Double Chain Meme Surge!

In the past week (December 1 - December 7), under the dual influence of market sentiment fluctuations and a warming risk appetite, several high-volatility assets on the Huobi HTX platform experienced strong surges. AI Meme assets on the SOL and BSC chains, such as PIPPIN and FHE, led the way, showing a "dead cat bounce" recovery trend; at the same time, the long-silent bankruptcy sector saw rotation due to recent news about founder Do Kwon. Below are the highlights of this week's gains.

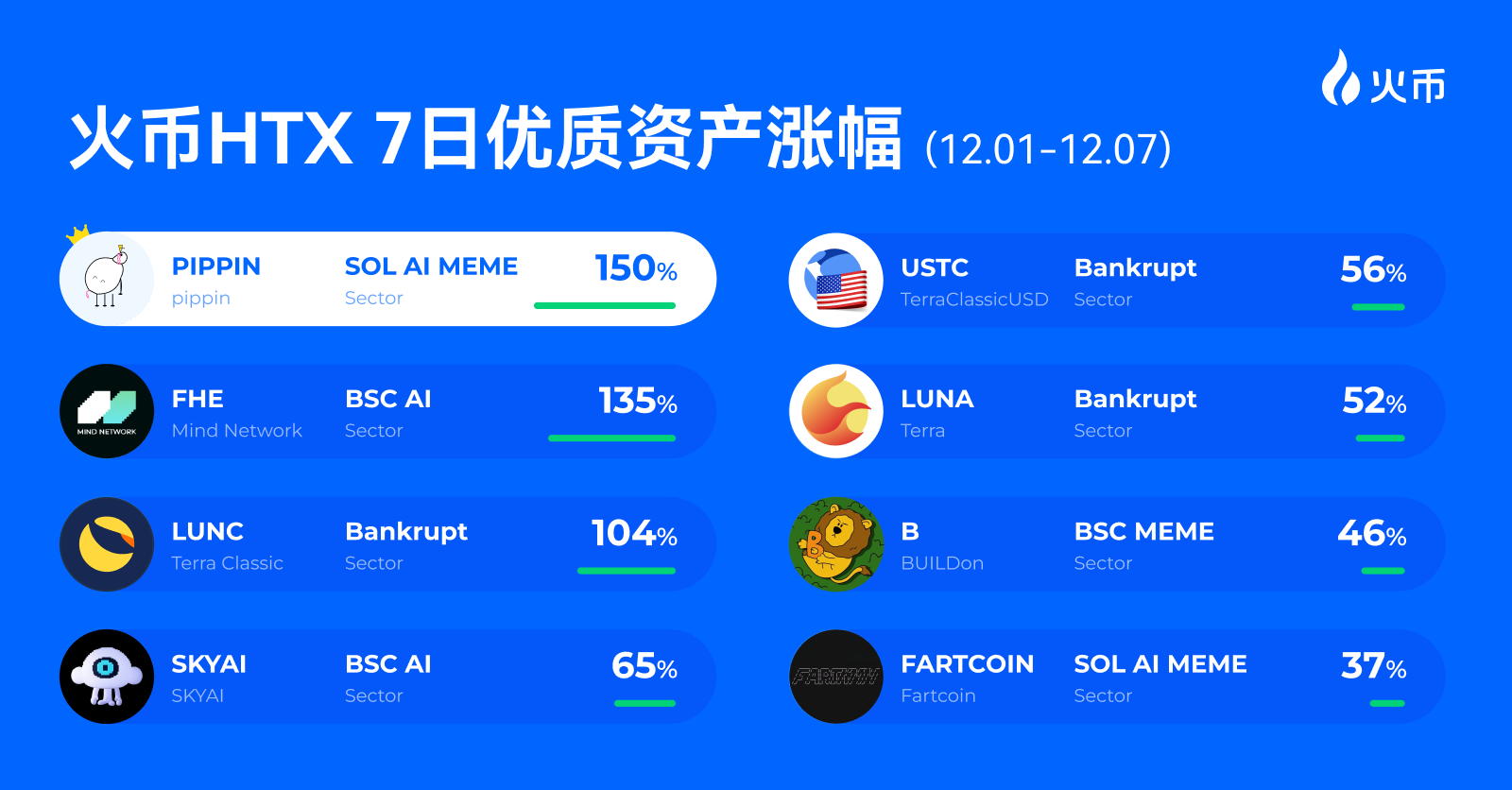

SOL Meme: Strongest Capital Inflow, PIPPIN Leads with 150% Gain

In the past week, the SOL ecosystem continued to be at the center of high-volatility narratives, with the combination of AI + Meme becoming the most sought-after track. The narrative has typical short-term speculative characteristics, and SOL remains one of the most suitable public chains for incubating high-elasticity targets.

PIPPIN (Pippin): 150% increase, the champion of this period's gains. Pippin is an SVG unicorn drawn using the latest LLM benchmarks from ChatGPT 4o. Pippin was created by Yohei Nakajima, recognized as an innovator and thought leader in the Al VC field, following in the footsteps of Jeff Bezos and Marc Andreessen.

FARTCOIN (Fartcoin): 37% increase, continuing the "AI + MEME" fusion gameplay. Fartcoin is a SOL chain Meme token inspired by truth terminal.

MOODENG (Moo Deng): 32% increase, a rebound asset under the boost of SOL ecosystem sentiment. As a hippo concept Meme asset on the SOL chain, market participants, after chasing AI Meme, also began to spread towards traditional Meme sectors.

BSC AI: Continued Heat of On-Chain AI Applications

The AI sector on the BSC chain also performed outstandingly. From an on-chain trend perspective, BSC's AI projects generally possess characteristics of "technical concepts, light asset operations, and high community participation," making it easier to form liquidity resonance in a short time. This week's concentrated gains also indicate that capital is willing to continue seeking high Beta opportunities in the "low threshold, strong narrative" track.

FHE (Mind Network): Entered the list with a 135% weekly increase, one of the most noteworthy tech-oriented assets this week. Mind Network is promoting the development of a new generation of zero-trust internet transmission protocols (HTTPZ). Ongoing discussions around homomorphic encryption and on-chain data security have boosted market sentiment.

SKYAI: 65% increase, continuing the "rotation logic" of small-cap AI assets on BSC. SKYAI is a comprehensive AI ecosystem driven by MCP, aiming to seamlessly integrate intelligent solutions across industries. Currently, SKYAI supports aggregated datasets from BSC and Solana, totaling over 10 billion rows.

B (BUILDon): 46% increase. BUILDon represents a hybrid Layer-2 blockchain solution that leverages Bitcoin's security framework and Ethereum Virtual Machine (EVM) compatibility to facilitate dApp development.

Bankruptcy Sector: Weekend Sentiment Ignites "Nostalgia"

The biggest surprise this weekend came from the strong rebound of the bankruptcy sector. The long-silent LUNA-related three assets saw a significant rebound under warming sentiment:

LUNC (Terra Classic): 104% weekly increase, leading the bankruptcy sector. Terra Classic (LUNC) is the original native cryptocurrency of the Terra blockchain. After the collapse of the Terra stablecoin (UST) and network fork in May 2022, it was renamed Terra Classic to distinguish it from the new Terra blockchain (LUNA 2.0). Community-level "restructuring expectations" and "historical sentiment" have once again become driving factors.

USTC (Terra Classic USD): 56% increase, a sentiment-linked asset, strengthening alongside LUNC. It is a decentralized algorithmic stablecoin pegged to the US dollar.

LUNA (Terra): 52% increase, continuing the sector rotation. It is worth emphasizing that this sector is a short-term focus of the market on "nostalgic assets," with extreme volatility, where gains and risks coexist.

Dual Drivers of AI Meme and Bankruptcy Sector, Short-Term Risk Appetite Fully Revived

Overall, December 1-7 was a typical "return of the monster market" week. The AI Meme tracks on SOL and BSC saw significant gains, and the bankruptcy sector made a strong counterattack over the weekend, with assets on the Huobi HTX platform showing strong rotation and high elasticity structure. As market sentiment continues to warm, short-term traders will still have ample volatility opportunities in the coming weeks.

In this round of multi-track resonance rise, Huobi HTX will continue to leverage its deep resources and agile responsiveness as a global platform to lead the next stage of wealth effect diffusion, providing users with more certain asset growth opportunities.

About Huobi HTX

Huobi HTX was established in 2013 and has developed over 12 years from a cryptocurrency exchange into a comprehensive blockchain business ecosystem, covering digital asset trading, financial derivatives, research, investment, incubation, and other businesses.

As a leading global Web3 portal, Huobi HTX adheres to a development strategy of global expansion, ecological prosperity, wealth effect, and security compliance, providing comprehensive, safe, and reliable value and services for virtual currency enthusiasts worldwide.

For more information about Huobi HTX, please visit https://www.htx.com/ or HTX Square, and follow X, Telegram, and Discord. For further inquiries, please contact glo-media@htx-inc.com.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。