Author: zhou, ChainCatcher

On December 1, Hong Kong licensed digital asset trading platform HashKey passed the listing hearing at the Hong Kong Stock Exchange, just one step away from going public. The joint sponsors for this IPO are JPMorgan and Guotai Junan.

1. Revenue Explosion: Trading Facilitation Services Account for Nearly 70%

The prospectus shows that HashKey is a comprehensive digital asset platform, with core businesses including trading facilitation services, on-chain services, and asset management services. The platform has the capability to issue and circulate tokenized real-world assets (RWA) and has launched the HashKey chain—a scalable, interoperable Layer 2 infrastructure to support on-chain migration.

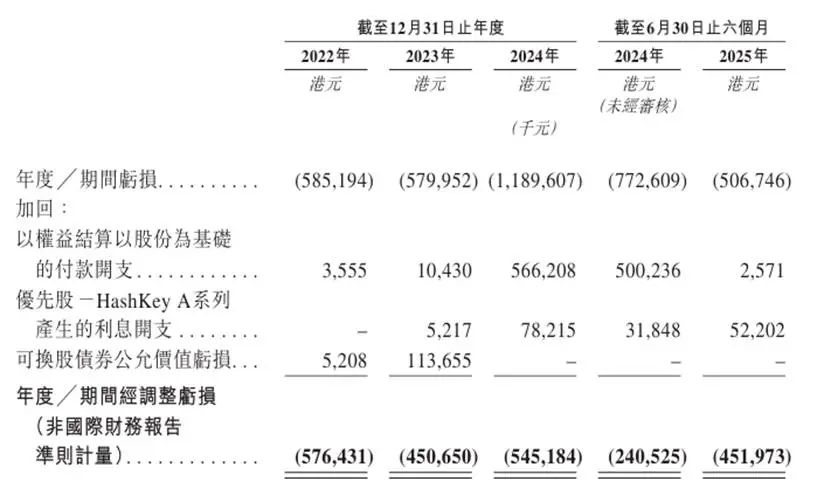

During the reporting period, the company's total revenue experienced explosive growth, increasing from HKD 129 million in 2022 to HKD 721 million in 2024, nearly a sixfold increase over two years. However, on the other side of this rapid revenue growth, the company remains in a continuous adjusted net loss state (cumulative loss of HKD 1.57 billion from 2022 to 2024).

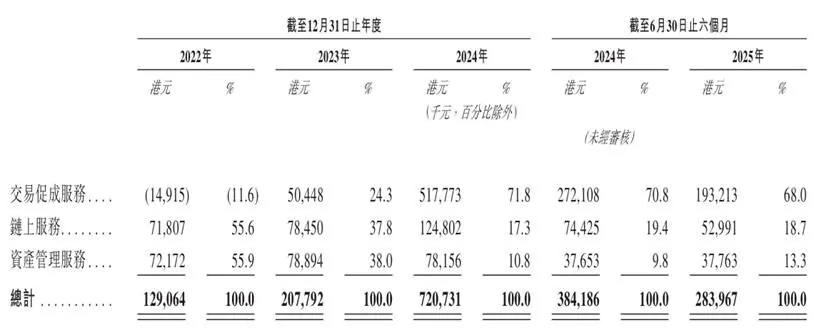

The company's revenue mainly comes from three major sectors: trading facilitation services, on-chain services, and asset management services. Among these, the core driver of revenue growth comes from trading facilitation services.

This business has successfully turned from loss to profit, jumping from a loss of HKD 14.915 million in 2022 to a positive revenue of HKD 518 million in 2024, accounting for 68% of total revenue in the first half of 2025. This growth is primarily due to HashKey's compliance first-mover advantage gained through licensed operations in Asia, particularly in the Hong Kong market.

According to data from Sullivan, HashKey holds over 75% market share among onshore digital asset platforms in Hong Kong, maintaining an absolute leading position. As of September 30, 2025, the platform's assets have surpassed HKD 19.9 billion, supporting trading of 80 types of digital asset tokens.

Another part of HashKey's revenue comes from on-chain services, which have a compound annual growth rate of 32%. The company provides a comprehensive suite of on-chain services, integrating blockchain staking infrastructure, tokenization capabilities, and blockchain-native development.

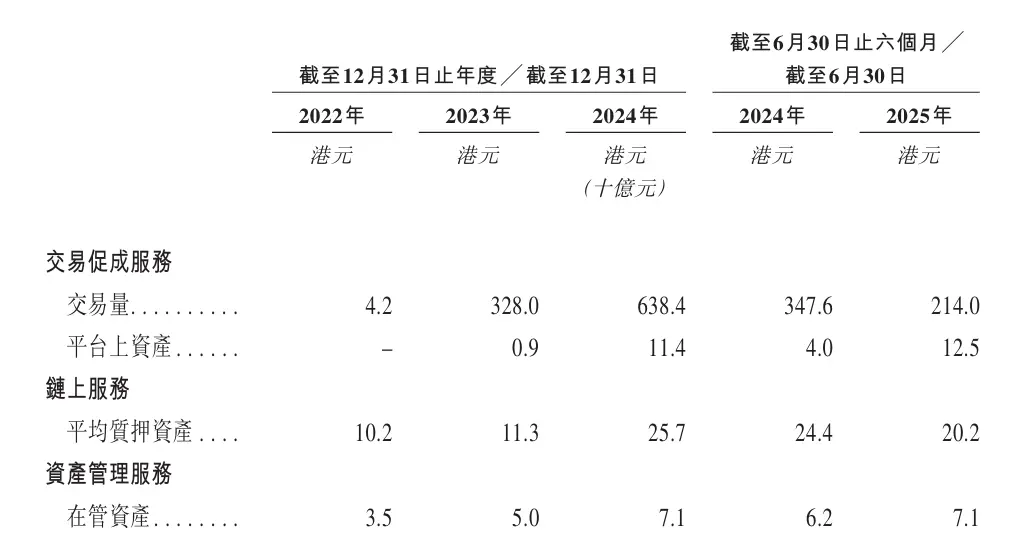

As of September 30, 2025, it has HKD 29 billion in staked assets, and the total value of real-world assets on the HashKey chain has reached HKD 1.7 billion. The company has become the largest staking service provider in Asia and the eighth largest globally.

In terms of asset management services, HashKey offers digital asset investment opportunities to institutional clients, covering venture capital and secondary fund investments. As of September 30, 2025, the company's assets under management have accumulated to HKD 7.8 billion since its establishment. As of December 31, 2024, the company is the largest asset management service provider in Asia by assets under management.

HashKey claims that its fund investment return rate exceeds 10 times, more than double the industry average. However, as the trading business scales up, the proportion of asset management revenue in the overall business has decreased from 55.9% to 10.8%, indicating a shift in the company's profit focus from earning management fees and investment income to relying on trading volume.

2. Trading Scale, User Expansion, and Equity Control

As of August 31, 2025, HashKey has HKD 1.657 billion in cash and cash equivalents, as well as digital assets valued at HKD 592 million. Among these HKD 592 million in digital assets, mainstream tokens account for 84%, including ETH, BTC, USDC, USDT, and SOL.

HashKey's trading volume surged from HKD 4.2 billion in 2022 to HKD 328 billion in 2023, and further increased to HKD 638.4 billion in 2024. This growth is attributed to the operation of its Hong Kong digital asset trading platform starting in the second half of 2023, as well as the operation of its Bermuda digital asset trading platform beginning in 2024.

However, on a semi-annual basis, the company's trading volume decreased from HKD 347.6 billion for the six months ending June 30, 2024, to HKD 214 billion for the six months ending June 30, 2025. The company explained that this was mainly due to strategic adjustments made in a sluggish market, leading to reduced trading activity among retail clients, which is also reflected in the decline in monthly trading volume among retail clients during the same period.

Looking at monthly trading clients, the number of retail monthly trading clients in 2024 was 15,967, with both monthly trading volume and number of trading clients contracting in the first half of 2025; meanwhile, the number of institutional monthly trading clients increased from 31 in 2022 to 273 in the first half of 2025, and the number of Omnibus monthly trading clients expanded from 1 in the first half of 2024 to 8 in the first half of 2025, indicating an increase in the stickiness and participation of institutional and Omnibus clients on the platform.

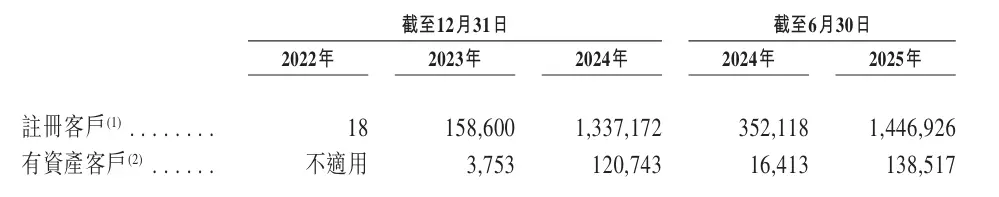

In terms of user base, the number of registered clients surged from 18 in 2022 to approximately 1.447 million as of June 30, 2025; among them, the number of asset clients jumped from 3,753 in 2023 to 120,700 in 2024, reaching 138,500 as of June 30, 2025. Against the backdrop of a temporary contraction in trading volume, the platform's registered and funded user base has expanded; the prospectus also disclosed that the retention rate of asset clients on the platform is as high as 99.9%.

In terms of equity, after the IPO, HashKey will have four parties jointly constituting the controlling shareholders: non-executive director Lu Weiding (referred to as "Mr. Lu" in the prospectus), GDZ International Limited, HashKey Fintech III, and Puxing Energy Limited (stock code: 00090). Mr. Lu also serves as the chairman and actual controller of Wanxiang Group, one of China's largest private auto parts suppliers.

Before the IPO, Mr. Lu held 42.47% of HashKey's shares through GDZ International, 0.7% through HashKey Fintech, and 0.02% through Puxing Energy Limited, totaling an indirect control of approximately 43.19% of HashKey's equity, and can exercise about 22.92% of the voting rights through the employee stock ownership plan platform. This means that the company's controlling shareholders have a highly concentrated control over the company, both through direct holdings and indirectly locking in a significant amount of voting rights through the employee stock ownership platform.

In terms of client structure, the revenue share of the company's top five clients rapidly decreased from nearly 80% in 2022 to 18.5% in 2024, significantly lowering client concentration. However, the early business had a high dependency on related parties; during the historical performance period, HashKey Fintech III, GDZ International Limited, and HashKey Fintech II were all among the company's top five clients and were related parties of the controlling shareholders.

On the supply side, Wanxiang Blockchain entities were among the top five suppliers in 2022, 2023, 2024, and for the six months ending June 30, 2025, and were related parties of one of the company's shareholders. This indicates that HashKey's early development of clients and suppliers was closely tied to related parties, lacking a certain degree of independent commercialization capability.

3. Future Growth Story: Building "Super App + Infrastructure Output"

From the planning disclosed in the prospectus, HashKey's future growth story revolves more around enhancing the main line of trading by building a super app, outputting infrastructure, and developing its own public chain to amplify the existing matching business.

On one hand, the company plans to create a super app (SuperApp) that gradually introduces more exchange products and services based on its existing spot business, including derivatives, perpetual contracts, and tokenization and trading of stocks/bonds, to enhance market liquidity and expand exchange functionality, allowing high-net-worth and institutional clients to complete more complex asset allocation and trading strategies on the same platform. Along with the proposed launch of a crypto debit card and an OTC marketplace for institutions, HashKey aims to lock in users' funds and trading needs as much as possible within its ecosystem, increasing fund retention and turnover rates.

On the other hand, HashKey is packaging its compliance and technical capabilities to output as infrastructure. The company's proposed Crypto-as-a-Service (CaaS) solution provides enterprise clients with a complete set of standardized tools, including APIs and smart contract protocols, allowing banks, brokerages, or other platforms to directly access its matching, custody, and clearing capabilities. Theoretically, this can bring in technical service revenue and is expected to introduce more institutional orders and trading volume, feeding back into the core matching business.

In line with the above layout, HashKey has also launched a Layer 2 infrastructure for real-world assets (RWA)—the HashKey chain—to support asset on-chain and tokenization trading. As of September 30, 2025, the scale of on-chain RWA is approximately HKD 1.7 billion. In the future, the company plans to monetize this infrastructure through gas fees, staking, etc., while connecting on-chain assets with the trading platform to form a closed loop of "public chain + exchange + institutional services," thereby adding a medium to long-term growth curve to trading revenue.

4. Continued Losses and Financial Leverage: Hidden Concerns Behind Growth

Despite the impressive performance in market share and revenue growth, HashKey's financial statements reveal structural challenges and potential risks it faces during its rapid expansion.

Profitability Dilemma and High Operating Costs

In 2024, the company's adjusted net loss expanded to HKD 545 million, primarily due to a significant increase in operating costs and expenses related to the HSK token, which rose from HKD 70.8 million in 2023 to HKD 177 million in 2024. In addition to HSK-related costs, the increasingly stringent regulatory environment, while constituting a competitive advantage, also brings high compliance costs. In the first half of 2025, the company's compliance costs are estimated to be around HKD 130 million, which is a nearly non-reducible fixed expense in a complex, multi-jurisdictional regulatory environment.

It is worth mentioning that the HSK token price has experienced a significant decline this year. The company has committed to repurchasing and destroying HSK tokens with 20% of its net profit in the market, but no repurchase has occurred during the reporting period as the conditions for repurchase have not yet been met. As of June 30, 2025, the usage rate of the HSK token was only 0.49%. This means that the vast majority of tokens have not been used for actual on-chain activities, and their real on-chain demand is still in a very early exploratory stage. In other words, HSK currently reflects more as a cost and burden in the financial statements rather than a mature, profit-generating ecosystem token.

High Debt and Financing Dependence

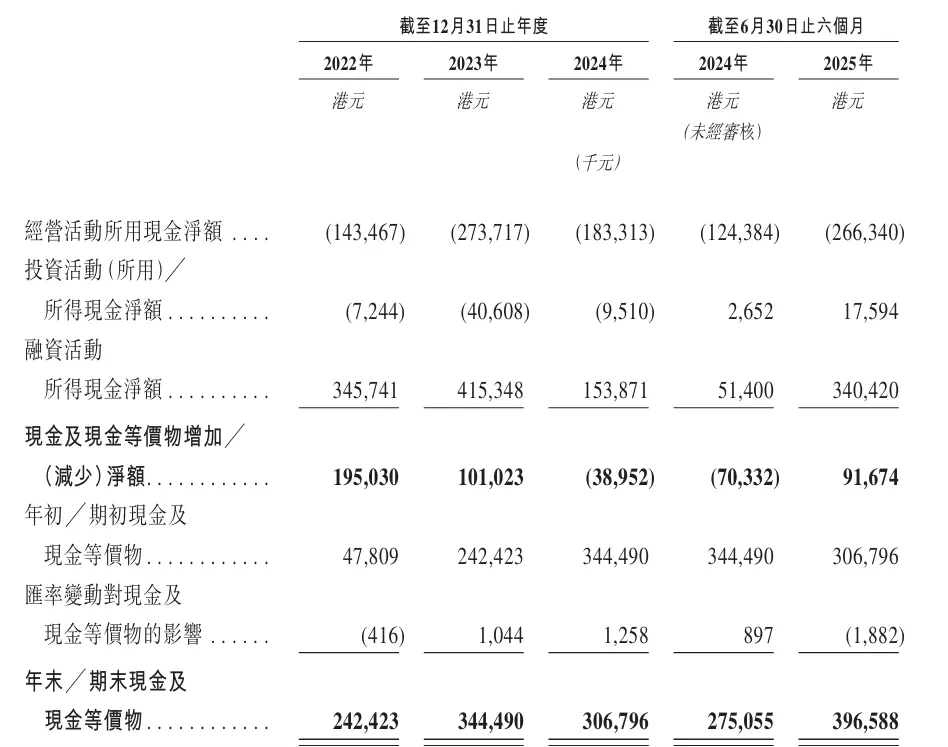

From the cash flow statement, HashKey's expansion is highly reliant on external funding. From 2022 to 2024, the net cash outflow from operating activities was approximately HKD 143 million, HKD 274 million, and HKD 183 million, respectively, with an additional outflow of HKD 266 million in the first half of 2025, indicating that the main business has yet to develop self-sustaining capabilities. Correspondingly, there has been a continuous strong inflow of cash from financing activities: HKD 346 million, HKD 415 million, and HKD 154 million from 2022 to 2024, with a staggering HKD 340 million for the six months ending June 30, 2025, primarily from financing arrangements such as issuing convertible bonds, preferred shares, and related party loans. As of June 30, 2025, the company's net debt has risen to HKD 1.582 billion, with redeemable debt balances reaching HKD 1.725 billion, indicating a high dependence on external financing for its business expansion.

Business Highly Sensitive to Market Cycles, Gross Margin Continues to Decline

HashKey's total revenue is highly correlated with platform trading volume, making its business extremely sensitive to fluctuations in digital asset prices and trading sentiment. Meanwhile, the company's overall gross margin has continued to decline, from 97.2% in 2022 to 65.0% in the first half of 2025. The decline in gross margin is primarily due to the increasing proportion of trading facilitation service revenue, which has a relatively lower gross margin, thereby diluting overall profitability.

Conclusion

In terms of exchange valuation, Coinbase has a market capitalization of approximately USD 70 billion, Kraken's latest valuation is around USD 20 billion, Upbit's parent company is valued at USD 10.3 billion, and Gemini currently has a market capitalization of about USD 1.16 billion. Placing HashKey on this valuation axis, it completed a round of strategic financing in February this year, with a valuation of approximately USD 1.5 billion.

Previous reports indicated that HashKey's IPO plans to raise USD 500 million, with an overall valuation expected to rise to around USD 2 billion. However, the compliance dividends and high growth narrative have brought HashKey to the doorstep of the capital markets, but whether it can obtain and maintain this valuation range in the future will still depend on its fundamentals.

Merely passing the listing hearing is just the first step. Next, HashKey needs to complete a series of capital market processes, including the disclosure of post-hearing materials, publication of the prospectus, public offering and international placement, book building, and pricing. If everything goes smoothly, it typically takes several weeks before it can officially be listed on the Hong Kong Stock Exchange.

Click to learn about ChainCatcher's job openings

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。