"First, let users stay for the tools, then there will be space for social interaction."

Written by: Bootly

After five years of establishment, raising approximately $180 million, and reaching a valuation that once approached $1 billion, Farcaster has officially acknowledged: the path of Web3 social has not succeeded.

Recently, Dan Romero, co-founder of Farcaster, posted consecutively on the platform, announcing that the team would abandon the "social-centric" product strategy and instead fully focus on the wallet direction. In his statement, this is not a proactive upgrade, but a choice forced by reality after a long period of attempts.

"We tried for 4.5 years to prioritize social, but it did not work."

This judgment not only signifies Farcaster's transformation but also once again brings the structural problems of Web3 social into the spotlight.

The gap between ideals and reality: Why Farcaster failed to become "decentralized Twitter"

Farcaster was born in 2020, during the rise of the Web3 narrative. It attempted to address three core issues of Web2 social platforms:

- Platform monopoly and censorship

- User data not belonging to the user

- Creators unable to monetize directly

Its design philosophy is quite idealistic:

- Decentralization at the protocol layer

- Clients can be freely constructed

- Social relationships on-chain and transferable

Among many "decentralized social" projects, Farcaster was once seen as the product closest to product-market fit (PMF). Especially after Warpcast gained traction in 2023, a large number of KOLs from Crypto Twitter joined, making it appear to be the prototype of the next generation of social networks.

However, problems soon emerged.

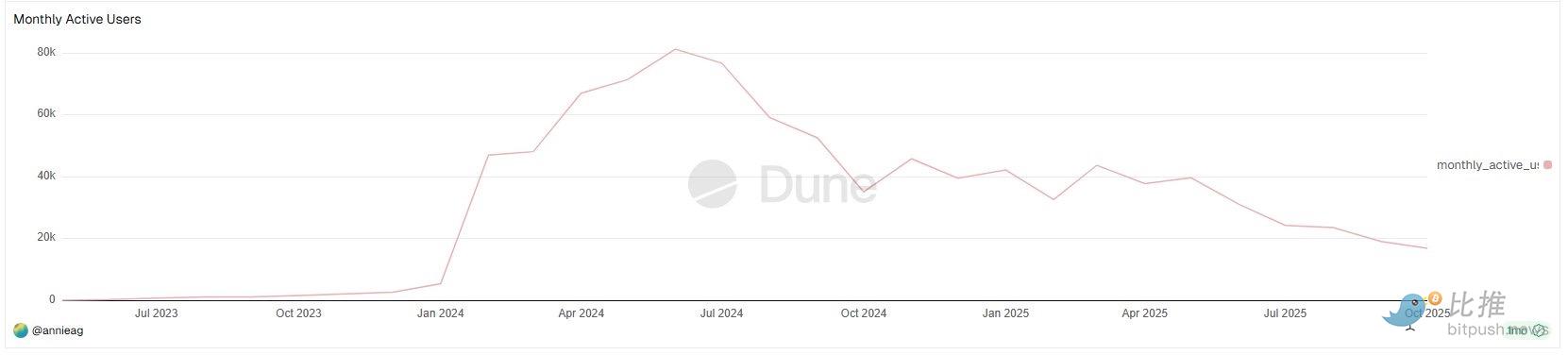

According to the monthly active user (MAU) statistics on Dune Analytics, Farcaster's user growth trajectory shows a very clear, but not optimistic, pattern:

For most of 2023, Farcaster's monthly active users were almost negligible;

The real growth inflection point appeared in early 2024, with MAU rapidly increasing from a few thousand to about 40,000–50,000 in a short time, and at one point in mid-2024, it approached 80,000 monthly active users.

This was the only true window of scaled growth since Farcaster's establishment. Notably, this growth did not occur during a bear market, but during a phase of high activity in the Base ecosystem and a surge in SocialFi narratives.

However, this window did not last long.

Starting in the second half of 2024, the monthly active user data showed a significant decline, and over the following year, it exhibited a downward trend:

- MAU rebounded multiple times, but the peaks continued to decline

- By the second half of 2025, monthly active users had fallen to less than 20,000

In fact, Farcaster's growth has always struggled to "break out," with its user structure being highly homogeneous:

- Crypto practitioners

- VCs

- Builders

- Crypto native users

For ordinary users:

- High registration threshold

- Social content is severely "insular"

- User experience is not superior to X / Instagram

This has prevented Farcaster from forming a true network effect.

DeFi KOL Ignas bluntly stated on X (@DeFiIgnas) that Farcaster "just acknowledged a fact that everyone has felt for a long time":

The strength of the network effect on X (formerly Twitter) is almost impossible to break through directly.

This is not a problem of crypto narratives, but a structural barrier of social products. From the product path perspective, the issues on the social side of Farcaster are very typical:

- User growth has always been locked within the crypto native crowd

- Content is highly insular, difficult to spill over

- Creator monetization and user retention have not formed a positive feedback loop

This is also why Ignas succinctly summarized Farcaster's new strategy with one sentence:

"It’s easier to add social features to a wallet than to add a wallet to a social product."

This judgment essentially acknowledges that "social is not a primary demand of Web3."

"Bubbles are comfortable, but numbers are cold"

If the MAU data answers the question of "how is Farcaster doing," then another question is: how big is this market itself?

Crypto creator Wiimee provided a set of striking comparative data on X.

After an "unexpected leap out of the crypto content circle," Wiimee created content for a general audience for four consecutive days, and his analysis showed that he gained 2.7 million exposures in about 100 hours, more than double the total views of all his crypto content in a year.

He stated:

"Crypto Twitter is a bubble, and it’s small. Four years talking to insiders is not as effective as four days talking to the public."

This is not a direct criticism of Farcaster, but reveals a deeper issue:

Crypto social is itself a highly self-circulating ecosystem with very weak spillover ability. When content, relationships, and attention are confined to the same group of native users, no matter how sophisticated the protocol design is, it is difficult to break through the upper limit of market scale.

This means that Farcaster is facing not a "product quality" issue, but a problem of "not enough people in the market."

Wallets, on the other hand, have found PMF

What truly changed Farcaster's internal judgment was not a reflection on social, but an unexpected validation of wallets.

Earlier in 2024, Farcaster launched a built-in wallet in the application, initially intended as a supplement to the social experience. However, from the usage data, the growth slope, usage frequency, and retention performance of the wallet were clearly different from those of the social module.

Dan Romero emphasized in a public response:

"Every new wallet user who is added and retained is a new user of the protocol."

This statement itself reveals the core logic behind the route adjustment. The wallet faces not "expressive desires," but real, rigid on-chain behavioral demands: transfers, transactions, signatures, and interactions with new applications.

In October, Farcaster acquired the AI Agent-driven token issuance tool Clanker and began to gradually integrate it into the wallet system, an action seen as a clear bet on the "wallet-first" path by the team.

From a business perspective, this direction has clear advantages:

- Higher usage frequency

- Clearer monetization paths

- Tighter binding with the on-chain ecosystem

In contrast, social seems more like a nice-to-have rather than an engine driving growth.

Although the wallet strategy stands up to data scrutiny, community controversy has followed.

Several long-term users have clearly stated that they do not oppose the wallet itself, but feel uncomfortable with the accompanying cultural shift: from "users" being redefined as "traders," and from "co-builders" being labeled as "old guard."

This exposes a real issue: when the product direction changes, community sentiment is often harder to shift than the roadmap. The protocol layer of Farcaster remains decentralized, but the choice of product direction is still concentrated in the hands of the team. This tension is amplified during the transformation.

Romero later acknowledged communication issues but also made it clear that the team has made a choice.

This is not arrogance, but a common reality decision faced by entrepreneurial projects in the later stages of their lifecycle. In this sense, Farcaster has not abandoned the ideal of social, but rather the fantasy of scaling it.

Perhaps, as one observer put it:

"First, let users stay for the tools, then there will be space for social interaction."

Farcaster's choice may not be the most romantic, but it could be the most realistic one; deeply integrating native financial tools (wallets, transactions, issuance) is the practical path to transforming into sustainable commercial value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。