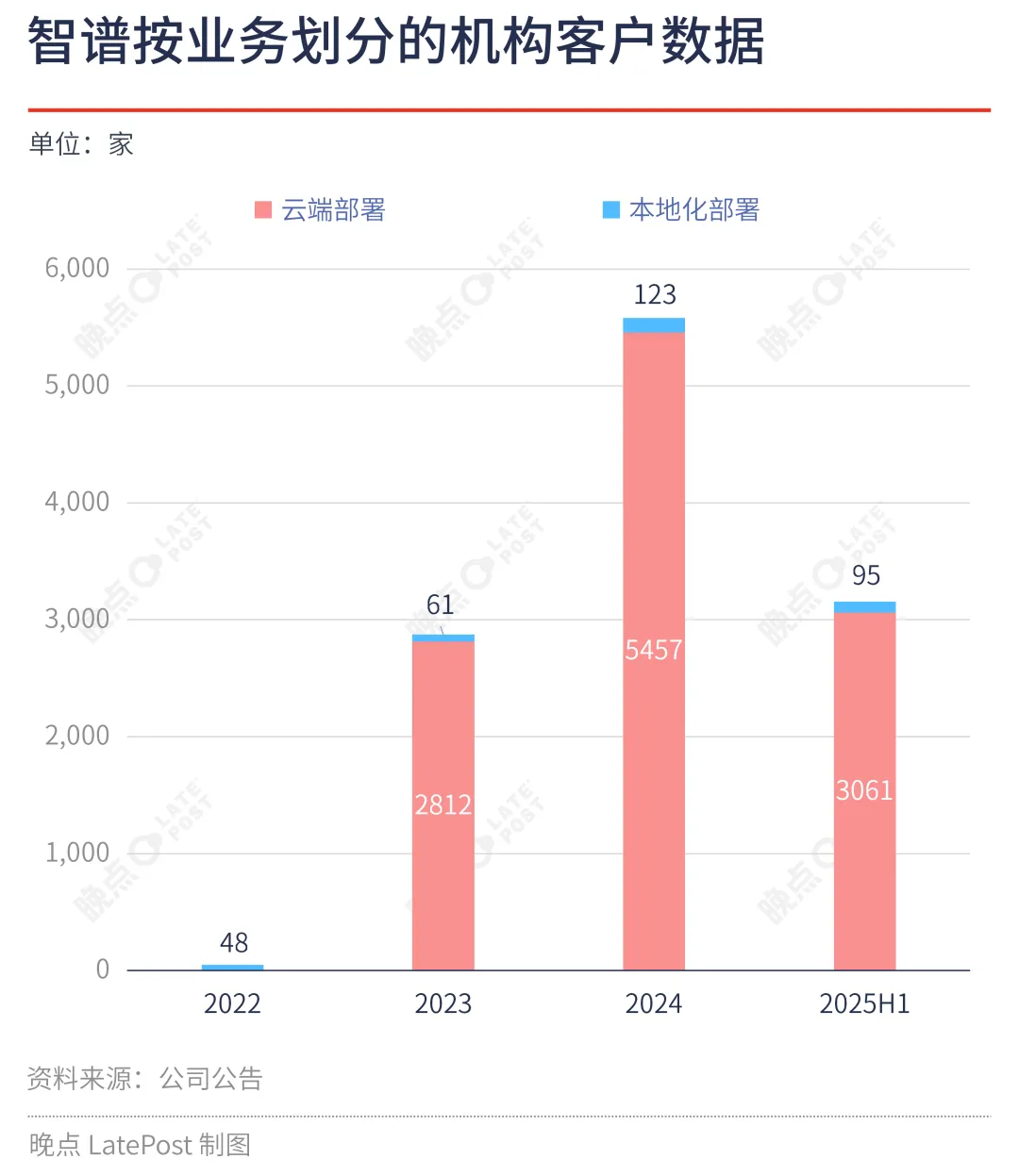

The result of this is that in the first half of 2025, Zhiyu had 95 institutional clients for localized deployment and 3,061 for cloud deployment, while the total number of institutional clients for 2024 was 123 and 5,457, respectively. The price cuts in the MaaS platform business not only increased the number of cloud institutional clients but also had a significant effect on driving traffic to the localized deployment business.

As of the third quarter of 2025, the company's models have empowered over 80 million end-user devices and over 45 million developers, with more than 12,000 institutional clients, a significant increase from 8,000 clients in the first half of 2025.

Additionally, by November 2025, Zhiyu's daily token consumption had reached 4.2 trillion, up from 500 million in 2022. This is a result of the release of Zhiyu's new generation GLM 4.5/4.6 open-source base model and reflects the direct effects of user and call volume growth.

Revenue is more important than anything else, but revenue requires patience

Zhiyu introduced a "vertical and horizontal strategy" in its prospectus for the growth prospects of commercial revenue.

Vertically, the price cuts and expansion of the MaaS platform business have gained widespread users and application scenarios. The influx of more users will drive traffic to the localized deployment business. This "MaaS traffic + localized monetization" model will initially build a cycle between customers and business.

Horizontally, similar to OpenAI and Anthropic, Zhiyu's MaaS platform features high flexibility and scalability. Unlike traditional heavy delivery customized projects, Zhiyu points out that the majority of revenue comes from enterprise-level MaaS projects, which deliver more general model capabilities, thus enabling faster scaling of token call volumes.

The vertical customer cycle model and horizontal general solution capability expansion reinforce Zhiyu's label as the largest independent model company in China by revenue size. This is the commercial synergy effect Zhiyu anticipates, and the revenue scale of the MaaS platform business is likely to achieve excessive growth. According to Zhiyu's forecast, future revenues from localized deployment and cloud business will be evenly split. Zhiyu is willing to sacrifice gross margins for this: unlike the high margins of localized projects, the gross margin of cloud business is relatively low due to significant costs incurred in purchasing computing power, which is also an inevitable result of the strategic price cuts in the MaaS business, a compromise necessary for short-term market share competition.

Models are products, products are growth

A popular saying in the large model industry is "model is product," which reflects a very simple first principle: users pay for the strongest models, and the process of building the model itself is about creating a highly competitive product.

This also constitutes the core growth logic of MaaS. In the second half of this year, Zhiyu's latest released GLM 4.5/4.6 base model is the first to achieve the native integration of reasoning, coding, and agent capabilities within a single model. Notably, in Code Arena, GLM ranks first alongside models from Anthropic and OpenAI, and after its release, the call volume on its MaaS platform has seen exponential growth.

Similar to the "vertical and horizontal strategy" in the first part, powerful model products are expected to trigger a data flywheel effect, which will be the ideal moat in the competition of large models. Zhiyu's commercialization goal will be realized within a complete platform that includes the latest models, APIs, and development tools, with MaaS becoming the "operating system" level infrastructure of the AI era, serving various industries and organizations of all sizes, from individuals and small development teams to large enterprises. On this complete platform, there is no delivery, only product managers.

According to data from Zhiyu's prospectus, MaaS has over 2.9 million enterprises and application developers, making it one of the most active large model API platforms in China. Currently, 9 out of the top 10 internet companies in China are using Zhiyu's GLM large model. Among them, the GLM Coding package (a standardized product for developers that requires monthly subscription fees) has exceeded 150,000 paying developers within two months of its launch, with annual recurring revenue rapidly surpassing 100 million.

The cost of the strongest model

Users pay for the strongest models, and the costs Zhiyu incurs for this judgment are clearly revealed in the prospectus.

From 2022 to 2024, and in the first half of this year, Zhiyu's adjusted net losses were 97 million yuan, 621 million yuan, 2.466 billion yuan, and 1.752 billion yuan, respectively, with R&D expenses being 80 million yuan, 530 million yuan, 2.2 billion yuan, and 1.59 billion yuan, accounting for a significant proportion.

Zhiyu pointed out that the proportion of computing service costs in R&D expenses has rapidly risen from an initial 17% to over 70%, indicating that a large portion of R&D costs is used to purchase computing power, which synchronizes with the rapid growth of the MaaS platform's call volume.

On one hand, the extremely high R&D investment is a calm strategic choice for Zhiyu. The pre-trained base model capabilities themselves are extremely resource-intensive, and as the development of AGI progresses, it will require the evolution of more application models to enhance the comprehensive performance of agents, thereby solidifying its comparative advantage in underlying model capabilities and attracting more developers and clients.

On the other hand, in the foreseeable medium to long term, competition among large technology companies around large models will not cool down. This is a race without an endpoint in the short to medium term, where competition for ranking is very intense. Only by remaining in the leading camp can one gain market recognition and attract capital.

Therefore, "running while supplementing energy" is the only choice.

Unlike the internet bubble around the year 2000, participants in the large model competition all understand that while long-term money burning is not a good narrative for commercialization, it is a common consensus in the market. In a situation where both model capabilities and market scale are rapidly changing, staying in the game is the top priority. As people look forward to the systemic changes brought by AI, creating a trillion-dollar market space, Zhiyu bets that a larger market space will create more revenue growth opportunities and more significant scale effects. The strong base model capabilities and the MaaS business model both imply a higher monetary multiplier, which is a simple arithmetic problem that everyone participating in the AI game understands.

Burning money attempts to ensure Zhiyu's place in an AI-dominated future.

The implicit price of professionalism, focus, and determination

AGI is a long struggle. As Zhiyu's CEO Zhang Peng puts it, it's like "running a marathon at the speed of a sprint." This contradictory description explains both sides of Zhiyu: it interprets Zhiyu's technical determination and explains the reason for choosing capitalization.

Originating from the Knowledge Engineering Laboratory of the Computer Science Department at Tsinghua University, Zhiyu was officially established in 2019. Starting from the underlying architecture of base large models, Zhiyu has continuously launched several "first models" in China, accumulating a set of domestically produced original model combinations.

Taking the base model GLM-4.5 released in July this year as an example, according to Frost & Sullivan's data, GLM-4.5 has achieved the following global leadership.

Based on the evaluation results of 12 industry standard benchmark tests conducted in July 2025, GLM-4.5 ranks third globally, first in China, and tops the global open-source model rankings.

In September 2025, according to the LLM hallucination ranking in the field of Retrieval-Augmented Generation (RAG), the hallucination rate of GLM-4.5 was the second lowest globally and the lowest in China;

Since the release of GLM-4.5, Zhiyu's token consumption on OpenRouter has consistently ranked among the top ten globally and the top three in China;

During the same period, Zhiyu's paid API revenue on OpenRouter exceeded the total of all domestic models combined.

In the second week of December, Zhiyu open-sourced its GLM multimodal and agent series models for five consecutive days, occupying five out of the top ten spots on the Hugging Face Trending list.

This includes AutoGLM, which can operate a mobile phone on behalf of users, the GLM-4.6V multimodal large model, the GLM-ASR series of speech recognition models, the GLMTTS industrial-grade speech synthesis system, and core technological achievements in video generation. At first glance, this operation seems almost contrary to the logic of emphasizing commercialization and profitability. However, at this sensitive time point before going public, Zhiyu's open-source strategy demonstrates a strong vision of a technology-centric artificial intelligence company, promoting the prosperous development of the entire AI technology stack and open-source community, regardless of timing, even as AI companies transition from technical competition to capital operations.

This temperament is precisely why Zhiyu was initially referred to as the "most OpenAI-like company" in China.

As OpenAI recently paused several non-core projects, including the Sora video generation model, and concentrated all resources over an eight-week period on enhancing the performance and user experience of its core product, ChatGPT, the two companies have once again returned to a common path in their model product roadmap: the model's capabilities themselves are decisive, and all other matters should make way for it.

The only significant difference may be the vast valuation gap between Chinese and American AI companies. OpenAI's extremely high valuation and continuous funding ensure that it has a steady stream of resources for model R&D, even without going public. In contrast, Chinese large model companies are valued at more than an order of magnitude lower, even though Zhiyu is already one of the best-performing companies among them. In its six years of establishment, Zhiyu has raised over eight rounds of funding, totaling more than 8.3 billion yuan.

Now, Zhiyu needs a broader market to secure more ample resources, and the capital market's response will confirm the quality of independent large model companies represented by Zhiyu, thereby fully pricing the entire Chinese large model industry.

The Battle for the Future

There is currently no independent large model company in the Chinese capital market that can serve as a reference, and various doubts surrounding the intense competition in large models still linger in the market. In the growth phase of technology companies, measuring their fundamentals and growth potential using financial profitability indicators is generally ineffective. The commercial value or growth logic of such companies is often measured by multiple complex dimensions, including revenue performance, product capabilities, market space, and business models, as well as, most importantly, expectations for the future.

Technological optimists firmly believe in the future envisioned by artificial intelligence. Two days after Zhiyu publicly filed its prospectus, another large model company, MiniMax, also disclosed its prospectus. Whichever company ultimately succeeds in going public first is destined to leave a profound mark in the history of AI development.

AI is an infinite battle about productivity and social transformation; this battle has only just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。