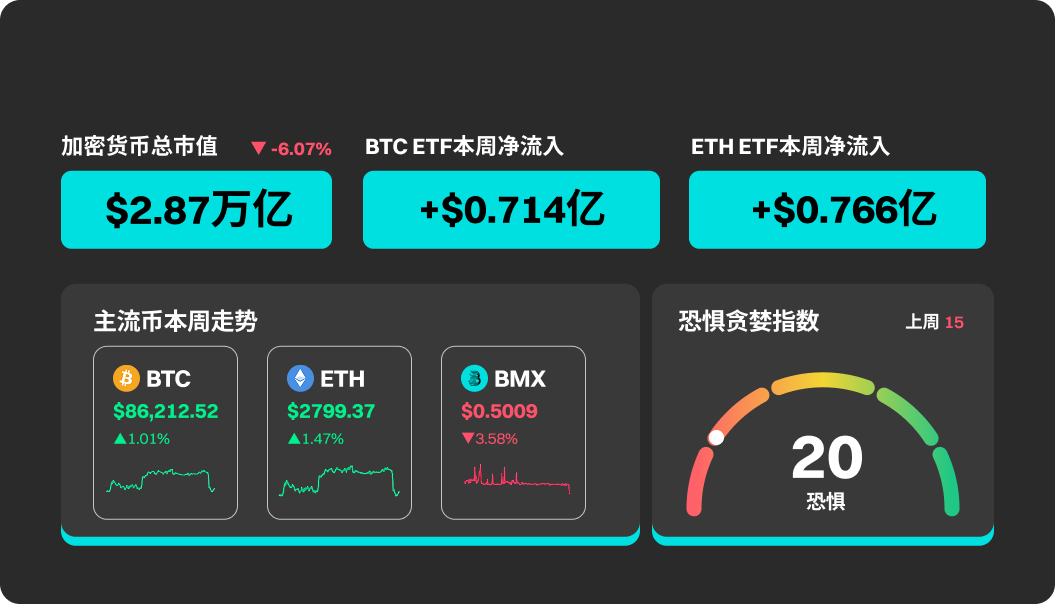

According to BitMart's market report on December 1, the total market capitalization of cryptocurrencies over the past week was $2.87 trillion, a decrease of 2.38% from the previous week.

Cryptocurrency Market Dynamics This Week

This week, the cryptocurrency market saw a slight recovery, with the selling pressure that had persisted for several weeks easing. Driven by expectations of a rate cut in December rising to about 85%, most tokens rebounded by over 5%. However, this round of recovery remains structurally significant: 79 out of the Top 100 tokens are still down more than 50% from their historical highs, with funds continuing to concentrate on BTC and mainstream assets, while established altcoins performed weakly due to a lack of structural buying. In contrast, exchanges/DEX, DeFi, and privacy sectors showed relative resilience.

The funding situation remains tight, with the growth of stablecoins, ETF inflows, and DAT issuance all slowing down, which suppresses broader rotation. Altcoin ETFs have become one of the few bright spots, continuously attracting net inflows and are expected to gradually reshape the demand structure for altcoins. On the fundamental side, Texas in the U.S. has initiated treasury purchases of BTC, and lawmakers are promoting policies to allow tax payments in BTC, which enhances adoption; however, the temporary suspension of CME, a hacking incident at Upbit, and a $11 million crypto robbery highlight security risks. Overall, the market is experiencing a mild recovery in a weak liquidity environment, but volatility remains constrained by macroeconomic factors and funding conditions.

Popular Tokens This Week

In terms of popular tokens, MYX, KAS, SPX, QNT, and SKY have all performed well.

QNT's price increased by 26.03% this week. SKY's price rose by 19.40%. KAS's price went up by 16.20%. MYX and KAS increased by 9.09% and 9.03%, respectively, this week.

U.S. Market Overview and Hot News

This week, risk sentiment in the U.S. stock market improved, with the major indices strengthening— the S&P 500 rose by 2.8%, and the NYFANG+ index approached 3%, mainly boosted by high expectations for a Fed rate cut in December. The U.S. dollar index fell by 0.54% due to weak employment data, while USD/JPY slightly retreated, with the yen strengthening under safe-haven demand. In commodities, gold rose by 2.88% driven by rate cut expectations; oil prices fluctuated, with supply signals still unclear. The yield on the U.S. 10-year Treasury bond fell due to weak data, but heavy issuance still exacerbated interest rate volatility. Market volatility significantly decreased—VIX and MOVE both fell, influenced by light trading during the Thanksgiving holiday and improved sentiment. Overall, market sentiment is cautiously optimistic, with macroeconomic uncertainty easing somewhat, but liquidity remains low.

On December 3, licensed virtual asset management company Pando officially announced that its Ethereum ETF will be listed on the Hong Kong Stock Exchange on December 3, directly holding Ethereum.

On December 3, the 2025 Dubai Blockchain Week will be held at the Coca-Cola Arena in Dubai from December 3 to December 4, 2025.

On December 4 at 10:00 AM (Eastern Time), the SEC Investor Advisory Committee will hold an online meeting to discuss corporate governance and stock tokenization issues.

On December 5, the U.S. September PCE data will be released on December 5, and the preliminary report for Q3 GDP has been canceled.

Project Unlocks

Sui (SUI) will unlock approximately 55.54 million tokens at 8:00 AM Beijing time on December 1, accounting for 0.56% of the total supply, valued at about $85 million.

Santos FC Fan Token (SANTOS) will unlock approximately 5.7 million tokens at 8:00 AM Beijing time on December 1, accounting for 19% of the total supply, valued at about $12.7 million.

Walrus (WAL) will unlock approximately 32.7 million tokens at 8:00 AM Beijing time on December 1, accounting for 0.65% of the total supply, valued at about $5.5 million.

Ethena (ENA) will unlock approximately 95.31 million tokens at 8:00 AM Beijing time on December 2, accounting for 0.64% of the total supply, valued at about $27.2 million.

Jito (JTO) will unlock approximately 11.31 million tokens at 8:00 AM Beijing time on December 7, accounting for 1.13% of the total supply, valued at about $5.4 million.

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve substantial risks. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。