Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The market is holding its breath for this week's Federal Reserve meeting, with widespread expectations of a 25 basis point rate cut. However, contrary to traditional logic, since the rate cut cycle began in September, long-term U.S. Treasury yields, which anchor global asset pricing, have risen instead of falling, sparking intense debates about the future economic path. Optimists view this as a signal of a "soft landing" for the economy, while pessimists worry it reflects a "bond vigilante" vote of no confidence in the U.S.'s high national debt and inflation risks. In this context, seasoned Wall Street strategists like Mark Cabana from Bank of America predict that to address potential liquidity strains, the Federal Reserve may announce a significant balance sheet expansion plan of up to $45 billion per month in addition to the rate cut.

Meanwhile, China is also set to enter a policy super week, with important meetings and the release of key economic data such as inflation and social financing providing new guidance for the market. Additionally, competition in the artificial intelligence sector is heating up, with OpenAI planning to release GPT-5.2 ahead of schedule to respond to competition. The earnings reports of chip designer Broadcom and cloud service giant Oracle, as well as Microsoft's CEO's visit to India, will serve as key indicators for assessing the investment climate in AI infrastructure and the future direction of the industry.

In the Bitcoin market, short-term sentiment is cautious, but long-term indicators still show resilience. Analyst Murphy predicts, based on the MVRV indicator, that Bitcoin prices may reach between $85,000 and $94,000 by December 31, and hit between $71,000 and $104,000 in early 2026, viewing $104,000 as a critical bull-bear dividing line. Several analysts consider the $86,000 to $88,000 range as key support. For instance, Daan Crypto Trades points out that falling below this critical Fibonacci level could lead to a price drop to a low of $76,000, while Michaël van de Poppe believes holding above $86,000 is a prerequisite for his bullish scenario (i.e., prices breaking above $92,000 and heading towards $100,000). On-chain data shows divergence: on one hand, Glassnode notes that ETF demand continues to weaken, indicating a decline in market risk appetite; on the other hand, analyst @TXMCtrades emphasizes that the "activity" indicator continues to rise, and CryptoQuant's data shows that the selling pressure from long-term holders has undergone a "complete reset," which may signal potential spot demand and the formation of a market bottom. Bloomberg ETF expert Eric Balchunas reassures the market from a more macro perspective, stating that Bitcoin's pullback this year is merely a normal cooling off after last year's extreme 122% surge, and its resilience in reaching new highs after multiple significant pullbacks makes it no longer suitable for comparison with the "tulip bubble."

Regarding Ethereum, short-term market sentiment leans pessimistic, but long-term technical patterns are showing optimistic signals. According to Nansen's data, "smart money" traders are still increasing their short positions on the derivatives platform Hyperliquid, with net short positions exceeding $21 million. However, analyst Sykodelic sees a positive side from the technical charts, noting that Ethereum's 5-day MACD and RSI indicators, after undergoing a full reset, are presenting a pattern that has historically led to significant price increases, suggesting that a market bottom is forming.

In the altcoin market, the AI project Bittensor (TAO) has become the market focus, as it is set to undergo its first halving on December 14, reducing the daily token issuance by half. Grayscale analyst Will Ogden Moore commented positively on this, viewing it as an important milestone towards the network's maturity, and pointed out that its strong adoption momentum, rising institutional interest, and the success of the dTAO mechanism could all serve as catalysts for price increases, with TAO rising nearly 10% in a day. Over the weekend, multiple events and figures drew widespread attention. Terraform Labs co-founder Do Kwon's legal case saw new developments, with U.S. prosecutors recommending a 12-year prison sentence due to the "massive scale" of his fraudulent actions. U.S. District Court Judge Paul Engelmayer is set to deliver a verdict on Do Kwon on December 11. This news briefly triggered a surge of over 100% in USTC and LUNA tokens over the weekend, followed by a significant drop, with a nearly 20% decline in the past 24 hours. Additionally, Binance founder CZ inadvertently sparked a meme coin of the same name due to a typo in a tweet mocking executive He Yi. Binance is also responding to community concerns, stating that it is conducting an internal review of potential corruption related to token listings. Another noteworthy piece of news comes from the intersection of technology and the crypto space, as "China's first domestic GPU stock" Moore Threads saw its stock price soar after listing on the Sci-Tech Innovation Board, bringing back controversies surrounding its co-founder Li Feng, including his past involvement in the "Malagobi" project with Li Xiaolai and a long-standing debt dispute with OKX founder Star involving 1,500 Bitcoins (currently valued at approximately $135 million). In response, Star recently stated on social media that the debt issue has been handed over to legal proceedings and should be looked at from a forward-looking perspective.

2. Key Data (as of December 8, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $91,596 (YTD -2.11%), daily spot trading volume $40.49 billion

Ethereum: $3,134 (YTD -6.17%), daily spot trading volume $25.27 billion

Fear and Greed Index: 20 (Extreme Fear)

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

Market share: BTC 58.7%, ETH 12.2%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, MOODENG, SOL

24-hour BTC long-short ratio: 50.54% / 49.46%

Sector performance: Meme and DeFi sectors slightly retraced, ScialFi and AI sectors rose over 2%

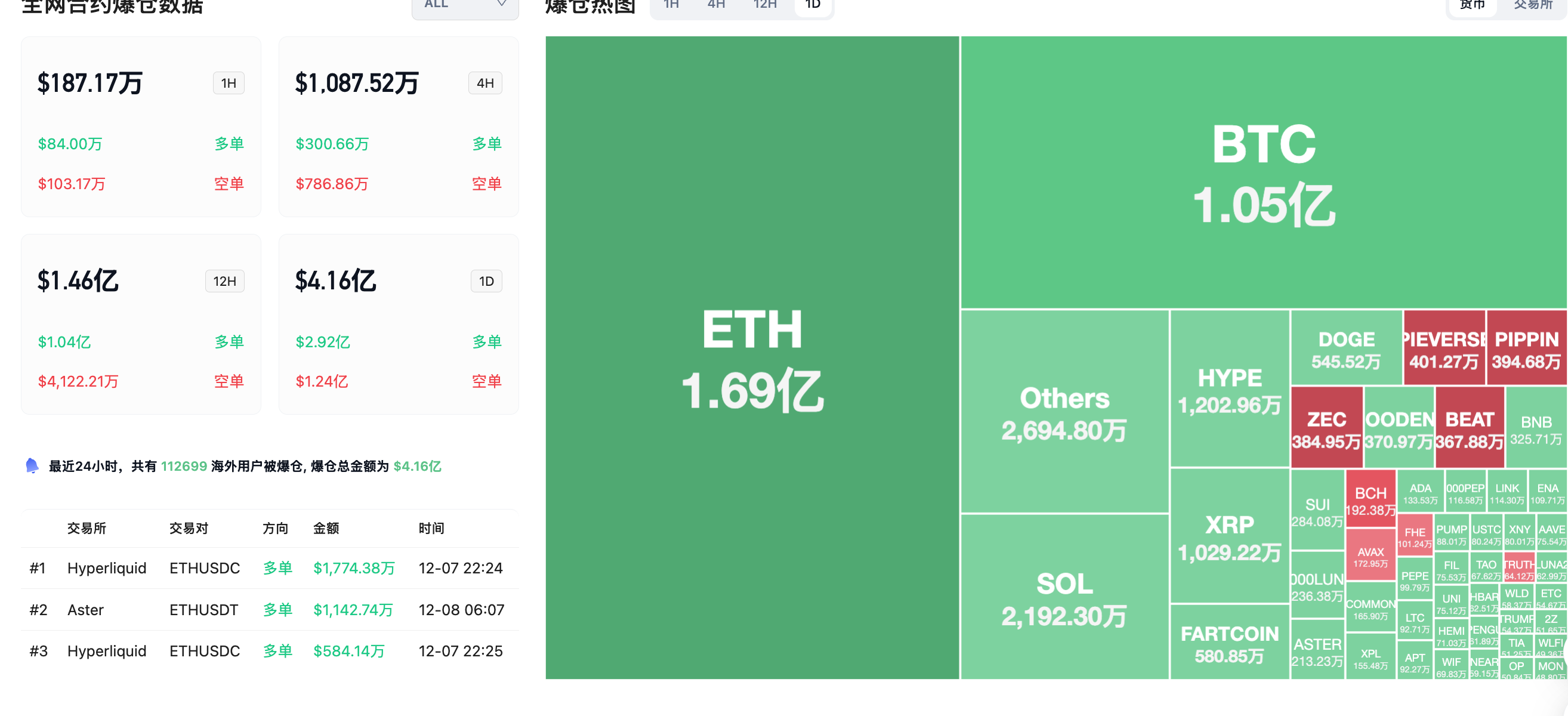

24-hour liquidation data: A total of 112,699 people were liquidated globally, with a total liquidation amount of $416 million, including $105 million in BTC, $169 million in ETH, and $21.92 million in SOL.

3. ETF Flows (as of December 5)

Bitcoin ETF: Net outflow of $87.77 million last week, with ARKB leading at a net outflow of $77.86 million.

Ethereum ETF: Net outflow of $65.59 million last week, with BlackRock's ETHA leading at a net outflow of $55.87 million.

Solana ETF: Net inflow of $20.3 million last week.

XRP ETF: Net inflow of $231 million last week, continuing a four-week net inflow trend.

4. Today's Outlook

HumidiFi: New token public sale will start at 23:00 on December 8

BounceBit (BB) will unlock approximately 29.93 million tokens at 8:00 AM on December 9, with a circulation ratio of 3.42%, valued at approximately $2.7 million.

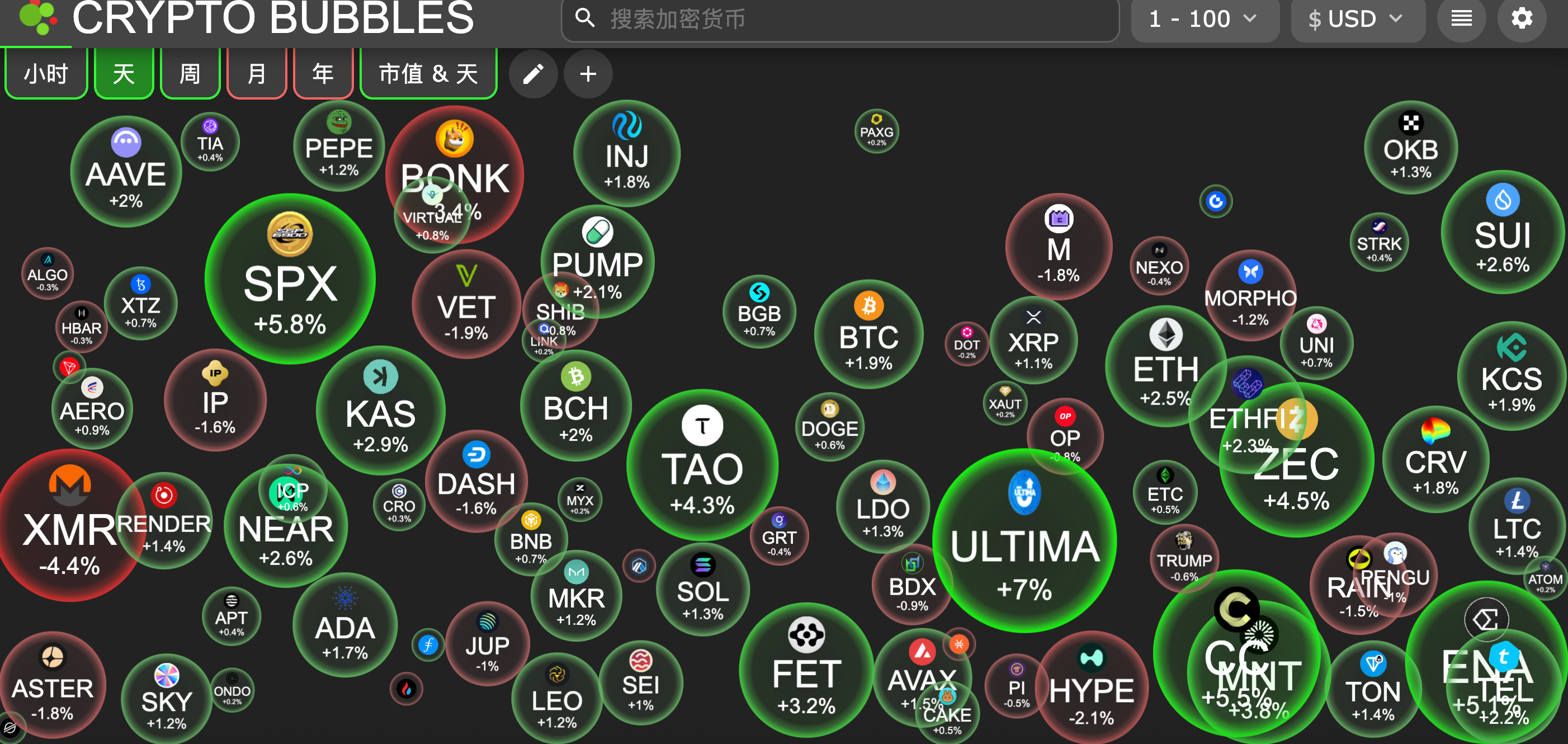

The largest gainers among the top 100 cryptocurrencies today: Ultima up 7%, SPX6900 up 5.8%, Canton Network up 5.5%, Ethena up 5.1%, Zcash up 4.5%.

5. Hot News

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。