Chapter 1: Executive Summary and Industry Landscape Analysis

As of December 19, 2025, the global digital asset mining sector is undergoing the most profound structural transformation since the inception of Bitcoin. Following Bitcoin's price reaching an all-time high of approximately $125,000 in October 2025 and subsequently retracing to the $86,000 range, along with the network's total computing power surpassing 1,000 EH/s, mining companies are facing the dual challenges of compressed profit margins and surging capital expenditures in the "post-halving era."

1.1 Industry Differentiation Pattern

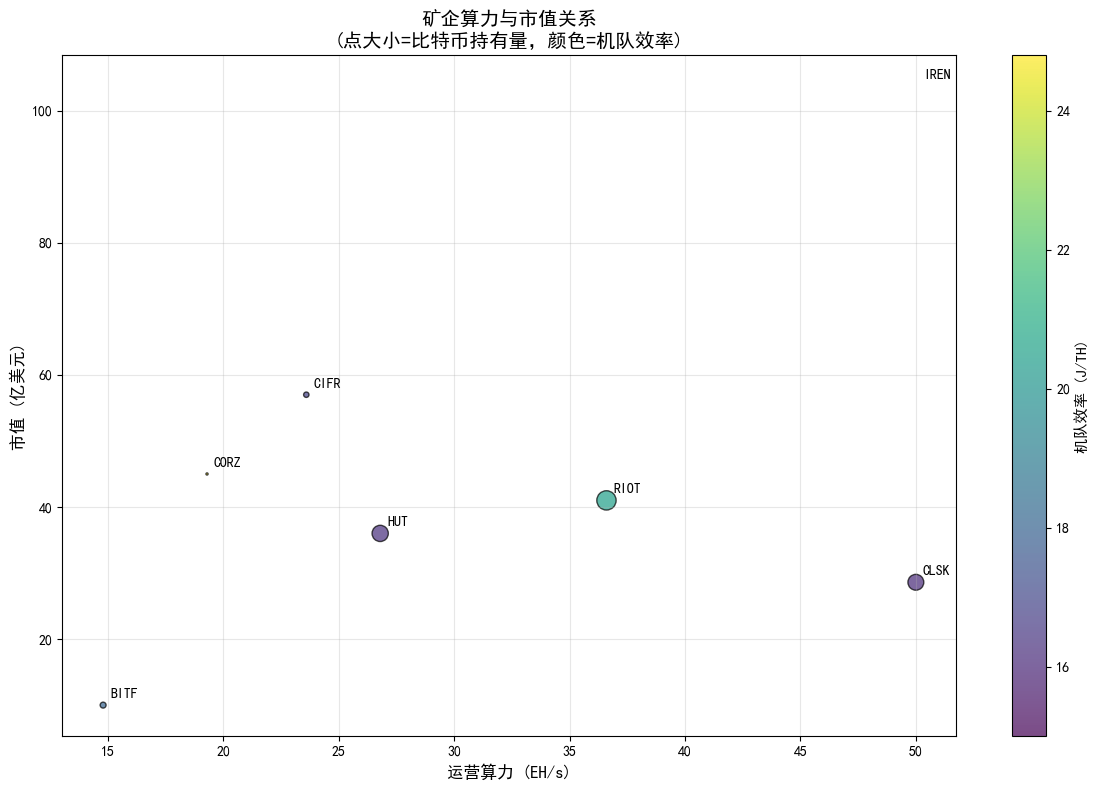

Figure 1: Analysis of the Relationship Between Mainstream Mining Companies' Computing Power and Market Value in 2025

The above chart clearly illustrates the current differentiation trend in the industry. Based on operational data analysis, the industry has formed two major camps:

First Camp: Bitcoin Fundamentalists

MARA Holdings: Computing Power 60.4 EH/s, Market Value $3.8 billion

CleanSpark: Computing Power 50.0 EH/s, Market Value $2.86 billion

Riot Platforms: Computing Power 36.6 EH/s, Market Value $4.1 billion

Second Camp: AI Transformation Pioneers

IREN Ltd: Computing Power 50.0 EH/s, Market Value $10.37 billion

Core Scientific: Computing Power 19.3 EH/s, Market Value $4.5 billion

Cipher Mining: Computing Power 23.6 EH/s, Market Value $5.7 billion

1.2 Strategic Transformation Weight Analysis

Figure 2: Mining Companies' Business Weight Distribution Matrix

From the analysis of business weights, it can be seen that IREN, Core Scientific, and Cipher Mining have AI/HPC business weights of 9, 9, and 8 respectively, indicating that their strategic focus has shifted towards the high-performance computing sector. Meanwhile, MARA Holdings and CleanSpark maintain high weights of 9-10 in their Bitcoin business.

Chapter 2: Comparative Financial Performance of Core Enterprises

2.1 Comprehensive Financial Performance Evaluation

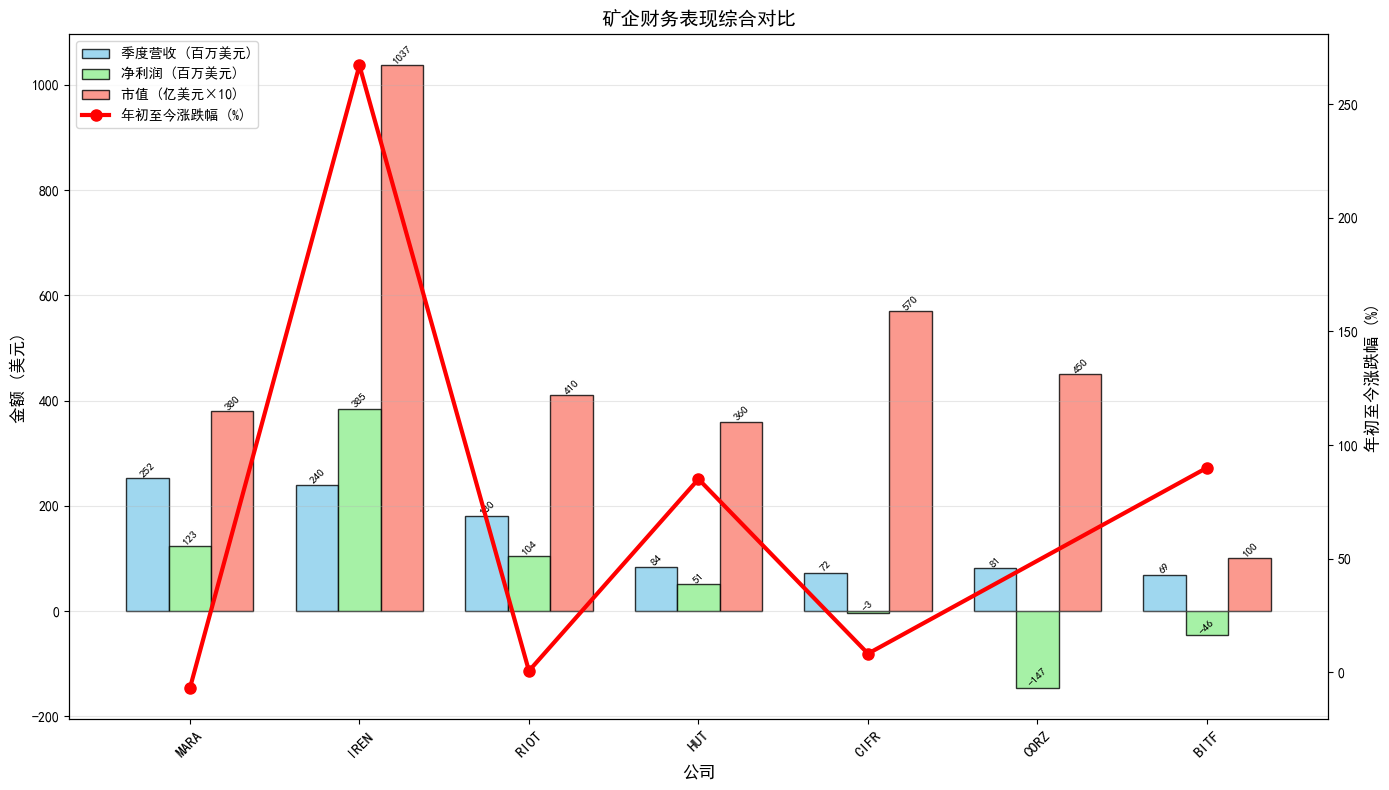

Figure 3: Comprehensive Comparison of Mining Companies' Financial Performance (2025)

Financial data shows significant differentiation:

Leading Revenue Performers:

IREN: Quarterly Revenue $240.3 million, Year-on-Year Growth 355%

MARA: Quarterly Revenue $252.4 million, Year-on-Year Growth 92%

Riot Platforms: Quarterly Revenue $180.2 million, Year-on-Year Growth 112%

Profitability Analysis:

IREN: Net Profit $384.6 million, Price-to-Earnings Ratio 18.9

CleanSpark: Net Profit $364.5 million, Price-to-Earnings Ratio 12.7

MARA: Net Profit $123.1 million, Price-to-Earnings Ratio 21.6

Market Performance:

IREN: Year-to-Date Increase 267%, Best Performer

Bitfarms: Year-to-Date Increase 90%

Hut 8: Year-to-Date Increase 85%

MARA: Year-to-Date Decrease 7%

Chapter 3: In-Depth Industry Insights and Trend Analysis

3.1 Fundamental Shift in Valuation Logic

Traditional mining company valuation models are primarily based on the leverage effect of Bitcoin prices, but data from 2025 shows that companies with AI businesses are beginning to exhibit independent market behavior.

Key Findings:

- Revaluation of Power Asset Value: IREN has a 3GW power reserve and secured a $9.7 billion AI cloud services agreement with Microsoft.

- Time Arbitrage Value: Mining companies transitioning to AI data centers save 3-5 years compared to new construction projects.

- Infrastructure Premium: Cipher signed a $5.5 billion 15-year lease with AWS, fundamentally changing the valuation logic.

3.2 Efficiency Watershed and Survival Threshold

As the total network computing power exceeds 1,000 EH/s, fleet energy efficiency has become a key survival metric:

First Tier (15-16 J/TH):

IREN: 15 J/TH

CleanSpark: 16.07 J/TH

Second Tier (20-25 J/TH):

Riot Platforms: 20.5 J/TH

Core Scientific: 24.8 J/TH

3.3 Capital Expenditure and Equity Dilution Risks

To support AI transformation, major mining companies undertook large-scale financing in 2025:

- IREN: Completed $1 billion and $2.3 billion in convertible bond financing.

- CleanSpark: Raised hundreds of millions through convertible bonds.

- Bitfarms: Completed financing at the billion-dollar level.

- While this financing strategy addresses construction funding issues, it also brings potential risks of equity dilution.

Chapter 4: Key Data Statistics and Standardized Indicators

4.1 Core Operational Indicators Comparison

| Stock Code | Company Name | Operating Computing Power (EH/s) | Fleet Efficiency (J/TH) | Bitcoin Holdings (BTC) | Market Value (Billion $) | |------------|-------------------|----------------------------------|-------------------------|------------------------|--------------------------| | MARA | MARA Holdings | 60.4 | N/A | 52,850 | 3.8 | | IREN | IREN Ltd | 50.0 | 15.0 | ~0 | 10.37 | | CLSK | CleanSpark | 50.0 | 16.1 | 13,054 | 2.86 | | RIOT | Riot Platforms | 36.6 | 20.5 | 19,368 | 4.1 | | HUT | Hut 8 Corp | 26.8 | 16.3 | 13,696 | 3.6 | | CIFR | Cipher Mining | 23.6 | 16.8 | 1,500 | 5.7 | | CORZ | Core Scientific | 19.3 | 24.8 | 241 | 4.5 | | BITF | Bitfarms | 14.8 | 18.0 | 1,827 | 1.0 |

4.2 Strategic Transformation Scoring Matrix

| Company | Bitcoin Business Weight (1-10) | AI/HPC Business Weight (1-10) | Key AI Partners | Power Reserve Advantage | |---------|--------------------------------|-------------------------------|--------------------------|-------------------------| | MARA | 10 | 2 | Exaion (Small Scale) | Medium | | IREN | 6 | 9 | Microsoft ($9.7B) | Extremely High (3GW) | | CORZ | 5 | 9 | CoreWeave (Major Client)| High | | CIFR | 7 | 8 | AWS ($5.5B) | High | | CLSK | 9 | 3 | Early Planning | Medium | | HUT | 6 | 7 | Anthropic/Fluidstack | High | | RIOT | 9 | 2 | Not Yet Defined | High (Texas Grid) |

Chapter 5: 2026 Outlook and Investment Recommendations

5.1 Three Core Trends

Trend One: AI Revenue Realization Period

The substantial contracts of IREN and Cipher will begin to contribute significant revenue in 2026, and the market will test these companies' capabilities in operating Tier 3/Tier 4 level AI data centers.

Trend Two: Accelerated Industry Consolidation

As small and medium-sized mining companies struggle to reduce costs through economies of scale, industry consolidation will accelerate. Companies like Bitfarms have become potential acquisition targets.

Trend Three: Increased Importance of ESG Compliance

Mining companies with renewable energy backgrounds (such as IREN and CleanSpark) will have an advantage in environmental compliance.

5.2 Investment Strategy Recommendations

Aggressive Growth: IREN + Core Scientific

Suitable for investors seeking high risk and high returns.

Provides dual exposure to Bitcoin and AI.

However, attention must be paid to execution risks and equity dilution.

Stable Value: CleanSpark

Strongest execution in pure mining.

Industry-leading fleet efficiency.

Suitable for investors seeking stable returns.

Leverage Play: MARA Holdings

The largest leveraged asset for Bitcoin.

Suitable for investors who are bullish on Bitcoin prices.

Must endure high volatility risks.

Infrastructure Defensive: Cipher Mining

Long-term AWS contracts provide stable cash flow.

An infrastructure asset with defensive attributes.

Suitable for risk-averse investors.

Chapter 6: Conclusion

The end of 2025 marks the conclusion of the "wild era" of digital asset mining. The industry is evolving into an "energy computing complex," where power infrastructure, AI transformation capabilities, and operational efficiency become core competitive factors.

Key Conclusions:

- Valuation logic has shifted from Bitcoin beta coefficients to infrastructure value.

- AI transformation capabilities are a key factor in market value differentiation.

- Fleet efficiency determines the survival baseline of enterprises.

- Power reserves have become the most critical strategic resource.

2026 will be the realization period for these transformation strategies, and the market will reassess the true value and long-term competitiveness of these enterprises.

Disclaimer: This report is based on publicly available market data and third-party research materials and does not constitute any investment advice. The cryptocurrency and related stock markets are highly volatile, and investors should independently assess risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。