Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

In a complex macroeconomic environment, the Federal Reserve's policy decision this week has become the market focus. The market generally expects the Federal Reserve to implement a 25 basis point rate cut, with probabilities as high as 88.6% to 95%. However, institutions like Bank of America believe that, given the labor market is showing signs of "low hiring, low turnover, and rising layoffs," the Federal Reserve may convey a "hawkish rate cut" signal, meaning a rate cut but suggesting the possibility of future policy tightening. This uncertainty has led to fluctuations in U.S. Treasury yields, while Goldman Sachs has warned of early signs of economic recession through indicators like Las Vegas consumer data.

In the commodity market, spot silver has performed remarkably, breaking through $60 per ounce for the first time, setting a historical high with an annual increase of over 100%, significantly outperforming gold, and the gold-silver ratio has dropped to its lowest since 2021. However, ARK Invest CEO Cathie Wood predicts that this trend may reverse, believing that the rise of gold as a safe-haven asset will retreat, while risk assets like Bitcoin will become active again. Meanwhile, tech giant SpaceX is planning the largest IPO in history, targeting a valuation of $1.5 trillion, with ARK predicting its value could reach $2.5 trillion by 2030, primarily driven by its Starlink business. Looking ahead, the market's dependence on macroeconomic data is increasing, and statements from Federal Reserve Chairman Powell will provide important guidance for policy direction in 2026.

Bitcoin's price recently rebounded to a three-week high of $94,625, triggering FOMO sentiment in the market, but analysts have differing views. Data from Santiment shows a surge in bullish sentiment on social media, but such peaks often serve as contrarian indicators. Investor "NoLimit" believes this rally is "pure manipulation," rather than organic market behavior. From a technical analysis perspective, several analysts have provided key price levels; Ali warns that Bitcoin historically faces downward pressure around the FOMC meeting, and while it may rebound to $100,000, there is still a risk of retracing to $80,000; AlphaBTC insists on a target of $97-98k but emphasizes the need to hold above $91.5k; Man of Bitcoin points out that the price has reached the upper trend line of an ascending wedge, and a breakout could challenge $96,962. Michaël van de Poppe further notes that Bitcoin's performance has diverged from the Nasdaq, indicating significant room for catch-up, with a potential return to the $110,000 to $115,000 range.

However, bearish voices also exist; analyst Astronomer has shorted at the $92.7k level, and historically, 6 out of 7 FOMC meetings have led to Bitcoin pullbacks. Standard Chartered has lowered its Bitcoin price forecast for 2025 from $200,000 to $100,000, citing a slowdown in ETF fund inflows. On the other hand, on-chain data provides a deeper perspective; Murphy's analysis using the BTC Profit Supply Percentage (PSIP) model indicates that PSIP has recently risen to 67.7% but is still fluctuating in the critical range of 65%-70%. If PSIP falls below 50%, a bear market bottom may emerge, with the current estimated corresponding price level at $62,000. Cathie Wood believes that the continued entry of institutions is reducing Bitcoin's volatility and may prevent its price from experiencing a historically significant crash.

Ethereum has shown relatively strong performance, with its price rebounding to a three-week high of nearly $3,400. According to analyst Mercury, Ethereum has broken through local resistance and reclaimed the high time frame trend line, becoming the "clear leader" in the current market. Analyst Man of Bitcoin points out that ETH has micro support at $3,201 and may continue to explore the $3,417 to $3,554 range. IncomeSharks views $3,500 as the "final hurdle" for Ethereum to confirm a bull market. Glassnode co-founder Negentropic believes that Ethereum is "quietly brewing" for the next breakout, having regained the 50-day moving average with momentum continuing to rise. Liquid Capital founder Yi Lihua also stated that under the macro backdrop of rate cut expectations and the trend of financial on-chain, Ethereum is significantly undervalued.

In the altcoin sector, the meme coin Pippin has emerged with a different market trend, reaching a historical high with a market cap exceeding $330 million and a daily increase of up to 90%. Additionally, the new token HumidiFi (WET) has performed well after being listed on multiple exchanges including OKX, with its price once breaking through $0.27, rising over 290% from its public sale price of $0.069.

2. Key Data (as of December 10, 13:00 HKT)

(Data source: GMGN, CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $92,591 (YTD -1.05%), daily spot trading volume $5.273 billion

Ethereum: $3,324 (YTD -0.2%), daily spot trading volume $3.431 billion

Fear and Greed Index: 25 (Fear)

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

Market share: BTC 58.46%, ETH 12.2%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, SOL, G

24-hour BTC long-short ratio: 50.79% / 49.21%

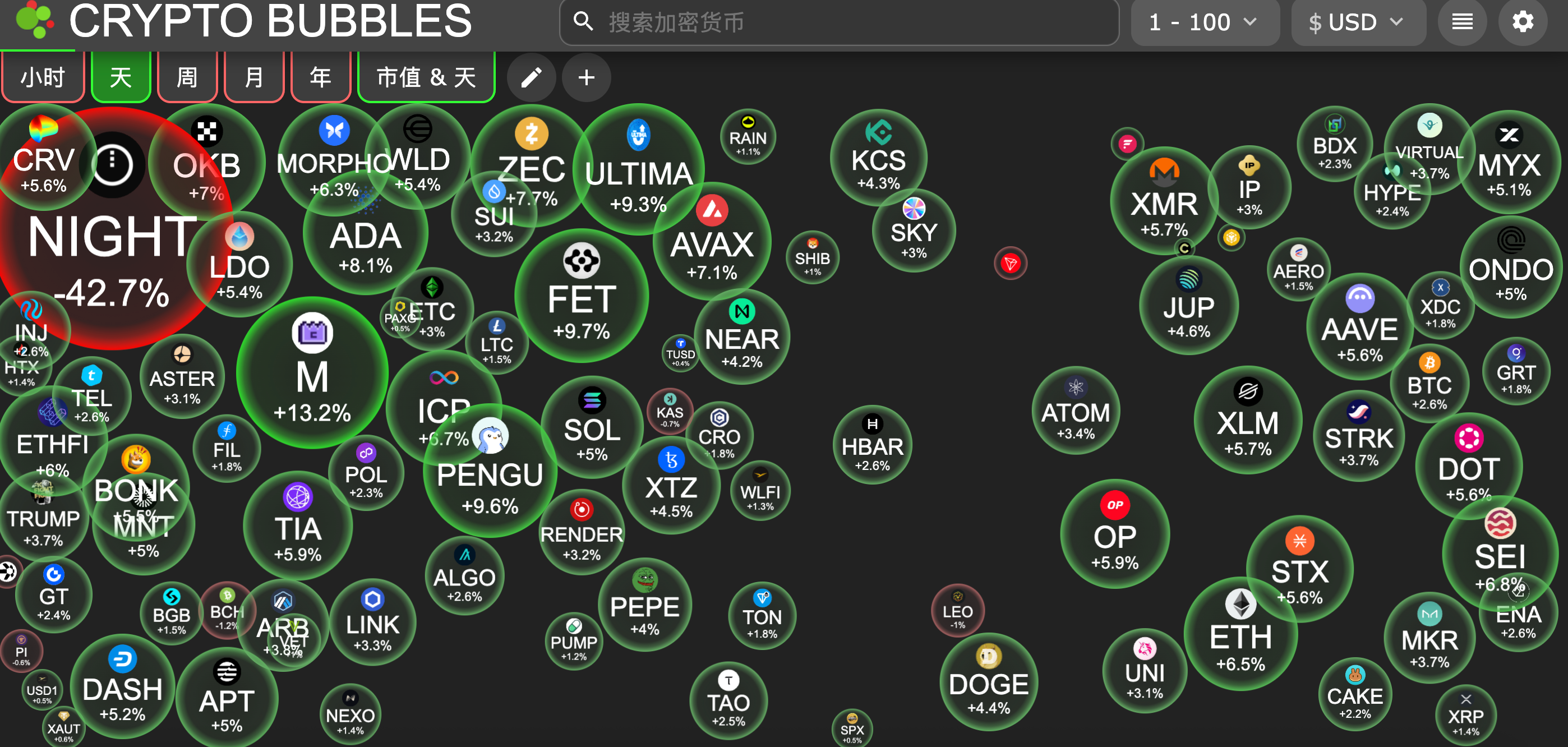

Sector performance: AI sector leads with over 5.9% increase, Meme sector up 5.3%

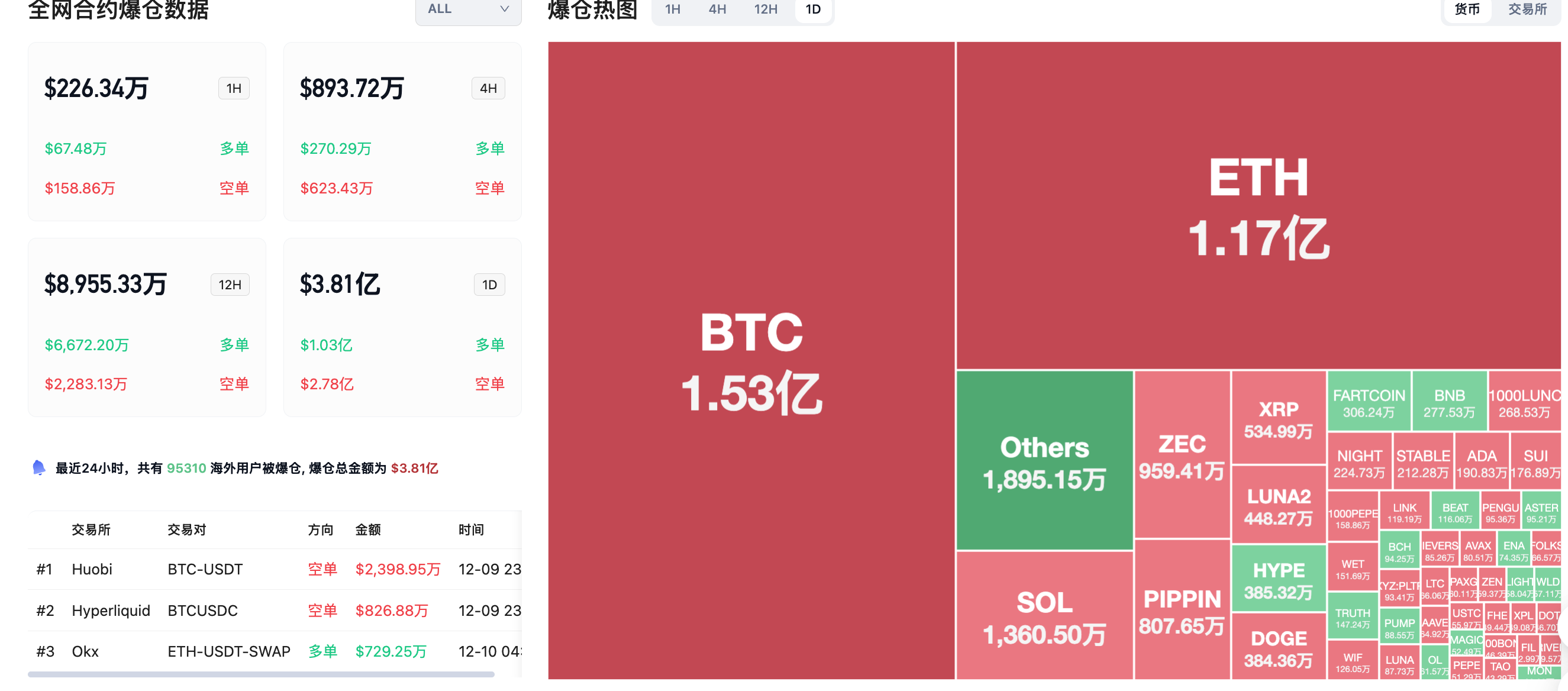

24-hour liquidation data: A total of 95,310 people were liquidated globally, with a total liquidation amount of $380 million, including $153 million in BTC, $117 million in ETH, and $13.6 million in SOL.

3. ETF Flows (as of December 9)

Bitcoin ETF: +$152 million, with Fidelity FBTC net inflow of $199 million leading

Ethereum ETF: +$178 million, with Fidelity FETH net inflow of $51.4727 million leading

Solana ETF: +$16.54 million

XRP ETF: +$8.73 million

4. Today's Outlook

Binance will delist multiple USDT perpetual contracts including SKATEUSDT and REIUSDT on December 10

U.S. District Court Judge Paul Engelmayer will sentence Do Kwon on December 11

U.S. Federal Reserve interest rate decision (upper limit) as of December 10: previous value 4%, expected value 3.75% (December 11, 03:00)

Federal Reserve Chairman Powell will hold a monetary policy press conference (December 11, 03:30)

Microsoft CEO Nadella will visit India from December 10 to 12 and meet with government officials

Today's top gainers among the top 100 cryptocurrencies by market cap: MemeCore up 13.2%, ASI Alliance up 9.7%, Pudgy Penguins up 9.6%, Ultima up 9.3%, Cardano up 8.1%.

5. Hot News

Bitcoin treasury company Twenty One's stock price dropped 20% after merging with Cantor Equity

Bitwise's top ten crypto index funds officially listed and began trading as ETFs on NYSE Arca

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。