Author: Lao Bai

During my time at OKX Ventures in the middle of this year, the discussions about projects were not as frequent as in 2023-2024, as the primary market has cooled down significantly compared to the previous two years. However, there is an advantage to this: each project can be discussed in more detail, and there is more time for due diligence (DD) and research. We can have "in-depth discussions."

Almanak left a deep impression on me at that time. The CEO seemed like a tech enthusiast at first glance, and after chatting for an hour, that feeling was only reinforced. To conduct DD on their product, we not only extensively tried out Almanak but also experienced several of its competitors one by one. I even threw a few thousand USDT into Almanak's Vault to track the returns. If it weren't for the latest news from Almanak Games, I might have forgotten that I had stored some money in there…

Back to the point, what does this project do? You can see its Twitter bio - Your personal AI quant team.

This goes a step further than a regular AI agent helping you yield or trade cryptocurrencies; I can set up a quant team composed of AI agents for you.

What's cooler is that you can think of Almanak as the Cursor of the DeFi world. Without needing to understand code, you can use Vibe Coding to build, test, and deploy institutional-level coded financial strategies through an AI Agent Swarm. In other words, you can command this AI quant team to construct quant strategies based on your requirements. You make the request, and the agents automatically sense, decide, backtest, and execute…

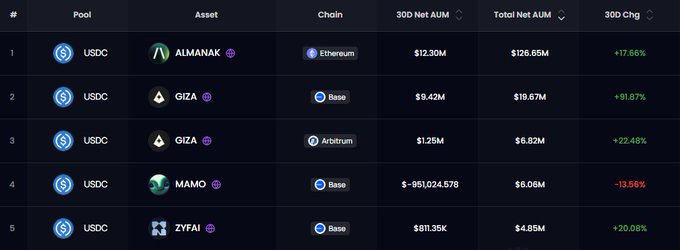

This is also why Almanak leads in various metrics on the Agent Yield website, with its TVL surpassing 100 million in just a few months, far ahead of the following competitors by several times.

At that time, my colleagues from the investment team and I not only tried out Almanak but also experienced several competitors like Hey Anon, Griffin, and Giza. Indeed, in terms of product functionality and complexity, Almanak is on a different level. Among the 18 agents, some are responsible for strategy design, some for auditing, some for alpha discovery, and crucially, some are responsible for backtesting and optimization, assessing overall returns and potential drawdowns through historical simulations and stress tests. This is certainly not something that a typical so-called "De-Agent" project or team can achieve.

This is likely why Almanak has secured over ten million in investments from top VCs like Delphi, HashKey, Bankless Ventures, RockawayX, and Shima, and why its public offering in August was oversubscribed by 400% despite a very cold market.

The project is not only innovative in its product but also in its Token Generation Event (TGE). Many projects create a bunch of false metrics, fake interactions, and fake communities before their TGE, desperately trying to secure airdrops, and then rush to list and sell. This time, Almanak not only prioritized the product but also focused on complete transparency, community co-creation, and high participation incentives in its design, avoiding hidden lock-ups and last-minute changes.

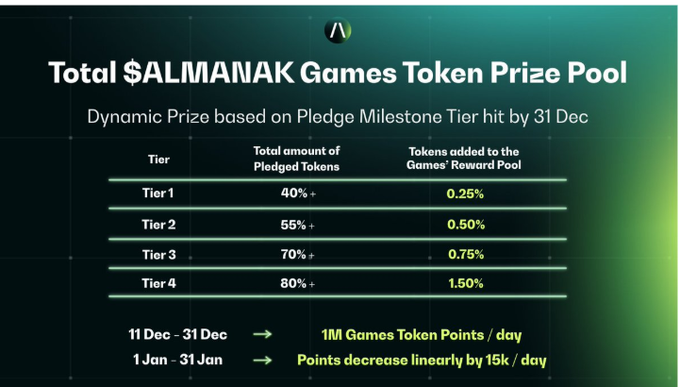

The upcoming Almanak Games (12/11–1/31) is an on-chain competition aimed at discovering real users and communities - users can earn rewards for trading, holding, providing liquidity (LP), and deploying strategies with $ALMANAK.

- Rewards include: token rewards (1.5%–3% Supply)

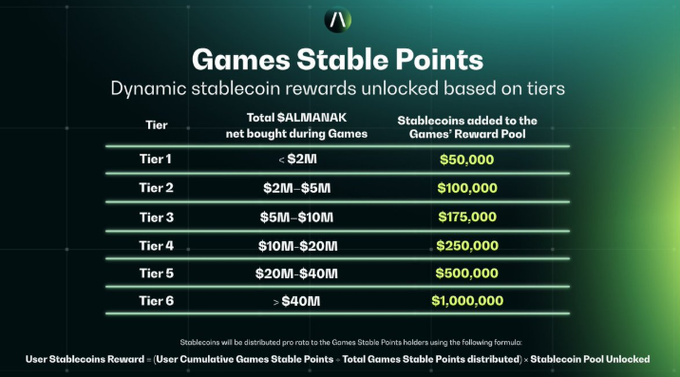

Stablecoin rewards (unlocked with community participation, and there are quite a few, including up to $1 million in stablecoin rewards)

If you commit to holding until the end of 2025, you can also receive a Boost.

Of course, the project is still in its early stages, and the richness of strategies and data validation will require more time for the market to test. However, based on the current functionalities and the framework provided, it seems just a matter of time before powerful "on-chain quant strategies" emerge. Looking forward to a wave of rise in the "Agent DeFi Summer"!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。