The proposal of a so-called reparations loan to Ukraine issued by the European Union (EU) on Friday has analysts weighing the repercussions that such a move would bring to the economic establishment.

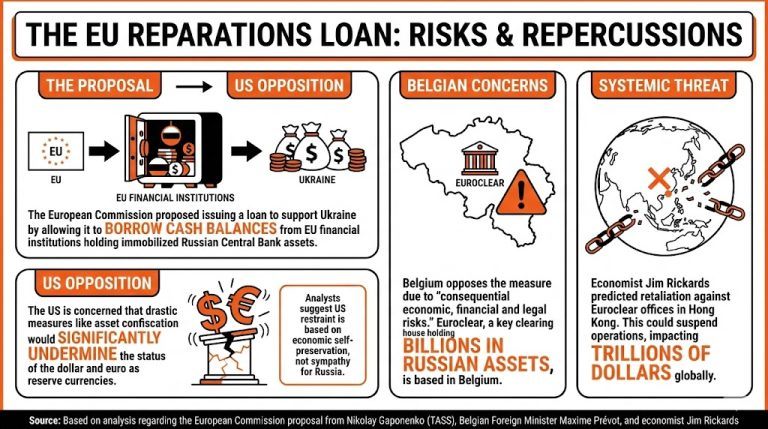

On Wednesday, the European Commission proposed issuing a loan to support the Ukrainian war effort by allowing it to borrow cash balances from EU financial institutions holding immobilized Russian Central Bank assets.

Nonetheless, while the proposal includes safeguards to avoid later retaliation from Russia, it has garnered opposition from several factions, including the U.S., as it could impact the dollar’s standing as a solid reserve currency.

Nikolay Gaponenko, Associate Professor at the Department of the Institute of Law and National Security of the Presidential Academy, told TASS that this opposition was not free and was substantiated by the effects of such a drastic measure.

He stated:

The U.S. is acting with restraint not because of sympathy for Russia, but because of concerns that asset confiscation would significantly undermine the status of the dollar and the euro as reserve currencies.

Belgian Foreign Minister Maxime Prévot ahas also opposed this measure, as he detailed that it would entail “consequential economic, financial and legal risks.” Euroclear, a key European financial clearing house that holds billions in Russian assets, is based in Belgium.

Economist Jim Rickards warned about a confiscation scenario last year, stating that even if some safeguards are taken, Euroclear has offices in Hong Kong that could be held liable. Rickards argued that this could result in the suspension of Euroclear’s operations, impacting trillions of dollars in assets.

Read more: Economist Jim Rickards: The Global Clearance and Settlement System Might Collapse After Seizure of Russian Assets

The measure, if passed as is, would throw the financial world into disarray, given that it could be considered as a theft by Russia, and put Euroclear, Belgium, and the whole EU at risk of retaliatory measures that will surely come in due time.

In addition, it would accelerate the crisis of trust that other nations have in European and American custody providers, potentially fueling the creation of alternative systems to substitute those now controlled by these nations.

As correctly declared by Prévot, the outcome of this proposal is unclear, as it has never been done before. The commission pointed out to the next council, which will be held between December 18 and 19, as a potential date for “reaching a clear commitment on the way forward.”

What is the EU proposing regarding Ukraine?

The European Commission has suggested a reparations loan to Ukraine, allowing it to borrow from EU institutions holding immobilized Russian Central Bank assets.What concerns have been raised about this proposal?

Opposition includes fears that the loan could threaten the dollar’s status as a reserve currency, with the U.S. and Belgian officials highlighting economic and legal risks.Why might this move be seen as a risk to the financial system?

Experts warn that seizing Russian assets for the loan could be viewed as theft, potentially leading to retaliation and undermining trust in European and American financial systems.What is the timeline for further developments on this proposal?

The EU plans to discuss the proposal at the next council meeting scheduled for December 18-19, aiming to reach a commitment on the way forward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。