In a wide-ranging conversation with Kitco News anchor Jeremy Szafron, Lyn Alden dissected the narrowing economic backdrop, bitcoin’s reset, gold’s run past $4,000, and the structural tensions pushing policymakers toward a future where printing becomes the default, not the exception.

Alden, never one to sugarcoat institutional behavior, put it plainly:

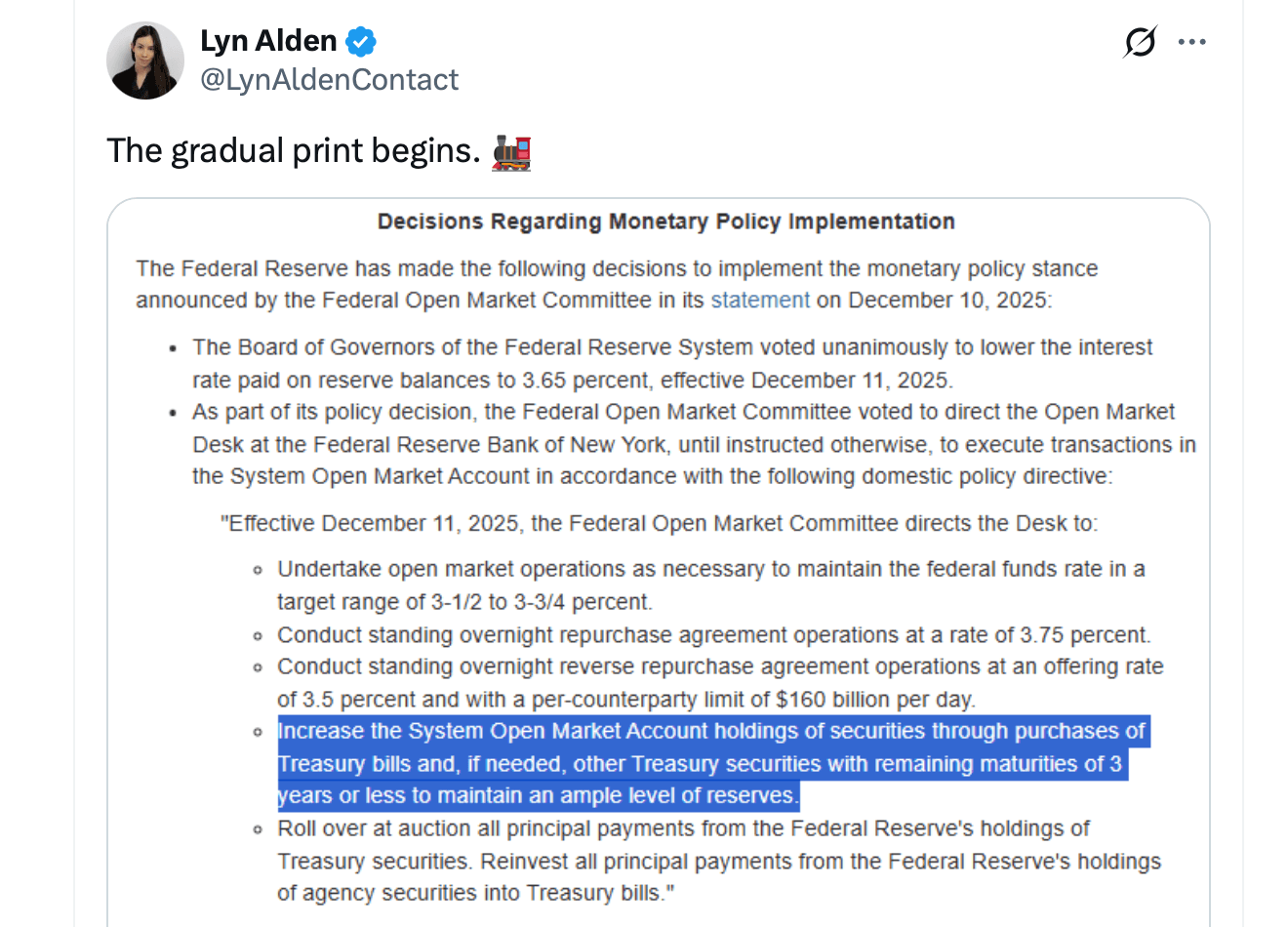

“My base case is more toward a gradual expansion of the balance sheet … which they won’t call a stimulus. They’ll say it’s for financial plumbing and technical issues.”

Alden described a U.S. economy that looks strong from 30,000 feet but feels increasingly hollow for the median household. Strip out the artificial intelligence (AI) giants and the fiscal firehose, she said, and most of corporate America is grinding along with weak capex and fading consumer strength. She likened the moment to a developed economy adopting “emerging market light” characteristics — strong headline data masking fragile underlying breadth.

This bifurcated structure, Alden argued, creates political rather than economic pressure. Americans see new market highs while their paychecks stretch thin, and the disconnect is beginning to define sentiment more than the data itself.

Source: Lyn Alden via X following the latest federal funds rate cut.

The interview’s biggest macro reveal came from Alden’s breakdown of the Federal Reserve’s December 1 halt to quantitative tightening. Liquidity stress in the repo market forced the Fed’s hand, she said, hitting the brake months ahead of schedule. This wasn’t a grand policy pivot — more like a “don’t look over here” maneuver to keep the Treasury market from seizing up.

Alden believes the next stage is pre-written: balance sheet expansion aligned with nominal GDP growth. Not a firehose, not a crisis-era sprint — but a slow, steady drip of liquidity that becomes an institutional habit.

And in that world, assets tied to scarcity — especially bitcoin and gold — tend to stand out.

Bitcoin’s correction off its 2025 highs didn’t surprise Alden. The selling, she noted, came mostly from long-term holders taking profits after years of appreciation — the classic late-cycle “distribution” pattern. At the same time, exchange-traded funds (ETFs), corporate treasuries, and retail cold storage picked up supply on the other side.

Read more: Bitcoin Treasuries: Corporate Crypto Buying Slows, but DAT Giants Keep Accumulating

Alden dismissed fears that bitcoin remains locked to the traditional four-year cycle, arguing that structural dynamics have shifted. Strategy’s Michael Saylor and Bitmine’s Tom Lee also share this view. She sees the downturn as leverage cleanup, not a thesis breaker, and believes the coming years still favor the asset — especially in a world defined by fiscal excess and liquidity accommodation.

Gold’s leap past $4,000, Alden said, reflects sovereign positioning rather than CPI anxiety. Countries aren’t dumping Treasurys outright, but they’re buying less of them — and they’re accumulating neutral reserve assets that can’t be frozen. With global reserves gradually diversifying, Alden sees gold’s role expanding in the years ahead.

Bitcoin’s long-term reserve appeal, she implied, fits into that same conversation — especially as sovereign wealth funds reportedly accumulate on dips.

Beyond bitcoin, Alden issued a blunt warning: token utility is not a bullish investment case. Highly efficient blockchains eventually compress their own margins, she argued, much like stock exchanges and ETF issuers do. Useful? Yes. Profitable to hold long term? Probably not. Bitcoin stands apart because demand stems from its monetary function, not its role as a toll road.

A major artificial intelligence (AI) spending slowdown or a sentiment swing among equity investors could destabilize the market’s two-pillar structure, Alden said. For now, she sees valuation risk in mega-caps, brewing stress in private credit, and political pressure building beneath the surface — but no obvious trigger for a broad systemic rupture yet.

- What does Lyn Alden mean by “the gradual print”?

She refers to the Federal Reserve slowly expanding its balance sheet to support financial plumbing rather than launching full-scale stimulus. - Why does Alden say the U.S. economy looks “emerging market light”?

Because headline growth remains strong even as real economic participation narrows beneath the surface. - What is Alden’s outlook on bitcoin after its correction?

She sees the downturn as a leverage flush and believes bitcoin remains well-positioned for the next few years. - Why are sovereigns accumulating gold and, in some cases, bitcoin?

They are diversifying reserves toward assets that cannot be frozen and serve as neutral stores of value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。