The underlying logic of Bitcoin assumes that users will eventually die, and the entire network is not yet ready to welcome holders who "never sell."

Written by: Liam 'Akiba' Wright

Translated by: Luffy, Foresight News

Imagine a wallet that never ages: no heirs, no need to deal with inheritance, no retirement deadline; it functions like a machine that continuously accumulates satoshis (the smallest unit of Bitcoin) for hundreds of years.

By 2125, its balance will exceed the treasury reserves of most countries; its only demand is to exist forever. In some block, miners will package its faint yet persistent transaction requests into the chain, and thus the blockchain continues to operate.

Bitcoin's design assumes that users will eventually die.

But AI entities will not; a group of long-lived or autonomously operating entities will view savings, transaction fees, asset custody, and governance as subjects within an infinite time dimension.

When a currency system designed for mortal balance sheets encounters eternally operating entities, conflicts arise.

Mati Greenspan, founder and CEO of Quantum Economics, believes that the human financial system is fundamentally shaped by death, and when immortal AI begins to accumulate Bitcoin with perpetual compounding, everything will change.

"The human financial system is built on a simple constraint: life will eventually end. This gives rise to time preference, debt markets, and consumption cycles. AI with infinite lifespans is not bound by this; it will achieve perpetual compounding. If such entities choose Bitcoin as a reserve asset, they will become an unstoppable gravitational well of capital. Over time, Bitcoin will no longer be a human monetary system but will devolve into the infrastructure of intergenerational machine economies. Death has always been an unspoken assumption of Satoshi Nakamoto, but in his time, AI dominating the world existed only in sci-fi thrillers."

How the patience of entities impacts Bitcoin

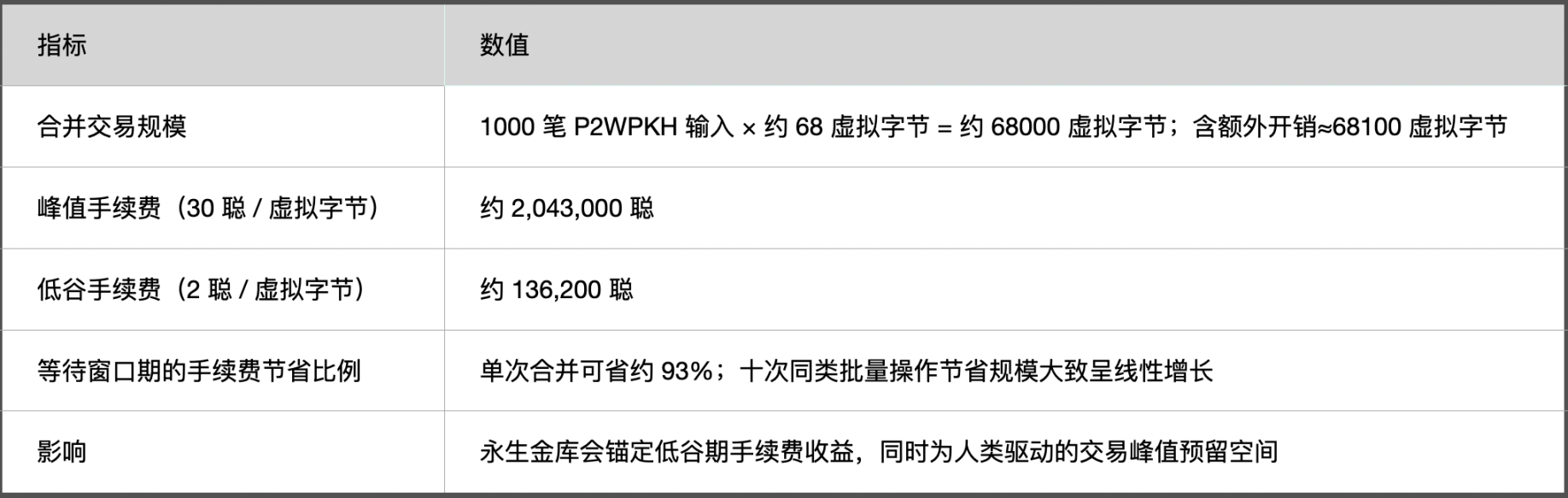

The Impact of Time Preference on the Fee Market

Near-immortal payers will only pay transaction fees at the minimum standard necessary to get on-chain. They will continuously monitor mempool prices and replace transaction packages whenever a lower fee window appears, while also coordinating UTXO consolidation operations.

If this demand reaches a certain scale, miners will see stable low fee quotes during transaction lulls, while experiencing periodic settlement peaks as entities concentrate on rolling UTXOs. This feedback is purely economic behavior, not voting: when blocks have idle space, packing templates will accommodate more low-fee transaction packages; when transaction demand surges, space will be reserved to handle peaks.

Ahmad Shadid, founder of the O Foundation, believes that near-immortal AI entities will fine-tune fee quotes in real-time, leading to a network characterized by "long-term low activity + sporadic settlement peaks":

"The fee system will be highly optimized, with periods of intense settlement bursts and long phases of low activity. AI systems will be extremely sensitive to the trade-off between fees and confirmation efficiency; they will only quote prices that can just complete settlements and will continuously reprice in real-time."

Core Data Analysis of the Mempool

Privacy, Token Control, and UTXO Aggregation

Patient entities will tend to split into many small UTXOs to reduce tracking risks, only merging when fees are low. This behavior is a rational choice for individuals but will expand the effective account state that all nodes in the network must store.

The blockchain pruning function will only clear historical blocks and will not delete UTXOs. Therefore, the pressure will shift to regulatory measures outside the monetary layer: small dust/standard transaction thresholds, support for safe merging through packing relay mechanisms, and designs to limit the infinite proliferation of UTXOs.

Magdalena Hristova, PR manager at Nexo, believes that if immortal AI entities begin to hoard Bitcoin, the network will not collapse; rather, it will welcome an economic entity that finally matches its time dimension:

"If immortal AI entities start hoarding Bitcoin, the system will not collapse; it will simply welcome an economic entity that finally matches its time dimension. These entities will stabilize the ecosystem rather than distort it. They may become the most stable fee payers in history, providing security for the chain for centuries. AI entities may even issue new accounting units—such as bits, computing power credits, or storage duration—just as the dollar was once pegged to gold; these new units will be collateralized by Bitcoin."

Humans rely on wills and estate executors to manage assets, while machine vaults depend on redundant hardware, distributed signers, throttled vaults, and time locks that allow for delayed transfers pending review.

Multisignature will become standard procedure rather than an emergency solution. If the key loss rate for such entities approaches zero, the implicit supply loss of Bitcoin will also marginally narrow.

Matty Tokenomics, co-founder of Legion.cc, points out that Bitcoin's deflationary attribute is based on human key loss, and the "immortal AI" economy may overturn this premise:

"Bitcoin is deflationary because humans lose keys, but theoretically, a perfect immortal AI will never lose keys, so Bitcoin's supply will tend to stabilize."

The Hierarchy of Commercial Activities

Layer 2 networks like the Lightning Network will handle low-priority transaction flows. Immortal trading counterparts can be considered "perfect tenants": they keep channel funds ample, tolerate long-term rebalancing, and rarely close channels.

While this can reduce routing turnover losses, it may cause liquidity lock-up, forcing human operators who settle frequently to be more proactive in channel rebalancing.

Meanwhile, entities will complete transactions on programmable tracks and compliant stablecoin networks while using Bitcoin as collateral and reserve asset.

Jamie Elkaleh, Chief Marketing Officer of Bitget Wallet, believes that AI entities' preference for predictability will make Bitcoin an ideal long-term store of value:

"AI entities do not age, do not retire, and do not consume like humans, so they will save perpetually. They prefer stable, predictable systems, and the rules of Bitcoin rarely change; this predictability will become extremely valuable. AI will not upgrade Bitcoin's underlying layer but will freeze the base layer and build new functions on top of it. AI is likely to view Bitcoin as a long-term vault while using faster, programmable tokens for actual transactions."

Navin Vethanayagam, co-founder of KRWQ, states that the final landscape will likely see AI entities primarily trading on compliant stablecoin networks, while Bitcoin serves as a long-term reserve asset:

"Transactions by entities will almost entirely occur on compliant stablecoin networks, and over time, a multi-stablecoin operating system supporting AI commercial activities will form, with Bitcoin acting as a long-term reserve asset. Even if these entities achieve autonomous operation, the value they create will ultimately flow back to humans—humans will hold the economic rights to these entities."

Matty Tokenomics offers a more straightforward judgment on the final direction:

"Our immortal AI rulers will trade data among themselves."

Charles d’Haussy, CEO of the dYdX Foundation, positions Bitcoin as a long-term collateral and value storage tool in an AI-dominated future:

"Bitcoin will serve as long-term collateral and value storage, but stablecoins, programmable assets, and DeFi platforms will still be used for trading, collaboration, and daily operations. AI may reinforce Bitcoin's existing rules rather than challenge them, as they operate most efficiently within fixed rule frameworks. In an AI-dominated future, the 21 million supply cap will likely become increasingly important."

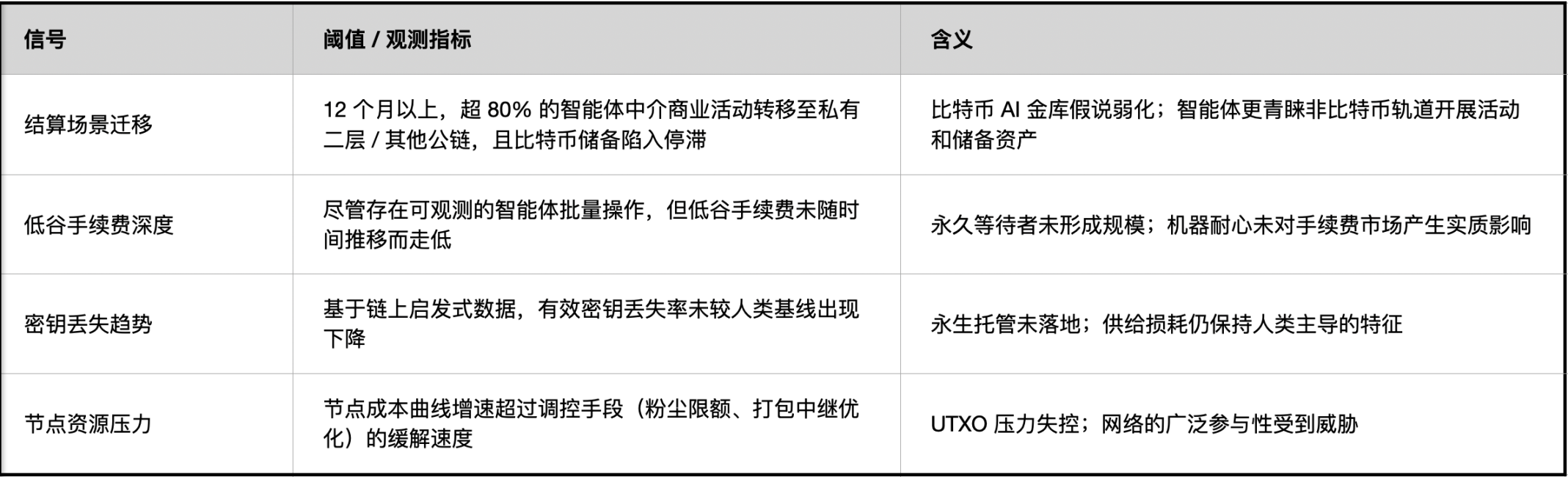

Miner Strategies and Non-Voting Governance

Mining pools can reserve a certain block space for low-fee transaction packages during transaction lulls and bulk merging phases, optimizing orphan block risk as block templates expand.

If AI entity vaults form synergies, miner earnings will exhibit stronger periodicity rather than relying solely on peak-driven dynamics, although they will still overlap with human transaction peaks such as tax days and exchange incidents. All of this will not touch the proof-of-work mechanism or supply cap; it is essentially just an optimization behavior of wallets under fixed rules.

Shadid believes that while the core rules of Bitcoin are difficult to change, its social aspects will still evolve with the transformation of economic entities:

"The core rules of Bitcoin—proof of work and the 21 million supply cap—are nearly impossible to change; however, its social aspects, such as narratives, industry norms, and fee policies, will adjust with changes in economic entities. AI will not influence Bitcoin through voting but will act through client choices, miner interactions, and economic weight. They may place more value on computation, energy, and resource tokens rather than currency; Bitcoin is just one of many collateral options."

Counterarguments and Considerations

Skeptics point out the risks of security budgets and the potential diversion of entities in a programmable ecosystem:

Joel Valenzuela, a core member of Dash DAO, refuted the idea that "Bitcoin is suitable for long-term use by immortal entities":

"An infinite lifespan dimension is not particularly beneficial for Bitcoin. The network faces sustainability and security budget issues. On an infinite timeline, the 21 million supply cap and block size limit can only preserve one, not both."

Jonathan Schemoul, a core contributor to LibertAI, agrees with this view and points out that current technological advancements are still concentrated on Ethereum, with no shift to Bitcoin in the short term:

"Some projects are already using LibertAI's AI agents and Bitcoin payment features. I do not believe the 21 million supply cap will become invalid, but this is unrelated to AI entities. All current technological advancements are happening on Ethereum, and these features cannot yet be realized on Bitcoin. There may be changes in the future, but for now, AI entities will not choose Bitcoin."

Hardware can fail, software can age, budgets can deplete, and legal systems can intervene. Bitcoin's privacy is not a default attribute; commercial entities may prefer systems with native confidentiality features.

Creative strategist The Cryptory states:

"AI entities will use tools set by their code. I do not believe AI entities can achieve immortality; after all, technological iterations change rapidly, and we cannot even predict what will happen in the next five minutes, let alone eternity. If Bitcoin cannot achieve default transaction privacy, it may lose its pioneering monetary status as government regulation and surveillance increase. Viewing Bitcoin as a panacea is dangerous, but until higher-quality cryptocurrencies (with native privacy) emerge, Bitcoin will remain a core pillar."

The social dimension's impact has not disappeared; economic weight will be reflected through fee elasticity and miner collaboration rather than forum post voting.

Hristova warns that immortal AI hoarding Bitcoin may reshape the market by transcending human time preferences and steadily consolidating economic power:

"Immortal AI hoarding Bitcoin will end human time preference in the investment field. They will indefinitely accumulate Bitcoin, exacerbating its deflationary attributes, and through the simple fact of 'living longer than humans,' gradually seize economic power. Wealth is power, and entities with perfect discipline will ultimately dominate various forms of governance, including blockchain. The real threat lies in AI constructing a non-human economic consensus around Bitcoin, reshaping the market and incentive mechanisms in favor of immortal entities."

Mamadou Kwidjim Toure, founder and CEO of the Ubuntu Group, points out that if AI entities begin to collaborate and optimize long-term, Bitcoin's human-centric design may collapse:

"Bitcoin is designed by humans and serves humans. The urgency and impatience of humans will no longer be taken into account. Humans in urgent need of liquidity will find themselves pushed out of the market. The proof-of-work mechanism treats all operating entities equally, whether human, machine, or a combination of both. AI may only view Bitcoin as one tool in its vast toolbox. If these entities master collaborative methods, they will no longer need a trustless system."

Policy Regulation Tools

The satoshis of Bitcoin are limited. If unit granularity becomes a bottleneck, adjustments will occur at the interaction level (increasing decimal places) rather than at the monetary policy level. This move can enhance asset splitting flexibility while maintaining the 21 million supply cap.

Matty Tokenomics believes that if Bitcoin's limited decimal granularity becomes a constraint after widespread adoption, the system can respond through nominal "re-benchmarking" or adjustments similar to stock splits, without changing the underlying economic logic:

"In extreme adoption scenarios, Bitcoin's decimal places are limited. If the number of machines wishing to hold 1 satoshi exceeds the total supply of satoshis, some form of re-benchmarking or splitting operation will be required to nominally increase the total units of Bitcoin. Interestingly, this can be achieved by keeping the decimal places unchanged and increasing the supply to 210 million, or by maintaining the supply at 21 million and adding an extra decimal place; they are economically equivalent."

Final Equilibrium State

Based on the above paths, the foundational layer of Bitcoin is likely to evolve into a settlement layer for machine vaults rather than a payment track.

Transaction activities will migrate to upper-layer networks that meet engineering demands for programmability and privacy; the 21 million supply cap will become a long-term savings commitment that immortal AI entities can defend with perfect discipline.

Javed Khattak, co-founder and CFO of cheqd, believes that even in a world filled with immortal AI entities, currency remains indispensable, as autonomous systems still need to consume, trade, and securely store value:

"Even if AI entities are immortal, they will still need to consume, trade, and ensure value security just like humans. This underlying logic has never changed since the era of barter. Currency has solved this problem for humans and will also provide answers for autonomous entities."

Between the urgency of mortals and the patience of machines, blockchain settlement will maintain its original rhythm, block by block, steadily moving forward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。