Author: Nancy, PANews

The UAE in the desert is quietly rising to become a crypto oasis.

From ubiquitous crypto payments on the streets to the direct involvement of national sovereign funds, and a clear and transparent regulatory framework, the UAE has rapidly ascended to become a crypto hub connecting the East and West.

Particularly in Abu Dhabi, with recent gatherings of crypto giants like Binance, Tether, Circle, and Ripple, this bustling city is becoming a new crypto stronghold that the world is targeting.

Key License Obtained, Binance Establishes Governance Center in Abu Dhabi

Abu Dhabi is accelerating its rise as a compliance hub for the global crypto industry.

On December 8, shortly after the conclusion of Dubai Blockchain Week, Binance announced a significant development, having obtained comprehensive regulatory authorization from the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA), becoming the first crypto centralized exchange (CEX) to receive a global license under this framework. According to the new regulations, starting January 5, 2026, Binance will split into three independently licensed entities covering the three key businesses of exchange, clearinghouse, and brokerage.

To cope with regulatory pressures, Binance had long adopted a no-headquarters strategy, seeking policy space in multiple countries. As the industry moves towards full compliance, Binance has begun actively seeking a physical base. Abu Dhabi is the most closely watched candidate, not only because co-CEO Richard Teng comes from the ADGM regulatory system and is familiar with the local environment, but also due to the strong capital connections.

In March of this year, Binance announced it had received a $2 billion investment from Abu Dhabi investment firm MGX, marking its first external institutional investment since its inception. Given MGX's unique relationship with the Abu Dhabi royal family and government, and the general perception that Binance's valuation in this round is low, this investment is seen as Binance's "letter of intent" to Abu Dhabi.

While Richard Teng did not clarify in a Fortune interview whether Abu Dhabi would become Binance's global headquarters, he emphasized that regulators are more concerned about where Binance is regulated and stated that ADGM will become the governance center for Binance's global platform.

Binance's actions themselves send a strong signal to the world that Abu Dhabi may become a new coordinate for global crypto compliance.

Crypto Institutions Flood In

This trend extends far beyond Binance. An increasing number of crypto giants are collectively flocking to Abu Dhabi to expand their ecological footprint.

On the same day, December 8, Tether announced that its stablecoin USDT had obtained "fiat-backed token" qualification certification from ADGM, meaning that transactions and custody related to USDT can be conducted in compliance within the regulatory framework. Additionally, the support network for USDT has expanded to a broader on-chain ecosystem including Aptos, Celo, Cosmos, Near, TON, and TRON.

Another stablecoin giant, Circle, also announced that it has successfully passed approval and is officially authorized to operate as a money service provider within ADGM. Dr. Saeeda Jaffar, Managing Director for the Middle East and Africa, will accelerate the adoption of trusted digital dollar and on-chain payment solutions in the UAE and the Middle East and Africa markets.

Ripple has also accelerated its operations in the UAE this year. In May, Ripple announced it had obtained the first blockchain payment license from the Dubai Financial Services Authority (DFSA) and reached partnerships with Zand Bank and Mamo in the UAE, as well as announcing the opening of a new office in Abu Dhabi for its acquired Ripple Prime. Recently, Ripple's stablecoin RLUSD received local regulatory approval for compliant payment and fund management services.

In addition, crypto institutions/projects such as Bybit, Kraken, Animoca Brands, eToro, TON Foundation, Paxos, and Aptos are also continuously entering Abu Dhabi and have been approved to conduct various crypto businesses locally.

From Policy to the Streets, the UAE Embraces the Crypto Economy

The UAE's embrace of the crypto economy is not a fleeting trend but one of the important chess pieces following the oil era.

In the face of the long-term trend of declining global demand for fossil fuels, the UAE is proactively breaking free from single-resource dependence, shifting its growth focus from traditional energy infrastructure to high-tech and digital economy. This strategy has already shown significant results, with non-oil industries accounting for over 70% of the UAE's GDP.

Today, the UAE has quietly become one of the countries with the highest crypto penetration rates globally, transitioning from mere investment speculation to actual scenarios such as payments and consumption, with crypto payments visible in daily life.

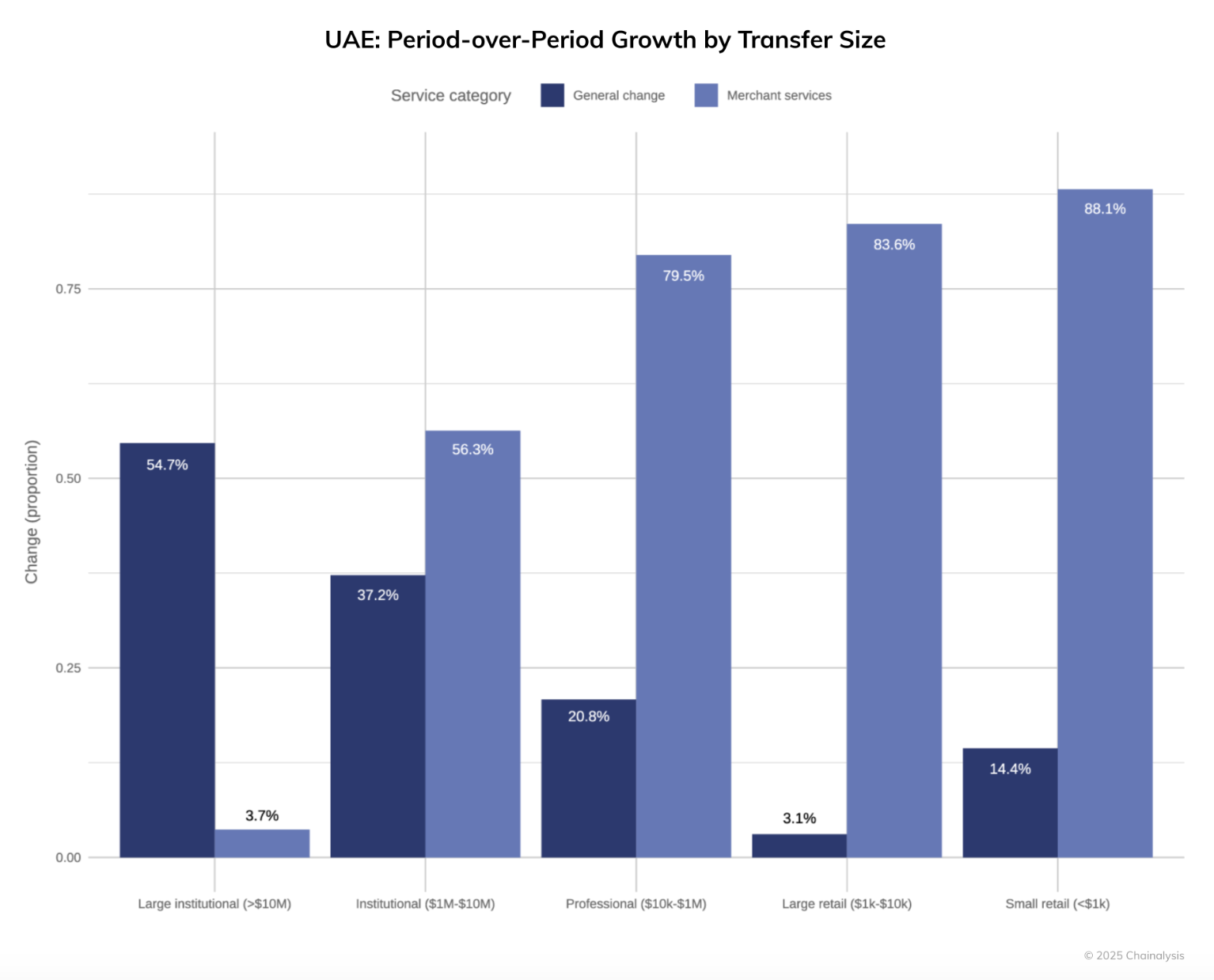

Recent research by ApeX Protocol shows that 25.3% of the local population holds cryptocurrencies, with an overall increase in penetration rate exceeding 210% in recent years. The latest "2025 Global Cryptocurrency Geography Report" released by Chainalysis indicates that between 2024 and 2025, the scale of crypto inflows into the UAE will exceed $56 billion, firmly establishing it as the second-largest crypto market in the MENA (Middle East and North Africa) region. This growth is primarily driven by institutional trading, with a year-on-year increase of 54.7%. Meanwhile, the country's small and large retail transactions have also grown by 88.1% and 83.6%, respectively.

Among the seven emirates, Dubai and Abu Dhabi are the two major crypto bases in the UAE. Dubai has gained global recognition for its keen business acumen, even overshadowing the UAE itself, and is the first to attract global institutions, with 70% of the Fortune Global 500 companies establishing regional headquarters there. As early as 2022, Dubai established the world's first independent regulatory agency specifically for virtual assets, VARA (Dubai Virtual Assets Regulatory Authority), quickly attracting global crypto companies. Although the FTX collapse raised questions about its initial licensing system, the VARA 2.0 upgrade strengthened the regulatory framework.

Abu Dhabi, known for its stability, relies on stronger government backing and financial capacity, making it the preferred choice for institutions seeking long-term security. Contributing over two-thirds of the national GDP and holding 94% of the oil reserves, Abu Dhabi itself bears the economic backbone of the UAE, needing to break free from the comfort zone of oil and possessing the "cash capability" required for transformation.

In 2018, the Abu Dhabi Financial Free Zone (ADGM) launched one of the world's earliest comprehensive crypto regulatory frameworks. ADGM has an independent court system that directly follows the Anglo-American legal system, placing its legal enforceability and regulatory transparency among the best globally. External evaluations describe it as "more detailed than the EU's MiCA and more coherent than the US."

Abu Dhabi's competitive advantage also comes from the government's direct involvement, using national credit and capital accelerators to promote industry development. For example, the UAE National Bank, wholly owned by the Dubai government, provides cryptocurrency services through its subsidiary banks; the Abu Dhabi sovereign wealth fund ADQ and other major institutions plan to collaborate on launching a dirham stablecoin; the Royal Group, closely related to the Abu Dhabi ruling family, is advancing a state-supported Bitcoin mining initiative, positioning the UAE as one of the world's major sovereign holders of Bitcoin; and the Abu Dhabi sovereign wealth fund Mubadala Investment Company has allocated Bitcoin.

An Excellent Location Connecting East and West

If Dubai or Abu Dhabi is taken as the center, two-thirds of the global population can be reached within an 8-hour flight.

At the same time, controlling the exit of the Persian Gulf and being close to the Strait of Hormuz makes the UAE a necessary transit point connecting the Asia-Pacific and European economic circles. The GMT+4 time zone configuration allows local financial institutions to seamlessly connect the Asian and European markets. For Western companies, it serves as a gateway to the Middle East; for Eastern companies, it is the preferred offshore headquarters with transparent laws and controllable risks.

This irreplaceable locational advantage has made the UAE a golden hub connecting the East and West, enhancing its attractiveness to the crypto industry.

More importantly, the rapid maturation of the UAE's crypto industry in a short time is due to its dual-layer framework of federal government and emirates, allowing for both unified regulation and differentiated practical experimentation. Recent crypto policies reflect this clear governance trajectory, delineating bottom lines while providing space for experimentation. For instance, the Dubai Financial Services Authority launched a tokenization regulatory sandbox, opening a channel for RWA testing for the first time; the UAE's latest Federal Decree No. 6 incorporates DeFi, stablecoins, DEX, cross-chain bridges, etc., into the central bank's regulatory framework. For the crypto industry, this means a clearer compliance path while still allowing room for innovation to grow.

It can be said that the rise of crypto in the UAE began with its geographical hub, achieved through compliance systems, and flourished with innovative strategies.

With strong sovereign wealth funds, a relaxed tax system, long-term ample fiscal reserves, and a friendly business tax environment, the UAE has won the favor of global capital. According to Henley & Partners, in 2025 alone, about 9,800 millionaires are expected to migrate to the UAE, making it the highest net inflow globally. Familiar figures in the crypto circle, such as CZ and Pavel Durov, are often based here.

Previously, Telegram founder Durov recommended on X that Dubai is the city he considers most suitable for living, citing "zero tax, pure ambition," describing it as a dreamland for libertarians.

The recent Bitcoin MENA 2025 conference has also made Abu Dhabi a focal point for the global crypto community. On the eve of the conference, giant billboards on the streets of Abu Dhabi prominently displayed the words of Bitcoin advocate Michael Saylor: "Bitcoin is digital energy, superior to all other assets," which may also reflect the city's attitude towards the outside world.

Currently, the UAE's crypto narrative is expanding from the desert to the globe. Whether it will, as Michael Saylor envisions, become the "Switzerland of the 21st century" if the Middle East embraces Bitcoin, the UAE may provide its answer through action.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。