Author: Nancy, PANews

From the past "investment barometer" to today's "fear of VC," crypto venture capital is undergoing a necessary demystification and cleansing.

The darkest hour is also a moment of rebirth. This brutal process of deflating the bubble is forcing the crypto market to establish a healthier and more sustainable valuation logic, pushing the industry back to rational construction and maturity.

Star VCs Fall, the Demystification of the Elite Halo

Another crypto venture capital firm has collapsed. On December 17, Shima Capital was reported to be quietly ending its operations.

In this harsh crypto cycle, the exit of VCs is not uncommon, but Shima Capital's departure is not dignified. Unlike other VCs that died from liquidity exhaustion or were dragged down by poor portfolios, Shima Capital's downfall stems more from internal moral hazards and management chaos.

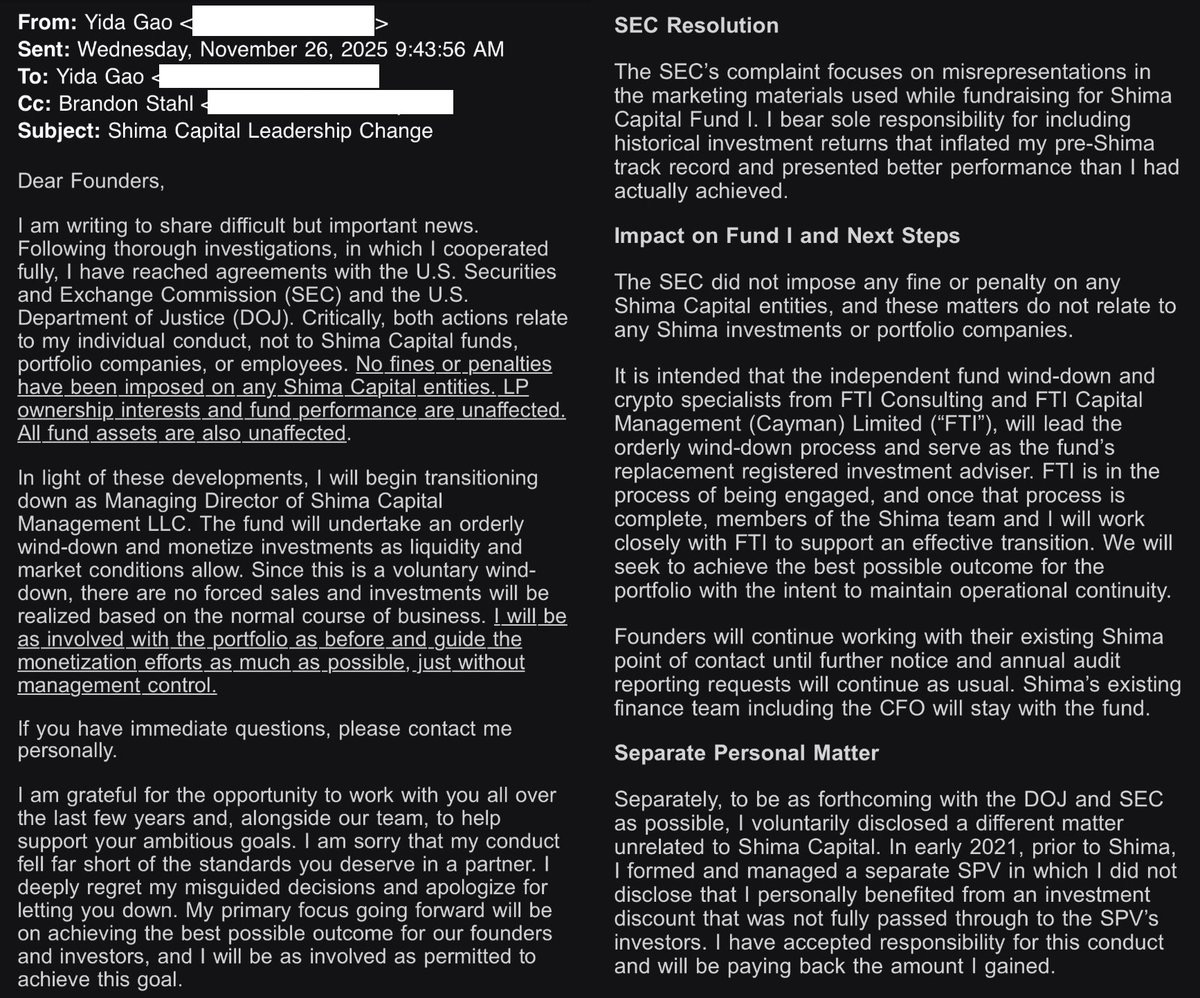

The immediate trigger for this decision was the lawsuit filed by the U.S. SEC against the firm and its founder, Yida Gao, three weeks ago. The allegations claim that it violated multiple securities laws and illegally raised over $169.9 million from investors through fraudulent means.

Under regulatory pressure, Yida Gao quickly chose to settle with the SEC and the U.S. Department of Justice, agreeing to pay a fine of about $4 million while deciding to close the fund and resign from all positions, expressing deep regret for his "misleading decisions." The foundation has entered liquidation procedures and will gradually liquidate assets to repay investors as market conditions allow.

As a once-active star VC in the crypto field, Shima Capital's rise relied more on the elite halo of its founder. Chinese-American Yida Gao was a top student on Wall Street, with a background from MIT, and had even taken over from former SEC Chairman Gary Gensler to teach crypto courses at MIT, with experience at well-known institutions like Morgan Stanley and New Enterprise Associates.

With this background, Shima's first fund easily raised $200 million, with backers including Dragonfly, billionaire hedge fund manager Bill Ackman, Animoca, OKX, Republic Capital, Digital Currency Group, and Mirana Ventures.

Holding substantial funds, Shima became one of the most active catchers in the last cycle, betting on over 200 crypto projects, including popular projects like Monad, Puddy Penguins, Solv, Berachain, 1inch, and Coin98. Despite the large portfolio, Shima and its team were evaluated by investors as young and inexperienced, lacking a true understanding of the industry, merely riding the speculative wave of cryptocurrencies.

More seriously, all of this was built on lies. According to the SEC's indictment, while raising $158 million for Shima Capital Fund I, he fabricated past performance, claiming that one of his investments achieved a 90-fold return, while the actual data was only 2.8 times. When the risk of the lie being exposed arose, he attempted to brush it off to investors as a "typo."

Not only that, Yida Gao raised funds from investors to purchase BitClout tokens through an SPV, promising discounts and principal protection. However, in reality, although he bought the tokens at a low price, he did not provide them to investors at the original price but instead marked them up and sold them to his own SPV, secretly profiting $1.9 million without disclosure.

From a long-term perspective, Shima's exit also sends a positive signal to the market that crypto wrongdoing is no longer a lawless land, and the industry's transparency and ethical standards will be better enhanced.

Related reading: Revealing the founder of Shima Capital suspected of misappropriating assets: From Fujian immigrant to Wall Street financial elite

The Era of Easy Money Ends, VCs Enter an Evolutionary Phase

The so-called VC model's failure is essentially the market forcing the industry to evolve.

Currently, the "VC gathering, retail investors taking over" assembly line model has been broken, and funds are rapidly withdrawing from air projects. For example, not long ago, the luxurious investment lineup of Monad still struggled with price difficulties after its launch, causing many VCs to "break down," leading to intense debates around value valuation among VCs like Dragonfly.

The industry's rules of the game have changed. Whether it is the success of projects without VC financing (like Hyperliquid) or the community's resistance to overvalued projects, these are pushing venture capital firms out of their arrogant ivory towers. Only when the path of making quick money solely by "issuing and selling tokens" is blocked will VCs truly focus on finding projects with real value creation capabilities that can solve actual problems.

This growing pain is evident. As retail investors exit, leading to liquidity exhaustion, traditional exit channels for VCs are obstructed, and valuation adjustments not only extend the return cycle but also leave many investments facing severe paper losses.

Recently, Akshat Vaidya, co-founder of Arthur Hayes' family office Maelstrom, publicly complained that the principal of his investment in a Pantera fund four years ago has nearly halved, while Bitcoin has risen about twice during the same period.

Moreover, some VCs have confided to PANews that they are overwhelmed by exits; even those who participated in seed rounds currently hold tokens priced below their cost. Even if their projects are listed on top exchanges like Binance, they have only recovered one-fifth of their principal after years. Many projects choose to list on small exchanges to appease investors, but there is fundamentally no liquidity exit, and some projects simply choose to lie flat, saying they are waiting for the right opportunity.

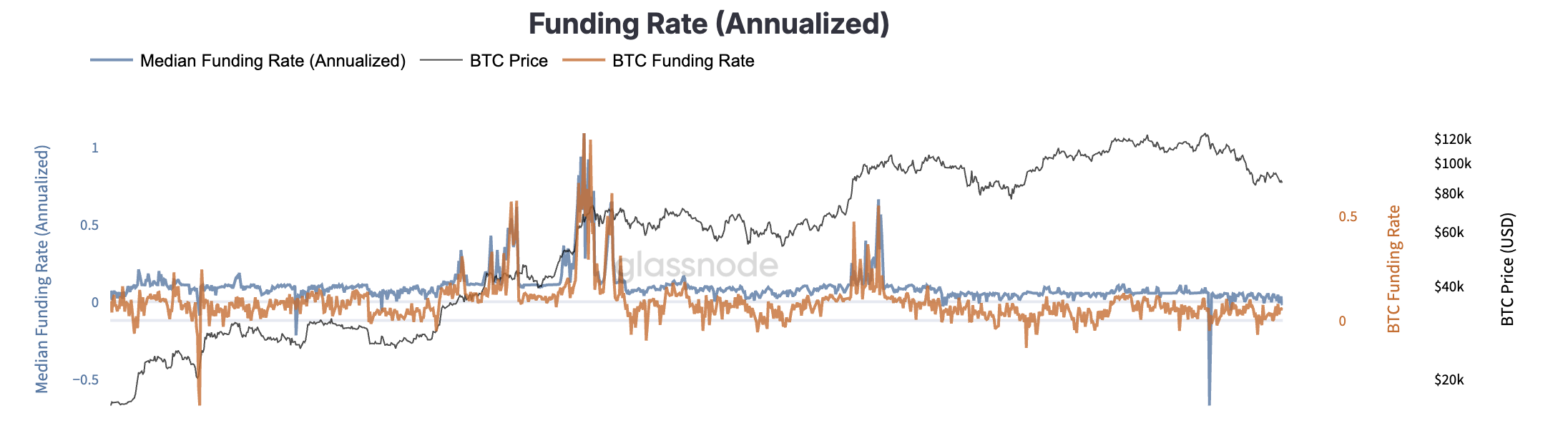

According to Glassnode data, currently, only about 2% of altcoin supply is in profit, and the market is showing unprecedented differentiation. Historically, it is not common for altcoins to consistently underperform during Bitcoin bull markets.

Data confirms that the era of easy money is completely over.

The end of one era signifies the beginning of another. Rui from HashKey Ventures pointed out on social media that VCs are not afraid of enduring but are afraid of speed, which is also why bear markets are more suitable for VCs. To truly succeed, one must endure until the next quiet period; unlike project parties, VCs can endure quite well. At the same time, most crypto VCs essentially rely on arbitrage from information asymmetry, coupled with some path dependence, earning a bit of hard-earned money and channel fees. More importantly, many of these people have now turned into market agents or market makers, which is essentially not much different.

Build the Road Before the Building, Seeking Certainty Opportunities

In the face of the retreat of hot money, not all VCs are "fleeing"; rather, they are strategically contracting and adjusting their lines.

"If a project does not have a data dashboard, we will not invest in it," a participant at a recent crypto event in Dubai revealed. VCs are now more focused on actual business data rather than just stories. Facing the bleak reality, VCs have significantly raised investment thresholds, or even completely abandoned new investments.

Dovey Wan, founder of Primitive Ventures, candidly stated that for investors, the ratio of strength to luck is becoming increasingly harsh, especially in the post-GPT era. This applies to all industries; choice is more important than effort, but choosing is much harder than effort.

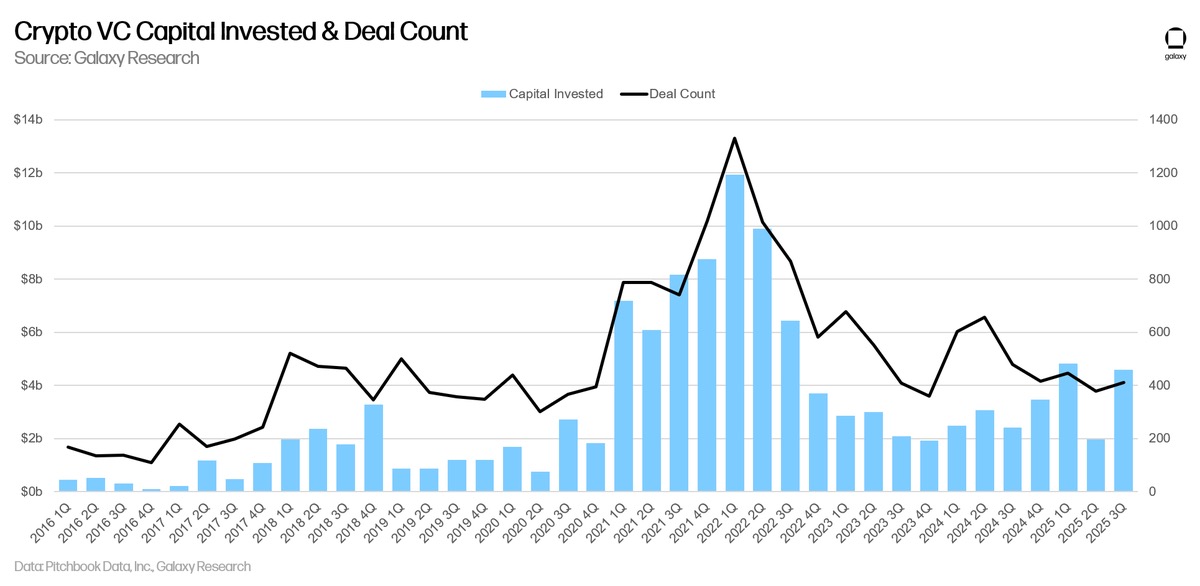

Pantera Capital recently revealed a positive trend in a video. According to their disclosure, although the total financing amount in the crypto field reached $34 billion this year, surpassing the records of 2021 and 2022, the number of transactions has decreased by nearly 50%. Several main reasons lie behind this phenomenon: first, the investor structure has changed. Family offices and individual investors that were active during 2021-2022 have become more cautious after experiencing losses in the bear market, with some even choosing to exit the market; second, existing VCs' investment strategies are becoming more concentrated, with these VCs preferring to invest funds in a few high-quality projects rather than casting a wide net as before, due to the higher costs of funding, time, and resources required to launch new projects; on the other hand, some funds have shifted towards relatively safer assets, which also explains why, in this cycle, a large amount of capital is highly concentrated in Bitcoin and a few mainline assets; finally, while funds are abundant, the pace of deployment has slowed. Many venture capital funds raised substantial amounts of money in 2021 and 2022 and currently hold ample "ammunition," mainly to support existing portfolios, without rushing to invest in new projects. From a longer-term perspective, this change is not a negative signal but rather a sign of the market's maturation.

Galaxy Research's recent analysis of Q3 investment reports also pointed out that the investment amount of crypto VCs increased during the quarter but was more concentrated. At the same time, nearly 60% of investment funds flowed to later-stage companies, the second-highest level since Q1 2021. Compared to 2022, venture capital fundraising data also shows a significant decline in investor interest. This data also demonstrates that VCs are more willing to heavily invest in certainty opportunities.

To hedge against the risks of a single market, some crypto VCs have begun to "diversify," targeting markets outside of crypto-native sectors. For instance, YZi Labs' recent investment list shows that its focus has shifted to biotech, robotics, and other non-crypto sectors. Some crypto-native funds have already started investing in AI projects, although they do not have significant bargaining advantages compared to tech funds, it is an attempt at transformation.

Pantera has also reflected on its investments from the previous cycle. "In the last cycle, a large amount of capital flowed into speculative areas like NFTs and the metaverse. These projects attempted to skip infrastructure and directly build the 'cultural top layer.' But it is like building a castle on sand; the underlying infrastructure is not ready, the payment tracks are not mature, the regulatory environment is unclear, and the user experience is far from mainstream levels. The industry was too eager to seek killer applications, pouring resources into application layers that lacked soil."

Pantera believes that this round of the crypto cycle is undergoing necessary "correction." Now, funds are flowing more towards infrastructure construction, such as more efficient payment chains, more mature privacy tools, and stablecoin systems; this path is the correct order, and the next cycle's applications will have the conditions to truly explode.

First, lay a solid foundation, then build the building.

The brutal cleansing of crypto VCs today is both a growing pain and a reshaping.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。