Saylor Issues Stern Warning: Being Explicitly Excluded from MSCI Could Trigger Huge Shockwaves in the Bitcoin Market

Author: Bitcoin Magazine Pro

Translation: Baihua Blockchain

News Briefs

Retail Miner Miracle: An amateur Bitcoin miner won with a probability of 1 in 180 million, receiving a block reward of $265,000.

Saylor's Warning: Michael Saylor warns that if MicroStrategy is clearly excluded from the MSCI index, it will have serious consequences.

Central Bank Dynamics: Coinbase believes the European Central Bank may follow the Czech experiment.

Legal Litigation: Calls for the developers of the pardon samurai suggest that legal loopholes will be restored.

Video Analysis: Using on-chain data to predict market cycle bottoms and tops.

Price Trends

Despite some short-term fluctuations, Bitcoin's price remained flat overall this week, down only 1.5% from last week.

Figure 1: Bitcoin price oscillating within a range over the past week

Figure 1: Bitcoin price oscillating within a range over the past week

This is mainly due to the prevailing market anxiety and a lack of catalysts to push prices in any direction. Over the past 12 months, with year-end results, Bitcoin has seen a decline of -14.71%.

Figure 2: Bitcoin's performance over the past 12 months

Figure 2: Bitcoin's performance over the past 12 months

From a technical perspective, while the support level we emphasized a few weeks ago (the green area in the lower chart) is still holding, the current rebound strength appears somewhat weak. If the price retests the $85,000 support level again, it will not be a bullish signal.

Figure 3: 1-Year Moving Average Target

Figure 3: 1-Year Moving Average Target

To return to a bull market, the target remains $100,000, which is also where the 1-year moving average is located. The 200-week moving average continues to rise, currently at $56,400. If the price falls to this level, it should provide support.

Major Headline: MicroStrategy Responds to MSCI Rules

MicroStrategy has officially challenged MSCI's proposal. The proposal states that if a company's digital assets exceed 50% of its total assets, it will be excluded from the global stock index. In a letter to the MSCI Index Committee, MicroStrategy warned that this rule could lead to operational companies becoming investment tools, thereby distorting the neutrality of the index.

MicroStrategy argues that the operations of Digital Asset Treasury Companies promote capital market activities rather than passive funds; they actively manage assets through stock finance and reporting tools to create returns for shareholders. The company also cautioned that a rigid asset ratio threshold could lead to index instability, forcing companies to enter or exit benchmark indices simply due to price shifts away from business fundamentals.

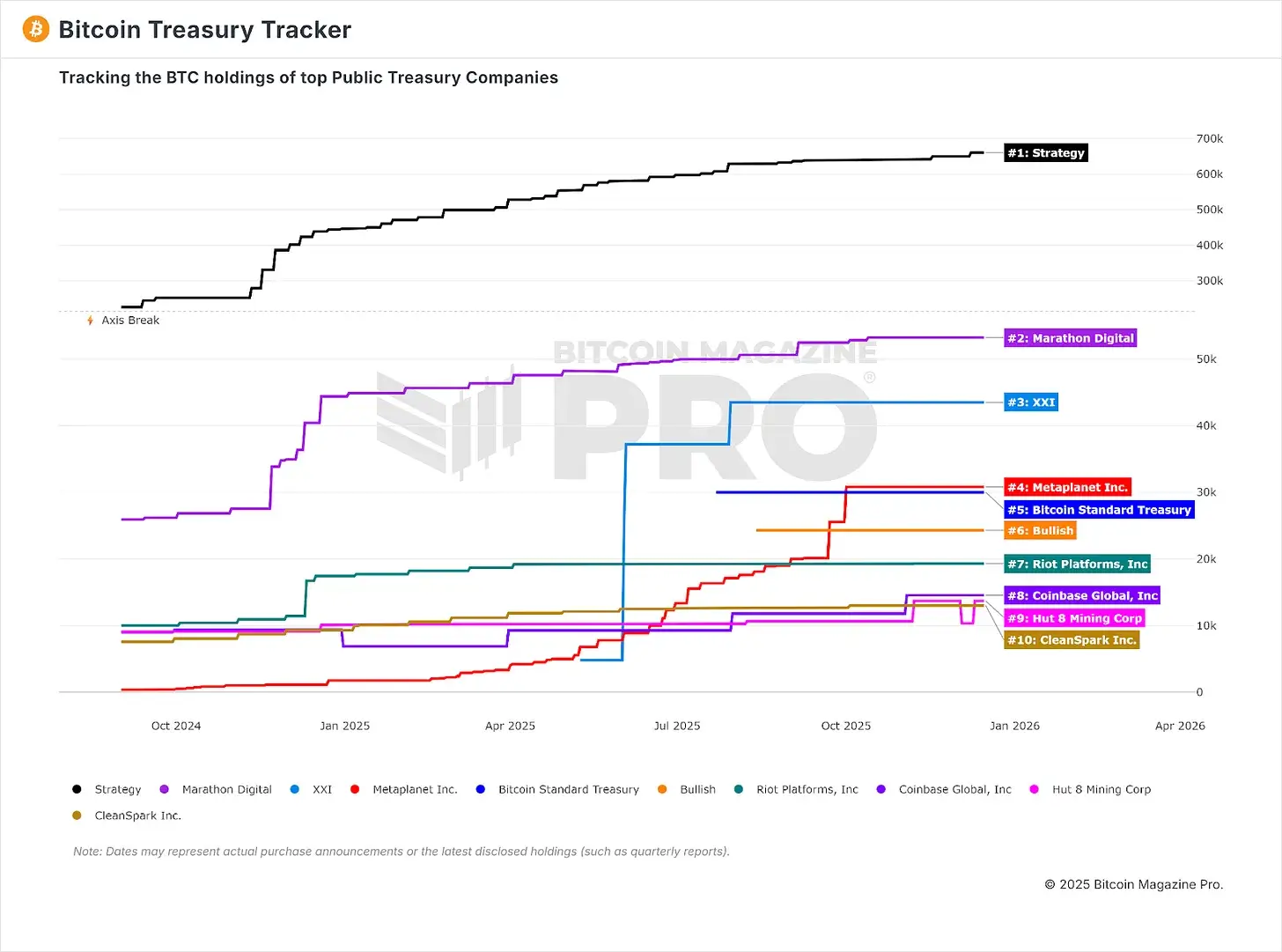

Currently, MicroStrategy is the publicly traded company with the largest Bitcoin holdings and has been continuously increasing its position. This advantage is clearly visible in the "Treasury Tracking Chart":

Figure 4: MicroStrategy's (black line) Bitcoin holdings far exceed others

Figure 4: MicroStrategy's (black line) Bitcoin holdings far exceed others

The company emphasized that energy, real estate, and other asset-intensive industries are often penalized for holding dominant asset classes. Analysts cited by MicroStrategy expect that if the proposal is approved, it could trigger up to $2.8 billion in potential forced sell-off disruptions.

As the debate unfolds amid macroeconomic uncertainty, Bitcoin briefly fell below $88,000 over the weekend. Despite the pullback, MicroStrategy Chairman Michael Saylor hinted at further increasing Bitcoin holdings, bolstering the company's long-term confidence.

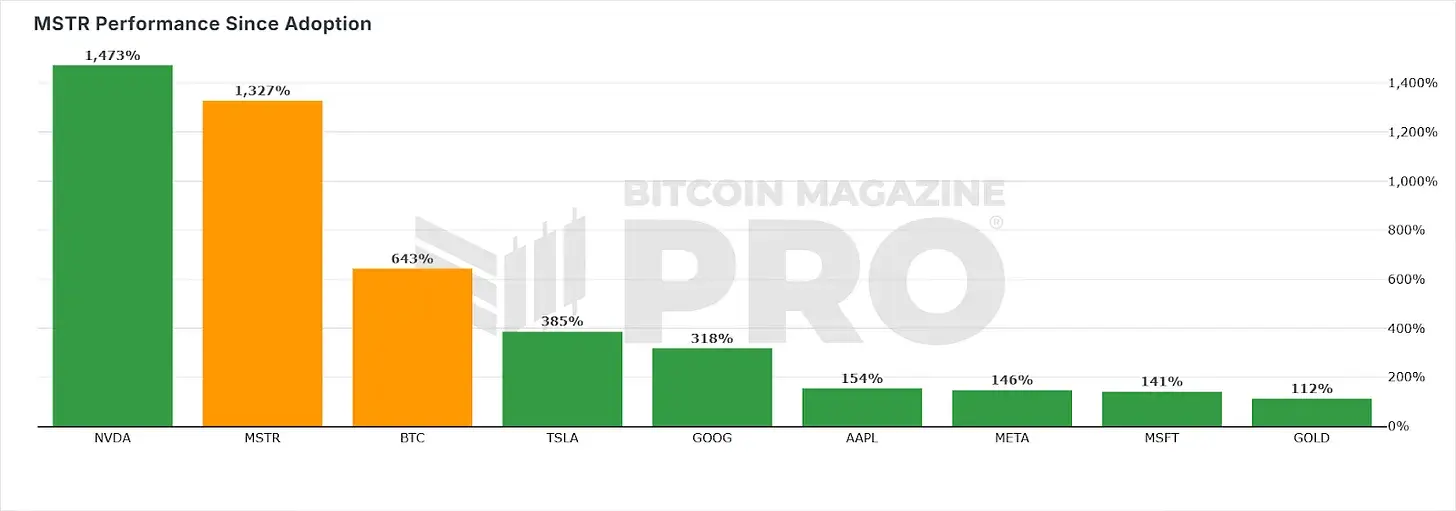

Due to the recent pullback in MicroStrategy's stock price, Nvidia's stock performance has outpaced MicroStrategy since adopting the "Bitcoin Standard." However, MicroStrategy still maintains an astonishing increase of 1,327%.

Figure 5: MicroStrategy's performance since adopting the Bitcoin strategy

Figure 5: MicroStrategy's performance since adopting the Bitcoin strategy

As digital assets increasingly appear in government policies and corporate asset holdings, MicroStrategy urges MSCI to allow market structures to evolve naturally rather than impose premature restrictions on this emerging field.

The outcome of the debate could trigger shockwaves in the market and potentially affect Bitcoin's price performance in the coming months. This is definitely a dynamic worth closely monitoring.

Article link: https://www.hellobtc.com/kp/du/12/6164.html

Source: https://bmpro.substack.com/p/strategy-vs-msci-a-rule-change-that

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。