Author: Zuo Ye

Finance in the West serves as a means of social mobilization, achieving remarkable effects only under the conditions of a "state-society" separation or even opposition. However, in the Eastern great powers where the family and country are structurally identical, social mobilization relies on water conservancy projects and governance capabilities.

From this point, we begin to discuss the phenomenon I have observed: after the hasty conclusion of the DeFi narrative in the 10 years of Ethereum + dApp, it has shifted to the competition of Consumer DeFi mobile apps in the Apple Store.

In contrast to exchanges and wallets that were early listed on major app stores, DeFi, which has been reliant on web platforms, arrived quite late. Compared to virtual wallets and digital banks targeting low-income, unbanked populations, DeFi, which cannot solve the credit system, has come too early.

In this entanglement, there even exists a narrative of human society transitioning from monetary banking back to fiscal currency.

The Treasury Reassumes Control of Currency

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

Consumer DeFi is directly aimed at end users through Aave and Coinbase's built-in Morpho, but our story must begin with the process of modern currency issuance to complete the background of DeFi Apps surpassing DeFi dApps.

Gold and silver are not inherently currency. When humans need large-scale exchanges, a general equivalent emerges in the form of commodities, and gold and silver, due to their various characteristics, are ultimately accepted by human society as a whole.

In human society before the entire industrial revolution, regardless of political systems or levels of development, metal coins dominated, essentially managed by the fiscal department overseeing the currency system.

The "central bank-bank" system we are familiar with is, in fact, a very recent story. Early developed countries generally followed a process of controlling banking crises, establishing central banks out of necessity to handle them, including the Federal Reserve, which we are most familiar with.

In this historical process, the fiscal department, as an administrative branch, has always been in an awkward position of power regression. However, the "central bank-bank" system is not without its flaws. In the central bank's management of banks, banks rely on the interest rate spread to earn profits, while the central bank influences banks through reserve requirements.

Image Description: The Role of Interest Rate Spread and Reserve Requirement

Image Source: @zuoyeweb3

Of course, this is a simplified and outdated version.

The simplification omits the role of the money multiplier; banks do not need to have 100% reserves to issue loans, which is where the leverage effect comes from. The central bank also does not force banks to maintain complete reserves; it needs to use leverage to adjust the overall money supply in society.

The only ones who suffer are the users, as deposits outside of reserves lack rigid repayment guarantees. When neither the central bank nor the banks want to bear the cost, users become the necessary price for the supply and recovery of currency.

The outdated aspect is that banks no longer fully accept the central bank's command. A typical example is Japan after the Plaza Accord, which effectively initiated QE/QQE (quantitative easing), where, under extremely low or even negative interest rates, banks could not profit from the interest rate spread and would choose to simply do nothing.

Thus, the central bank would directly buy assets, bypassing banks to supply currency, exemplified by the Federal Reserve buying bonds and the Bank of Japan buying stocks. The entire system increasingly becomes rigid, leading to a complete failure of the clearing ability, which is crucial for economic circulation: Japan's massive zombie companies, the TBTF (Too Big to Fall) Wall Street financial giants formed after 2008, and the emergency interventions following the collapse of Silicon Valley Bank in 2023.

What does all this have to do with cryptocurrencies?

The financial crisis of 2008 directly gave birth to Bitcoin, while the collapse of Silicon Valley Bank in 2023 directly triggered a wave of opposition to CBDC (Central Bank Digital Currency) in the U.S. In the House of Representatives vote in May 2024, all Republicans supported not developing CBDCs, instead favoring private stablecoins.

The logic of the latter is somewhat convoluted. One might think that after the collapse of Silicon Valley Bank, which was crypto-friendly, the U.S. should turn to support CBDCs, especially after the significant de-pegging of USDC. However, in reality, the Federal Reserve's dollar stablecoin or CBDC has formed a de facto confrontation with the Treasury's dollar stablecoin, which is led by the administrative branch and Congress.

The Federal Reserve itself originated from the chaos and crisis of the post-1907 "free dollar" system. After its establishment in 1913, it maintained a peculiar situation of "gold reserves + private banks." At that time, gold was directly managed by the Federal Reserve until 1934, when its management rights were transferred to the Treasury. Before the collapse of the Bretton Woods system, gold was always a reserve asset for the dollar.

However, after the Bretton Woods system, the dollar essentially became a fiat currency, or what is called a Treasury bond stablecoin. This conflicts with the Treasury's positioning. From the public's perspective, the dollar and Treasury bonds are two sides of the same coin, but from the Treasury's perspective, Treasury bonds are the essence of the dollar, and the Federal Reserve's private nature interferes with national interests.

Returning to cryptocurrencies, especially stablecoins, stablecoins based on Treasury bonds give administrative departments like the Treasury the power to issue currency while bypassing the Federal Reserve, which is why Congress collaborates with the government to prohibit the issuance of CBDCs.

Only from this perspective can we understand Bitcoin's appeal to Trump. Family interests are merely a front; the ability to compel the entire administrative system to accept Bitcoin indicates that the pricing power of crypto assets is profitable for them.

Image Description: Changes in USDT/USDC Reserves

Image Source: @IMFNews

Currently, the mainstream dollar stablecoins are backed by assets that are essentially cash, Treasury bonds, BTC/ETH, and other interest-bearing bonds (corporate bonds). However, in reality, USDT/USDC are reducing the proportion of dollar cash while significantly switching to Treasury bonds.

This is not a short-term action under an interest-bearing strategy; rather, it corresponds to the transition of dollar stablecoins to Treasury bond stablecoins. The internationalization of USDT is merely about buying more gold.

In the future, the stablecoin landscape will only be a competition among Treasury bond stablecoins, gold stablecoins, and BTC/ETH stablecoins, and there will not be a confrontation between dollar stablecoins and non-dollar stablecoins. No one would genuinely believe that a euro stablecoin would become mainstream, right?!

With the Treasury bond stablecoin, the Treasury has regained the power to issue currency, but the money multiplier or leverage issuance mechanism of banks cannot be directly replaced by stablecoins.

Treating Banks as DeFi Products

Physics has never truly existed, and the commodity attributes of currency are the same.

Theoretically, after the collapse of the Bretton Woods system, the historical mission of the Federal Reserve should have ended, just like the First and Second Banks of the United States. Therefore, the Federal Reserve continuously adds the roles of regulating prices and stabilizing financial markets.

As mentioned earlier, in the context of inflation, central banks can no longer influence the money supply through reserve requirements and instead directly purchase asset packages. This leverage mechanism is not only inefficient but also fails to clear bad assets.

The progress and crisis of DeFi are providing us with another option, allowing crises to exist and occur, which itself acts as a clearing mechanism, forming a framework where the "invisible hand" (DeFi) is responsible for leverage cycles and the "visible hand" (Treasury bond stablecoins) ensures underlying stability.

In short, on-chain assets are more conducive to regulation, as information technology penetrates the web of ignorance.

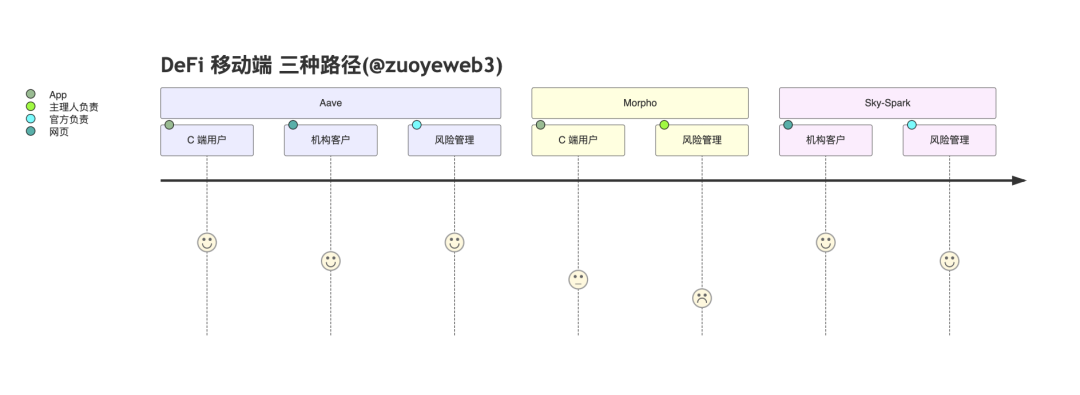

In terms of specific implementation, Aave has built a C-end app that directly connects to users, Morpho uses a B2B2C model through Coinbase, and the Sky ecosystem's Spark has abandoned the mobile end to specifically serve institutional clients.

The specific mechanisms of the three can be subdivided: Aave serves C-end users + institutional clients (Horizon) + official risk control, Morpho has the main operator responsible for risk control + front-end outsourced to Coinbase, and Spark itself is a sub-DAO of Sky, having forked from Aave, primarily targeting institutions and on-chain markets, which can be understood as temporarily avoiding Aave's spotlight.

Sky is the most unique, as it belongs to on-chain stablecoin issuers (DAI->USDS), hoping to expand its usage scope. It fundamentally differs from Aave and Morpho, as a pure lending protocol needs to maintain sufficient openness to attract various assets. Therefore, Aave's GHO is unlikely to have a promising future.

Sky needs to seek a balance between USDS and lending openness.

After Aave voted to reject USDS as a reserve asset, people were surprised to find that Sky's own Spark also did not support USDS much, while Spark was actively embracing PYUSD issued by PayPal.

Although Sky hopes to set up different sub-DAOs to balance the two, this inherent conflict between stablecoin issuers and open lending protocols will accompany Sky's development in the long term.

In contrast to Ethena's decisiveness, Ethena has partnered with Hyperliquid to promote the HYPE/USDe spot trading pair and rebates, directly embracing existing ecosystems like Hyperliquid, temporarily abandoning self-built ecosystems and public chains, and focusing on the role of a single stablecoin issuer.

Currently, Aave is the closest to an all-purpose DeFi app, a quasi-bank-level product, starting from the wealth management/yield field, directly engaging with C-end users, hoping to use its brand and risk control experience to migrate traditional mainstream clients onto the chain. Morpho, on the other hand, hopes to emulate the USDC model, binding with Coinbase to amplify its intermediary role and facilitate deeper cooperation between more main operators' treasuries and Coinbase.

Image Description: Morpho and Coinbase Cooperation Model

Image Source: @Morpho

Morpho represents another extreme open route, USDC + Morpho + Base => Coinbase. Behind the $1 billion loan amount lies the burden of challenging USDT and countering USDe/USDS through Yield products, with Coinbase being the largest beneficiary of USDC.

What does all this have to do with Treasury bond stablecoins?

In the entire process of on-chain stablecoin yields and off-chain customer acquisition, the central role of banks has been bypassed for the first time. This does not mean that banks are no longer needed; rather, banks are increasingly becoming middleware for deposits and withdrawals. Although on-chain DeFi cannot solve the credit system issues, and there are many problems such as over-collateralization capital efficiency and the risk control capabilities of treasury operators,

the permissionless DeFi stack can indeed play a role in leverage cycles, and the collapse of treasury operators can indeed fulfill the function of market clearing.

In the traditional "central bank-bank" system, third-party and fourth-party clients, or dominant large banks, may have the possibility of secondary clearing, which can undermine the central bank's penetration management capabilities and lead to misjudgments in the economic system.

In the modern "stablecoin-lending protocol" system, no matter how many cycles of loans there are or how great the risks of treasury operators are, they can all be quantified and penetrated. The only thing to be cautious about is not to attempt to introduce more trust assumptions, such as off-chain negotiations and lawyers intervening in advance, as this would lead to inefficient use of funds.

In other words, DeFi does not defeat banks through permissionless regulatory arbitrage but will win through capital efficiency.

After the central bank established its control over currency issuance for over a century, the Treasury system has for the first time bypassed the entanglement with gold and reconsidered reclaiming the dominance over currency. DeFi will also take on the new responsibilities of currency reissuance and asset clearing.

There will no longer be distinctions between M0/M1/M2; there will only be a division between Treasury bond stablecoins and DeFi utilization rates.

Conclusion

Crypto sends greetings to all friends, wishing that after a long bear market, they can still witness a spectacular bull market, while the overly impatient banking industry may go ahead of them.

The Federal Reserve attempts to set up a Skinny Master Account for stablecoin issuers, and the OCC tries to quell the banking industry's concerns about stablecoins seizing deposits. All of this reflects the anxiety of the banking industry and the self-rescue actions of regulatory authorities.

We can imagine an extreme scenario: if 100% of Treasury bonds are minted as stablecoins, if 100% of the yields from Treasury bond stablecoins are distributed to users, and if 100% of the yields are reinvested by users into Treasury bonds, would MMT (Modern Monetary Theory) completely come true or fail?

Perhaps this is the significance that Crypto brings to us. In an era dominated by AI, we need to follow in Satoshi Nakamoto's footsteps to rethink economics and attempt to outline the real significance of cryptocurrencies, rather than wholeheartedly following Vitalik in a game of pretend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。