Despite Trump's suggestion to appoint his economic advisor Hassett as the next Federal Reserve Chair, the market does not expect significant rate cuts. Instead, interest rate futures indicate that the market anticipates only modest easing next year.

Source: Jin Shi Data

Financial commentators seem convinced that the new Federal Reserve Chair will be a super-dovish loyalist of Trump, aiming to implement significant rate cuts without considering the economic fundamentals. However, the market does not buy this narrative.

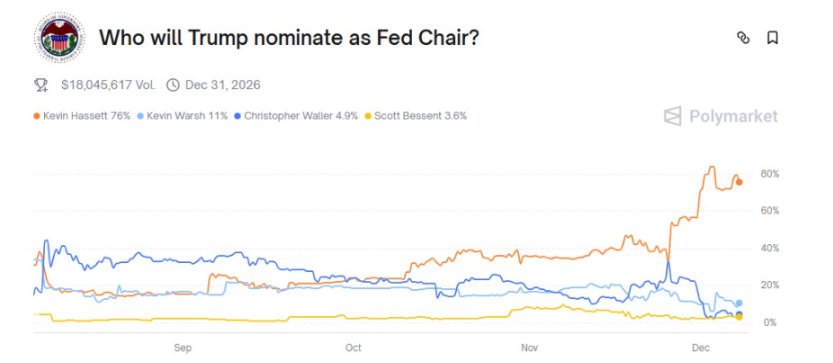

Powell's eight-year term as Federal Reserve Chair will end in May next year, and the market widely expects him to be replaced by Trump's chief economic advisor, Kevin Hassett. Trump hinted at this last week, stating that he had narrowed down the candidate list to one person, and then introduced Hassett as a "potential Federal Reserve Chair" at an event at the White House.

Hassett is undoubtedly a loyal supporter of Trump. However, market prices clearly indicate that traders do not believe a Fed led by Hassett will ease monetary policy as significantly as Trump suggests.

In fact, according to the pricing in the interest rate futures market, the expected easing by the end of next year is barely 75 basis points. This amounts to just three rate cuts of 25 basis points each—likely with two occurring before Powell's departure and only one after the new Chair takes office in the second half of 2026.

Fiscal easing may constrain the Fed's actions

There are two interpretations of this situation.

Either the market is underestimating the risk of further easing in the second half of next year, which means risk assets are currently undervalued; or the futures market is correct in judging that the Fed will not behave particularly dovishly next year, thus limiting the policy's ability to drive the stock market up and the dollar down.

Considering all factors, the latter scenario seems more likely. A recent Reuters survey consensus median forecast shows that the S&P 500 index's target for the end of next year is 7490 points, only a 9% increase from last Friday's closing price.

Given the policy legacy that the new Federal Reserve Chair will inherit, it is reasonable for the market to expect limited rate cuts from the Fed in 2026.

Admittedly, the U.S. labor market has weakened, but inflation has been above the Fed's 2% target for nearly five years and continues to persist.

If the market's expectations are correct, by the time the new Chair takes office, the Fed will have already lowered the policy rate by 100 basis points: two cuts earlier this year, one later this week, and one in the first half of next year. This is on top of a 100 basis point cut expected between September and December 2024.

This would bring the federal funds rate target range down to 3.25%-3.50%. Looking at this number alone, hardly any observer would consider it restrictive. But the essence of the issue goes far beyond that. With inflation still hovering around 3% at that time, the real interest rate when the new Chair takes over could be close to zero—indicating that the monetary policy environment is actually very accommodative.

More importantly, next year will see a wave of fiscal stimulus in the form of tax cuts from the "Big and Beautiful Act," and each household may receive a $2000 stimulus check funded by tariff revenues.

In such an environment, how much more can monetary policy ease?

Preparing for historic divisions

Powell's successor will also face a daunting task: reaching consensus in what may be the most polarized Federal Open Market Committee (FOMC) in history. This division may become even more entrenched next year.

Although the new Federal Reserve Chair will almost certainly steer the FOMC's stance towards a dovish direction, they will also face opposing forces. Cleveland Fed President Mester and Dallas Fed President Logan (who can be considered the most hawkish among the 19 FOMC members) will both become voting members in 2026.

Of course, differing opinions within the FOMC are not uncommon. In policy meetings chaired by Powell, dissent has occurred about once every five meetings. According to the St. Louis Fed's database, nearly half of the meetings chaired by his predecessor Yellen saw dissent, while the proportion exceeded 60% during Bernanke's tenure.

However, these dissents are mostly single votes. The decision to cut rates by 25 basis points in October was only the third time since 1990 that there was dissent both for tightening policy and for further easing. Moreover, the number of dissents this year has already surpassed any time in the past thirty years.

Thus, a 7 to 5 voting outcome may now emerge, reminiscent of the Bank of England's policy decisions. Such divisions will make pushing any agenda extremely challenging—no matter how hard the new Federal Reserve Chair tries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。