Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Driven by the dual expectations of the Federal Reserve's interest rate cuts in 2026 and escalating geopolitical tensions, the macro market has shown strong risk aversion. Both gold and silver prices have reached historic highs, with spot gold breaking the $4,400 mark for the first time, up about 66% year-to-date; silver has risen to $69, potentially achieving its best annual gain of over 100% since 1979. Platinum has also surpassed $2,000 for the first time since 2008, with a year-to-date increase of over 120%. Although market traders generally bet that the Federal Reserve will cut rates twice in 2026, Cleveland Fed President Beth Hammack, who will soon have FOMC voting rights, believes that given persistently high inflation, there is no need for rate adjustments in the coming months and suggests that the neutral rate may be higher than commonly perceived. Ahead of the Christmas holiday, U.S. stock index futures rose slightly, but the New York Stock Exchange will close early on Christmas Eve and will be closed on Christmas Day. Looking ahead, Goldman Sachs analysts predict that gold will further rise to $4,900 per ounce next year, while TD Securities believes that although silver prices may retreat, 2026 will be a year led by platinum and palladium in commodity prices.

Bitcoin has been oscillating between $84,000 and $94,000 for a month, currently hovering around $88,000. Bullish analysts like AlphaBTC and Captain Faibik anticipate a "Santa Claus rally," believing that the adjustment is complete and prices may soon break through to the $98,000 to $100,000 range; Korinek_Trades predicts, based on Elliott Wave theory, that prices could reach a new high of $150,000. Ignas points out that the massive options expiration on December 26 could push prices towards $96,000.

However, bearish voices cannot be ignored. Santiment founder Maksim Balashev analyzes social media sentiment and believes that the market has not yet shown enough "panic" to confirm a bottom, suggesting that Bitcoin could still drop to $75,000. CryptoQuant analyst CryptoOnchain warns that due to a $1.4 billion BTC inflow at Binance, prices may pull back to the demand zone of $70,000 to $72,000. Analysts like Killa and Doctor Profit predict that after several months of oscillation, the market may enter the next round of deep declines in the first quarter of 2026, targeting $60,000. Fidelity's Jurrien Timmer believes the four-year cycle is not over, and the bear market may last until 2026, with support levels between $65,000 and $75,000. From on-chain data, analyst Murphy notes that a large amount of accumulation has occurred in the $80,000 to $90,000 range, while the $70,000 to $80,000 range is a liquidity vacuum that may become strong support. In the long term, Galaxy Digital's Alex Thorn predicts that BTC could reach $250,000 by the end of 2027, while Arthur Hayes believes that the Fed's RMP plan is essentially quantitative easing, and once the market realizes this, BTC will quickly surge to between $124,000 and $200,000.

Ethereum is also at a critical juncture, with prices consolidating around the $3,000 mark. Technical analysts Ted Pillows and Dami-Defi point out that ETH is in a contracting triangle pattern, and if it can effectively break through $3,000 and the 200-day moving average, it may rise to $3,200 or even $4,200; if rejected, it may retest the support zone of $2,700 to $2,800. Marcus Corvinus also mentions that after breaking below the ascending channel, the price found support in the demand zone of $2,750 to $2,850 and is currently at a critical moment for direction choice. Man of Bitcoin leans towards a price pullback to the $2,825 to $2,894 range before breaking upwards. Notably, on-chain data shows positive signals, with analyst CW finding that while small whale holdings have decreased, addresses holding over 10,000 ETH have been significantly increasing their positions since July, with their buying rate reaching an all-time high, indicating high expectations for a potential large-scale rebound in the future. Michaël van de Poppe analyzes from the perspective of market sentiment cycles, believing that the current pessimism towards ETH mirrors the "death" narrative at the previous $1,600 level, which often presents a good opportunity for contrarian trading.

In the altcoin market, the Aave project has recently experienced significant volatility, with its second-largest holding address selling 230,000 AAVE at a loss of $13.45 million, causing the price to drop from $176 to $156 in a short time. Subsequently, the Aave community proposed transferring brand ownership and social accounts to DAO control, sparking discussions in the market about whether this move truly reflects "decentralization." Additionally, BitMEX co-founder Arthur Hayes believes that the "altcoin season" has always been ongoing, but investors need to focus on new narratives rather than repeating history, citing Solana's rise from $7 to nearly $300 and the emergence of Hyperliquid as examples, expressing optimism about Ethena (ENA)'s potential.

2. Key Data (as of December 22, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $88,833 (Year-to-date -5.1%), daily spot trading volume $27.13 billion

Ethereum: $3,022 (Year-to-date -9.33%), daily spot trading volume $25.11 billion

Fear and Greed Index: 24 (Fear)

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

Market share: BTC 58.5%, ETH 12.4%

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, SOL, DOOD

24-hour BTC long/short ratio: 50.01% / 49.99%

Sector performance: NFT sector up 8.48%, GameFi sector up 4.47%

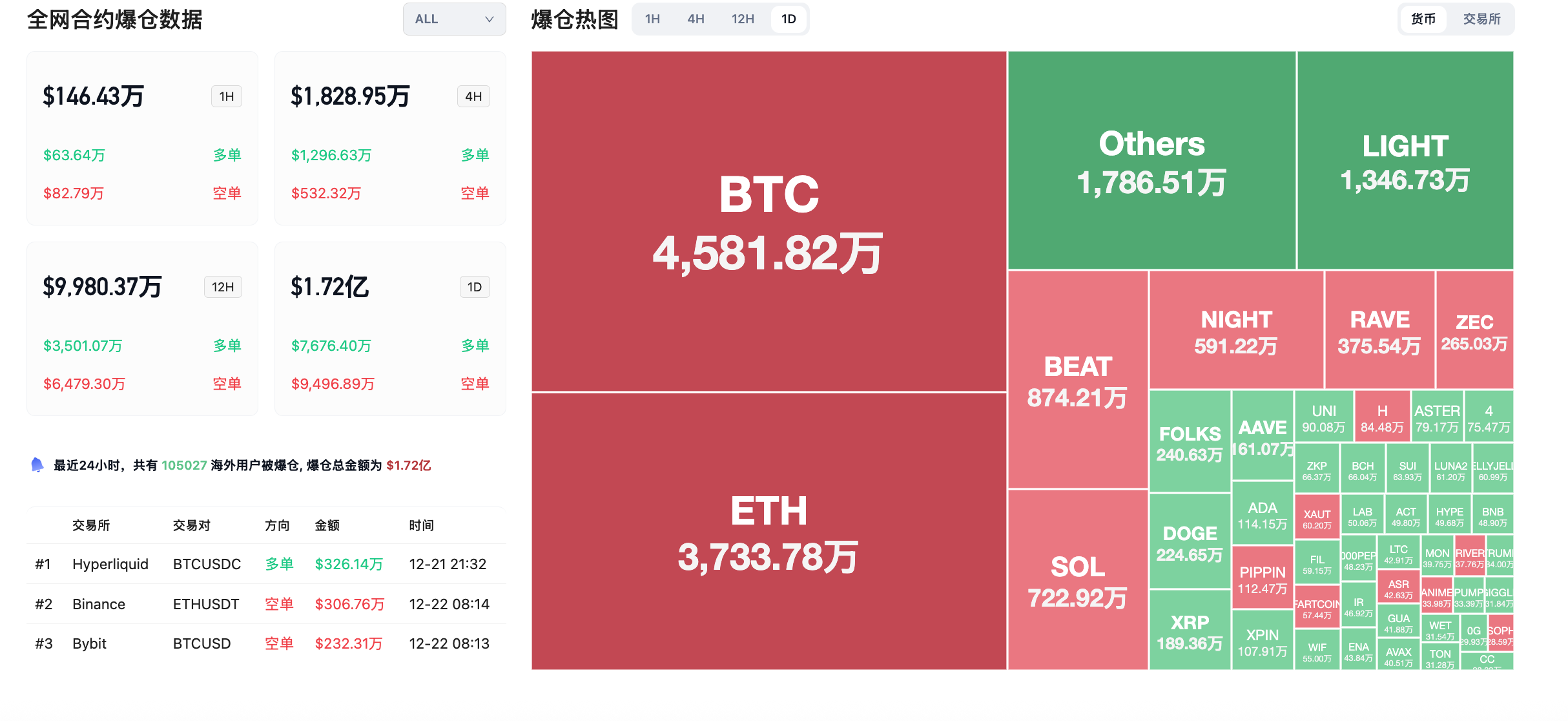

24-hour liquidation data: A total of 105,027 people were liquidated globally, with a total liquidation amount of $172 million, including $45.818 million in BTC liquidations, $37.3378 million in ETH liquidations, and $7.229 million in SOL liquidations.

3. ETF Flows (as of December 21)

Bitcoin ETF: Net outflow of $497 million last week

Ethereum ETF: Net outflow of $644 million last week

Solana ETF: Net inflow of $66.55 million last week

XRP ETF: Net inflow of $82.04 million last week

4. Today's Outlook

Aster will launch the fifth phase of airdrop on December 22, distributing 1.2% of the total supply

Binance Wallet: Bitway (BTW) Pre-TGE event will start on December 22

The U.S. Bureau of Economic Analysis will release third-quarter GDP data on December 23

Binance will remove several leveraged trading pairs including DOT/FDUSD, ENA/FDUSD

Today's top gainers among the top 100 cryptocurrencies by market cap: Audiera up 57.7%, Midnight up 25.1%, MYX Finance up 13.5%, Kaspa up 5.7%, Sky (previously Maker) up 5.6%.

5. Hot News

Dragonfly Capital has deposited 6 million MNT into Bybit in the past 7 days, valued at $6.95 million

Hilbert Group acquires high-frequency trading platform Enigma Nordic for $32 million

Vitalik sold various tokens including UNI and BNB within two days

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。