Author: Sanqing, Foresight News

On December 10, the high-performance public chain Sei announced a partnership with Xiaomi, the world's third-largest smartphone manufacturer. The Sei Foundation will develop a new generation of cryptocurrency wallets and a decentralized application (DApp) discovery platform, which will be pre-installed directly on Xiaomi's new smartphones aimed at the global market (excluding mainland China and the United States).

The two parties plan to utilize multi-party computation (MPC) technology, allowing users to log into the wallet directly using their Google or Xiaomi accounts, eliminating the intimidating "mnemonic phrases" for ordinary users. They also plan to trial a stablecoin payment system in regions such as Hong Kong and the European Union in the second quarter of 2026, enabling users to purchase electronic products at over 20,000 Xiaomi offline retail stores using tokens like USDC.

Review: Seven Years of Evolution of Web3 Phones

Initial Attempts (2018–2020): Hardcore Security and Wild Imagination

Image source: Internet, compiled by AI

Around 2018, with the first major bull market in the cryptocurrency market, the first batch of "blockchain phones" emerged. The representatives of this period were Sirin Labs' Finney and HTC's Exodus 1, both designed with the concepts of "hardware sovereignty" and "extreme security."

Taking Sirin Labs' Finney as an example, this phone features a unique sliding "secure screen" specifically designed to display transaction details and input passwords through physical isolation, ensuring that funds remain safe even if the main system is compromised. HTC collaborated with Binance to develop Exodus 1, which introduced "Zion Vault," utilizing the phone's Trusted Execution Environment (TEE) to store private keys.

In addition to Sirin and HTC, another device worth mentioning is SikurPhone, which represented an attempt at a "closed system." Launched by a Brazilian security company, SikurPhone focused on "hacker-proof" features and built-in cold wallets. Its extreme approach involved running a highly closed SikurOS, which does not allow users to install third-party applications (requiring vendor evaluation) to reduce the attack surface.

Beyond secure storage, entrepreneurs at the time had even more cyberpunk imaginations. The Blok On Blok (BOB) phone launched by Pundi X attempted to solve the decentralization of communication. This modular phone allowed users to switch between "Android mode" and "blockchain mode," claiming to enable calls and data transmission over decentralized networks without going through mobile operators.

During this phase, Electroneum released the M1 phone, priced at only $80. It targeted developing countries, allowing users to earn tokens to pay for phone bills through "cloud mining." Although it did not gain traction due to poor user experience, it was actually the precursor to the later "phone as a mining machine" and JamboPhone models.

However, these devices ultimately could not escape the fate of commercial failure. Finney, priced at $999, had dismal sales, and Pundi X's decentralized communication struggled to take off due to a lack of user base. The technological features at the time overly emphasized turning phones into "cold wallets" or "full nodes," which posed too high a barrier for ordinary users, leading to the products circulating only within geek circles.

Mainstream Manufacturers Testing the Waters (2019–2022): Cautious Exploration

Image source: Internet, compiled by AI

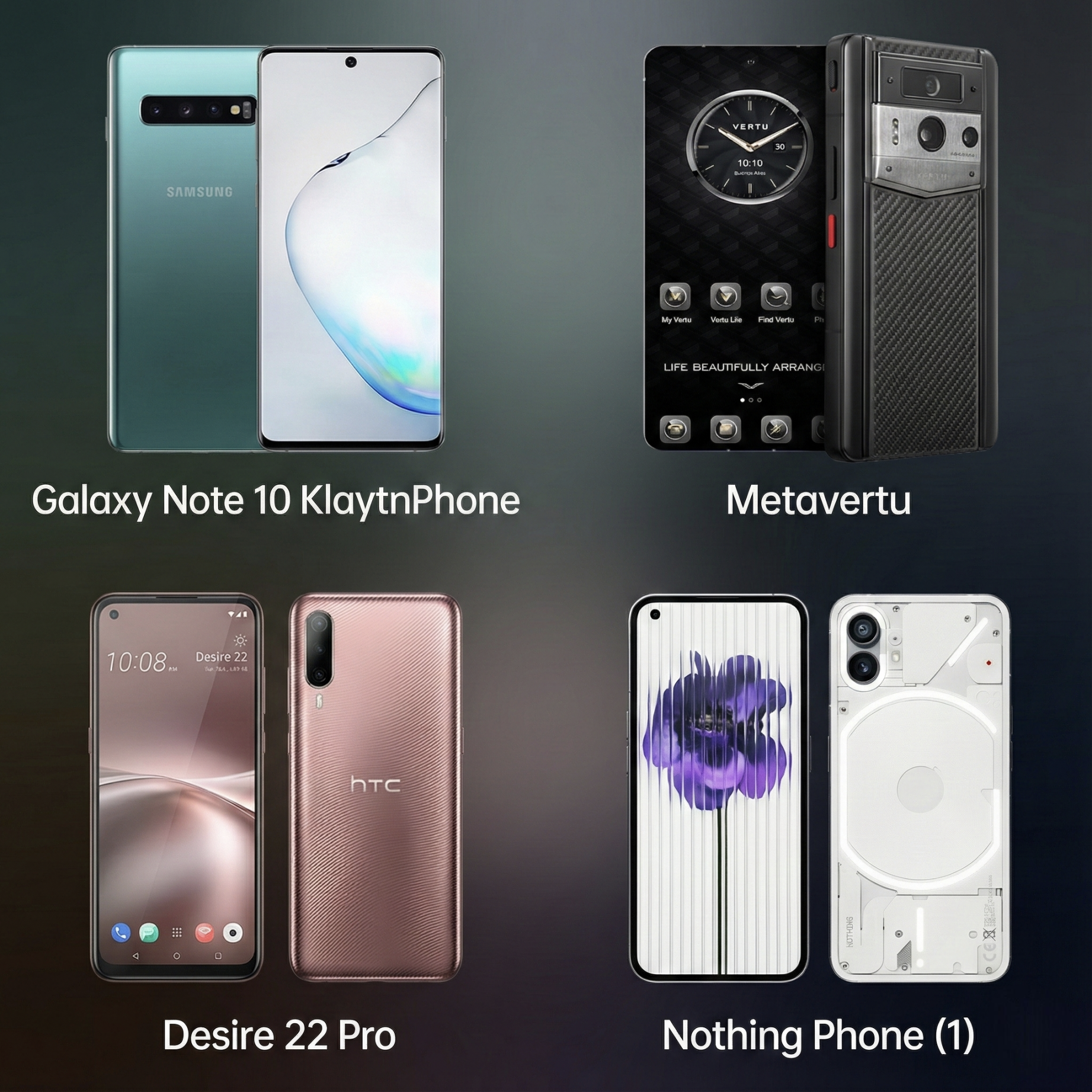

After observing the attempts of early entrepreneurs, mainstream smartphone manufacturers began to cautiously test the waters. Samsung integrated the Samsung Blockchain Keystore into its Galaxy S10 series, theoretically providing tens of millions of flagship users with hardware-level encrypted wallets.

Notably, Samsung had actually laid the groundwork for "buying a phone with tokens" as early as 2019. In the special edition "KlaytnPhone" of its Galaxy Note 10, Samsung collaborated with South Korean internet giant Kakao to randomly include 2,000 KLAY tokens. This can be seen as the earliest prototype of the successful model later seen with Solana Saga, although it was limited to the South Korean market and did not create a global sensation.

During this period, there were also attempts targeting specific niche markets. For example, Vertu launched Metavertu, priced at tens of thousands of dollars, focusing on "dual system" switching and luxury services to attract crypto millionaires. HTC also pivoted to launch the Desire 22 Pro, centered around the concept of the metaverse.

Although the entry of major manufacturers brought better hardware experiences, the limitations of this phase remained evident: Web3 features were often hidden in deep menus or merely served as marketing gimmicks, failing to fundamentally change user habits.

In addition to the "hardware wallet" attempts by major manufacturers (Samsung) and "luxury gimmicks" (Vertu), there was also a lightweight path of "software-defined membership" with the Nothing Phone. Nothing Phone collaborated with Polygon to establish a decentralized membership loyalty program through the "Black Dot" NFT.

New Generation Wave (2023–2025): Ecological Binding and Infrastructure

Image source: Internet, compiled by AI

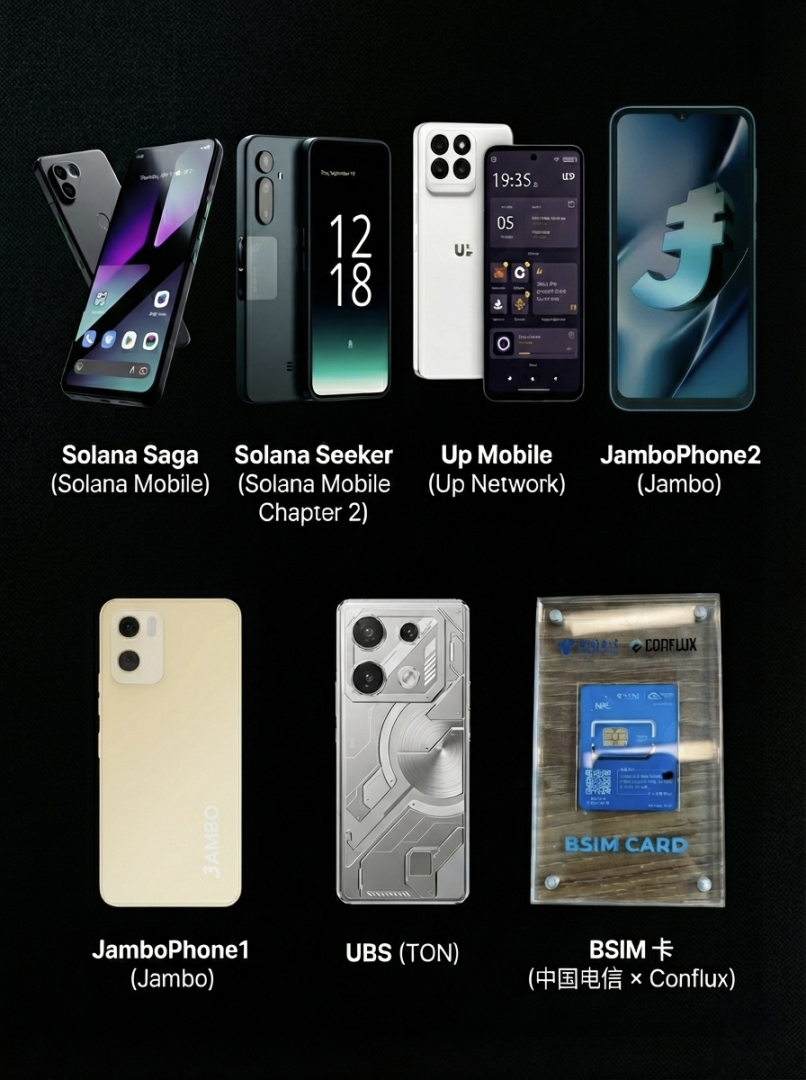

Entering 2023, the Web3 phone market was completely activated by Solana Saga, ushering in a new era of "ecological binding" and "token incentives." Initially, Solana Saga faced stagnant sales due to its high price-performance ratio, but as the value of the included BONK token airdrop exceeded the phone's price, the device sold out instantly, earning the nickname "dividend phone."

The subsequent Solana Seeker (Chapter 2) continued this airdrop logic, binding "soulbound tokens" (SBT) to prevent scalping and introduced the TEEPIN architecture to support decentralized infrastructure networks.

Meanwhile, ecological competition intensified. The TON ecosystem launched the Universal Basic Smartphone (UBS), also priced at $99, directly challenging JamboPhone. The TON phone leveraged Telegram's vast user base, focusing on "data dividends," allowing users to earn money through tasks and profit from selling their data. The Coral Phone, incubated by Binance Labs, also joined the fray, aiming to create a dedicated hardware entry for the BNB Chain ecosystem, focusing on multi-chain aggregation and AI features.

In the low-end market, JamboPhone entered the race with an ultra-low price of $99, serving as an entry point for "super applications" and attracting users in Africa and Southeast Asia through a "Learn to Earn" model. New players like Up Mobile also began to combine AI and Move language technology to share in the pie. Jambo has already launched its second-generation product, maintaining the $99 price while upgrading the memory to 12GB RAM (though the processor remains entry-level), which is now capable of handling more Web3 tasks and "super applications" in emerging markets.

The BSIM card launched by China Telecom and Conflux showcased another path: a SIM card with a built-in high-performance security chip. Users can simply replace the SIM card to transform any ordinary Android phone into a higher-security Web3 device. This "Trojan horse" strategy provides a new approach for large-scale adoption in compliant markets.

Trends: Five Directions of Change

Looking back over these eight years, we can clearly see five key transformations occurring in Web3 phones.

Hardware capabilities and security architectures are upgrading. Early security primarily relied on software or simple TEE isolation, but now technology is evolving towards more complex solutions. Solana Seeker introduced the TEEPIN (Trusted Execution Environment Platform Infrastructure Network) architecture, enabling phones to participate as trusted nodes in DePIN network construction. The BSIM card from China Telecom and Conflux directly integrates private key generation and storage into the SIM card, achieving telecom-grade hardware security. The collaboration between Xiaomi and Sei employs MPC technology, allowing users to log in with their Google accounts, achieving secure management without mnemonic phrases.

Ecological binding has become standard. Today's Web3 phones are not just generic crypto devices but also gateways to specific public chain ecosystems. Saga binds to Solana, Up Mobile binds to Movement Labs, while JamboPhone is based on Aptos, further aggregating the Solana and Tether payment ecosystems, becoming a super application entry point in emerging markets. Phones have become channels for public chain application distribution and user retention.

Airdrops or incentives dominate user growth. The motivation for users to purchase Web3 phones has shifted from "secure storage" to "earning rewards." The success of Saga proves that hardware can serve as a tool for "loss-leading customer acquisition," compensating users through subsequent token airdrops or other incentives. This "phone as a mining machine" or "phone as a golden shovel" economic model has become the strongest driving force in the current market.

Application scenarios take precedence over technical concepts. Early products were obsessed with "running full nodes" and other geek features, while the focus has now shifted to practical applications. The core of the collaboration between Xiaomi and Sei lies in stablecoin payments, while JamboPhone focuses on monetizing traffic from built-in applications. Solving real payment and application distribution issues is more attractive than purely technical stacking.

Channel and scale effects are beginning to show. Selling 20,000 units of Solana Saga is seen as a significant success, but in the face of Xiaomi's annual shipment of 168 million units, it is just a drop in the bucket. When large manufacturers like Xiaomi start pre-installing wallets through system updates, the growth of Web3 users will leap from "thousands" to "millions." This scale effect is unmatched by any vertical crypto phone manufacturer.

Conclusion: Breaking Down Walls, Integrating with the Public

In these eight years of evolution, we have attempted to build secure fortresses through expensive, closed Web3 phones. But reality has proven that the true "walls" hindering the popularization of Web3 are not security, but the complexity of mnemonic phrases and the disconnection in user experience.

Truly valuable Web3 phones will no longer need to brand themselves as "Web3 phones." They should be like today's 5G phones, where you don't need to understand the underlying communication protocols; you just enjoy the fast experience they bring.

Solana Mobile has proven that interest-driven breaking of barriers is feasible, while SEI's collaboration with Xiaomi is attempting to demonstrate that experience-driven integration is the long-term solution. In this evolution from "hardcore toys" to "public tools," whoever can lower the technical threshold of Web3 the most and completely break down this cognitive wall will hold the ticket to the next hundred million users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。