Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The market is closely watching the future direction of U.S. monetary policy. President Trump has made it clear that he plans to nominate a new Federal Reserve chairman in early 2026, hinting that National Economic Council Director Kevin Hassett is his preferred candidate. Trump has long criticized current Chairman Powell for being slow to act on interest rate cuts and hopes that his successor will more aggressively push for easing policies. Although the final candidate must be confirmed by the Senate, and the list includes senior figures like Christopher Waller and Michelle Bowman, the market's focus has already shifted to a potential policy shift in the future.

Meanwhile, Amazon's cloud computing division, AWS, launched the next-generation AI chip Trainium 3 at its annual conference and previewed Trainium 4, which will support NVIDIA's NVLink. AWS also released the Nova 2 series models and several innovative services, aiming to further challenge NVIDIA and Google's market position in the AI field. This move boosted Amazon's stock price, while NVIDIA and AMD faced pressure. Overall, despite the recent strong performance of U.S. stocks, macroeconomic uncertainty, intensified tech competition, and diverging market sentiment leave future trends full of variables.

The Bitcoin market has recently experienced significant volatility, rebounding strongly after a price drop to $83,800, returning above $93,800, sparking heated debates among analysts about future trends. Optimists believe a new round of upward momentum may have begun. Analyst Michaël van de Poppe pointed out that breaking through $92,000 is key to testing the $100,000 mark. Nick Ruck also stated that thanks to macro positives like expectations of Fed rate cuts and ETF fund inflows, Bitcoin is expected to return to $100,000 in the coming months. A report from Bitwise analyzes Bitcoin's current value from the perspective of global money supply, arguing that it is severely undervalued, with a fair value close to $270,000. Technical analysts Man of Bitcoin and Axel Bitblaze also hold positive views, with the former setting a target price of $96,965 and the latter suggesting that $80,000 may already be the cycle bottom, with a potential breakthrough of $100,000 by the end of the year, noting that short liquidations above $93,000 could act as a catalyst for the rise.

However, the market is also filled with cautious and bearish voices. Bloomberg analyst Mike McGlone warned that Bitcoin could revisit $50,000. BRN research director Timothy Misir observed that the slowdown in whale wallet accumulation while retail investors accelerate buying is a typical sign of late-cycle vulnerability. Analyst Murphy emphasized that if the price falls below $80,000, it would lead to many long-term holders turning to losses, triggering price sensitivity risks. Additionally, F2Pool data shows that at the current price level, most older mining models are in a loss shutdown state, which poses potential selling pressure on the market. Technically, analysts are generally focused on the key support area of $86,000-$88,000, and a drop below this level could trigger a broader sell-off. Furthermore, the market is profoundly influenced by traditional finance and the real economy; for instance, Strategy updated its earnings expectations for the fiscal year 2025 based on Bitcoin's price range, with its revenue targets closely tied to whether Bitcoin can stabilize in the $85,000 to $110,000 range.

The Ethereum market is also facing a critical decision, with its price rebounding above $3,000, but market sentiment remains generally skeptical. Derivatives market data shows that the annualized premium for Ethereum futures remains low at 3%, while the premium for put options relative to call options is expanding, indicating that traders are still actively hedging against downside risks and lack confidence in further price increases. Fundamentally, the Ethereum network is facing challenges, with weekly network fees plummeting by 49% and DEX trading volume shrinking. Against this backdrop, analysts have provided different price path forecasts. Bearish views suggest that if the price loses key support, it may face a deep correction. Glassnode's MVRV model indicates that if it falls below the support band around $2,820, the next target will be $2,500. The "bearish pennant" pattern on the daily chart points to the $2,200-$2,220 area. However, there is still hope for an upward movement in the market. Analyst Don pointed out that the "descending wedge" pattern retains the possibility of a rebound to $3,550. Man of Bitcoin predicts that the price may rise to $3,216 based on Fibonacci retracement levels. Analyst Wolf believes the market is approaching a critical point, with the head-and-shoulders neckline around $3,700, and whether it can break through this position will determine if the bull market can continue.

2. Key Data (as of December 3, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $93,546 (YTD -0.34%), daily spot trading volume $89.26 billion

Ethereum: $3,023 (YTD -7.12%), daily spot trading volume $29.26 billion

Fear and Greed Index: 28 (Fear)

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

Market share: BTC 58.7%, ETH 11.6%

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, SOL, SUI

24-hour BTC long-short ratio: 51.32% / 48.68%

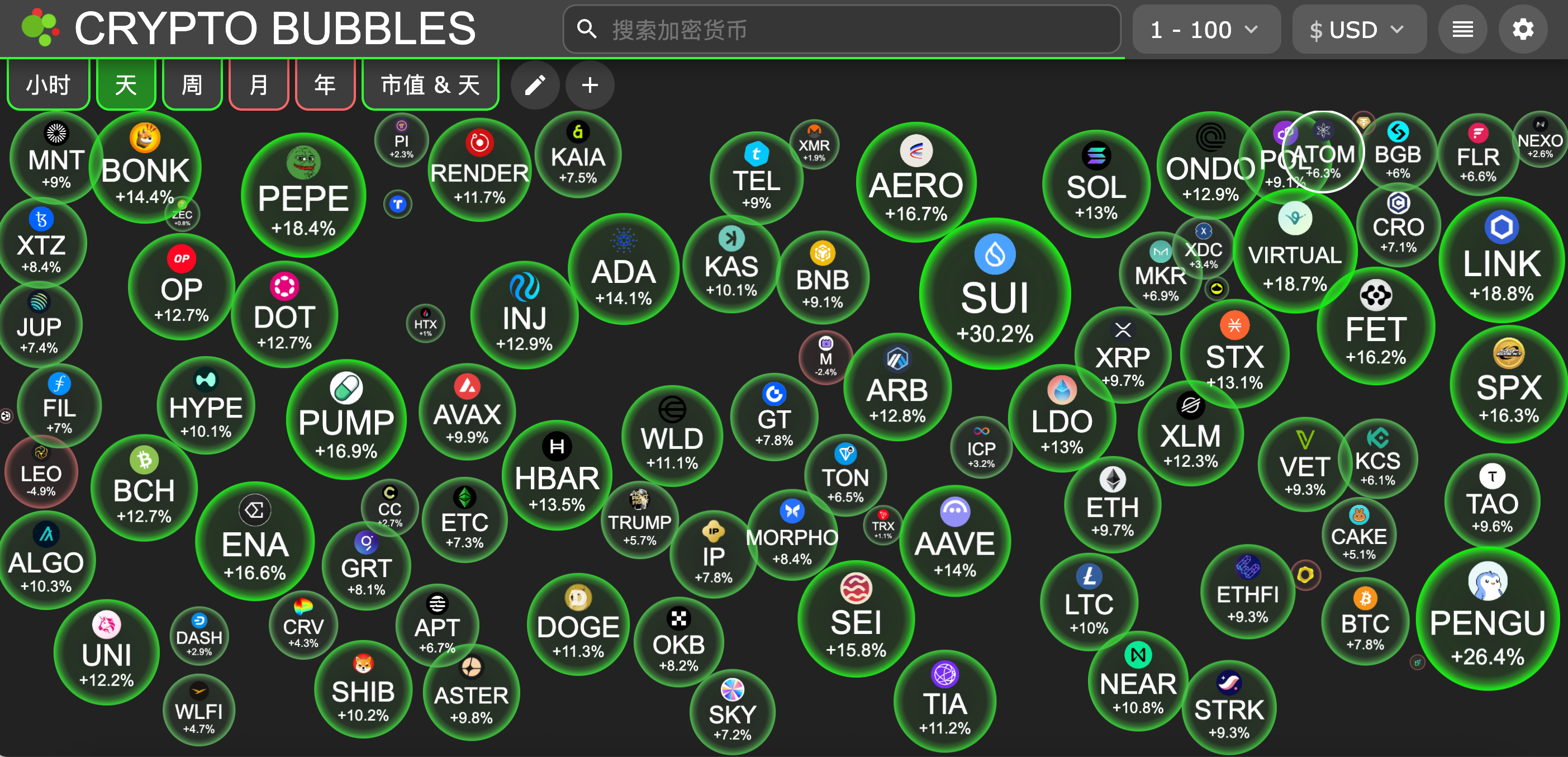

Sector performance: The crypto market rebounded across the board, with a general increase of about 3% to 12% in 24 hours, with the NFT sector rising by 11.87%

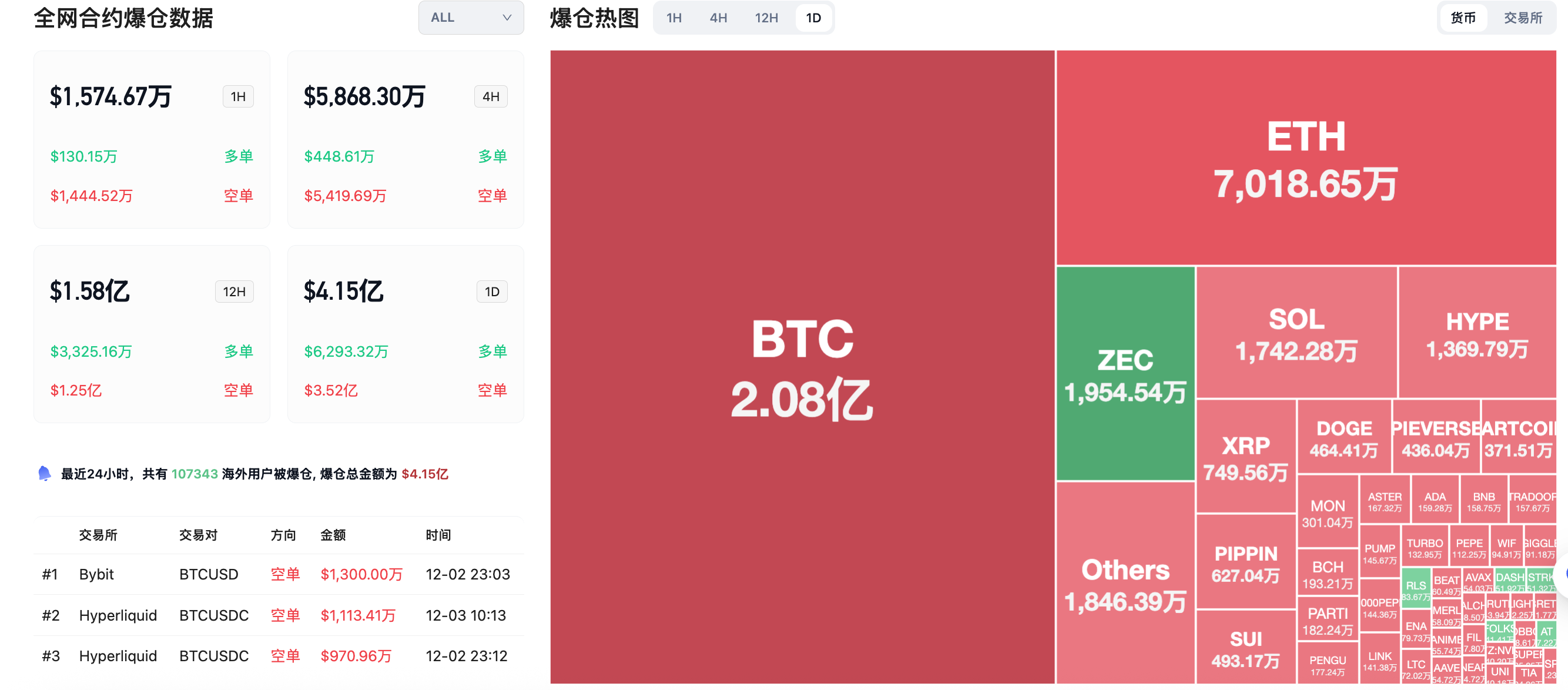

24-hour liquidation data: A total of 107,343 people were liquidated globally, with a total liquidation amount of $415 million, including $208 million in BTC, $70.18 million in ETH, and $19.54 million in ZEC.

3. ETF Flows (as of December 2)

Bitcoin ETF: +$58.4995 million

Ethereum ETF: -$9.9121 million

Solana ETF: +$45.77 million

XRP ETF: +$67.74 million

4. Today's Outlook

HumidiFi's WET token will be issued on December 3 through the Jupiter DTF platform

Ethereum developers have officially set the upgrade target date for Fusaka to December 3

Coinbase will launch Dash perpetual contract trading on December 4

The largest gainers among the top 100 cryptocurrencies today: Sui up 30.2%, Pudgy Penguins up 26.4%, Chainlink up 18.9%, Virtuals Protocol up 18.7%, Pepe up 18.5%.

5. Hot News

Binance will delist 15 spot trading pairs on December 5, including ACH/BTC, WAXP/BTC, etc.

BitMine's new wallet received over 30,000 ETH from Kraken, worth approximately $91.75 million

USDC Treasury mints an additional 500 million USDC on the Solana chain

CME launches Bitcoin Volatility Index, similar to the VIX in the stock market

Coinbase adds five new tokens to its listing roadmap, including WET, ZKP, and PLUME

Tether Treasury mints an additional 1 billion USDT on the Tron network

Analysis: Suspected insiders of PIPPIN control half of the supply, valued at $120 million

Coinbase 50 Index adds 6 new projects: HBAR, MANTLE, VET, FLR, SEI, and IMX

Vanguard opens cryptocurrency ETF trading, supporting mainstream assets like BTC and ETH

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。