At first blush, treasury company Strategy (Nasdaq: MSTR) and mining firm Mara Holdings (Nasdaq: MARA) appear similar. They are both recognizable names in the bitcoin community with loads of BTC on their balance sheets. Strategy has roughly ten times more bitcoin, but other than that, both firms employ the same approach: hoarding the cryptocurrency to maximize bitcoin yield. But according to Vaneck’s Head of Digital Assets Research, Matthew Sigel, Mara is in a much weaker position, and as bitcoin flounders, the mining giant will be fighting stronger headwinds.

“MSTR and MARA are worth comparing because both are down ~50%+ in the last 6 weeks,” Sigel wrote on Thursday. “MARA appears extremely cheap with unusually high short interest. But dig deeper and the picture changes quickly.”

What Sigel is referring to is the difference in debt structure between the two companies. Back in August 2020, Strategy had an enormous pile of surplus cash lying around. Chairman Michael Saylor thought it would be a good idea to buy bitcoin and earn a higher return than what was being offered by traditional assets at the time. Strategy eventually pivoted from developing business intelligence software to accumulating bitcoin and is now the largest corporate holder of the cryptocurrency. One approach the company employed was issuing convertible debt to purchase bitcoin. The tactic was so successful that a slew of other companies followed suit, including Mara.

Read more: This Former Cash App Executive Is Sounding the Alarm on Bitcoin

The mining firm has now issued approximately $3.3 billion in convertible bonds, according to its latest financials. This didn’t raise any alarm bells when bitcoin was rallying, but at $88K, things are starting to get a little shaky. Share price has fallen by about 50% as Sigel noted. But that doesn’t make Mara a cheap buy because its enterprise value has ballooned, thanks to the billions owed in debt. Those outstanding bonds have jacked up Mara’s mNAV, a metric that tracks enterprise value relative to the value of a company’s bitcoin holdings. In other words, investors are paying way more for Mara stock than can be justified by its BTC stash.

“MARA only screens inexpensive if you ignore its $3.3B face value of convertible debt,” says Sigel. “It’s trading at a premium once debt is included.”

(Mara’s mNAV is significantly higher than MSTR’s, making it a riskier and less attractive option for investors. / bitcointreasuries.net)

To be clear, Strategy is also trading at a premium, but a much smaller one. Bitcointreasuries.net shows Mara’s mNAV at 1.59 while MSTR’s is at 1.14. Bitcoin’s shenanigans over the past few weeks have placed both firms in a precarious position. But Mara has a messier debt structure that clouds the correlation between its stock price and the value of bitcoin. And despite the current hullabaloo around Strategy’s finances, Sigel says more people should be worried about Mara.

“MARA is up 30% from the lows and running into resistance so I sold some today and added to MSTR,” Sigel said.

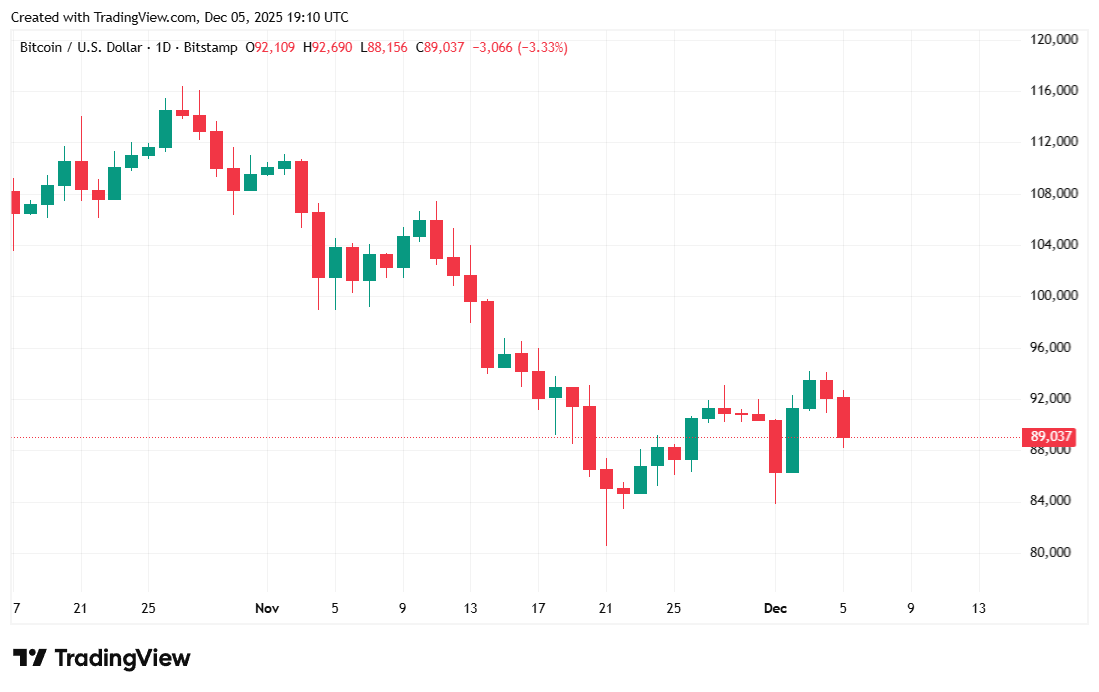

Bitcoin was priced at $89,018.14 at the time of writing, down 3.14% from yesterday’s price and also down 1.96% over seven days, according to Coinmarketcap data. The digital asset’s price fluctuated between $88,152.14 and $92,707.20 over the past 24 hours.

( BTC price / Trading View)

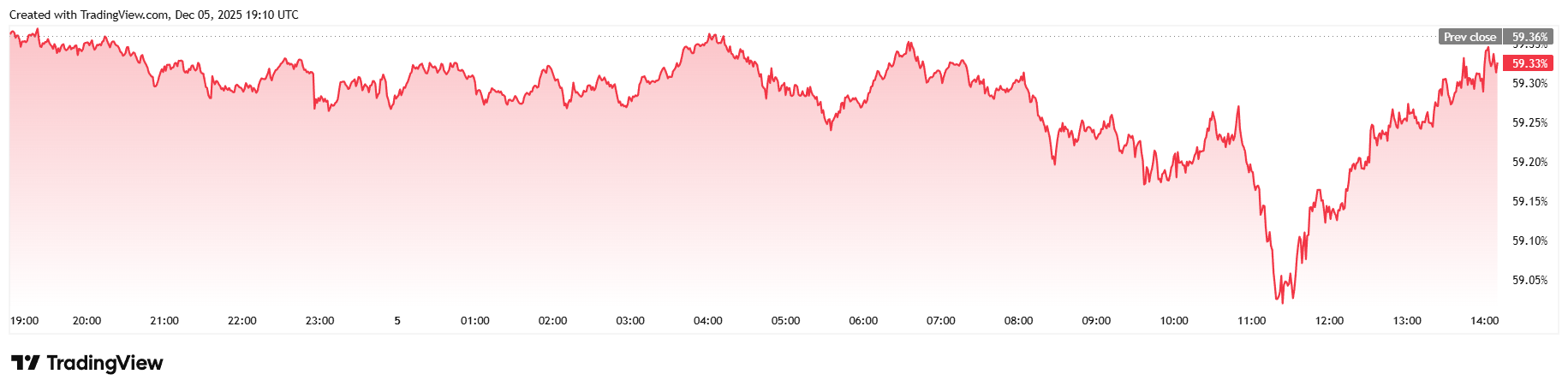

Daily trading volume was down 2.04% at $64.18 billion and market capitalization eased to $1.77 trillion. Bitcoin dominance edged lower, shedding 0.07% to reach 59.33%.

( BTC dominance / Trading View)

Total bitcoin futures open interest fell 3.88% to $57.40 billion, according to data from Coinglass. Total liquidations doubled over 24 hours and stood at $192.56 million at the time of reporting. Long investors dominated that amount with $170.76 million in liquidated margin. Short sellers were largely spared and only saw $21.79 million wiped out.

- Why does VanEck’s Matthew Sigel think MARA is in worse trouble than MSTR?

Sigel argues that MARA’s $3.3B in convertible debt makes the company far riskier than it appears, especially with bitcoin now under $90K. - How does MARA’s debt affect its valuation compared to its bitcoin holdings?

Once its massive debt load is included, MARA trades at a steep premium to the value of its BTC, making it far more expensive than headline numbers suggest. - Why is MSTR considered a cleaner bet on bitcoin than MARA?

MSTR holds more BTC with a simpler capital structure, giving it a higher correlation to bitcoin and fewer distortions from leverage. - What does Sigel recommend based on current market conditions?

Sigel says he is reducing exposure to MARA and adding to MSTR, calling MARA’s rally “resistance” and warning that its risks are underappreciated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。