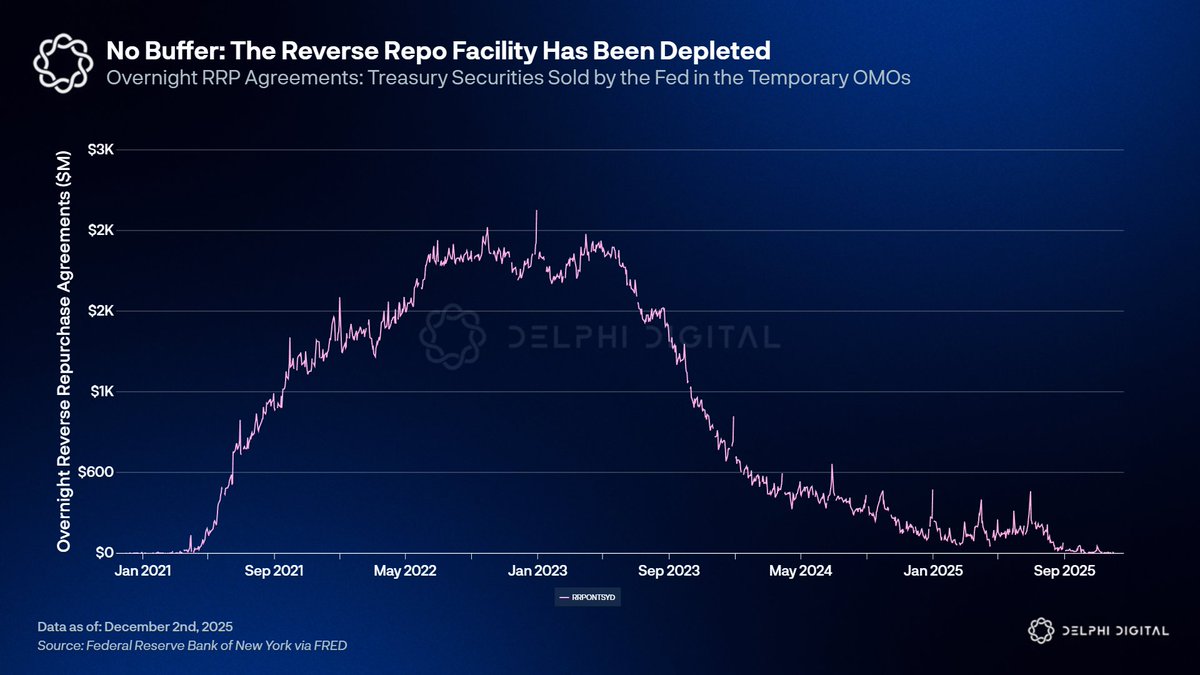

The Fed's liquidity buffer is gone.

Reverse Repo Balances collapsed from over $2 trillion at the peak to practically zero.

In 2023, the RRP was full enough to cushion the TGA refill by absorbing Treasury issuance instead of draining bank reserves. With the RRP now at the floor, that buffer no longer exists.

Any future Treasury issuance or TGA rebuild has to come directly out of bank reserves. The Fed is left with two options: let reserves drift lower and risk another repo spike or expand the balance sheet to provide liquidity directly.

Given how badly 2019 went, the second path is far more likely. That would mean the Fed shifts from draining liquidity to adding it back to the market, a meaningful pivot from the past two years.

Combined with QT ending and the TGA set to draw down, marginal liquidity is turning net positive for the first time since early 2022. A key headwind for crypto could be fading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。