Author: Jiawei, IOSG

I

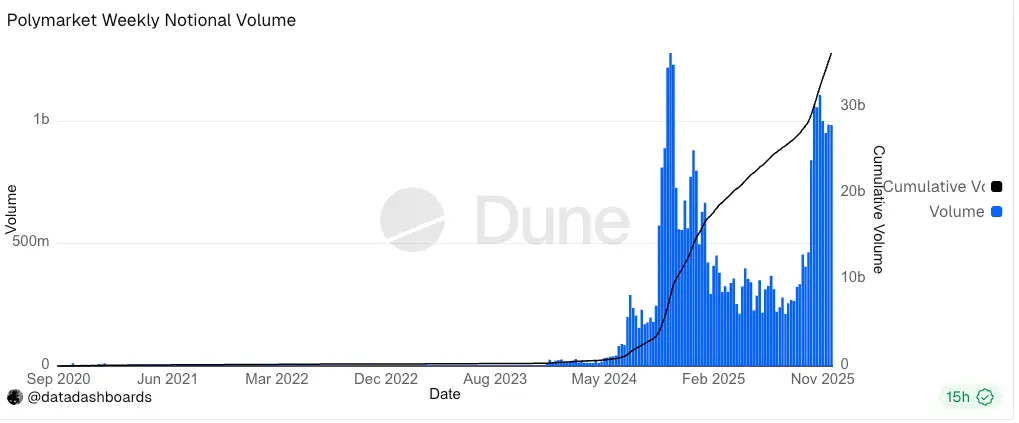

Prediction markets are undoubtedly one of the most attention-grabbing sectors in the crypto industry. The leading project Polymarket has accumulated over $36 billion in trading volume and recently completed a strategic round of financing with a valuation of $9 billion. Meanwhile, platforms including Kalshi (valued at $11 billion) have also received substantial capital injections.

▲Source: Dune

However, behind the continuous influx of capital and impressive data growth, we find that prediction markets, as a type of trading product, still face many challenges.

In this article, the author attempts to set aside mainstream optimism and provide some observations from different perspectives.

01

Predictions are based on events—events are essentially discontinuous and non-replicable. Unlike the prices of assets such as stocks and foreign exchange that change over time, prediction markets rely on limited and discrete events in the real world. In comparison to trading, it is low-frequency.

In the real world, there are very few events that have widespread attention, clear outcomes, and settle within a reasonable timeframe—presidential elections occur every four years, the World Cup every four years, the Oscars once a year, and so on.

Most social, political, economic, and technological events do not have a sustained trading demand. The number of such events is limited each year, and their frequency is too low to build a stable trading ecosystem.

In other words, the low frequency of prediction markets is not something that can be easily changed by product design or incentive mechanisms. This underlying characteristic determines that without significant events, trading volume in prediction markets will inevitably not remain at a high level.

02

Prediction markets do not have fundamentals like stock markets: the value of the stock market comes from a company's intrinsic value, including its future cash flows, profitability, assets, and so on. In contrast, prediction markets ultimately point to an outcome, relying on users' "interest in the event's result itself."

(Of course, this discussion excludes objective arbitrage and speculation factors; even in the stock market, there are many speculators who may not care about the essence of the underlying assets.)

In this context, the amount people are willing to bet is significantly positively correlated with the importance of the event, the market's attention, and the time cycle: scarce and highly followed events like finals and presidential elections attract substantial funds and attention.

Naturally, an ordinary sports fan is more likely to care about the outcome of the annual finals and place heavy bets on it, rather than showing such behavior during regular season games.

On Polymarket, the 2024 presidential election event accounts for over 70% of the platform's total open interest. Meanwhile, the vast majority of events remain in a state of low liquidity and high bid-ask spreads for extended periods. From this perspective, the scale of prediction markets is difficult to expand exponentially.

03

Prediction markets have a gambling nature but struggle to achieve the retention and expansion seen in gambling.

We all know that the true mechanism of gambling addiction lies in instant feedback—slot machines provide feedback every few seconds, poker games every few minutes, and contract and memecoin trading changes every second.

In contrast, the feedback cycle for prediction markets is long, with most events taking weeks to months to settle. If the event has quick feedback, it may not be interesting enough to warrant heavy betting.

Instant positive feedback significantly increases the frequency of dopamine release, reinforcing user habits. Delayed feedback fails to create stable user retention.

04

In some types of events, there is a high degree of information asymmetry among participants.

For competitive sports events, aside from the paper strength of the teams, a large part also relies on the athletes' performance on the day, leading to considerable uncertainty.

However, for political events, there are internal information, channels, and networks involved in a black-box process, where insiders have a significant information advantage, making their bets much more certain.

For example, in the election's vote counting process, internal polling, and organization in key areas, external participants find it challenging to obtain this information. Currently, there has been no clear definition from regulatory bodies regarding "insider trading" in prediction markets, leaving this area somewhat gray.

Overall, for such events, the party at an information disadvantage can easily become the exit liquidity.

05

Due to the ambiguity of language and definitions, the events in prediction markets are also difficult to be entirely objective.

For instance, "Will Russia and Ukraine cease fire in 2025?" depends on which statistical criteria are used; "Will the cryptocurrency ETF be approved at a certain moment?" includes fully approved, partially approved, or conditionally approved, etc. This involves the issue of "social consensus"—when two parties are evenly matched, the losing side is unlikely to admit defeat gracefully.

Such ambiguity requires platforms to establish a dispute resolution mechanism. Once prediction markets touch on language ambiguity and dispute resolution, they cannot rely entirely on automation or objectivity, leaving room for human manipulation and corruption.

06

The main value proposition of prediction markets in the market is "collective intelligence," meaning that with lower trust in media and mainstream discourse, prediction markets can aggregate the best information globally to achieve collective consensus.

However, before prediction markets achieve massive adoption, this "information sampling" is bound to be one-sided, and the sample is not diverse enough. The user base of prediction market platforms may be highly homogeneous.

For example, in the early stages of prediction markets, it is certainly a platform primarily composed of cryptocurrency users, whose views on political, social, and economic events may be highly aligned, thus forming an information echo chamber.

In this case, the market reflects the collective bias of a specific circle, still far from "collective intelligence."

II. Conclusion

The core of this article is not to be pessimistic about prediction markets but to hope that we can remain calm amid the heightened FOMO sentiment, especially after experiencing the ups and downs of popular narratives like ZK and GameFi.

Over-reliance on special events like elections, short-term emotions from social media, and airdrop incentives often amplifies the superficial data, which is insufficient to support judgments about long-term growth.

Nevertheless, from the perspective of user education and user acquisition, prediction markets still hold an important position in the next three to five years. Similar to on-chain yield savings products, they have an intuitive product form and low learning costs, making them more likely to attract users from outside the crypto ecosystem compared to on-chain trading protocols. Based on this, prediction markets are likely to further develop and, to some extent, become entry-level products in the crypto industry.

In the future, prediction markets may also occupy certain vertical fields, such as sports and politics. They will continue to exist and expand, but in the short term, they do not have the foundational conditions for exponential growth. We should think about investments in prediction markets with a cautiously optimistic perspective.

Recommended Reading:

Rewriting the 2018 Script, U.S. Government Shutdown Ends = Bitcoin Price Will Soar?

$1 Billion Stablecoin Evaporates, What’s the Truth Behind the DeFi Chain Reaction?

MMT Short Squeeze Event Review: A Carefully Designed Money-Making Game

Click to Learn About ChainCatcher's Job Openings

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。