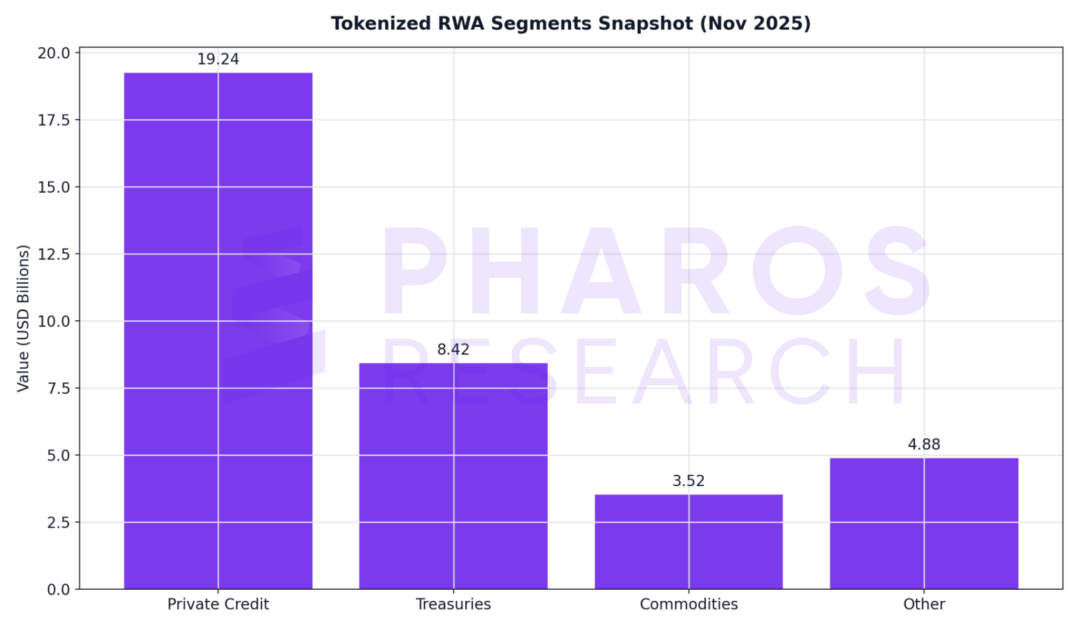

Real-World Assets (RWA) on-chain tokenization is experiencing explosive growth from 2020 to 2025: over $26 billion of physical assets have been mapped on-chain globally[1]. RWA opens up a new blue ocean worth trillions of dollars for blockchain finance, but at the same time, it imposes stringent requirements on infrastructure. To successfully bring traditional assets on-chain and circulate them in decentralized finance, the technology stack must overcome two critical thresholds: a trustworthy data input layer and a secure contract execution layer. The former ensures that on-chain asset prices, net values, and other information are authentic and reliable, while the latter guarantees that financial operations such as lending and clearing are foolproof. This article will take the Chainlink oracle network (representing the data layer) and the Aave lending protocol (representing the execution layer) as typical cases to deeply analyze the technical implementation mechanisms of these two pillars, explore how they each address core challenges, and discuss their synergistic effects and composability in practice; as for the credit infrastructure layer, we will elaborate separately in a subsequent article themed on Morpho × RWA.

01. The Rise of RWA and Technical Challenges

Figure 1: Main Structural Components of Tokenized Real-World Assets (RWA)

Source: RWA.xyz (Treasuries / Private Credit / Commodities / Global Overview)

The RWA tokenization market has rapidly emerged in recent years, growing from nearly zero in 2020 to over $26 billion by 2025[1]. Large financial institutions are moving traditional assets such as bonds, stocks, and real estate onto the blockchain, and this market is expected to expand to trillions of dollars in the coming years. However, to unlock the potential of RWA, the trust gap between the off-chain and on-chain worlds must first be addressed: how to ensure that the asset values reflected on-chain are authentic and reliable, and how to guarantee the secure execution of smart contracts, which has become an unavoidable technical challenge for RWA development.

The Rise of RWA: RWA refers to tokenized real-world assets, such as fiat currencies, government bonds, equity, and real estate. Blockchain digitizes these assets, allowing for faster transactions and broader accessibility. According to data from Chainlink Labs in June 2025, RWA is considered one of the largest potential markets in the blockchain industry, with the theoretical potential market size reaching hundreds of trillions of dollars[3]. Despite starting late, RWA has developed rapidly in recent years: in April 2021, MakerDAO first accepted RWA as collateral, marking the entry of DeFi into traditional asset financing[4]. By the end of 2023, the total locked value (TVL) of on-chain RWA-related protocols had risen to approximately $5 billion. In 2024, one of the world's largest asset management companies, BlackRock, tokenized its "BUIDL" fund through the Securitize platform, reaching a scale of billions of dollars, becoming the largest RWA case at that time. As we enter 2025, more and more banks and asset management institutions are getting involved.

Core Challenges: To unlock value in DeFi, RWA must address two key points: on-chain data must be authentic and reliable, and on-chain contract execution must be secure and controllable. First, oracles must solve the issue of "data reliability." On-chain contracts cannot directly access real-world data and must rely on oracles to provide information such as asset prices, net values, and interest rates. If the data provided by the oracle is inaccurate or tampered with, the consequences can be severe—users may exploit this for arbitrage, leading to bad debts in the system, or even the collapse of the entire protocol. In the early days of DeFi, there were painful cases of price manipulation due to the use of a single centralized data source (for example, the bZx protocol in 2020 was attacked due to using a single exchange price, resulting in a flash loan attack). Therefore, a secure oracle network is seen as the cornerstone for the implementation of RWA. Secondly, the security and compliance of smart contracts also pose challenges. RWA involves real assets and legal contracts, and contract vulnerabilities or design flaws directly threaten the safety of substantial funds. Unlike pure crypto assets, RWA often requires consideration of compliance access (such as KYC/AML), special rules for clearing, and potential concentration default risks. This necessitates that DeFi protocols embed robust security mechanisms and risk control measures in their contract architecture. From system architecture (permission isolation, multi-signature) to code level (strict audits, formal verification, bounty programs) to operational level (dynamic adjustment of risk parameters, emergency management), everything must be foolproof.

RWA brings unprecedented opportunities to decentralized finance, but also imposes unprecedented requirements: only by building trustworthy data input and secure contract execution as the two pillars can we truly usher in a new era of on-chain finance for trillions of dollars of traditional assets. These two pillars are technically independent yet collaboratively interdependent: the data layer requires a decentralized oracle network to solve the trust issue of bringing off-chain information on-chain; the execution layer requires a thoroughly validated smart contract architecture to handle financial operations such as collateral, lending, and clearing. The following sections will focus on these two technical pillars, using Chainlink (a benchmark in the oracle field) and Aave (a model lending protocol) as primary cases to analyze the implementation solutions at various levels, compare different technical paths, and explore their collaborative models and future evolution in RWA scenarios. From an infrastructure perspective, for institutional-level RWA to truly operate, it often requires the collaboration of "three layers" of capabilities: the data input layer (represented by Chainlink), the contract execution layer (represented by Aave), and the emerging credit infrastructure layer (represented by new-generation lending networks like Morpho). This article focuses on the foundational capabilities of the first two layers, while we will separately dissect how Morpho plays the role of a "credit hub" in RWA scenarios in the next article of the series.

02. Data Layer Pillar: Decentralized Oracle Network (Taking Chainlink as an Example)

Figure 2: Overall Landscape of the Blockchain Oracle Market in Q3 2025

Source: Chainlink Quarterly Review Q3 2025 (including DefiLlama market share reference; TVS milestones)

Source: Chainlink Quarterly Review Q3 2025 (including DefiLlama market share reference; TVS milestones)

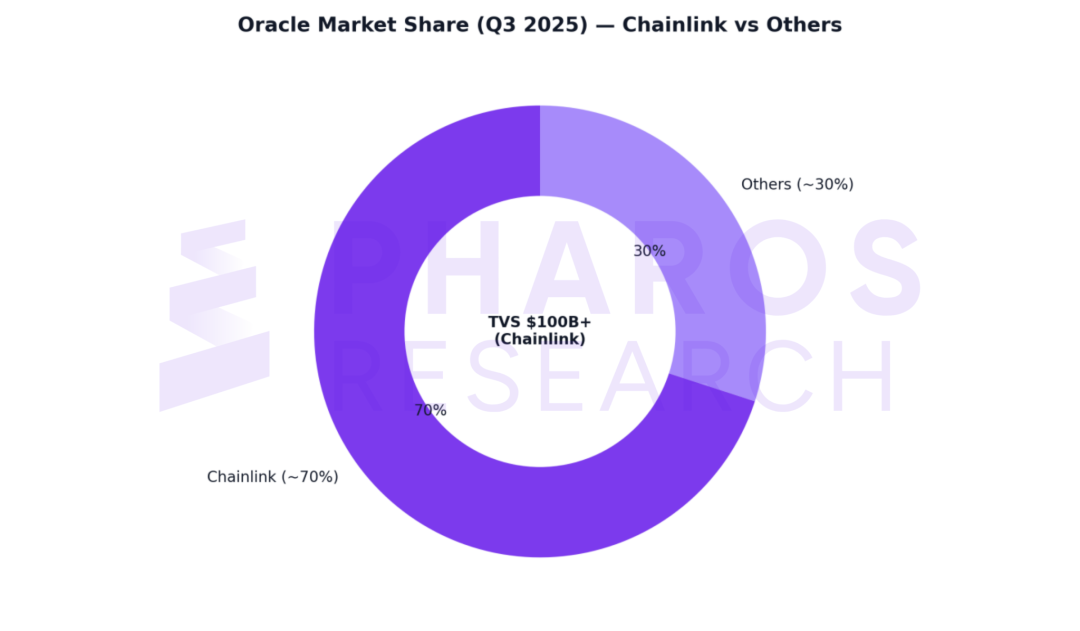

Oracles are the core infrastructure of the RWA data input layer, responsible for reliably transmitting key information such as off-chain real-world asset prices, net values, and reserves to on-chain smart contracts. Among various oracle solutions, Chainlink has become the industry benchmark due to its highly decentralized network architecture and proven reliability in practice. By aggregating dozens of independent nodes and multi-source data, Chainlink provides high reliability real-time data feeds for scenarios like RWA. As of 2025, the Chainlink oracle network has securely served over 1,800 projects, with a cumulative on-chain data point count exceeding 5.8 billion, supporting on-chain transaction values of up to $6.9 trillion[7]. Especially in the RWA field, Chainlink has launched dedicated SmartData data solutions, including Net Asset Value (NAV) oracles and Proof of Reserve, providing a reference technical implementation path for on-chain protocols[2]. This section will take Chainlink as the main case to analyze how oracles solve the data reliability issue and compare the technical paths of other oracle solutions at the end.

2.1 The Role of Oracles in RWA

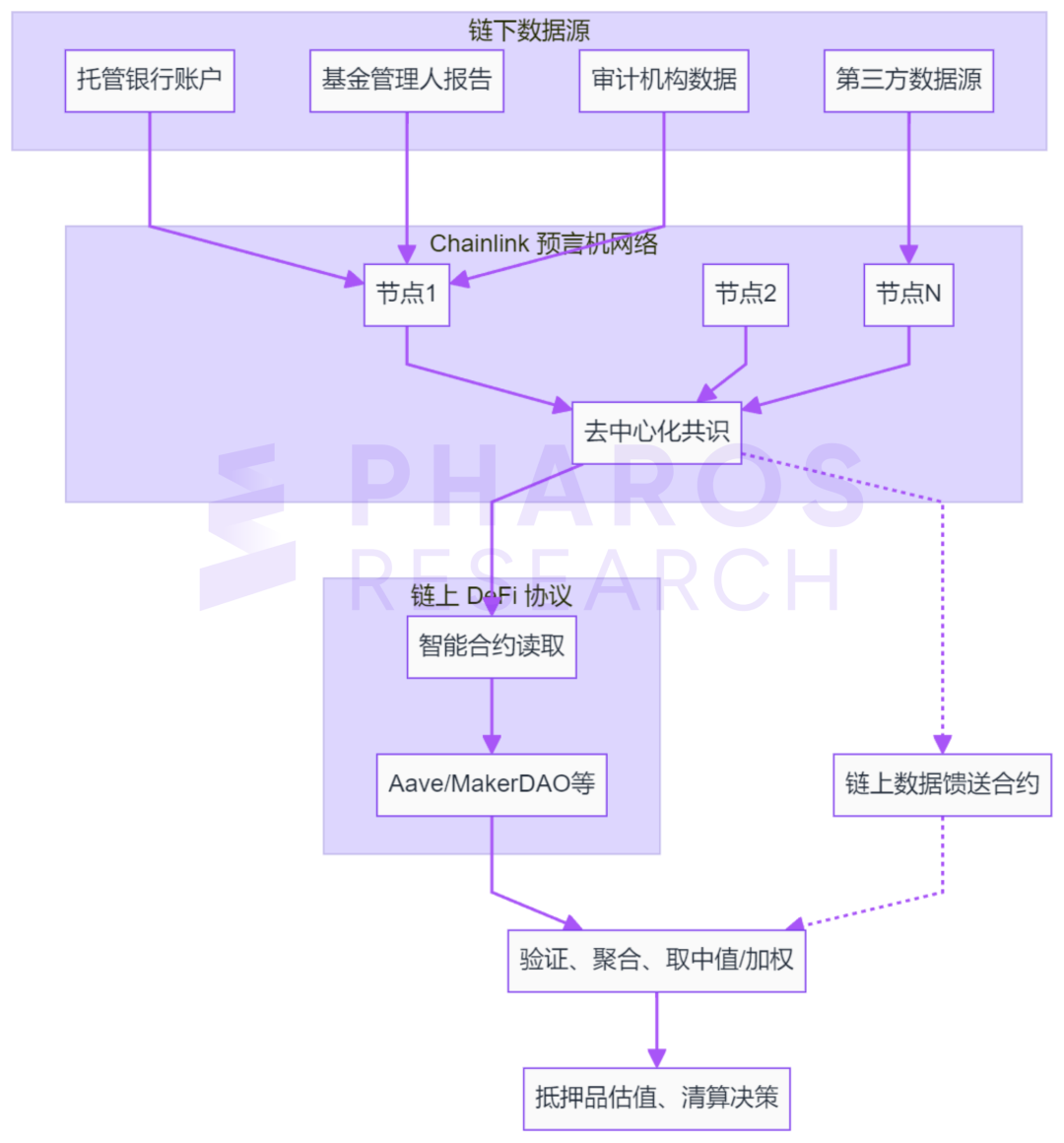

Oracles are likened to the "data bridge" between blockchain and the real world. In RWA scenarios, this bridge is particularly critical. For example, when protocols like Aave allow users to use tokenized government bonds or stocks as collateral for loans, the contracts need to know the market value and net value changes of these assets in real-time. If the price reported by the oracle is higher than the actual value, borrowers may over-borrow, leading to insufficient collateral; conversely, if the price is underestimated, it may trigger liquidation too early, harming the interests of holders. Therefore, the timeliness and accuracy of data directly determine the safety and efficiency of the RWA collateral lending market. Traditional financial market prices are usually maintained off-chain by exchanges, custodians, and fund managers. How to reliably bring these high-quality off-chain data on-chain and resist malicious nodes or network delays is the core challenge faced by oracles. As a pioneer in decentralized oracle networks, Chainlink significantly reduces the risks of errors and manipulation through its multi-layered architecture design and economic mechanisms.

2.2 Mechanism and Reliability of Chainlink Oracles

Chainlink's data feed contracts adopt a model of multiple nodes, multiple data sources, and decentralized consensus, ensuring that any single point of failure does not contaminate the final result[7]. Taking a typical asset price feed as an example, Chainlink obtains market data from numerous independent data providers, each of which may integrate quotes from professional sources like Bloomberg, Reuters, and top exchanges. The Chainlink network typically selects several (usually 10–30) independently operating nodes to jointly provide a certain price data; each node submits the price it obtains, and the final price is taken as the median or weighted value in the on-chain contract, filtering out outliers. This mechanism means that unless more than half of the nodes are simultaneously compromised and provide similar erroneous information, the oracle result remains trustworthy. This anti-manipulation capability has withstood the test of extreme market conditions in practice. For instance, during the severe fluctuations in the crypto market from 2021 to 2022, DeFi protocols using Chainlink price feeds operated normally without major security incidents caused by oracle failures. According to official data from Chainlink, as of the end of 2022, its oracle network achieved 100% uptime, with over 580 million data updates on-chain, covering thousands of trading pairs in cryptocurrencies, commodities, and foreign exchange[7]. Additionally, Chainlink launched a staking mechanism at the end of 2022, requiring node operators to lock LINK tokens as collateral, with potential penalties for providing erroneous data in the future. This model of economic incentives and penalties further enhances the integrity of the oracle network.

Chainlink oracles currently lead the market share and reputation in DeFi. As of 2025, over 1,800 blockchain projects globally have integrated Chainlink services, including price data, random numbers (VRF), and automated execution. Chainlink oracles directly or indirectly safeguard over $93 billion in DeFi assets.

2.3 RWA-Specific Data Solutions: NAVLink, SmartAUM, and Proof of Reserve

To address the complex information of RWA, Chainlink has recently launched the SmartData series of data feed products, specifically designed to meet the data needs of traditional financial assets on-chain[2]. These tools go beyond simple price feeds, directly providing key indicators from traditional finance for use in on-chain contracts. Below are detailed explanations of the three core products:

Workflow illustration:

Figure 4: How Oracles Work

Source: Pharos Research

Detailed Explanation:

NAVLink (Net Asset Value Oracle): In RWA scenarios, many tokens represent shares of underlying asset portfolios (such as a basket of government bonds or loan portfolios), and their prices are not determined by market matching but by net asset value (NAV). NAV is typically calculated daily or weekly by fund administrators and includes the market value of underlying assets, accrued interest, and the value per share after deducting fees. Chainlink integrates with custodians and auditors to feed verified NAV data on-chain to DeFi platforms[10][1]. For example, when a token representing a portfolio of U.S. government bonds is used as collateral, the lending protocol can assess the collateral value based on NAV rather than secondary market prices, ensuring that the lending process aligns with the actual value of the assets. The Aave Horizon platform, launched in August 2025, has integrated NAVLink to achieve real-time tracking of RWA collateral net values.

SmartAUM (Assets Under Management Oracle): AUM data is crucial for assessing the scale of protocols, triggering governance decisions (such as fee adjustment thresholds), or verifying the declared scale of funds. SmartAUM combines on-chain visible TVL data with off-chain reports from custodians to provide a comprehensive picture of asset management scale. This is particularly important for cross-chain or hybrid (partly on-chain, partly off-chain) RWA products.

Proof of Reserve (PoR): For tokens anchored to real assets (such as stablecoins or physical asset tokens backed by gold or fiat reserves), PoR oracles periodically query third-party audit reports or custodian data to publish off-chain reserve balances on-chain[11]. This allows anyone to verify whether the token issuer has sufficient off-chain assets to back the tokens, thereby quickly identifying risks such as "insufficient reserves" or "misappropriation of funds." Following the collapse of certain centralized platforms at the end of 2022, the demand for PoR surged, and Chainlink's PoR oracles have provided over 700,000 reserve audit verifications for stablecoins and wrapped assets[7]. For instance, Chainlink provides bank reserve queries for stablecoins like USDC and TUSD, and on-chain Bitcoin reserve verification for tokens like WBTC.

Summary of Technical Advantages: The common characteristics of these three types of SmartData products are multi-source verification + decentralized consensus + transparency and auditability. Compared to the information black box of traditional finance, on-chain oracles make all data traceable and verifiable, significantly enhancing the transparency and trustworthiness of the RWA market.

In addition to numerical data, Chainlink is also exploring the on-chain data of complex events. Between 2023 and 2024, Chainlink collaborated with institutions like SWIFT and DTCC to develop corporate actions oracles, attempting to validate events such as stock dividends and stock splits through oracles and large language models before putting them on-chain[12]. These efforts indicate that in the future of fully digitized RWA, various financial events and indicators can be provided with "institutional-level" data services by platforms like Chainlink. In August 2025, Chainlink even launched the Data Streams product, providing high-frequency real-time market data for U.S. stocks and ETFs directly on-chain, supporting multiple updates per second and including trading session information, volume, and other context[13]. This lays the foundation for future DeFi markets to develop on-chain stock trading, perpetual contracts, and other innovative businesses[13]. It is foreseeable that as Chainlink continues to enrich data types and improve transmission performance, the application scope of RWA on-chain will expand from simple collateral lending to broader fields such as securities trading, derivatives, and asset management.

03. Execution Layer Pillar: Smart Contract Security and Risk Control System (Taking Aave as an Example)

With reliable data input, RWA also requires a secure and controllable on-chain execution environment to handle financial operations such as collateral, lending, and clearing. Smart contracts, as the core of the execution layer, must be foolproof at the code level, architectural level, and operational level. Aave, as a leading lending protocol in the DeFi space, has set an industry benchmark in smart contract security and risk management. It provides a reference security practice paradigm for innovative applications like RWA. Aave has undergone multiple rounds of audits and practical tests without any major contract theft incidents, demonstrating bank-level security standards. The mechanisms employed by the platform, such as over-collateralization, risk parameter management, and insurance reserves, allow it to maintain system robustness even in extreme market conditions and with complex asset integrations. For example, at the end of 2022, a trader attempted to manipulate the CRV token, resulting in approximately $1.6 million in bad debt for Aave, but Aave quickly repaid this loss through governance, which was negligible compared to the protocol's net deposits[15]. In 2025, Aave launched the Horizon RWA market for institutions, introducing features such as whitelisting, non-transferable aTokens, and oracle sentinels in the contract architecture to strictly limit permissions and meet compliance requirements. This section will delve into how Aave constructs multi-layer security defenses and compare the execution layer designs of other RWA platforms at the end.

3.1 Overview of Aave's Security Architecture

At the core of Aave is a set of decentralized smart contracts deployed on chains like Ethereum, responsible for custodial user assets, calculating interest rates, and executing loans. Unlike traditional finance, Aave operates entirely through code, which places high demands on contract security. First is the audit at the code level: Aave has undergone multiple internal and external security audits, with several professional institutions auditing the Aave V3 version between 2024 and 2025. The Aave team has introduced formal verification and other methods to enhance code reliability and has publicly listed the audit reports. Secondly, at the operational level, Aave has established a bug bounty program, offering up to $1 million through the Immunefi platform to white-hat hackers who discover vulnerabilities, which helps proactively identify and fix potential risks. In terms of contract deployment, Aave employs a modular design and sets up multi-signature permissions to control upgrades and parameter adjustments. The powers of contract administrators are limited and require community governance voting for approval, which reduces insider risks. However, Aave has also experienced single bad debt incidents (such as the CRV incident in 2022), indicating that even well-audited contracts may carry risks, necessitating ongoing risk management and emergency response mechanisms.

3.2 Risk Control Mechanisms

Aave's ability to remain robust in the highly volatile crypto market relies on its finely tuned risk parameters and liquidation mechanisms. First, Aave sets parameters such as loan-to-value (LTV) ratios, liquidation thresholds, and liquidation penalties for each supported asset to measure the risk of that asset. For example, the LTV for highly volatile assets like Bitcoin may only be 50–70%, while stablecoins can reach 75–90%. Due to liquidity and credit risk factors, RWA assets generally have more conservative collateralization rates. In the case of the Horizon market, each RWA collateral has a dedicated risk analyst providing risk modeling to ultimately determine its maximum borrowable amount[10]. Aave also introduces interest rate models to dynamically adjust lending behavior: when the utilization rate of a certain asset pool rises, interest rates sharply increase to induce repayments or more deposits, thereby avoiding fund depletion. Notably, Aave V3 introduced features like isolation mode and eMode. When introducing higher-risk or unknown correlation assets, they can be placed in isolation mode, limiting borrowing to specific assets like stablecoins and imposing a total borrowing cap. This way, even if the asset price fluctuates dramatically, losses are contained within a manageable range and do not threaten the entire protocol. Conversely, for highly correlated assets (such as staked Ether and Ether), enabling efficient mode (eMode) allows for higher collateralization rates to improve capital efficiency. The unexpected CRV incident that Aave faced in 2022 also highlighted the importance of risk management. At that time, a trader borrowed tens of millions of Curve (CRV) tokens in an attempt to short, triggering a price surge that led to a liquidation of their position, leaving Aave with approximately $1.6 million in bad debt. Post-analysis revealed that this was primarily due to the limited market depth of CRV at the time, allowing a single user to manipulate the price. The Aave community quickly adjusted the risk parameters for CRV and repaid the bad debt through a safety reserve fund. This incident demonstrated that Aave's emergency governance and safety backup operated effectively.

3.3 Security and Compliance in RWA Scenarios: The Aave Horizon Case

Aave launched the "Horizon" platform in 2025, specifically catering to the institutional RWA collateral lending needs. Horizon is based on the Aave V3.3 architecture but has made customized improvements in security and compliance. First is permission management: the regular Aave is open, allowing anyone to access assets. In contrast, Horizon adopts a permissioned access model, where only qualified investors who pass the issuer's qualification review can deposit RWA tokens as collateral. These RWA tokens typically represent compliant issued securities, such as Circle's USYC fund shares and Superstate's government bond fund tokens. To align with these restrictions, Horizon issues non-transferable aTokens to represent collateral positions. This means that when a qualified institution deposits an RWA token, it receives a corresponding amount of aTokens as proof of its collateral, but these aTokens cannot be freely transferred to others, preventing accounts that have not undergone KYC from indirectly obtaining RWA exposure. This mechanism respects the regulations regarding the restricted transfer of traditional financial securities. Secondly, the Oracle Sentinel plays an important role in Horizon. If an oracle failure occurs, the sentinel can temporarily freeze the borrowing and liquidation of related assets, avoiding a chain reaction caused by erroneous pricing. This design is particularly important for RWA, as some RWA tokens may have low liquidity and infrequent price updates. Furthermore, Horizon combines compliance control with transparent governance: the issuer is responsible for managing whitelisted investors and operating the underlying assets; Aave only provides a non-custodial technical platform, with all actions automatically executed according to contract rules. All permission operations are completed through on-chain governance processes and are publicly auditable. This allows institutional users to meet regulatory requirements while still benefiting from the transparency and accountability of decentralized finance. In terms of security isolation, Horizon's RWA market operates separately from Aave's main market, running as an independent pool on Ethereum, ensuring that any potential issues do not spread to affect other crypto asset pools. In summary, Aave enables traditional financial institutions to participate in its RWA platform through a "technical security + risk control security + compliance security" triple guarantee.

3.4 Comparison: Aave and Other RWA Platform Security Designs

Currently, there are three main types of platforms in the DeFi space involving RWA: general lending protocols like Aave that expand into the RWA market, stablecoin protocols like MakerDAO that directly hold RWA collateral, and specialized RWA financing platforms like Centrifuge. Each has its own focus in terms of security and risk control design:

04. Case Analysis: The Synergy of Aave and Chainlink on the Horizon Platform

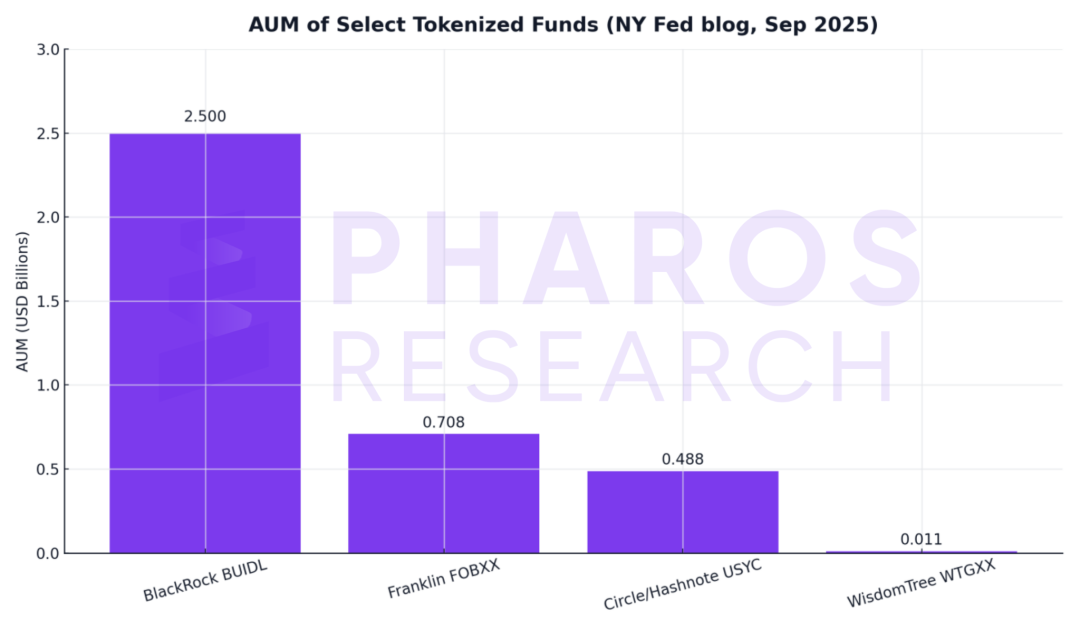

Figure 6: AUM of Four Institutional-Level Tokenized Funds

Source: New York Fed — Liberty Street Economics (2025-09-24)

The Aave Horizon platform is a landmark case in the RWA field in 2025, fully demonstrating the technical synergy between Aave and Chainlink. In Horizon, Chainlink provides high-precision real-time net asset value data (NAVLink), which Aave uses to automatically execute smart contracts, creating a closed loop for traditional asset collateralization to borrow stablecoins. This case proves that reliable data input + secure contract execution enables institutional investors to confidently lend hundreds of millions of dollars on-chain, while ordinary stablecoin holders can earn returns from high-quality assets like government bonds. In the first month after its launch, Horizon attracted participation from several institutions, including Circle, Ripple, and WisdomTree, involving various RWA products such as government bond funds and short-term loans[10]. Chainlink's oracle network provides accurate net values and prices for these assets, ensuring that the lending process remains in sync with traditional markets[1]. Aave's contracts automatically manage collateral, calculate interest, and handle liquidations in the background, operating around the clock without human intervention. This synergy shows that blockchain technology can now support large-scale traditional financial operations, and DeFi and TradFi are achieving organic integration through oracles and smart contracts.

05. Comparative Study: Oracle Solutions and RWA Platform Models

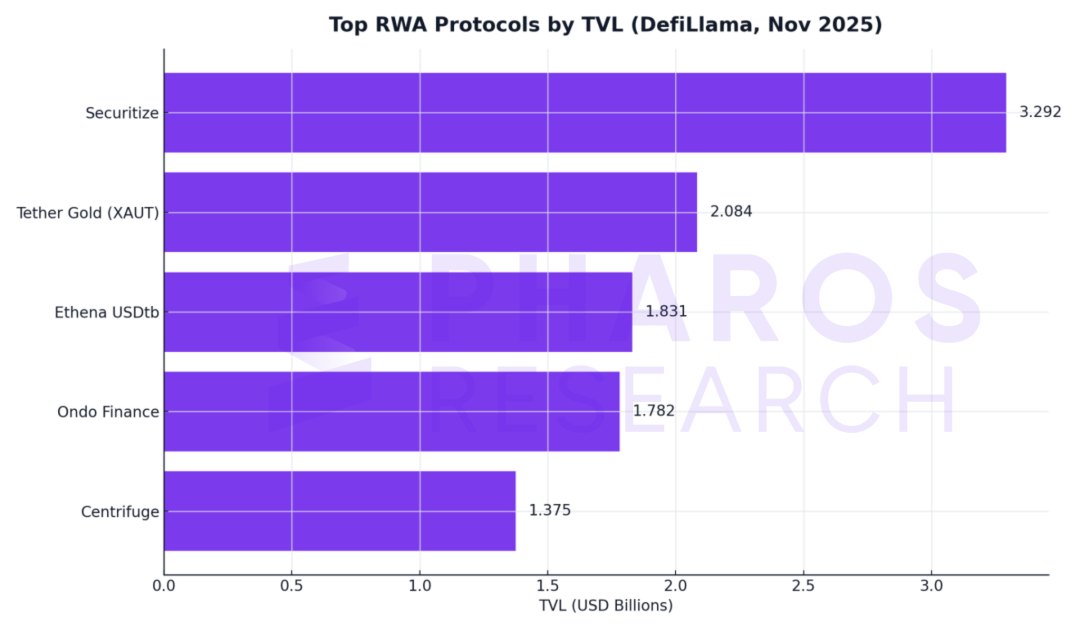

Figure 7: Top Five RWA Protocols Tracked by DefiLlama by TVL (Total Value Locked) as of November 2025

Source: DefiLlama — RWA Category (Protocol TVL Rankings)

Source: DefiLlama — RWA Category (Protocol TVL Rankings)

Through the above analysis, we recognize that the reliability of oracle data and the security of smart contracts are the two pillars for the smooth on-chain integration of RWA. This section will further compare the similarities and differences between different oracle solutions and RWA platform models from a broader perspective, extracting their respective advantages and limitations. Overall, Chainlink's decentralized oracle leads competitors in performance and credibility, while in terms of RWA platforms, the model of decentralized protocols + compliance hubs (like Aave Horizon) is expected to outperform single-institution closed-loop models, achieving a balance between scalability and security.

5.1 Summary of Oracle Solution Comparisons

The performance of different oracle designs in providing RWA data can be summarized as follows:

• Highly decentralized oracles (like Chainlink): Rely on multi-node consensus, are resistant to manipulation, have high data quality, and their security has been long validated, making them very suitable for high-value RWA scenarios. However, the corresponding operational costs are relatively high, and the feeding speed may be slightly lower than centralized solutions (as it requires waiting for multiple nodes to submit). Chainlink is enhancing performance through Layer 2 and optimization algorithms; for example, its Data Streams can now achieve second-level updates to meet real-time trading needs.

• Semi-decentralized oracles (like Pyth): Data is provided by professional institutions, offering high update frequency and low latency, suitable for high-frequency trading scenarios. Pyth has accumulated rich experience in traditional financial data such as stocks and foreign exchange, but its level of decentralization is relatively low, mainly relying on the reputation and governance mechanisms of participating institutions. For RWA scenarios, Pyth provides basic price data support, but there is still room for development in handling complex financial indicators like NAV and proof of reserves compared to specialized RWA data solutions.

• Centralized/self-built oracles: Simple to implement but proven to be highly risky. During the small-scale trial phase of RWA, some projects may push data manually or via their own servers, but once the scale and value increase, no one will trust data from a single source. For example, in a multi-hundred-million-dollar lending market, no institution would trust a company's claimed price without independent verification. Therefore, centralized oracle solutions are destined to be marginalized in the RWA wave, with their only role being to provide emergency fallback (for instance, in the event of an overall oracle failure, manually inputting a reference price and freezing the market).

5.2 Comparison of RWA Platform Models

The on-chain practice of RWA is currently roughly divided into three models:

• Decentralized lending platform model: Represented by Aave Horizon and the potential future RWA market of Compound. The characteristics are an open market with multiple participants. The protocol itself does not select specific borrowers or assets but establishes rules (collateral ratios, liquidation, etc.) that allow anyone holding compliant assets to borrow. This is somewhat similar to an open mortgage market. This model relies on oracles and contracts to ensure fair order, has strong scalability, and can accommodate numerous assets. Similarly, it requires very robust technology and risk control; otherwise, consequences can quickly propagate. In the Horizon case, we see that through permissions and parameters, a balance can be struck between openness and security, allowing institutions to participate without having to trust a single counterparty.

• Single asset direct connection model: Represented by MakerDAO. Maker is more like a traditional bank's "mortgage": individual borrowers use collateral (government bonds, loan agreements) to borrow from Maker (issuing DAI). Each project involves point-to-point negotiations to determine conditions. This model has high security because Maker has in-depth knowledge of each transaction and often has off-chain legal protections (such as signed loan contracts). The risk of bad debts is controllable (as of 2023, Maker has not experienced any incidents of RWA borrower default losses). However, the downside is low efficiency and slow expansion: each transaction must be reviewed individually, limiting scalability. Moreover, the entire model remains relatively centralized, as it relies on the Maker Foundation/core unit to connect with traditional institutions, and ordinary DeFi users cannot directly participate in RWA generation, only indirectly through holding DAI.

• Asset on-chain financing market model: Represented by Centrifuge, Maple, Goldfinch, etc. These protocols act as a bridge, mapping real-world lending relationships into on-chain investment products. In Centrifuge's pools, both borrowers and investors undergo KYC, and the platform facilitates loans but does not bear the risk. Maple/Goldfinch instead uses a layer of "trusted" asset managers to conduct risk assessments instead of smart contracts. The advantage of this model is its proximity to traditional business practices, knowing how to filter borrowing projects, controlling risks through tiered structures, and aligning with regulatory thinking (whoever audits is responsible). The downside is insufficient decentralization, and the transparency of information is not as high as fully open platforms, requiring investors to trust the borrower selection process. Additionally, this model often lacks secondary liquidity—investors' funds are locked for long periods, unlike in Aave, where deposits can be made and withdrawn at will. In comparison, Centrifuge has partnered with Aave to place its pool tokens into Aave lending, thereby providing liquidity. This indicates that this model ultimately seeks to connect with the larger DeFi market rather than operate in isolation.

06. Trend Outlook: The Future Development and Technological Evolution of RWA

Looking ahead to the next five years, RWA is expected to leap from its current scale of tens of billions to the trillions. Institutions will flood in, and the types and quantities of traditional assets on-chain will grow exponentially. During this process, oracle and smart contract technologies will continue to iterate and upgrade: oracle networks will introduce more high-frequency data and complex event handling, increasing bandwidth and reducing latency to meet real-time trading demands; the security framework for smart contracts will become more refined, potentially adopting modular multi-chain deployments and on-chain/off-chain combined risk control architectures to support massive asset flows. Additionally, regulatory frameworks will gradually take shape; after the EU's MiCA regulations come into full effect in 2024-2025, it is expected that the U.S. and major Asian economies will also issue clear guidelines for security tokens[22][21]. This will eliminate institutional barriers, allowing more traditional financial institutions to participate in DeFi in a compliant manner. The dual advancements in technology and regulation will drive RWA from the experimental phase to mainstream application, blurring the lines between on-chain and off-chain finance, and a new financial market prototype that is "24/7, seamless across regions" is expected to take shape by 2030.

6.1 Trend Outlook: Key Variables and Uncertainties in RWA Development

The long-term development of RWA tokenization is influenced by multiple key variables rather than simple linear growth. The most critical uncertainty lies in the evolution path of the regulatory framework: if regulatory agencies in various countries choose a lenient "innovation-friendly" approach, RWA could reach trillions in scale by 2030; however, if an overly cautious regulatory stance is adopted, the pace of development will significantly slow. Another important variable is the maturity of the technological infrastructure—the scalability of oracle networks and the security of smart contracts will directly determine the depth of institutional participation. Currently, stablecoins, as the "minimum viable product" for RWA, have proven basic feasibility, but more complex asset classes (such as corporate bonds and equities) face challenges such as valuation difficulties and poor liquidity.

It is noteworthy that the development of RWA may exhibit discontinuous characteristics: certain asset classes may suddenly explode (such as the tokenization of commercial real estate during the pandemic), while others may stagnate for a long time. The decision-making logic for institutional participation is also far more complex than it appears on the surface: not all traditional financial institutions are suitable for on-chain transformation; those with complex legal structures or high regulatory requirements may prefer to participate indirectly through SPVs (special purpose vehicles) rather than directly deploying smart contracts. This means that the RWA ecosystem may form a pattern of "core participants + peripheral supporters," where the former directly builds protocols and the latter provides assets and liquidity.

On a deeper level, the rise of RWA may reshape the power structure of traditional finance: the decentralization of asset issuance rights will weaken the monopoly of centralized institutions, but it will also require the DeFi community to establish compliance and risk management capabilities that match traditional finance. This is not a simple "TradFi vs DeFi" competition, but rather a deep integration and mutual adaptation process between two financial paradigms.

6.2 Directions of Technological Evolution

Evolution of Oracle Technology: As the scale of RWA expands, oracle technology will need to support data demands that are hundreds of times greater than now. Future development directions include support for higher-frequency data, enhanced cross-chain interoperability, and the introduction of AI-assisted complex event processing. These technological advancements will enable oracles to handle a wide range of financial data, from macroeconomic indicators to corporate actions.

New Directions for Smart Contract and Protocol Security: The security demands of RWA protocols will give rise to new technologies, such as trusted execution environments, formal verification, and AI auditing. In the future, we may see blockchains specifically designed for RWA, as well as more refined multi-layer security isolation mechanisms. These innovations will balance the requirements of decentralization and security, allowing institutions to confidently participate in on-chain finance.

6.3 Regulation and Standardization

Beyond technology, the evolution of regulations will have a profound impact on RWA. The implementation of the EU's MiCA regulations will provide a clear regulatory framework for RWA tokens, promoting the standardized development of the European market. The U.S. may gradually establish RWA regulatory standards through the existing securities law framework. Major Asian economies are also actively exploring regulatory paths for digital assets. These regulatory advancements will clear institutional barriers for RWA development, driving large-scale participation from traditional financial institutions.

Conclusion and Outlook: Two Pillars Constructing the Future of RWA

The on-chain process of Real-World Assets has moved from proof of concept to substantial breakthroughs. This article, through an in-depth analysis of Chainlink (representing the data layer) and Aave (representing the execution layer), showcases the two core pillars of the RWA technology stack: a trustworthy data input layer and a secure contract execution layer. For traditional assets to successfully go on-chain, it is essential to first address the fundamental issues of "how to ensure the on-chain data is real and reliable" and "how to make financial operations safe and controllable."

Methodological Summary:

• Data Layer: A decentralized oracle network is needed, ensuring data reliability through multi-node consensus, multi-source verification, and economic incentive mechanisms. Chainlink's practices have demonstrated that dedicated tools like NAV oracles and proof of reserves can effectively serve RWA scenarios.

• Execution Layer: A thoroughly audited smart contract architecture is required, complemented by risk parameter management, isolation mechanisms, and emergency governance as multi-layer protections. Aave's practices have shown that bank-level security standards can also be achieved in a decentralized environment.

• Composability: These two pillars can be flexibly combined through standardized interfaces, allowing different oracle solutions and lending protocols to integrate with each other, forming a unique "Lego-style" innovation ecosystem in DeFi.

Future Vision: When the two pillars of oracles and smart contracts are sufficiently robust, traditional assets will achieve around-the-clock trading, real-time settlement, and global connectivity, allowing investors, whether institutional or individual, to participate fairly in an open yet secure network. Over a decade ago, Satoshi Nakamoto solved the trust issue of digital currency with blockchain; today, oracle networks and smart contracts are addressing the trust issues of real asset digitization. In the foreseeable future, we may no longer distinguish between "crypto assets" and "traditional assets," as all value carriers will flow freely on the same digital foundation.

Directions of Technological Evolution: The data layer will evolve towards higher frequency and richer data types, introducing AI-assisted verification and cross-chain interoperability; the execution layer will strengthen formal verification, AI monitoring, and multi-chain deployment. More oracle solutions (Pyth, API3, Chronicle, etc.) and lending protocols (Compound, Morpho, Spark, etc.) will join the RWA ecosystem, driving the entire infrastructure towards maturity through competition and collaboration. The story of RWA is just beginning, and the continuous evolution of these two technological pillars will safeguard this trillion-dollar financial transformation.

Therefore, after discussing the "data + execution" thresholds using Chainlink and Aave as examples, the next article will shift the focus to Morpho, systematically outlining its role in the RWA scenario, its collaborative methods with RWA public chains like Pharos, and how it becomes a key piece in institutional-level RWA credit.

References

[1] Aave Labs Debuts Horizon to Let Institutions Borrow Stablecoins Against Tokenized Assets https://www.coindesk.com/business/2025/08/25/aave-labs-debuts-horizon-to-let-institutions-borrow-stablecoins-against-tokenized-assets

[2] Aave Labs Unlocks Onchain Liquidity For Real-World Assets With Chainlink-Powered Horizon Platform - Chainlink Today https://chainlinktoday.com/aave-labs-unlocks-onchain-liquidity-for-real-world-assets-with-chainlink-powered-horizon-platform

[3] Real-World Assets (RWAs) Explained | Chainlink https://chain.link/education-hub/real-world-assets-rwas-explained

[4] RWA Market: The Aave Market for Real World Assets goes live. | Centrifuge (Lucas Vogelsang) https://medium.com/centrifuge/rwa-market-the-aave-market-for-real-world-assets-goes-live-48976b984dde

[5] Securitize, the Leading Tokenization Platform, to Become a Public Company at $1.25B Valuation via Business Combination With Cantor Equity Partners II https://www.prnewswire.com/news-releases/securitize-the-leading-tokenization-platform-to-become-a-public-company-at-1-25b-valuation-via-business-combination-with-cantor-equity-partners-ii-302596208.html

[6] Tokenization of Real-World Assets is Gaining Momentum, Says Bank of America https://www.coindesk.com/markets/2025/08/01/tokenization-of-real-world-assets-is-gaining-momentum-says-bank-of-america

[7] The Chainlink Network in 2023 | Chainlink Blog https://blog.chain.link/the-chainlink-network-in-2023

[8] WILL LINK REACH ITS OLD PEAK BY 2025 | Binance Square https://www.binance.com/en/square/post/17669203056594

[9] Celebrating Chainlink’s 7th Birthday: What Is It and Why It Matters https://wirexapp.com/blog/post/chainlink-birthday-0961

[10] Aave’s RWA Market Horizon Launches | Aave https://aave.com/blog/horizon-launch

[11] SmartData | Chainlink Documentation https://docs.chain.link/data-feeds/smartdata

[12] Chainlink Becomes Official Oracle Provider For Ondo’s Tokenized Securities - Chainlink Today https://chainlinktoday.com/chainlink-becomes-official-oracle-provider-for-ondos-tokenized-securities

[13] Chainlink Launches Data Streams for U.S. Equities and ETFs To Power Secure Tokenized RWA Markets Onchain https://www.prnewswire.com/news-releases/chainlink-launches-data-streams-for-us-equities-and-etfs-to-power-secure-tokenized-rwa-markets-onchain-302520632.html

[14] Chainlink establishes itself as the undeniable leader in real-world asset (RWA) tokenization | Bitget News https://www.bitget.com/news/detail/12560604932131

[15] DeFi: Aave Clears Bad CRV Token Debt From Exploit Attempt https://www.coindesk.com/markets/2023/01/26/defi--aave-clears-bad-crv-token-debt-from-exploit-attempt

[16] Security | Aave https://aave.com/security

[17] AAVE Bug Bounties | Immunefi https://immunefi.com/bug-bounty/aave/scope

[18] GitHub - aave/risk-v3 https://github.com/aave/risk-v3

[19] Overview of the Real-World Asset Digitalization Sphere - Boosty Labs https://boostylabs.com/blog/rwa-review

[20] MakerDAO Defies Bear With $19M in Profit - The Defiant https://thedefiant.io/news/markets/makerdao-earnings

[21] European crypto-assets regulation (MiCA) | EUR-Lex https://eur-lex.europa.eu/EN/legal-content/summary/european-crypto-assets-regulation-mica.html

[22] Regulating crypto-assets in Europe: Practical guide to MiCA | Norton Rose Fulbright https://www.nortonrosefulbright.com/en-419/knowledge/publications/2cec201e/regulating-crypto-assets-in-europe-practical-guide-to-mica

[23] Real World Assets (RWAs) and Their Impact on DeFi | Galaxy https://www.galaxy.com/insights/research/rwas-and-their-impact-on-defi

[24] MiCA Regulation 2024: Transforming Crypto Markets with Titles III & IV – Key Insights https://actlegal.com/publications/mica-regulation-2024-transforming-crypto-markets-with-titles-iii-iv-key-insights-1

Core Contributions

Author: Ricky (X: @RickyEACC)

Reviewed by: Colin Su, Grace Gui, NingNing, Owen Chen

Design: Alita Li

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。