Author: Kev.Ξth, Crypto Researcher

Compiled by: Felix, PANews

The following 10 summaries are based on Vitalik's interpretation of public goods funding (PGF) in 2026 and a recent survey based on public data and user-reported data.

Possible development directions for the reformed PGF field:

- Traditional funding still accounts for a significant proportion, but innovative on-chain PGF mechanisms are beginning to take shape.

- Verifiable mechanisms replace unverifiable concepts: on-chain PGF has shifted from a charitable model to a verifiable, liquid, and dependency-driven funding model.

- Privacy and open source take priority: focus on public goods that are crucial for the survival of Ethereum.

- Funding for dependencies: systems like Deep Funding allocate funds based on real upstream influence rather than popularity.

- Sustainable revenue streams: fees from sorters, open-source licensing models, and revenue-based PGF (like Octant) create ongoing funding support rather than relying on the emergence of donors.

- AI + ZK become coordination technologies: AI assesses vast dependency graphs, while ZK ensures privacy-preserving, anti-manipulation governance.

- Alliance-style funding: L2s, application chains, and protocols fund their own ecosystems, forming alliances if they have dependencies—creating a network of numerous PGF funding sources rather than relying on a single large funding pool.

- Diversification is an advantage: multiple PGF funding innovators (such as Gitcoin, OP, ARB, CLRFund, Giveth Drips, Octant, Nouns, etc.) can enhance anti-fragility, promote innovation, and reduce the risk of monopolization.

1. Current Sources of Funding

a. Majorly from Traditional Grants (Reliable Traditional Channels)

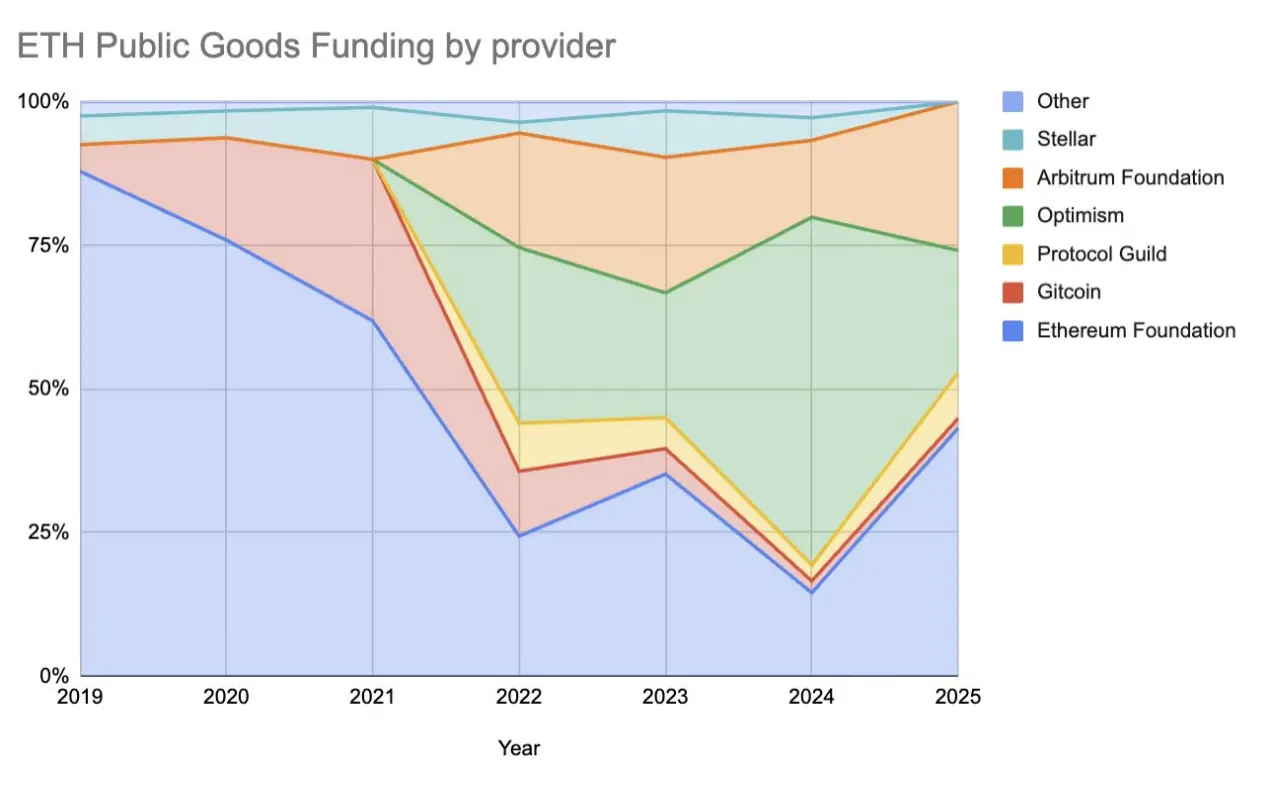

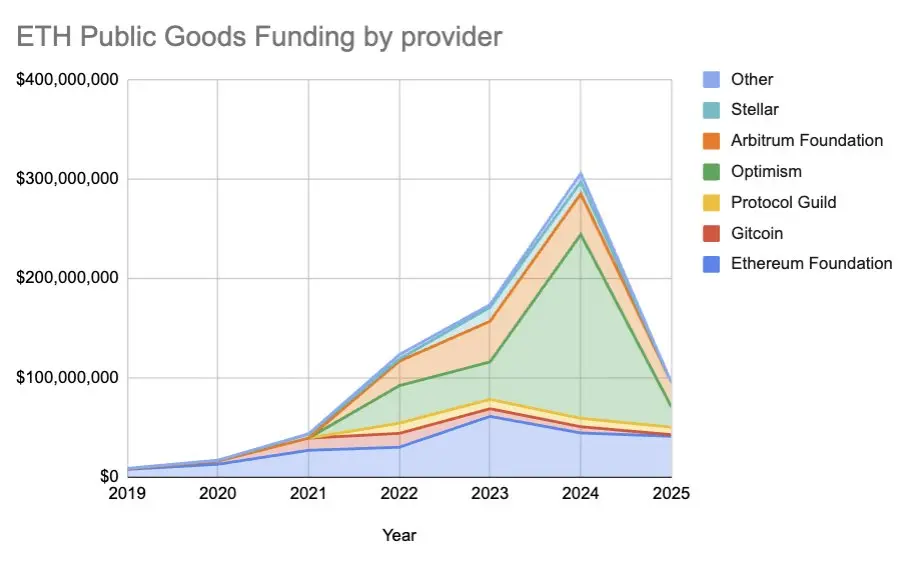

Currently, the vast majority of funding for Ethereum public goods still comes from traditional funding programs of L1 and L2, such as the Ethereum Foundation, Stellar, Optimism, Arbitrum, etc.

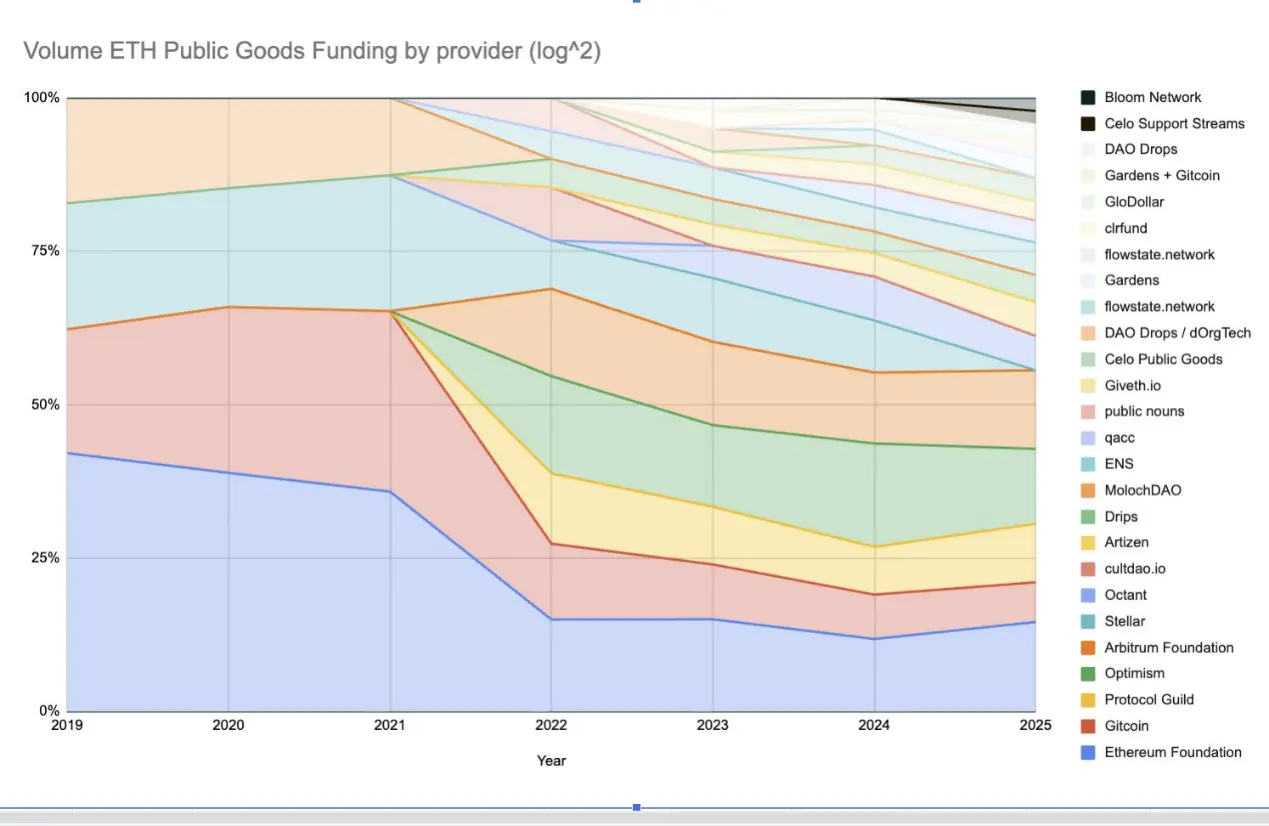

(Distribution area chart of various funders in USD—percentage form)

(Distribution area chart of various funders in USD—absolute value form)

b. Innovative Long-Tail Effect

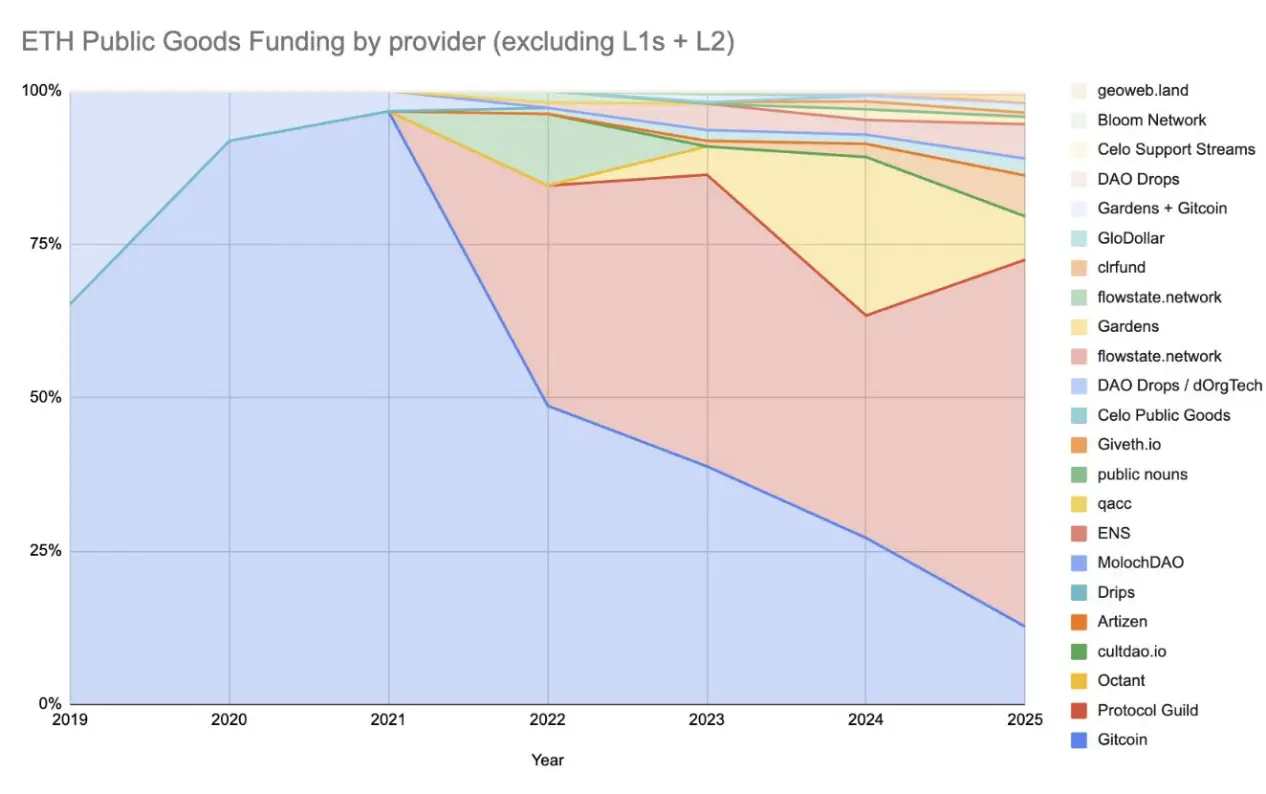

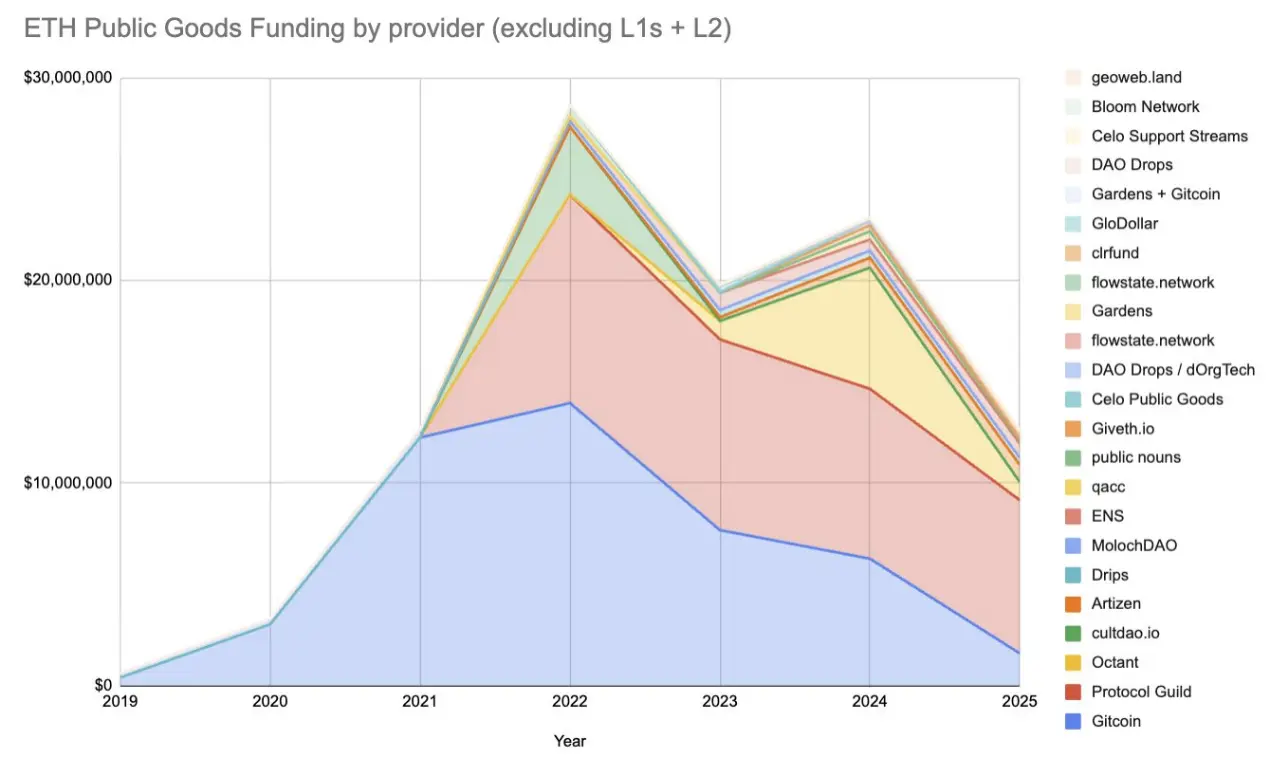

Gitcoin and MolochDAO were the earliest exceptions to break the L1/L2 traditional funding monopoly from 2019 to 2021—they independently raised and distributed funds that accounted for only a single-digit percentage of the total ecosystem at that time.

In 2022, Protocol Guild emerged and quickly became a major funding pillar.

Since then, a series of experiments and innovations have formed a relatively long cycle.

(Distribution area chart of non-L1/L2 funders in USD—percentage form)

(Distribution area chart of non-L1/L2 funders in USD—absolute value form)

2. Diversification is a Feature, Not a Flaw

In the early development of Ethereum, the Ethereum Foundation was the main funder of public goods.

From 2019 to 2021, Gitcoin and MolochDAO provided new on-chain funding methods for Ethereum public goods.

2021 saw an explosion of innovation: Protocol Guild, Optimism, Arbitrum, Drips, Octant, DAO Drops, CLR.Fund, Public Nouns, CultDAO, etc.

(Logarithmic area chart of fund distribution among various funders)

By 2025, the diversification of public goods funding sources seems to have become the norm. This is a good thing, equivalent to the diversity of clients for public goods funding.

Benefits include:

- Reducing the risk of control

- Expanding the audience for excellent ideas, accelerating innovation

- Creating redundancy

- Preventing any single funder from becoming a "kingmaker"

- Allowing builders to bypass dysfunctional systems

- Highly aligned with Ethereum's philosophy

3. The "Vibes Era" is Completely Over

PGF in 2021 tended to favor "regen vibes," with frequent fund flows and mutual donations.

After a round of stagnant ETH prices, industry-wide tightening, and the decline of vibe-based funding, the wind has completely changed.

The future belongs to verifiable, precise, structural funding derived from income or revenue.

The reformed PGF field focuses on:

- Proof of impact, not vibes

- Precise funding criteria, not "funding everything"

- Mechanisms that can survive in a chaotic and adversarial world

- Focus on the core infrastructure that Ethereum's survival depends on

- Sustainable funding sources, such as income or revenue

The quadratic funding era of 2021 assumed a more universal and abundant altruism.

PGF in 2026 defaults to a chaotic, fragmented world and builds credibility from the ground up at the structural level.

The biggest unlock of reformed PGF: shifting from "praying for donors to appear" to structural, sustainable funding flows.

Here are some possible development directions:

4. Structured, Sustainable Revenue Streams

To scale PGF, it is essential to connect revenue centers and cost centers. Currently, the revenue sources for most projects are: L1 block rewards, L2 sorter fees, and DeFi protocol fees. These cash flows have already been used to fund a provable public good: blocks. Proof-of-work/proof-of-stake mechanisms make block production quantifiable, allowing rewards to be automatically allocated. This creates a clear cycle.

The problem is that most other public goods cannot prove their value, so their funding sources rely on personal connections, grants, and political processes rather than intrinsic economic mechanisms.

The transformation in 2026 and beyond aims to bridge this gap: Deep Funding, open-source protocol licensing, Protocol Guild, etc., make more public goods provable like block production. Once the impact is clearly visible, revenue from L1, L2, and DeFi can continuously flow to these cost centers.

Long-term vision: expand the range of provable public goods, making PGF structural rather than charitable. When revenue centers can see and support their dependencies, the flywheel effect can sustain itself.

5. Open Source Licensing as a Revenue Engine

This is a brand new concept:

- Incorporate a Harberger-style "Openness Tax" into open-source licensing

- Include "funding dependencies" in the rules

- Only require profit-sharing when someone closes the source code

This can transform the trillions of dollars of commercial value built on open source into a small portion of sustainable, continuous PGF funding flows.

6. Revenue-Based PGF

People are more willing to donate revenue rather than principal. This is significant both psychologically and structurally.

Octant is a typical representative and absolute leader in this niche market.

Privacy and Open Source are Priorities

These two points are crucial.

- Open source—Ethereum operates on open-source protocols. Funding dependencies is a good practice. It is also an excellent way to connect with the real world.

- Privacy—Privacy can prevent PGF and governance mechanisms from becoming a bribery market. ZK and programmable cryptography are key technologies to achieve this goal. Both are pillars of the reformed PGF tech stack.

7. Funding for Dependencies

Deep Funding is the flagship project in this area.

- Build a real dependency graph of the internet

- Use AI to sort millions of edges

- Utilize reviewers for random checks

- Allocate funds based on actual upstream value

Most importantly: accountability is internalized. For example, if users stop using your service, you stop receiving rewards. No more "lying flat" projects that merely survive due to connections.

8. L2 and Application Multi-Centric Tree Structure

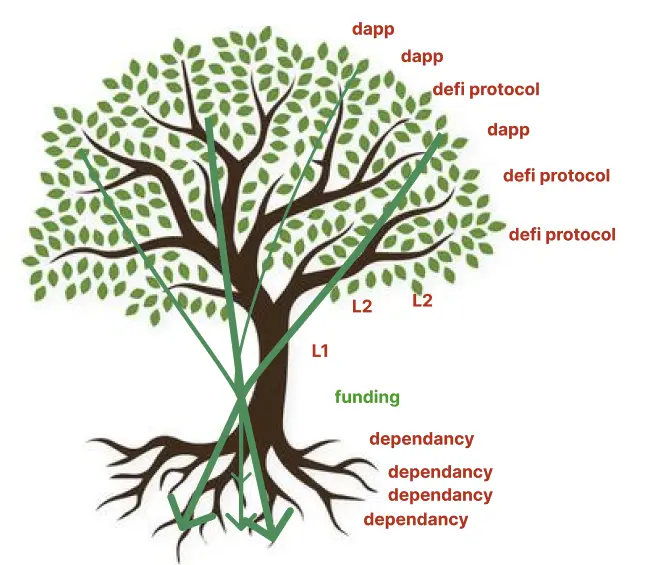

From a macro perspective, the PGF architecture exhibits decentralized characteristics: each L2 layer, application chain, and protocol funds its own dependencies, which spread out like mycelium.

No longer is there a single large donor trying to fund everything; instead, alliance-style funding has formed: many smaller ecosystems each support their dependent public goods, collectively covering the entire tech stack.

Economic incentives embedded in the architecture replace "universal charity." When each layer funds its upstream dependencies and there is overlap between these layers, the ecosystem forms a resilient alliance of funders.

(Depicting how funds flow on a large scale from a child's perspective)

9. New PGF Builders Should Be Compatible with New Systems Rather Than Old Systems

New PGF builders should focus on how to be compatible with new systems rather than old systems:

- Most old-style vaults resist change

- New ecosystems are eager to grow, act quickly, and embrace new tools

If you are building a brand new PGF infrastructure in 2026, your focus should primarily be on the frontier areas: new ZK ecosystems, new application chains, and new open-source software licensing standards.

Note: There are some exceptions to this rule—such as Filecoin and Gitcoin, which are prioritizing support for builders of new PGF mechanisms, and there are certainly other organizations doing the same.

10. New PGF Builders Must Leverage Two Superpowers: AI + Cryptography

The reformed PGF field has become possible due to the maturity of two technologies:

Artificial Intelligence:

- Assisting reviewers

- Assessing vast dependency trees

- Providing explainable reasoning processes

- Supporting continuously operating on-chain mechanisms

ZK / Programmable Cryptography:

- Ensuring privacy

- Ensuring credible neutrality

- Reducing manipulation

AI provides scale, while ZK provides integrity.

Conclusion

Overall: Funding for Ethereum public goods is not disappearing; it is transforming. The cloak of the vibes era is shedding, and beneath it, a more durable, mechanized, and scalable PGF ecosystem is gradually taking shape.

The previous cycle revealed the limitations of charity, the fragility of vibes, and the dangers of relying on any single source of funding. The next cycle will be characterized by diversification, provability, sustainable revenue streams, and new privacy + AI technologies that can truly operate at internet scale.

If the period from 2017 to 2021 was about discovering the importance of PGF, and from 2021 to 2024 was about bold experimentation, then 2026 and beyond will be about putting what has been learned into practice: funding your dependencies, building provable systems, embracing alliance-style funding, and using AI and ZK to transform funding from an art into an engineering discipline.

We are moving towards a world where funding flows continuously rather than in rounds of fundraising, with open source and privacy seen as the true infrastructure for survival.

The road ahead is not easy, but it is exciting. This is the frontier. If done right, it will leave behind a PGF system that is more trustworthy, anti-fragile, and regenerative than any before. If you are building in this space: now is your opportunity.

Related reading: Ethereum Foundation Funding Program Major Reform: Focus on Strategic Tracks, Mentor Program Supports Founders

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。