I just saw a very interesting piece of news:

A few hours ago, Nasdaq officially submitted documents to the SEC, planning to extend U.S. stock trading hours to 23 hours a day, officially incorporating "night trading" into the official trading system.

Hmm? Are you trying to set a precedent for the 7X24 "on-chain stocks" and "asset tokenization" market two years from now, starting with a 5X23?

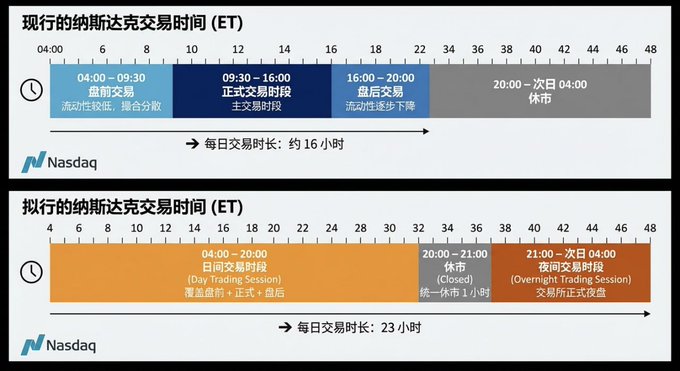

In simple terms, it currently looks like the above image, and if approved, it will change to the one below.

If it really goes through, the impact will be quite significant.

- Retail Investors - First of all, retail investors will definitely have a better experience, as they won't have to stay up late waiting for the market to open; they can buy during the day.

Moreover, this experience boost is not limited to Futu and Tiger Brokers; you can also use on-chain U.S. stocks like Ondo Finance and StableStock. Essentially, your buying and selling are executed through the brokers behind them, which is the underlying mechanism for "on-chain U.S. stocks with no slippage and infinite liquidity," as they are connected to the NYSE and Nasdaq. As long as the brokers execute trades more smoothly, your on-chain actions will naturally be smoother as well.

DeFi - The low liquidity and trading volume in pre-market and after-hours trading have affected the composability of on-chain U.S. stocks participating in DeFi, as the price discovery mechanism is actually in a "downgraded mode" during non-trading hours. Now, with an almost 24-hour official market, it can provide the most authoritative and uninterrupted "price oracle" for future DeFi protocols (such as lending and derivatives).

On-chain U.S. stock Brokers/MM - These brokers/market makers will be able to hedge in the U.S. stock market at any time within 23 hours, making the price curve smoother. Market makers can provide deeper liquidity on-chain around the clock without worrying about extreme risks. Unlike before, when a major event or black swan occurred a few hours before the market opened, prices had no way to reflect, and everyone had nowhere to run; they could only wait patiently for the market to open.

The era of on-chain U.S. stocks and the tokenization of everything is indeed getting closer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。