Russia is betting heavily on gold and its strength as a universal store of value, as it has now parked close to half of its international reserves in the precious metal.

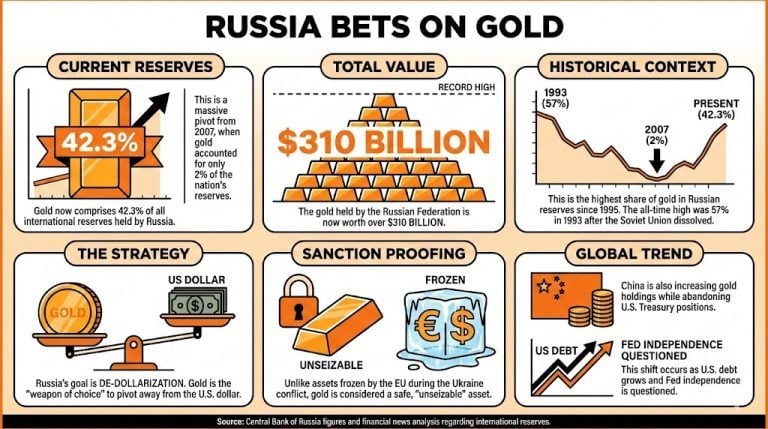

According to figures from the Central Bank of Russia, gold now comprises 42.3% of all assets held by Russia. While the proportion is still high compared to today’s central bank standards, it is down from its all-time high of 57% in 1993, following the dissolution of the Soviet Union.

Nonetheless, Russia almost abandoned gold circa 2007, when the precious metal only accounted for 2% of the nation’s reserves.

These numbers represent the highest share of gold as part of Russian reserves since 1995, reaching a milestone as a result of Russia’s flight to safe and unseizable assets.

The gold held by the Russian Federation is now worth over $310 billion, reaching record value numbers.

Read more: Russia’s Gold Reserves Climb to $207.7B — A Shift in Global Strategy?

Russia’s newfound lust for gold represents a pivot to assets that hold their value over time, can be easily liquidated, and cannot be seized like the assets that the EU froze as part of the sanctions against the country for its incursion into Ukraine.

Russia’s objective is clear: to de-dollarize its economy as much as possible, and gold has been selected as the weapon of choice to carry out this process.

And not only is Russia behind gold: China has also been slowly abandoning its U.S. Treasury position and increasing its gold holdings at the same time, as the U.S. debt grows and the Federal Reserve’s independence gets attacked.

Russia is expected to park more of its reserves in gold in the future, as the reasons that push the nation into this shift remain fundamentally unchanged in the current geopolitical context.

What recent trend is Russia following regarding its international reserves?

Russia has allocated nearly 50% of its international reserves to gold, now making up 42.3% of all its assets.How does this compare to historical figures?

This is the highest share of gold in Russian reserves since 1995, though it has decreased from an all-time high of 57% in 1993.Why is Russia focusing on gold now?

This shift represents a strategy to invest in unseizable assets and move away from the U.S. dollar, especially following sanctions imposed by the EU.What does this indicate about broader trends in global finance?

Russia’s pivot to gold mirrors a similar trend in China, which is also increasing its gold holdings, reflecting concerns over U.S. debt and financial stability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。