In the midst of strategizing, we decide victories from thousands of miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

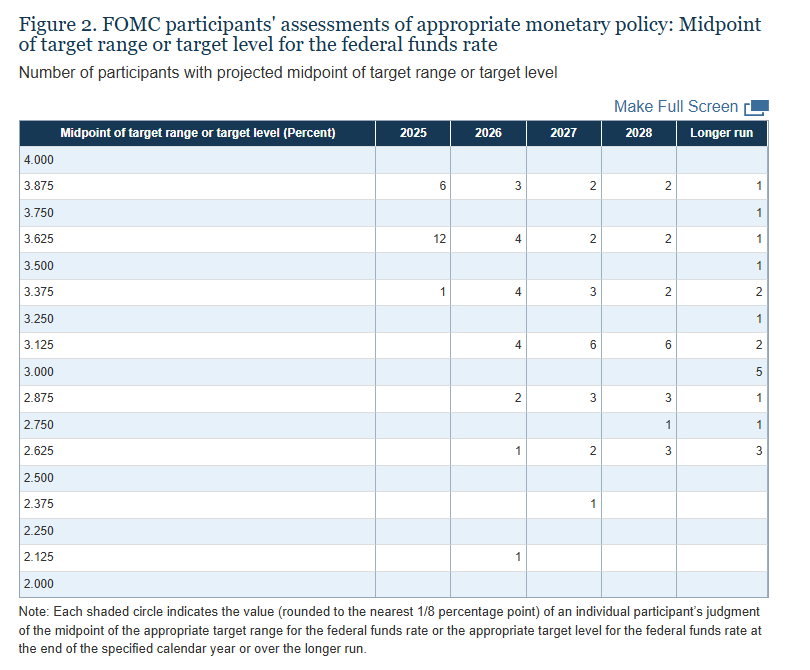

Yesterday morning, the last Federal Reserve meeting of 2025 concluded, and overall, the market reaction was not significant. From the dot plot, it is actually slightly more accommodative than in September, but there is still a gap from what the market expected. But that's okay, next year—2026—the biggest variable is actually that Powell will be replaced by Haskett (as mentioned in yesterday's article). Once the handover is complete, the June dot plot will be more important than it is now.

In Powell's speech this time, aside from showing little enthusiasm for a rate cut in January, he did not release any hawkish signals in other areas, and he was even quite optimistic about inflation. He believes that as long as the tariff issue can be clarified, the impact on goods inflation is likely to be just a one-time effect; he also emphasized again that if inflation goes down, the Federal Reserve will consider more rate cuts; if the labor market continues to weaken, they will intervene (i.e., cut rates).

So for the next month, we will still let the data speak: the worse the employment data, the higher the probability of a rate cut; the lower the inflation data, the higher the probability of a rate cut, and a rate cut means an increase after liquidity is released—this logic has not changed. The Supreme Court is likely to make a ruling on the Trump tariff case in January, so we will observe then. Overall, Powell's performance this time was much better than last December; last year's speech was truly hawkish. Additionally, he mentioned that GDP in 2026 might see a noticeable increase.

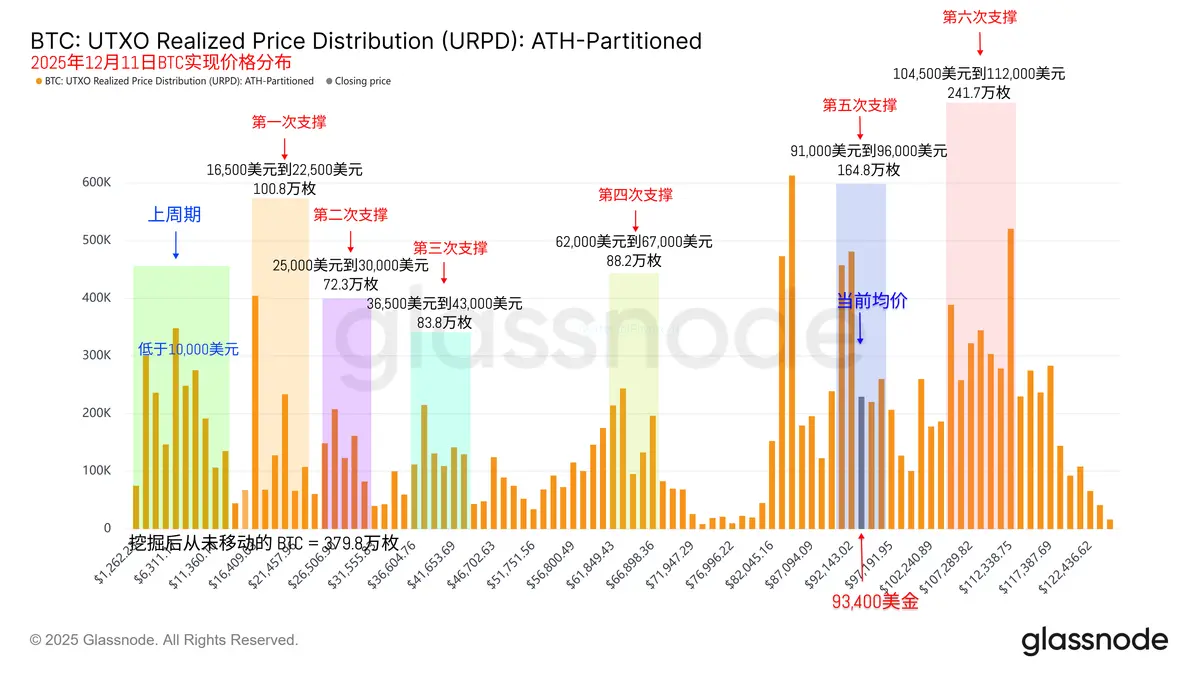

Looking back at Bitcoin, the on-chain turnover rate is still very high, reflecting investors' speculative mentality during critical periods. After today, the turnover rate may gradually decrease. The increase in turnover rate also indicates that short-term investors are more active; data indeed shows that in recent days, those who bought the dip, especially new investors with costs below $90,000, have been reducing their holdings significantly. The chip structure is currently still normal, with no signs of stability issues, and investors who are stuck at high positions are not showing signs of panic selling. Next, we will see the data released in December; if the expectations for a rate cut in January can continue to heat up, the market's enthusiasm should be maintained for a while.

Powell also mentioned that there will be a lot of December data released before the January meeting, which will help the Federal Reserve decide on the next monetary policy path. It’s still the phrase “data-driven decision-making,” but this time it’s a bit different; he believes that if there are no tariff impacts, inflation is actually around 2% now, and the key is to confirm whether the price increases caused by tariffs are one-time effects.

Overall, Powell did not make very hawkish statements this time; instead, he feels that the U.S. economy is performing well, with resilient growth driven by AI, and he did not mention economic downturn risks, only noting that there is a possibility of a slowdown in the labor market. A reporter pressed him on whether the weakening labor market is related to AI, which was indeed a bit of a tough question for Powell. He feels that the current layoffs are not closely related to AI, and the unemployment rate is still at a low level. In short, we still need to look at the data, and his attitude can be considered neutral to mildly dovish.

Lin Chao's Summary

I believe that in this interest rate meeting, we can set aside rate cuts and the dot plot for now; the real "game changer" is RMP (Reserve Management Purchase). For Bitcoin and Ethereum, a $40 billion monthly bond purchase plan is much more direct than a 25 basis point rate cut. The market has been debating the issue of the "Bitcoin halving cycle" and the "economic cycle" being misaligned for two years due to the pandemic, and we may have found the answer now. The last time the Federal Reserve had a similar operation—restarting repos—was in 2019; does that ring a bell?

The "repo crisis" in the fall of 2019 and the current RMP are essentially the same thing, with the only difference being that the Federal Reserve does not want to call it QE this time. But if something looks like a duck, walks like a duck, and quacks like a duck, then it is a duck. Back then, the overnight repo rate soared to 10%, and Powell announced the purchase of $60 billion in short-term debt each month, repeatedly stating, "This is not QE," but did everyone believe it was not QE?

This time, the Fed announced it would buy $40 billion in short-term debt over the next 30 days, citing "maintaining sufficient reserves," which is almost identical to the script from 2019, nominally fixing the pipeline, but in reality, it is just flooding the market. Referring to the experience of 2019, we cannot simply say that Bitcoin will rise immediately because there may be a "liquidity lag." The market may first react to the Fed's hawkish statements like "pausing rate cuts" with a risk-averse response, or it may pull back due to year-end profit-taking. It is likely that we will have to wait until next year for the base currency to be injected into the banking system, combined with the increase in TGA account balances during the traditional tax season in April, for the overflowing liquidity to truly seek out high-risk assets like Bitcoin. Therefore, Lin Chao has already clearly pointed out the direction in yesterday's article: 2026 will definitely be a year of rapid development for the crypto market, but at this current juncture, it is also the best time to lay out positions in spot trading. The big bull market will not arrive immediately, but it is already very close.

If you are feeling lost—don’t understand the technology, don’t know how to read the charts, don’t know when to enter the market, don’t know how to set stop losses, don’t understand take profits, randomly increasing positions, getting stuck while trying to buy the dip, unable to hold onto profits, missing out on market opportunities… these are common problems for retail investors. Lin Chao can help you establish the correct trading mindset. A thousand words are not as good as one profitable trade; repeated failures are not as good as finding the right direction. Instead of frequent operations, it’s better to strike precisely, making each trade more valuable.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocation is essential for steady progress in the ocean of investment. Life is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or a momentary profit or loss, but rather planning before action and knowing when to stop to gain.

The global market is ever-changing, the world is a whole; follow Lin Chao to gain a top-tier global financial perspective

This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market has risks; invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。