The Battle for the Bitcoin Conversion Channel Between MicroStrategy and STRC.

Written by: MarylandHODL

Translated by: AididiaoJP, Foresight News

This article aims to reveal the specific leverage and structural dynamics behind the phenomenon, delving into the core to explore how the derivatives system and emerging financial products fit into the new framework.

The entire picture is becoming clear:

Bitcoin is the battlefield.

MicroStrategy is the signal.

And the conflict is a showdown between financialists and sovereignists.

This is not just a discussion about asset allocation, but the early stages of a transformation that could last for decades, akin to tectonic friction deep within society, ultimately leading to cracks emerging.

We now stand on this fault line.

1. The Collision of Two Systems

Matt @Macrominutes provides us with the most powerful analytical framework to date.

Financialists

Since a secret backroom deal in 1913, financialists have firmly controlled the situation. This camp includes:

- The Federal Reserve

- JPMorgan and American banking giants

- European banking families

- Globalist elites

- An increasing number of politicians entangled in interests

- And the derivatives system that has dominated global capital flows for over a century

Their power is built on synthetic monetary signals, namely the ability to create credit, shape expectations, manipulate price discovery, and control all major settlement methods.

Eurodollars, swap trades, futures, repos, forward guidance—these are their tools. Their existence relies on controlling the abstract layers that obscure the underlying currency.

Sovereignists

On the other side are the sovereignists, those pursuing a healthier, less distorted monetary system. This group does not always agree, encompassing friends and foes, individuals and nations, different political ideologies and moral frameworks.

This group includes:

- Sovereign nations seeking monetary independence

- Institutions and companies dissatisfied with the bottlenecks of the banking system

- And individuals choosing to break away from the credit system in pursuit of self-sovereignty

They view Bitcoin as an antidote to centralized monetary power, and even though many do not fully understand its implications, they intuitively recognize the core truth:

Bitcoin breaks the monopoly on currency.

And for financialists, this is intolerable.

The Trigger: The Conversion Channel

The current focus of the struggle is the conversion channel, namely the system that exchanges fiat currency for Bitcoin and Bitcoin for credit.

Whoever controls the channel controls:

- Price signals

- Collateral bases

- Yield curves

- Liquidity pathways

- And the process of transitioning between old and new monetary systems

This battle is no longer a theoretical exercise.

It has arrived, and it is accelerating.

2. Echoes of History (1900-1920)

We have experienced a similar situation, not regarding Bitcoin, but a technological revolution that fundamentally reshaped American finance, politics, and society.

Between 1900 and 1920, American industrial giants faced:

- Public outrage

- Antitrust pressures

- Political hostility

- And a crisis where their monopolistic positions could collapse

Their response was not to retreat.

But to move towards more centralized control.

The traces of these efforts are still clearly visible today:

Healthcare System

The Flexner Report (1910) unified medical education standards, eliminated age-old traditional therapies, and laid the foundation for the Rockefeller medical system, becoming the core of modern American medical power.

Education System

Industrialists funded the establishment of a standardized school system aimed at cultivating compliant workers for centralized industrial production. This system continues to this day, only shifting from serving manufacturing to serving the service industry.

Food and Agriculture

The integration of agribusiness established a food system high in calories, low in nutrition, and filled with additives and chemicals. This has reshaped the health, social dynamics, and political economy of Americans over a century.

Monetary System

In December 1913, the Federal Reserve Act introduced the European central banking model.

Ten months earlier, the federal income tax (which then only taxed income over $3,000 at 1%, equivalent to about $90,000 in 2025) created a permanent revenue channel for servicing national debt.

Thus, the foundation of the modern fiat debt system was laid.

This was the last major systemic shift, a silent reorganization of the American power structure around the core of centralized currency, controlled by an institution independent of elected government and operating under opaque rules.

We are at the next turning point.

But this time, the foundation is decentralized… and cannot be corroded.

This foundation is Bitcoin.

The participants seem familiar: on one side are the contemporary echoes of industrial giants, and on the other are Jeffersonian populists, but the stakes are higher. Financialists possess the means of manipulation and narrative control accumulated over a century, while the sovereignist camp, though fragmented, has tools that the old system never anticipated.

And since 1913, this struggle has for the first time spread into the public eye.

3. STRC: The Great Conversion Mechanism

In July of this year, MicroStrategy launched STRC ("Stretch"). Most observers dismissed it, thinking it was just another one of Michael Saylor's whimsical ideas, a special corporate lending tool or a fleeting marketing experiment.

They missed the true significance of what STRC represents.

"STRC is the great conversion mechanism of the capital markets, the first key to incentive adjustment."

STRC is the first scalable, compliant mechanism that:

- Exists within the existing financial system

- Seamlessly connects with capital markets

- Transforms the fiat savings craving for yield into real returns backed by Bitcoin collateral

When Saylor called STRC "MicroStrategy's iPhone moment," many laughed it off.

But from the perspective of the conversion channel?

STRC may actually be Bitcoin's iPhone moment, the point at which the Bitcoin price mechanism reaches a self-reinforcing equilibrium, providing a stable foothold for systemic conversion.

STRC connects Bitcoin assets, collateral bases, and Bitcoin-driven credit and yield.

This is important because, in an environment of inflation and currency devaluation, value is quietly flowing away from the uninformed. Those who understand what is happening can now obtain pure collateral, a way to store and protect personal wealth and life across time and space.

Ultimately, when trust collapses, people seek truth, and Bitcoin represents mathematical truth. STRC turns this principle into a financial engine.

It not only provides yield.

It also channels suppressed fiat liquidity into a spiraling Bitcoin collateral loop.

Financialists feel threatened, and some even understand what this means for their exploitative system.

They can sense the consequences of this expanded loop.

4. The Positive Cycle of Financialist Fear

As the U.S. attempts to "grow out" of debt pressure through monetary expansion and yield curve control, savers will chase real returns as inflation rises.

But traditional channels cannot provide this, while Bitcoin can. MicroStrategy has built an enterprise-level monetary loop:

Bitcoin appreciates:

- MicroStrategy's collateral base strengthens

- Borrowing capacity expands

- Capital costs decrease

- STRC offers attractive Bitcoin collateral yields

- Capital flows from fiat to STRC and then to Bitcoin collateral

- Bitcoin circulation tightens

- The loop repeats on a higher basis

This is the scarcity engine, a system that self-reinforces as fiat weakens.

The gap between the suppressed returns of fiat and the structural yield of Bitcoin becomes a monetary black hole.

If STRC scales up, financialists may lose control over:

- Interest rates

- Collateral scarcity

- Monetary transmission mechanisms

- Liquidity channels

- And even the capital costs themselves

This is the backdrop for the first attack.

5. Coordinated Suppression

After Bitcoin peaked on October 6:

- BTC fell from $126,000 to below $80,000

- MSTR's stock price dropped from over $360 to just over $100

- STRC remained stable amid widespread turmoil in the cryptocurrency market

- Until cracks appeared when liquidity suddenly dried up on November 13

Days later, rumors circulated that MSCI "might remove MSTR," targeting MicroStrategy directly.

This series of events seems unnatural, bearing the marks of a coordinated attack on the conversion channel for the first time. Again, this pattern is hard to ignore.

When STRC remained stable, it showcased what a well-functioning Bitcoin collateral credit engine could look like.

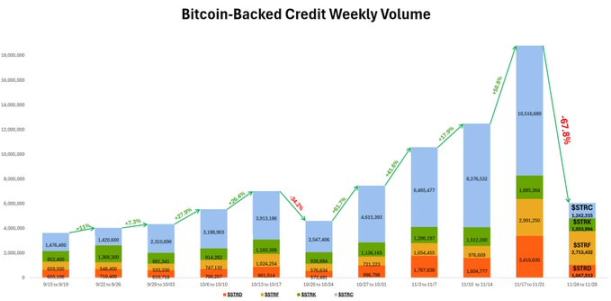

The initial data scale over the first two weeks was small but significant:

- November 3-9: $6.4 billion in volume purchased $26.2 million in BTC

- November 10-16: $8.3 billion in volume purchased $131.4 million in BTC

Do not just look at the dollar amounts; the mechanisms behind them are key.

Amplifying these mechanisms, the financialists' reactions become understandable.

If STRC scales up:

- The money market will lose significance

- The dominance of the repo market will decline

- Derivative price suppression will fail

- Bank-generated yields will collapse

- Capital flows will bypass the banking system

- The Treasury will lose control over domestic savings

- The dollar monetary base will begin to differentiate

MicroStrategy is not just launching a product; it is building a new conversion channel, and JPMorgan immediately responded.

6. JPMorgan's Counterattack: Synthetic Shadows

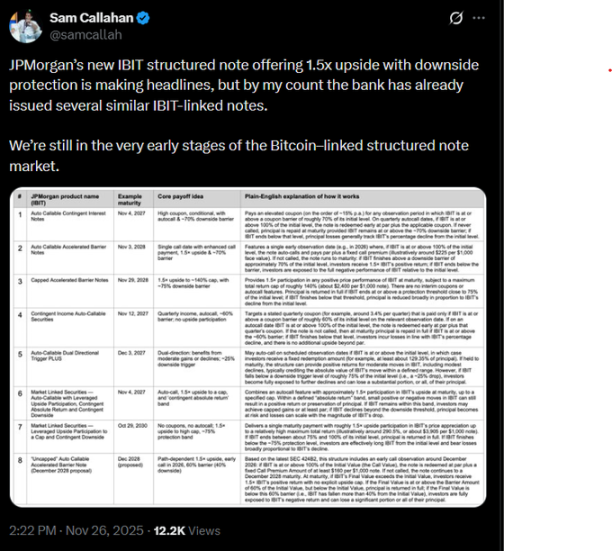

In an ideal time for structural operations during a holiday-shortened trading week, JPMorgan boldly launched a "Bitcoin-linked" structured note.

Its design reads like a confession:

- Not related to Bitcoin spot, but linked to IBIT

- Cash settled

- Does not purchase real Bitcoin

- Does not reduce market circulation

- Returns are capped

- The bank retains most of the profits

- Risks are transferred to customers

@Samcallah's findings reveal a graver reality: JPMorgan recently released a series of structured products linked to IBIT.

This is not innovation, but a centralized old trick, where profits go to the designers and losses are socialized.

This is an attempt to regain control, pulling Bitcoin risk exposure back into the banking system without touching real Bitcoin.

This is the rebirth of the paper gold system. Among them:

Synthetic Shadow = Countless Paper Bitcoins

In contrast:

- STRC requires real Bitcoin

- STRC reduces market circulation

- STRC strengthens the scarcity engine

Two products, two paradigms, one pointing to the future, the other stuck in the past.

7. Why MicroStrategy Became the Primary Target

MicroStrategy poses a threat to financialists because it is:

- The largest publicly traded Bitcoin holder

- The first corporate Bitcoin reserve bank

- The only company that monetizes Bitcoin collateral on an institutional scale

- The only regulated entity providing real yields on Bitcoin collateral

- The only bridge that can bypass all synthetic risk exposure channels

This helps explain the various pressures it has faced:

MSCI adjusting rules targeting companies with heavy Bitcoin holdings—see @martypartymusic's post:

- Credit rating agencies (products of Wall Street) barely rated MSTR preferred stock, then targeted Tether, both attempting to undermine the status of sound money as legitimate collateral

- Rumors of JPMorgan obstructing MSTR stock transfers

- BTC/MSTR synchronized declines around MSCI news

- Sudden attention from policymakers

- Banks rushing to launch synthetic Bitcoin products, trying to pull demand back into the old system

MicroStrategy is under attack, not because of Michael Saylor, but because its balance sheet structure is dismantling the financialist system.

This is still a phenomenon pattern that is not yet confirmed, but various signals resonate with each other.

8. Sovereign Layer—The Final Picture

Zooming out, the larger architecture becomes clear:

- Stablecoins will dominate the short-term yield curve.

- Bitcoin bonds will stabilize the long-term yield curve.

- Bitcoin reserves will become the anchor of sovereign balance sheets.

MicroStrategy is the prototype of a capital market-level Bitcoin reserve bank.

Sovereignists may not have explicitly articulated this plan, but they are converging in this direction, and STRC is the upstream catalyst.

Because STRC is essentially neither a debt nor an equity product, STRC is an escape mechanism, a derivative that forces fiat currency to dissolve in scarcity through a violent chemical reaction.

It breaks the following monopolies:

- Sources of yield

- Collateral systems

- Monetary transmission mechanisms

And it is achieved from within the old system, leveraging the system's own regulatory framework.

9. The Moment We Are In

To this day, the inherent devaluation of fiat currency has become a simple and undeniable mathematical fact, increasingly evident to the public. If Bitcoin is used as a tool by sovereignists, the financialist system could collapse as quickly as the Berlin Wall.

Because ultimately, when the truth is allowed to surface, its victory often comes swiftly.

- Bitcoin is the battlefield

- MicroStrategy is the signal

- STRC is the bridge

The war unfolding before us is a battle for the conversion channel between fiat currency and Bitcoin.

This war will define this century.

For the first time in 110 years, both sides have revealed their cards.

To be alive at this moment is truly extraordinary.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。