Decentralized infrastructure has the capability to support complex financial products, laying the technical and community foundation for a larger scale of traditional assets to be on-chain in the future.

Written by: ODIG

How many types of assets are being traded on-chain?

Most are crypto-native tokens, stablecoins, etc. This year has seen a significant increase in rapidly growing RWAs (Real World Assets) such as bonds, stocks, gold, and more.

Innovation continues: Recently, the leading decentralized exchange Hyperliquid launched perpetual contracts for the AI unicorn OpenAI.

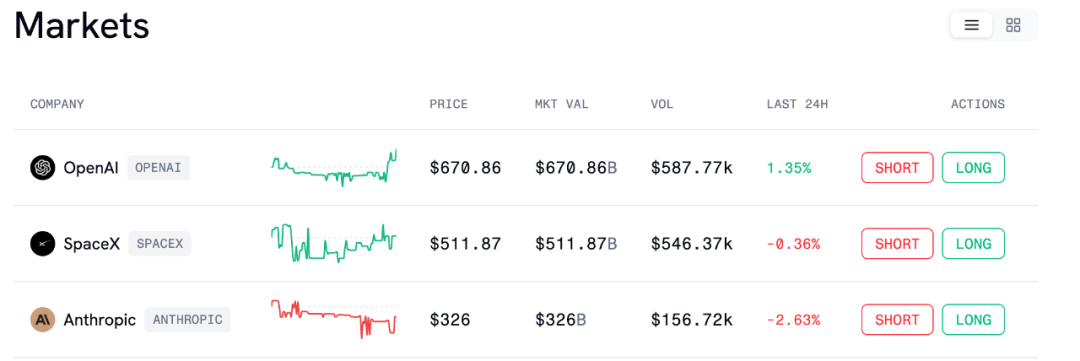

Yes, based on the Hyperliquid HIP-3 infrastructure, the decentralized derivatives platform Ventuals has deployed perpetual contracts for SpaceX, OpenAI, and Anthropic. The platform offers 3x leverage, and the open interest cap has been increased from $1 million to $3 million.

(*Hyperliquid allows builders to stake 500,000 HYPE to deploy custom perpetuals through the HIP-3 framework. It employs an economic margin and validator supervision mechanism to prevent oracle manipulation through staking penalties, while providing deployers with up to 50% fee sharing to ensure security and incentivize third-party innovation. Ventuals can be seen as a sub-project based on HIP-3.)

This token can be viewed as the "perpetual contractization" of Pre-IPO assets.

This definition is highly imaginative. In traditional financial markets, Pre-IPO equity trading is heavily regulated and extremely restricted. Combining Pre-IPO with perpetual contracts does not involve actual equity delivery but rather engages in "valuation contract games," allowing originally illiquid assets to "come into existence," thus possessing a larger market space.

The good performance is: after launch, the trading activity of the contracts has slightly increased, with both volume and price fluctuating within a certain range, reflecting a certain demand in the market for Pre-IPO asset trading.

(ventuals.com)

However, early low liquidity markets still face many challenges: Is the oracle stable? Is the risk control mechanism reliable? These are key prerequisites for its continued development.

Regardless, this year the PerpDEX track has significantly accelerated, and Pre-IPO tokens have the potential to reshape the on-chain derivatives landscape.

Hyperliquid founder Jeff estimates the perpetual contract market for "any asset" as follows: "As finance fully goes on-chain, mobile applications built for non-crypto users will create billion-dollar market opportunities."

How to view the "contractization" of Pre-IPO tokens?

Core: The authenticity and credibility of price data

As part of the RWA asset range, its feasibility depends on the standardization of the underlying assets. Pre-IPO assets have a reliable price source to some extent; how to continuously, stably, and verifiably provide prices for Pre-IPO assets that are closer to real valuations requires rigorous observation of the oracle mechanism (a third-party service tool used to obtain, verify external information, and transmit it to smart contracts running on the blockchain), which is also key for the sustainability of the entire track.

Policy arbitrage space

The regulatory environment remains ambiguous. The U.S. CFTC's innovation exemption provides a regulatory sandbox for innovative derivatives; the EU's MiCA mainly focuses on spot trading; there is still some room for innovation in perpetual contracts.

Hyperliquid's contractization and non-physical delivery method provided through HIP-3 gives liquidity to unlisted assets, which can be seen as providing an on-chain alternative for "restricted trading."

Innovations brought by crypto natives

The on-chain contract speculation valuation brought by Pre-IPO tokens can to some extent reflect retail investors' views on the valuation of private companies, thus generating broader impacts.

If the market continues to develop, it has the potential to form a "shadow market for restricted trading targets." This is a new market brought about by Web3 technological innovation.

Acceleration of competition in the PerpDEX track

From the perspective of the Perp DEX track, in order to compete for market share and liquidity, DEXs are also continuously exploring new, high-growth trading targets to attract more users.

In early data, the trading volume of Pre-IPO assets like OpenAI is relatively limited, with the main impact still concentrated at the innovative experimental level. However, if RWA-type perpetual contracts continue to be introduced, it may allow liquidity to be redistributed between crypto assets and traditional assets.

The wave of perpetual contractization of everything

2025 is a tumultuous year; on one hand, the crypto market is in a period of dense events and is very volatile; on the other hand, RWAs are on the rise, and RWA + perpetual contracts are also rapidly evolving.

This is a trend of "comprehensive perpetual contractization" from crypto assets to traditional financial instruments: prior to this, the public chain Injective made strides in the field of tokenized stock perpetual contracts, and by the first half of 2025, it had accumulated a trading volume of over $1 billion through its Helix DEX, offering leverage of up to 25 times.

Although the current trading volume of RWA perpetual contracts is relatively limited, it is becoming clear: decentralized infrastructure has the capability to support complex financial products, laying the technical and community foundation for a larger scale of traditional assets to be on-chain in the future.

This innovation will force traditional financial institutions to seriously consider how to leverage blockchain technology to reduce transaction costs, improve efficiency, and ultimately may drive the tokenization of RWAs and the development of on-chain derivatives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。