Source: Bankless

Author: David Christopher

Original Title: Hyperliquid & The Year Perps Caught Fire

Translation and Compilation: BitpushNews

Looking back at the growth of the crypto industry in 2025, Hyperliquid is an unavoidable focal point.

The exchange ended 2024 with an epic airdrop and price performance, attracting a large number of crypto Twitter users to pay attention to the product once again.

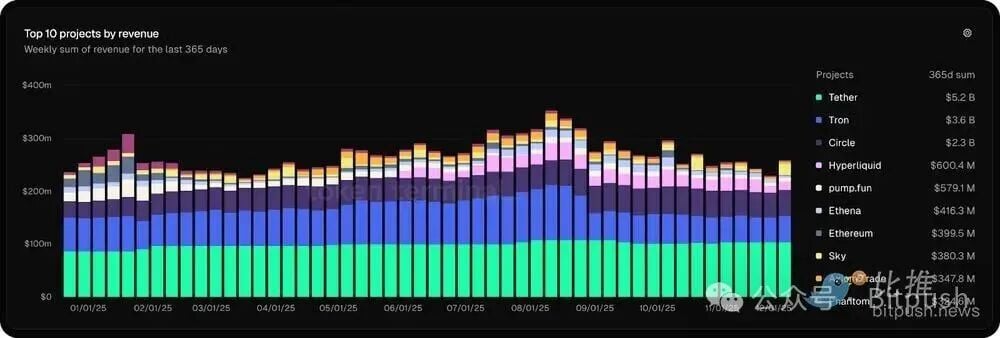

By the end of 2025, it had completely transformed—becoming a platform that broke the mold, ranking fourth in revenue across the entire crypto ecosystem, with total revenue exceeding $650 million, and at one point accounting for 70% of perpetual contract trading volume.

If you haven't been closely tracking every step of Hyperliquid, this groundbreaking success may seem to have appeared out of nowhere. But its path to conquest is the result of carefully designed, unconventional growth strategies and well-deserved external recognition.

Here’s a comprehensive review of Hyperliquid's development in 2025 (and why it will truly be tested in 2026):

Q1 2025: The Advantage of Being Crypto-Native

Hyperliquid's year of rapid growth began with a profound reminder of the importance of "truly keeping pace with the industry."

When the TRUMP token launched in January, Hyperliquid almost immediately listed perpetual contracts, beating other exchanges to the punch and starting a winning streak as the "preferred venue for pre-issue token trading."

Of course, its ability to act quickly was partly due to the absence of the "corporate guardrails" that protect users and companies at large exchanges.

But a key factor was its firm "insight"—because its team was closely intertwined with on-chain dynamics, they were able to spot opportunities and recognize the advantages of being the first to list these tokens. This solidified Hyperliquid's reputation as the go-to place for trading new assets before existing giants could react.

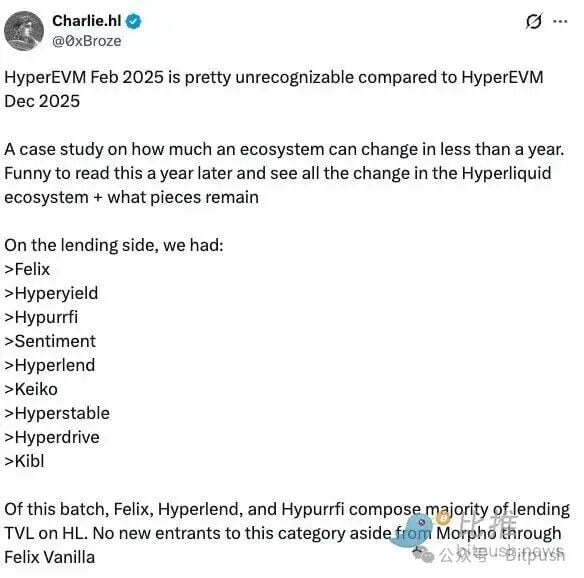

In February, HyperEVM was launched—a universal smart contract layer built on HyperCore (Hyperliquid's exchange engine). Although it took some time to find its footing, its success came without any top-down incentive programs. This meant that by the time it got on track in Q2, it had built a core user base that was there not to "farm" rewards, but because they believed in the chain's vision and wanted to leverage its unique features (such as interoperability with HyperCore), rather than just to extract incentives.

Q2 2025: Full Explosion

Market attention came faster than most expected. In addition to the HYPE token rising nearly fourfold from its April lows, by May, Hyperliquid accounted for 70% of all on-chain perpetual contract trading volume—an astonishing figure for a platform with zero VC backing and zero token incentives.

The peak of the HYPE token, explosive growth in HyperCore activity, and the development of the HyperEVM ecosystem all contributed to spreading the story of Hyperliquid.

As the market revived, Hyperliquid's smooth user experience (UX) and deep liquidity captured a significant amount of order flow, with total trading volume climbing to $1.5 trillion.

As mentioned, HyperEVM also got on track, with its total value locked (TVL) growing from $350 million in April to $1.8 billion by mid-June, thanks to the launch of projects like Kinetiq, Felix, and Liminal, as well as users exploring new earning opportunities—all of which kept the HYPE token burning in the background.

In this rapid growth, Hyperliquid seemed to be everywhere.

It appeared on national television, was reported by Bloomberg, and became the focus of CFTC policy discussions. The exchange became impossible to ignore.

Q3 2025: Peak Momentum and Beginning of Differentiation

As Q3 began, a signal emerged indicating that Hyperliquid's infrastructure was becoming indispensable beyond its own ecosystem.

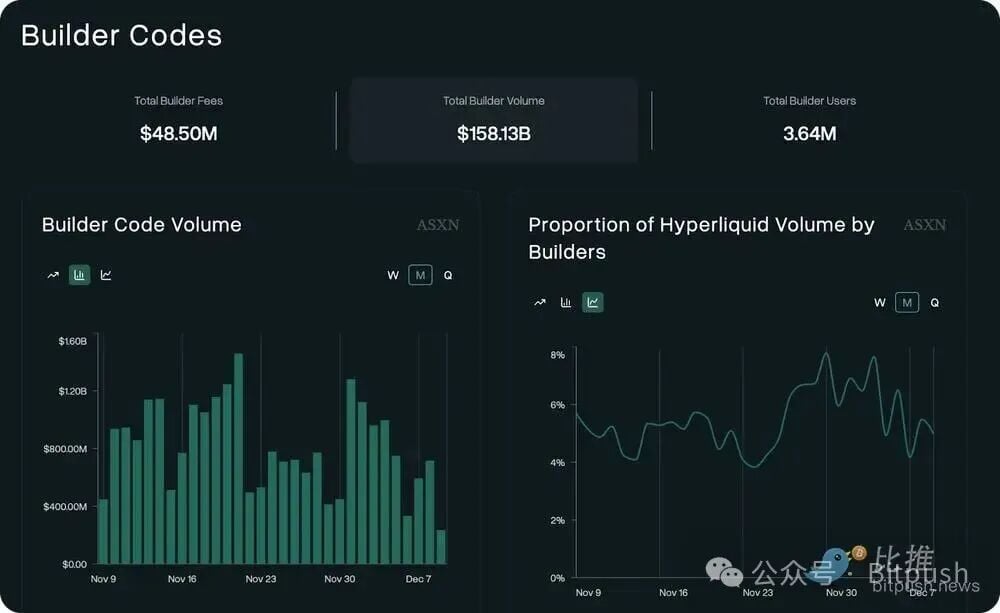

Phantom wallet bypassed Solana-based perpetual contract platforms, choosing to integrate Hyperliquid through builder codes. Builder codes are a mechanism of Hyperliquid that allows external platforms to earn fees by routing trades to HyperCore.

Rabby followed suit. Then came MetaMask.

A large number of mobile trading applications went live through builder codes.

In total, through these integrations, "partners" earned nearly $50 million in fees, routing $158 billion in trading volume.

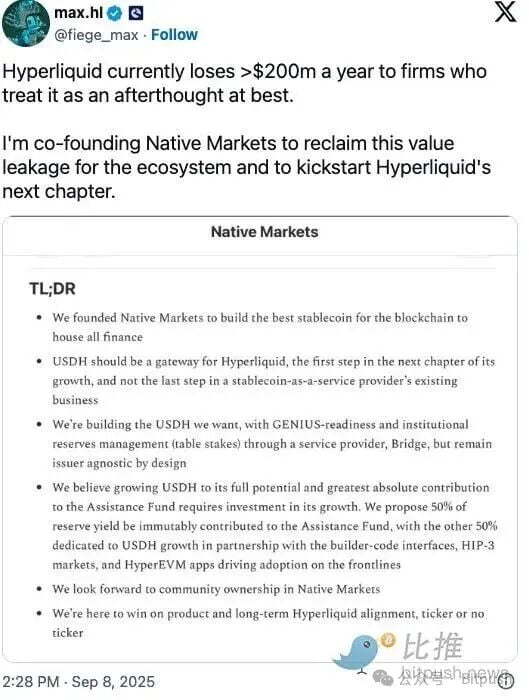

Subsequently, in September, a bidding war for USDH erupted—revealing how valuable and well-known Hyperliquid had become.

The question was simple: Hyperliquid held about 8% of Circle's USDC supply in its cross-chain bridge, leaking about $100 million in revenue annually to direct competitors (Coinbase), while Hyperliquid's own ecosystem could not reclaim this revenue. Issuing a native stablecoin could solve this problem, potentially redirecting $200 million in annual revenue back to Hyperliquid.

A proposal to issue a stablecoin was put forth, and many heavyweight players participated in the bidding.

Ethena offered a $75 million growth commitment and institutional partnerships. Paxos threw in PayPal and Venmo integrations, even getting PayPal to mention Hyperliquid on Twitter.

But ultimately, Native Markets won the bid—a team led by respected HYPE contributor Max Fiege, former Uniswap Labs COO MC Lader, and Paradigm researcher Anish Agnihotri.

Why could a smaller, less capitalized team defeat these giants? Because they were more favored, more aligned with Hyperliquid's spirit: bootstrapped, goal-oriented, and ready to build something truly organic—just as Hyperliquid itself was built.

The chain reaction extended beyond Hyperliquid itself. MegaETH soon announced its native stablecoin plan. Sui followed suit in November.

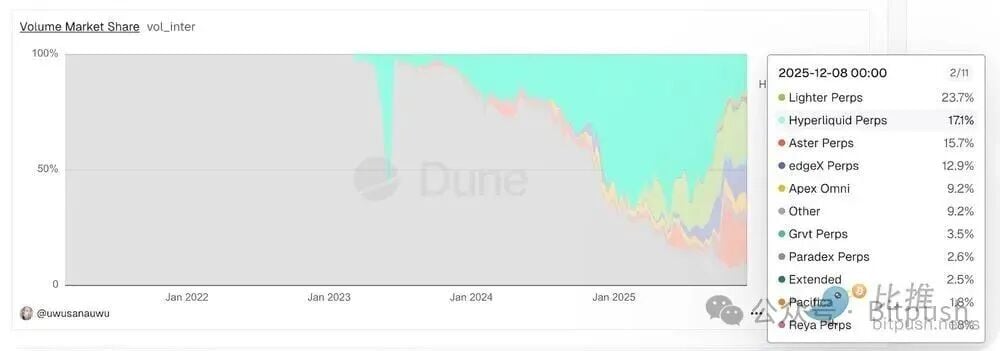

However, USDH also marked the peak of the HYPE token in mid-September—also the moment when competition began to show. Aster (a Binance-backed exchange) and Lighter (an Ethereum L2 perpetual contract platform) both launched through aggressive airdrop campaigns. Trading volume continued to disperse, and Hyperliquid's market share split, accounting for only 17.1% at the time of writing.

Q4 2025: Growing Pains and Maturity

In October, the long-awaited HIP-3 went live, opening up permissionless token listings on HyperCore, driving the exchange's expansion and decentralization.

Anyone staking 500,000 HYPE could now deploy custom markets, such as:

- Stock perpetual contracts from Unit's Trade.xyz and Felix Protocol

- Perpetual contract markets using yield-bearing collateral (like sUSDE) from protocols like Ethena

- Markets providing synthetic exposure to private companies like SpaceX or Anthropic through platforms like Ventuals

However, despite the launch of HIP-3, the price of the HYPE token still fell nearly 50% from its September peak.

What was the reason? Aside from market conditions and competition, two things stood out in particular.

First, Hyperliquid encountered its first ADL (automatic deleveraging) event in over two years this quarter. During the market crash on October 10, over-leveraged positions depleted margin faster than the liquidation engine and HLP (Hyperliquid Liquidity Provider) could absorb. The protocol triggered over 40 automatic deleveragings in 12 minutes, forcing the reduction of the most profitable positions to rebalance the books. While some argued that the affected positions were still "green liquidations," others contended that the mechanism liquidated more than what was needed to repay bad debts. Yes, the system maintained solvency without external funding, but Hyperliquid, like the entire market, might need time to recover from this event.

Secondly, in November, the team token unlocks began. Although the total unlock was below expectations, this vesting arrangement may have also contributed to the poor performance of HYPE. The sell-off was small—only 23% flowed to OTC desks, while 40% was re-staked—but the future pace of unlocks remains unclear. My interpretation is that the core team may still be determining the timeline to balance contributor equity with ecosystem health. But for a protocol known for transparency and "honesty," this ambiguity could cause market unease.

Hyperliquid's first unlock released 1.75 million HYPE after the lock-up period ended, but the future pace of team unlocks has not been fully disclosed.

The Testing Ground for Perpetual Contracts

Despite a cooling market and trading activity, we should not overlook the profound evolution that the perpetual contract ecosystem has undergone alongside Hyperliquid's own development when trying to understand the reasons behind Hype's poor performance.

Lighter and Aster are just two examples of on-chain competition. Although their trading volumes may be inflated due to airdrop hunting behavior, they do provide real alternatives.

In the off-chain realm, Coinbase's perpetual contract product will soon compete with Robinhood's layout in this space. As perpetual contracts continue to go mainstream, more competitors will emerge.

In other words, Hyperliquid is in its testing phase, which will continue into 2026.

The question is not whether it achieved significant accomplishments in 2025—it certainly did. The question is whether, as this space becomes crowded, the exchange can prove that its growth path through integrations like builder codes and decentralized models like HIP-3 remains advantageous.

What has brought them to today is building a better product and a better ecosystem without taking shortcuts. What will keep them ahead is doing it once again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。