In November 2025, the U.S. cryptocurrency market witnessed a historic moment—after nearly two years of successful operation of Bitcoin and Ethereum spot ETFs, the first wave of altcoin ETFs was finally approved for listing.

Four altcoin ETFs—Litecoin, XRP, Solana, and Dogecoin—showed starkly different fates. Together, XRP and Solana attracted over $1.3 billion in institutional funds, becoming the absolute winners in the market; meanwhile, Litecoin and Dogecoin faced complete neglect, with combined inflows of less than $8 million.

This report conducts a horizontal comparison of the performance of the four major altcoin ETFs, deeply analyzing their impact on the market and predicting how subsequent ETFs will influence market trends.

Part One: The Divergent Fates of the Four ETFs

XRP: The Biggest Winner Among Altcoin ETFs

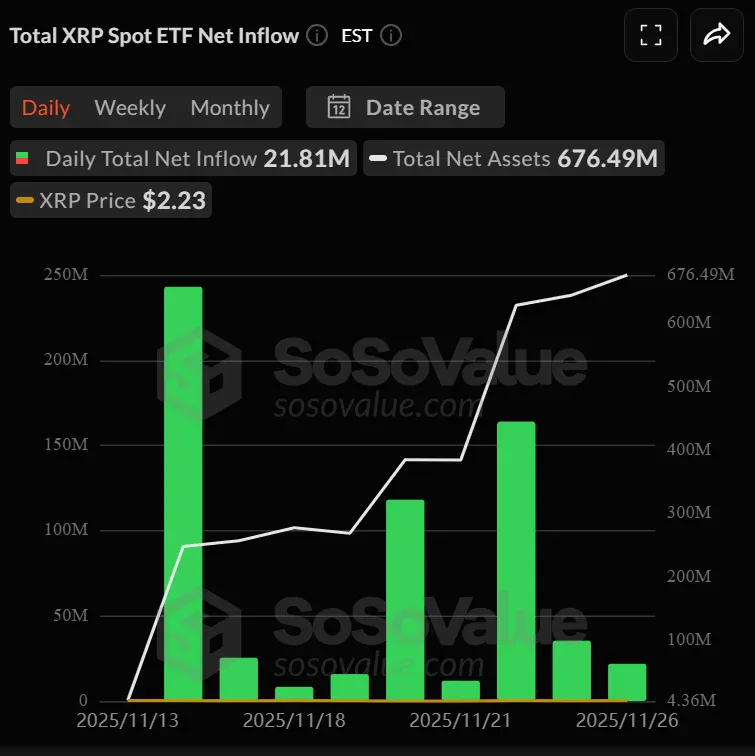

XRP was undoubtedly the winner in November. As of November 27, the total assets of six XRP ETFs reached $676 million, maintaining a record of zero outflow days since their launch. On November 13, Canary Capital's XRPC debut created a net inflow of $245 million, marking the strongest ETF debut of 2025. This was followed by daily inflows of $15-25 million, and on November 24, when Grayscale and Franklin Templeton joined, an additional $164 million was added. More critically, in a market filled with despair in November, XRP's price rose from $2.08 to $2.23, an increase of 7.2%, making it the only altcoin to achieve positive growth.

The success of XRP can be attributed to three factors:

- Regulatory clarity is key: In August 2025, Ripple settled with the SEC for only $125 million, based on Judge Torres's ruling that "XRP is not a security in the secondary market," providing institutional investors with reassurance.

- Practical narrative provides support: RippleNet collaborates with over 200 financial institutions, allowing institutions to discuss "financial infrastructure investment" rather than speculative stories.

- Fee competition creates an advantage: Franklin's XRPZ is completely free for the first $5 billion until May 2026, directly targeting Grayscale's 0.35% fee.

The ETF acts more like an amplifier, converting these favorable conditions into actual institutional fund inflows.

Solana: $600 Million Inflow but a 29% Plunge

The total assets of Solana's six ETFs reached $918 million, with a cumulative net inflow of $613 million, comparable to XRP. However, the price plummeted from $195-205 to $142.92, a decline of 29.2%.

Systemic risks rendered ETF inflows powerless. On November 21, Bitcoin crashed from $126,000 to $80,000, triggering $90 billion in on-chain liquidations, with Solana, as a high-risk altcoin, bearing the brunt. Daily ETF buying of $20-30 million was merely a drop in the bucket before the sell-off. A deeper issue lies in the ETF arbitrage mechanism: market makers sell SOL in the spot market when hedging, which exacerbates the decline during downturns.

However, Solana has a unique advantage: staking rewards. All Solana ETFs offer an annualized return of 6-8% from day one, with BSOL netting about 7% after a 0.20% management fee—this is a "money-making ETF," capable of attracting institutions even amid price crashes.

Litecoin and Dogecoin: Abandoned by the Market

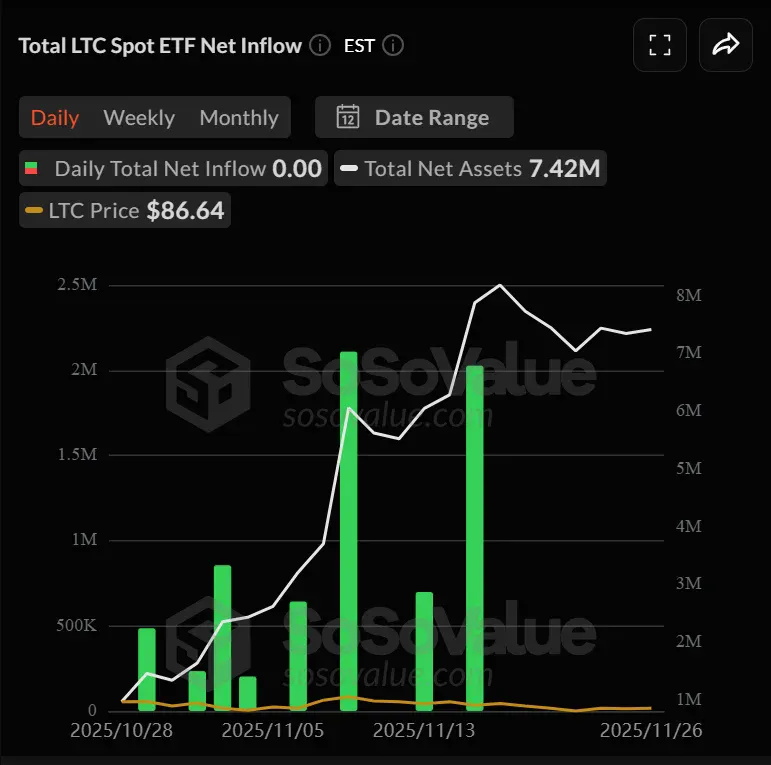

Once regarded as "digital silver," Litecoin has been abandoned by the market. LTCC's total assets are only $7.42 million, less than 3% of XRP's first-day total, with a 24-hour trading volume of just 267K. The main reasons for LTC's lack of appeal are the absence of a compelling narrative ("faster Bitcoin" is outdated), fee disadvantages (0.95% is 2-3 times that of BTC ETFs), and liquidity traps (low AUM leads to wider spreads, driving institutions away).

Once regarded as "digital silver," Litecoin has been abandoned by the market. LTCC's total assets are only $7.42 million, less than 3% of XRP's first-day total, with a 24-hour trading volume of just 267K. The main reasons for LTC's lack of appeal are the absence of a compelling narrative ("faster Bitcoin" is outdated), fee disadvantages (0.95% is 2-3 times that of BTC ETFs), and liquidity traps (low AUM leads to wider spreads, driving institutions away).

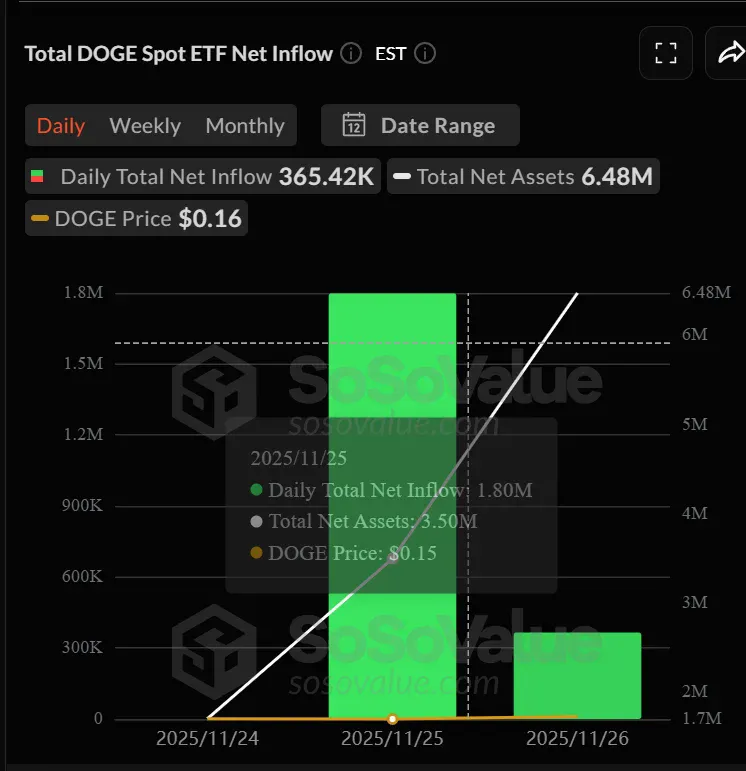

Dogecoin fared even worse. The total assets of three ETFs are $6.48 million, with a net inflow of $2.2 million. Grayscale's GDOG had a mere $1.4 million in trading volume on its first day. The meme coin fundamentally conflicts with institutional demand: a 3.3% annual inflation permanently dilutes supply, with no supply cap/smart contracts/DeFi, and institutions cannot simply buy because "Elon likes it," compounded by whale sell-offs from September to November that further exacerbated market pessimism.

Part Two: Born in the Storm

The Disappointing November for Bitcoin and Ethereum ETFs

To understand the performance of altcoin ETFs, we must view them in a broader market context. November 2025 was the worst month for Bitcoin and Ethereum ETFs since their launch in January 2024. Eleven Bitcoin spot ETFs saw a cumulative net outflow of $3.5-3.79 billion in November, but more alarming was the persistence of these outflows: in 20 trading days in November, there were net outflows on 16 days, accounting for 80%.

On November 21, the day Bitcoin crashed to $80,000, the single-day outflow reached $903 million, marking the second-largest single-day outflow in Bitcoin ETF history. BlackRock's IBIT, the largest and most favored Bitcoin ETF among institutions, was not spared. This product, once seen as a "perpetual motion machine," experienced an outflow of $2.2 billion in November, setting its worst monthly record since launch. The situation for Ethereum ETFs was equally grim, with nine Ethereum spot ETFs seeing a cumulative outflow of about $500 million in November.

Combined, Bitcoin and Ethereum ETFs saw total outflows exceeding $4 billion in November. This figure reflects the collapse of institutional investor confidence in the cryptocurrency market. As Bitcoin plummeted from $126,000 to $80,000, hedge funds, family offices, and other institutions chose to cut losses and exit, while the convenient redemption mechanism offered by ETFs accelerated this process.

Two Parallel Worlds

Amidst this wreckage, altcoin ETFs attracted $1.3 billion in inflows. This contrast seems contradictory but actually reflects the existence of two parallel worlds.

1: The Retreat of Traditional Financial Institutions. The $4 billion outflow from Bitcoin and Ethereum ETFs primarily came from traditional financial institutions. These institutions entered the market in droves when the BTC ETF launched in early 2024, when Bitcoin was priced at $40,000-$50,000. By November, when Bitcoin reached $126,000, many institutions had enjoyed paper gains of 200-250%. The crash triggered their risk control mechanisms—when drawdowns exceed 20-30%, they must forcibly reduce positions. These institutions completely exit the crypto space during tightening risk, rather than shifting to other crypto assets.

2: The Entry of Crypto-Native Institutions. The $1.3 billion inflow into altcoin ETFs likely came from a completely different group of investors. Crypto-native hedge funds, venture capital firms, and high-net-worth crypto believers have a higher tolerance for market volatility. For them, the November crash was not a signal to retreat but an opportunity window to allocate new products. More importantly, the altcoin ETFs had only been listed for 2-3 weeks, and many institutions had set their initial allocation orders months before the launch, which would not be canceled due to short-term fluctuations.

This market stratification explains a key phenomenon: why on the day of the crash on November 21, the Bitcoin ETF saw a single-day outflow of $903 million, while the Solana ETF still maintained a positive inflow of about $12 million? Because the holders of the two ETFs are different investor groups, with completely different risk preferences, investment goals, and decision-making mechanisms.

The Boundaries of the New Product Effect

This is not a case of "capital rotating from Bitcoin to altcoins," but more about the "new product effect"—investors' initial allocations to new ETFs, market makers' demand for building positions, and retail funds driven by media hype are all natural phenomena accompanying the launch of new products.

The new product effect has its temporal boundaries. The Solana ETF saw its first outflow on November 26, breaking the record of 21 consecutive inflow days. This turning point is significant—it marks the end of the "new product honeymoon period" and the beginning of "real market testing." Once initial allocation orders are completed, market makers finish building positions, and media hype fades, ETFs must rely on the fundamentals of the assets themselves to attract funds.

This is also why Litecoin and Dogecoin performed so poorly. They also enjoyed the "new product" label, but even during the honeymoon period, they attracted less than $8 million in inflows. This indicates that the new product effect has its limits—assets without a strong narrative and practical value cannot attract sufficient funds, even when packaged as ETFs.

Conclusion: Opportunities and Challenges of the Era

The listing of altcoin ETFs in November 2025 marks a new phase in the cryptocurrency market. This is not just the launch of a few new products, but a fundamental shift in the entire market structure and participant composition. Institutional investors now have compliant and convenient tools to allocate to altcoins, and the bridge between traditional finance and cryptocurrency is being rapidly established.

In the ETF era, "recognition" and "historical status" are no longer sufficient conditions for attracting funds. Only those assets with strong practical narratives, clear regulatory status, and active ecosystems can truly benefit from ETFization.

By mid-2026, the U.S. market may have 200-250 cryptocurrency ETFs trading. However, this does not mean that all ETFs will succeed. As seen with Litecoin and Dogecoin, assets without strong narratives and practical value will struggle.

The ETF market will undergo a process of elimination. The top 5-10 products will capture the vast majority of market share, enjoying economies of scale and network effects. The middle tier will consist of 20-30 products that manage to survive, barely maintaining operations. However, a large number of tail products will be liquidated after struggling for a year or two. This process may be painful but is necessary—only through market competition can truly valuable assets be identified.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。