The Divided Federal Reserve and a Potential "Hawkish" Rate Cut

Written by: ChandlerZ, Foresight News

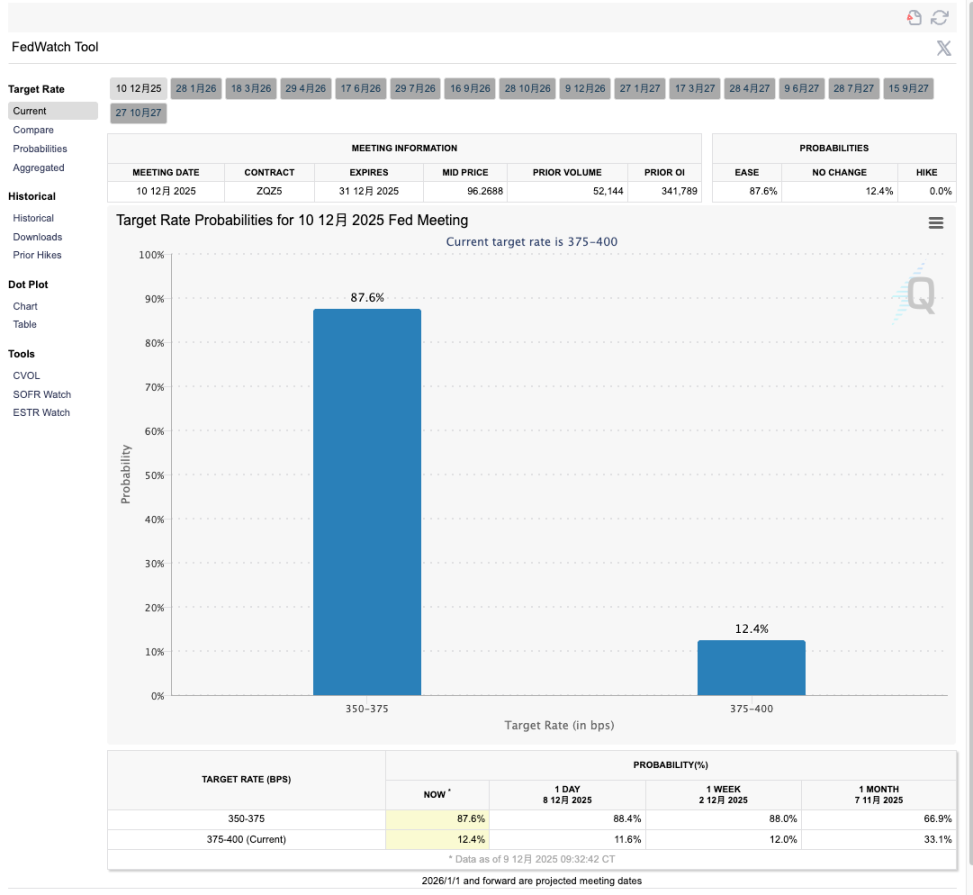

In the early hours of December 11, Beijing time, the Federal Reserve will announce its final interest rate decision of the year. The market has almost reached a consensus that the federal funds target range is likely to be lowered by another 25 basis points, from 3.75%–4.00% to 3.50%–3.75%, completing the third rate cut since September.

However, rather than waiting to see if there will be a rate cut, the market is more concerned about whether this will be a standard hawkish rate cut.

Behind this subtle sentiment is a highly divided Federal Open Market Committee (FOMC). Some members are worried that the job market has already shown signs of weakness in the context of a government shutdown and companies actively reducing their workforce, and that keeping interest rates high will only amplify the risk of recession. Meanwhile, other members are focused on core inflation, which remains above the 2% target, believing that current rates are already sufficiently restrictive and that prematurely shifting to easing will only lay greater price risks for the future.

Complicating matters is that this debate is occurring during a data vacuum. The U.S. government shutdown has delayed the release of some key macroeconomic data, leaving the FOMC to make decisions based on incomplete information, which has made policy communication for this meeting significantly more challenging than usual.

The Divided FOMC and the Reappearance of a Hawkish Rate Cut

If we view this interest rate meeting as a grand performance, then the hawkish rate cut in October serves as the prologue. At that time, the Federal Reserve lowered the federal funds rate target range by 25 basis points while announcing the official end of its three-year quantitative tightening process, halting further balance sheet reduction. From an operational perspective, this is a clearly dovish combination; a rate cut combined with the cessation of balance sheet reduction should, in theory, provide ongoing support for risk assets.

However, during that time, Powell repeatedly poured cold water on the situation during the press conference. He emphasized that whether there would be another rate cut in December was by no means a foregone conclusion and notably mentioned the strong dissent within the committee. The result was that rates did indeed decrease, and the Federal Reserve signaled a marginal easing of monetary conditions, but the dollar and U.S. Treasury yields rose sharply, while the stock market and crypto assets quickly retraced their gains after a brief surge.

New York Fed President Williams clearly stated in late November that there is still room for further adjustments to the federal funds rate target range in the short term, which was seen as a public endorsement of this rate cut. In contrast, several officials, including those from the Boston Fed and Kansas City Fed, have repeatedly reminded that current inflation remains above the 2% target and that service prices exhibit significant stickiness, indicating that there is no strong necessity to continue easing in this environment. In their view, even if there is another cut this time, it would be more like a minor adjustment to previous policies rather than the start of a new easing cycle.

Predictions from external institutions also reflect this dilemma. Investment banks like Goldman Sachs generally expect that this meeting's dot plot will slightly raise the rate cut path beyond 2026, meaning that while acknowledging current pressures on economic growth and employment, they will still deliberately signal to the market not to interpret this rate cut as a return to a continuous easing mode.

Three Paths: How Bitcoin Prices in the Macroeconomic Gaps

On the eve of the interest rate decision, Bitcoin finds itself in a rather delicate position. After peaking in October, the price has experienced a roughly 30% pullback and is currently oscillating above $90,000; meanwhile, net inflows into ETFs have significantly slowed compared to the early-year peak, and some institutions have begun to lower their medium- to long-term target prices, with concerns about the high risk-free interest rate slowly permeating pricing models. The signals from this interest rate decision are likely to push the market toward three completely different trajectories.

The first is the most probable baseline scenario: rates are expected to be cut by another 25 basis points, but the dot plot depicts a slightly conservative outlook for rate cuts in 2026 and beyond, with Powell continuing to emphasize that there is no preset path for consecutive rate cuts, and everything will depend on the data. In this combination, the market still has reason to buy into the rate cut itself in the short term, and Bitcoin may attempt to challenge the resistance zone near its previous high that night. However, as U.S. Treasury yields stabilize or even slightly rise, real interest rates may increase, and the sustainability of sentiment recovery will be tested, with prices more likely to oscillate at high levels rather than trend upward in a single wave.

The second is a relatively dovish but less probable surprise scenario: in addition to the rate cut, the dot plot significantly lowers the mid-term interest rate center, suggesting that there is still room for more than two rate cuts in 2026, and the post-meeting statement positions the end of balance sheet reduction closer to reserve management-style purchases, with a clearer commitment to maintaining ample reserves. This scenario essentially represents another rate cut + a turnaround in liquidity expectations, which would constitute a substantial benefit for all long-duration assets.

For the crypto market, as long as Bitcoin can stabilize around $90,000, it has the opportunity to challenge the psychological barrier of $100,000 again, while on-chain assets represented by ETH and mainstream DeFi and L2 protocols may yield significant excess returns driven by the return of on-chain liquidity.

The third is an unexpected scenario that would significantly suppress market risk appetite: the Federal Reserve chooses to remain on hold, or although it cuts rates, it significantly raises long-term rates through the dot plot and compresses the number of future rate cuts, signaling to the market that the cuts in October and December were merely precautionary adjustments, and that maintaining high rates for a longer period remains the main theme. In this combination, the dollar and U.S. Treasury yields are likely to strengthen, and all cash flow-dependent assets will come under pressure.

Given that Bitcoin has already experienced a significant pullback, ETF funding is marginally slowing, and some institutions are beginning to adjust their expectations, combined with the negative macro narrative, it is technically possible for Bitcoin to seek new support downward. Among altcoins, high-leverage and purely narrative-driven sectors are more likely to become targets for liquidation in this environment.

For participants in the crypto market, this interest rate decision night feels more like an options expiration day on a macro level.

In both the U.S. stock market and Bitcoin's history, the movements on most FOMC decision nights exhibit a similar rhythm. The hour following the announcement is the most concentrated battlefield for sentiment, algorithms, and liquidity, with K-line charts experiencing sharp fluctuations, but directional signals are unstable; the real trend often only becomes apparent after the press conference ends and investors have read through the dot plot and economic forecasts, gradually revealing itself in the following 12–24 hours.

The interest rate decision determines the current rhythm, while the direction of liquidity is likely to determine the second half of this cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。