Practicality First: Building the Cornerstone of a Trillion-Dollar Economy

Author: yq_acc

Translation: Plain Language Blockchain

## I. The Shift from Philosophical Infrastructure

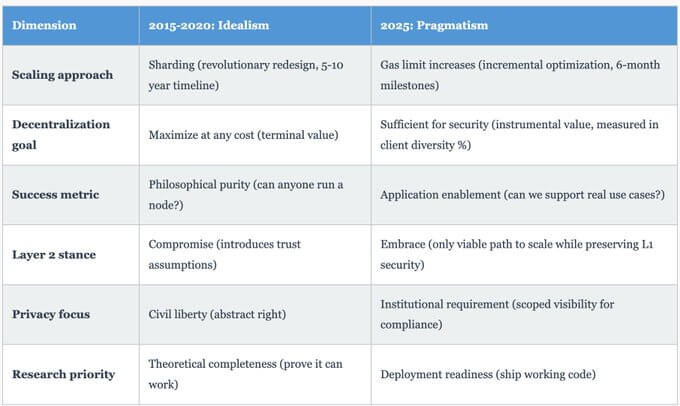

Since the launch of Ethereum in 2015, its vision has been rooted in the cypherpunk movement, prioritizing decentralization, censorship resistance, and trust minimization as ultimate values (the goal itself).

However, by 2025, these indicators have shifted to instrumental value (means to achieve practical purposes), such as eliminating counterparty risk, achieving global financial inclusivity, and reducing operational costs. The crux of this shift lies in idealism asking, “How decentralized can we achieve?” while pragmatism asks, “How much decentralization is needed to solve this problem?”

At the 2025 Argentina Devconnect conference, the change was undoubtedly evident. Researchers and application builders from the Ethereum Foundation focused their strategic efforts on pragmatic infrastructure improvements aimed at supporting practical applications while abstracting the pursuit of perfection in protocols.

In April 2025, the Ethereum Foundation underwent a strategic reorganization centered around three specific priorities:

Scaling Layer 1 by increasing the Gas Limit.

Scaling Blob data availability through configuring PeerDAS.

Improving user experience through cross-chain interoperability.

Specific implementations include: the Gas Limit being doubled from 30 million to 60 million in the December 2025 (Fusaka upgrade); the number of validators exceeding 1.1 million, with approximately $70 billion in ETH staked to secure the network.

II. Layer 1 Scaling: Gradual Optimization of Hardware Architecture Revolution

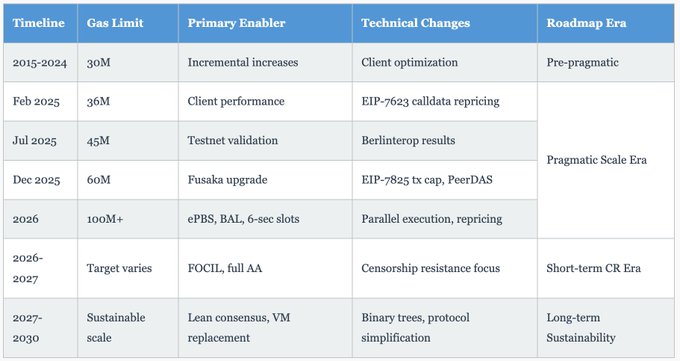

The foundation abandoned years of shard research, opting instead for a goal of tripling throughput annually through orderly client optimizations and queued protocol adjustments.

Gas Limit Expansion Strategy

The Gas Limit expansion underwent three steps in 2025, ultimately fixed at 60 million in the Fusaka upgrade in December 2025:

30M to 36M (February 2025)

36M to 45M (July 2025)

45M to 60M (November 2025)

Client performance benchmarks (for 60 million Gas blocks):

Geth (approximately 60% validator market share): 3.0 (20M gas/second)

Nethermind (fastest): 2.4 seconds (25M gas/second)

All implementations remained within the critical threshold of 4 seconds, ensuring cognitive security. The threshold has shifted from original execution speed to state access patterns and disk I/O. At 60 million Gas, the state grows by approximately 60 gigabytes (GB) annually.

PeerDAS and Blob Expansion

The second major strategic focus is expanding Blob data availability, directly serving Layer 2 (L2) Rollups.

Currently: Each block supports 3 to 6 Blobs (384KB to 768KB).

PeerDAS (Peer Data Availability Sampling): Deployed in the Fusaka upgrade, recently able to partition 16 Blobs, achieved through Reed-Solomon error correction codes. It can enhance Rollup data availability by more than 10 times.

Deployment Timeline: Mainnet activation in mid-2026.

ZK-EVM Proof: From Theory to Production Timeline

Multiple ZK-EVM teams (such as PSE, Scroll, Polygon) achieved an average block proof time of sub-10 seconds in 2025, a significant breakthrough compared to the 5-10 minutes in 2024.

Goal: Achieve real-time proof (under 12 seconds).

Production Deployment Timeline: Gradual, expected to achieve full ZK-EVM from 2027 to 2030.

III. Cross-Layer Interoperability: Addressing L2 Fragmentation

Currently, over 50 Layer 2 chains have achieved an aggregated throughput of over 100,000 TPS, but fragmentation severely impacts user experience and liquidity. For example, transferring assets from Arbitrum to zkSync to purchase an NFT requires a 7-day bridge through Layer 1, incurring a $35 Gas fee.

Ethereum Interoperability Layer (EIL)

EIL is collaboratively developed by teams like Arbitrum and Optimism, based on ERC-4337 account abstraction, utilizing Merkle tree batching authorization to achieve single-signature cross-chain operations.

Efficiency Improvement: Reducing the traditional bridging time of 7+ days and $35+ cost to approximately 1 minute weekly, with a fee of about $5 (0.1% fee).

Foundation: ERC-4337 replaces traditional externally owned accounts with fast smart contract accounts, supporting ERC-20 Token payments for Gas, social recovery, etc. By November 2025, security reports indicated over 10 active smart accounts.

Rapid Finality Confirmation and 6-Second Slots

Rapid Confirmation Rules (Q1 2026 Deployment): Providing 95% certainty within 1-2 blocks (12-24 seconds), eliminating the need to wait 13 minutes for economic finality.

Long-term Plan: Reducing the time slot from 12 seconds to 6 seconds. Combined with rapid confirmation rules, effective finality confirmation time will range from 6 to 12 seconds.

IV. DeFi Infrastructure: $300 Trillion Credit Opportunity

Stani Kulechov proposed the theory of “Financial Finance,” positioning decentralized credit markets as a $300 trillion global opportunity.

Aave Horizon Protocol

This protocol aims to transform traditional credit (e.g., local credit history, legal enforcement) into assets that can participate in global DeFi liquidity.

Mechanism: Local credit analysts assess borrowers, tokenizing loan budgets into tokenized batches for on-chain trading. DeFi liquidity providers purchase these batches, thereby saving the returns of local credit markets.

Argentina's Commitment: Tokenizing receivables in Argentina to offer to global DeFi investors, with annual interest rates ranging from 15% to 25%.

Atomic Settlement and Focused Composability

Ethereum's atomic settlement completes within 12 seconds, with costs on Layer 2 below $5, representing a 99.9% improvement in time and cost compared to traditional finance's T+1/T+2 settlements.

Traditional Settlement: Involves 20 manual steps, with a 5% to 10% failure rate.

Atomic Composability: Enables financial products that traditional systems cannot achieve, such as cross-zombie networks.

Privacy Infrastructure and Range Visibility

Privacy has become a major barrier to institutional adoption. Institutions require “range visibility”: different stakeholders view different subsets of data based on roles and permissions.

Technical Solutions: Utilizing Aztec and other tree Layer 2 chains, zero-knowledge proofs for key disclosure, and multi-party computation.

Current Status: The BlackRock BUIDL Fund reached $500 million in assets by November 2025, but requires permissioned access and off-chain reporting to maintain privacy.

Expected: Local privacy features expected to go live in 2026 will unlock more institutional deployments, potentially reaching $100 billion in tokenized assets by 2027.

V. Autonomous Agent Economy: ERC-8004 and x402

Agent Day proposed a complete infrastructure for the AI agent economy.

ERC-8004: Portable and Convenient Infrastructure

Function: Extends the ERC-721 standard, providing each agent with a unique TokenID and accumulating performance metrics (task count, success rate, etc.) as portable supplements.

Mechanism: On-chain storage structure load support, with off-chain infrastructure indexing complete performance data, requiring Merkle proofs to verify performance claims.

x402: Payment Displacement Authentication

Problem: Autonomous agents struggle with the manual interactive authentication required for traditional API access (e.g., CAPTCHA, key management).

Solution: Using payment displacement authentication. Agents only need to pay a specified amount of cryptocurrency to access resources.

Process: The server responds with HTTP 402 (Payment required), including payment details. After payment, the agent re-requests resources using transaction hash as proof of payment.

VI. Institutional Adoption: Counterparty Risk and Cryptoeconomic Security

Wall Street actively demands decentralization, viewing it as a solution to counterparty risk, operational inefficiencies, and regulatory burdens.

$70 Billion ETH Economic Security

Ethereum's atomic settlements eliminate counterparty reliance through settlement cryptography.

Cost/Time Improvement: Layer 2 costs are below $5, with a failure rate close to 12 seconds atomic execution, reducing the fund lock time by 99.99% compared to T+2 settlements.

Economic Security: Approximately $70 billion in staked ETH provides economic security. Attackers must not only target the code but also acquire 51% of the stake, which is costly and economically unfeasible.

Achieving 100% Uptime Through Client Diversity

Ethereum ensures its infrastructure never stops running through client diversity.

Architecture: Four independent load clients (Geth, Nethermind, Besu, Erigon) and five consensus clients (Prysm, Lighthouse, etc.).

Reliability Record: Since the September 2022 merge, Ethereum has maintained 100% uptime, a reliability record that surpasses traditional financial market standards.

VII. From Idealism to Pragmatism: What Changed

This shift represents the ultimate goal of the philosophical change towards instrumental means:

Decentralization: From abstract principles to measurable security attributes (client diversity, geographic distribution, economic analysis).

Censorship Resistance: Transitioning from social opinion to game-theoretic mechanisms (whitelisting, separation of proposers and builders) set in economically unfeasible terms.

Gaining Trust: Means quantifying security assumptions (how much stake corruption is needed to restore finality) and providing cryptographic proofs.

This pragmatic shift is reflected in the technical content, emphasizing performance benchmarks (20-25M Gas/second), deployment timelines (Fusaka Q4 2025), and user experience improvements (EIL 1-minute cross-chain).

VIII. Conclusion: Infrastructure Ready for Applications

The 2025 Argentina Devconnect conference showcased Ethereum Foundation's decisive shift towards application infrastructure. The technical demonstrations focused on solving specific problems with clear timelines:

Cross-chain liquidity fragmentation: EIL to be deployed in mid-2026.

DeFi privacy needs: ZK-Rollup encrypted states to be put into production in 2026-2027.

Agent payment infrastructure: x402 and ERC-8004 to launch in Q1 2026.

Throughput capacity: PeerDAS in the Fusaka upgrade.

The strategy reflects decades of valuable lessons: protocol reforms are often so deep, while application layer innovations (DeFi Summer, NFTs) can create tremendous value on existing infrastructure.

Looking ahead, this pragmatic infrastructure will:

Achieve 300 million gas throughput by 2028.

Realize privacy-preserving smart contracts in 2026-2027.

Enable seamless cross-chain operations through EIL by mid-2026.

Maintain institutional-grade reliability (100% uptime).

Ethereum has transitioned from philosophical purity to deployable solutions, replacing abstract decentralization with measurable security attributes, and is preparing the infrastructure to support trillions of dollars in economic activity.

Article link: https://www.hellobtc.com/kp/du/12/6150.html

Source: https://x.com/yq_acc/status/1995598311081054664

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。