Watching Crypto Twitter, the profit-making effect is gone

Author: Lauris

Translation: Shenchao TechFlow

Welcome to the "Post-Crypto Twitter" era

The term "Crypto Twitter" (CT) refers to Crypto Twitter as a market discovery and capital allocation engine, rather than the entire crypto community on Twitter.

"Post-Crypto Twitter" (Post-CT) does not mean the disappearance of discussions, but rather that Crypto Twitter as a mechanism for "coordinating through discourse" is gradually losing its ability to repeatedly create significant market events.

A single culture cannot continue to attract the next wave of new participants if it can no longer produce a sufficient number of significant winners.

The "significant market events" mentioned here do not refer to situations like "a certain token's price tripled," but rather to the attention of most liquidity market participants being focused on the same thing. In this framework, Crypto Twitter was once a mechanism that transformed public narratives into a coordinated flow around a dominant meta-narrative. The significance of the "Post-Crypto Twitter" era is that this transformation mechanism is no longer reliably functioning.

I am not trying to predict what will happen next. Frankly, I do not have a clear answer. The focus of this article is to explain why the previous model worked, why it is declining, and what this means for how the crypto industry reorganizes itself.

Why did Crypto Twitter work?

Crypto Twitter (CT) is important because it compresses three market functions into one interface.

The first function of Crypto Twitter is narrative discovery. CT is a high-bandwidth salience mechanism. "Salience" is not just an academic term for "interesting," but a market term that refers to how the spectrum converges on what is currently worth paying attention to.

In practice, Crypto Twitter creates a focal point. It compresses a vast hypothesis space into a small number of "actionable" objects at the moment. This compression solves a coordination problem.

To put it more mechanically: Crypto Twitter transforms dispersed, private attention into visible, public common knowledge. If you see ten credible traders discussing the same object, you not only know of its existence, but you also know that others are aware of it, and you know that others know you know of its existence. In liquidity markets, this common knowledge is crucial.

As Herbert A. Simon said:

"The richness of information leads to a poverty of attention."

The second function of Crypto Twitter is to act as a trust router. In the crypto market, most assets do not possess strong intrinsic value anchors in the short term. Therefore, capital cannot be allocated solely based on fundamentals, but flows through people, reputations, and ongoing signals. "Trust routing" is an informal infrastructure that determines whose claims can be believed early enough to have an impact.

This is not a mysterious phenomenon, but rather a rough reputation function calculated continuously by thousands of participants in public settings. People infer who the early entrants are, who has good pre-judgment, who has resource channels, and whose actions are associated with positive expected value (Positive EV). This layer of reputation makes capital allocation possible without formal due diligence, as it serves as a simplified tool for selecting counterparties.

It is worth noting that the trust mechanism of Crypto Twitter does not solely depend on "follower count." It is a composite result of follower count, who follows you, the quality of replies, whether credible people interact with you, and whether your predictions withstand reality checks. Crypto Twitter makes these signals easy to observe and at a very low cost.

Crypto Twitter has both public trust, while over time, certain communities have gradually formed a tendency to emphasize private trust.

The third function of Crypto Twitter is to transform narratives into capital allocation through reflexivity. Reflexivity is the key to this core loop: narratives drive prices, prices validate narratives, validation attracts more attention, and attention brings more buyers, with this loop continuously reinforcing itself until it collapses.

At this point, the microstructure of the market comes into play. Narratives do not abstractly drive the "market," but rather drive order flow. If a large group is persuaded by a narrative that a certain object is "key," then marginal participants will express this belief through purchases.

When this loop is strong enough, the market temporarily tends to reward behaviors that align with consensus rather than the ability for deep analysis. In hindsight, Crypto Twitter was almost like a "low-IQ version of a Bloomberg terminal": a single information stream that integrates salience, trust, and capital allocation.

Why was the "single culture" era possible?

The "single culture" era was possible because it had a repeatable structure. Each cycle would revolve around an object simple enough for large groups to understand, yet broad enough to attract the attention and liquidity of most of the ecosystem. I like to refer to these objects as "toys."

The term "toys" is not derogatory, but rather a structural description. It can be understood as a game—easy to explain, easy to participate in, and inherently social (almost like an expansion pack for a massively multiplayer online role-playing game). A "toy" has a low barrier to entry and a high degree of narrative compressibility, allowing you to explain what it is to a friend in one sentence.

The "meta-narrative" manifests when "toys" become a shared game board. Meta refers to the dominant set of strategies and the dominant objects around which most participants revolve. The power of the "single culture" lies in the fact that this meta-narrative is not just "popular," but a shared game across users, developers, traders, and venture capitalists. Everyone is playing the same game, just at different levels of the stack.

@icobeast once wrote a brilliant article about the cyclical nature and changing essence of "trendy things," which I highly recommend reading.

https://x.com/icobeast/status/1993721136325005596

The market system we have experienced requires a "window of inefficiency" that allows people to quickly earn "incredible wealth."

In the early stages of each cycle, the market is not fully efficient because the infrastructure for large-scale participation in the meta-narrative has not yet been fully established. While opportunities exist at this time, the market's niche space has not been completely filled. This is crucial because the widespread accumulation of wealth requires a window period that allows a large number of participants to enter the market, rather than facing a completely hostile environment from the start.

As George Akerlof said in "The Market for Lemons":

"The information asymmetry between buyers and sellers leads the market away from efficiency."

The key is that for this system to work, you need to provide a highly efficient market for some people, while for others, this market is a typical "lemon market" (i.e., a market filled with information asymmetry and inefficiency).

The single culture system also requires a large-scale shared context, and Crypto Twitter (CT) provided this context. Shared context is rare on the internet because attention is usually dispersed. However, when a single culture forms, attention tends to concentrate. This concentration can lower coordination costs and amplify the effects of reflexivity.

As F. A. Hayek said in "The Use of Knowledge in Society":

"The information about the circumstances we must utilize never exists in a concentrated or integrated form, but is dispersed among all individuals in those incomplete and often contradictory bits of knowledge."

In other words, the formation of a shared context allows market participants to coordinate actions more efficiently, thus promoting the prosperity and development of the single culture.

Why was the "single meta-narrative" once so credible? When the constraints of fundamentals on the market are weak, salience becomes a more important constraint than valuation. The primary question for the market is not "How much is it worth?" but "What are we all paying attention to? Is this trade already too crowded?"

A rough analogy is that popular culture was once able to concentrate attention on a few shared objects (like the same TV shows, chart-topping music, or celebrities). Nowadays, attention is dispersed across various niche areas and subcultures, and people no longer share the same reference set on a large scale. Similarly, Crypto Twitter (CT) as a mechanism is also undergoing a similar transformation: the top-level shared context is diminishing, while more localized contexts are beginning to appear in smaller circles.

Why is the "Post-Crypto Twitter" era coming?

The emergence of "Post-Crypto Twitter" (Post-CT) is due to the gradual failure of the conditions that support the "single culture."

The first failure is that "toys" are being cracked faster.

In previous cycles, the market learned the rules of the game and industrialized these rules. Once the game rules are industrialized, the window of inefficiency closes faster, and its duration becomes shorter. The result is that the distribution of returns becomes more extreme: there are fewer winners, while structural losers increase.

Memecoins are a typical example of this dynamic. As an asset class, they are effective because they have low complexity while possessing high reflexivity. However, it is precisely this characteristic that makes memecoins easy to produce in bulk. Once the production line matures, the meta-narrative becomes an assembly line.

As the market develops, the microstructure has changed. The median participant is no longer trading with other ordinary people but is instead in opposition to the system. By the time they enter the market, information has been widely disseminated, liquidity pools have been "pre-buried," trading paths have been optimized, insiders have completed their layouts, and even exit paths have been pre-calculated. In such an environment, the expected returns for the median participant are compressed to very low levels.

In other words, in most cases, you simply become someone else's "exit liquidity."

A useful mental model is that order flow in the early stages of a cycle is primarily dominated by naive individual investors, while order flow in the later stages of a cycle increasingly exhibits adversarial and mechanized characteristics. The same "toy" can evolve into completely different games at different stages.

A single culture cannot sustain itself if it cannot produce enough significant winners to attract the next wave of new participants.

The second failure is that value extraction has overwhelmed value creation.

Here, "extraction" refers to those actors and mechanisms that capture liquidity value rather than create new liquidity.

In the early stages of a cycle, new participants can increase net liquidity while benefiting from it, as the pace of market expansion outstrips the harvesting speed of the value extraction layer. However, in the later stages of a cycle, new participants often become net contributors to the value extraction layer. When this sentiment becomes widely recognized, market participation begins to decline. The decline in participation weakens the strength of the reflexive loop.

This is also why changes in market sentiment are so consistent. If a market no longer provides broad, clear paths to victory, overall sentiment gradually deteriorates. In a market where the median participant experiences "I am just someone else's liquidity," cynicism often becomes rational.

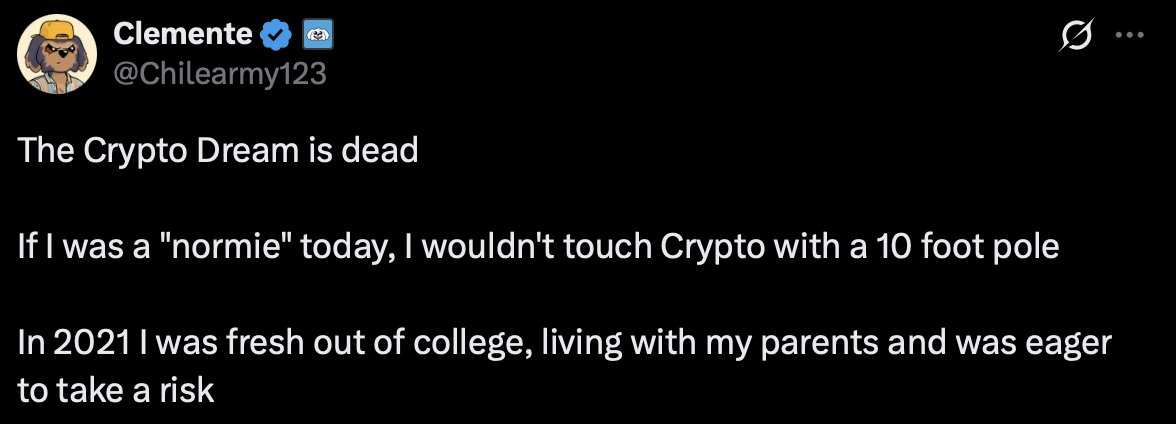

To understand the overall market sentiment of current retail participants, you can refer to @Chilearmy123's post.

The third failure lies in the dispersion of attention. When no single object can attract the attention of the entire ecosystem, the market's "discovery layer" loses clear salience. Participants begin to differentiate into narrower fields. This dispersion is not only cultural but also brings significant market consequences: liquidity is spread across different segments, price signals become less intuitively visible, and the dynamic of "everyone is making the same trade" disappears.

Additionally, there is another factor that needs to be briefly mentioned: macroeconomic conditions can affect the strength of the reflexive loop. The "single culture" era coincided with a period of strong global risk appetite and liquidity environment, making speculative reflexivity appear as a "norm." However, when capital costs rise and marginal buyers become more cautious, narrative-driven capital flows become harder to sustain in the long term.

What does "Post-Crypto Twitter" mean?

"Post-Crypto Twitter" (Post-CT) refers to a new market environment in which Crypto Twitter is no longer the primary coordinating mechanism for capital allocation across the entire ecosystem, nor is it the core engine around which on-chain markets concentrate on a single meta-narrative.

In the "single culture" era, Crypto Twitter repeatedly and massively linked narrative consensus with liquidity concentration. In the "Post-Crypto Twitter" era, this connection becomes weaker and more intermittent. Crypto Twitter still holds significance as a discovery platform and reputation indicator, but it is no longer the reliable driving engine that synchronizes the entire ecosystem around "a trade," "a toy," or "a shared context."

In other words, Crypto Twitter can still generate narratives, but only a few narratives can translate into "common knowledge" on a large scale, and even fewer "common knowledge" narratives can further translate into synchronized order flows. When this transformation mechanism fails, even if many activities are still happening in the market, the overall feeling may seem "quieter."

This is also why subjective experiences have changed. The market now appears slower and more specialized because broad coordination has disappeared. The emotional shift is primarily a response to expected value (EV) conditions. The market's "quietness" does not mean there is no activity, but rather a lack of narratives and synchronized actions that can resonate globally.

The Evolution of Crypto Twitter: From Engine to Interface

Crypto Twitter (CT) will not disappear; rather, its function has shifted.

In the early market system, Crypto Twitter was upstream of capital flow, to some extent determining the direction of the market. In the current market system, Crypto Twitter is closer to an "interface layer": it broadcasts reputation signals, surfaces narratives, and helps route trust, but actual capital allocation decisions are increasingly happening in higher-trust "subgraphs."

These subgraphs are not mysterious. They are dense networks with higher information quality and frequent interactions among participants, such as small trading circles, specific community niches, private group chats, and institutional discussion spaces. In this system, Crypto Twitter resembles a superficial "facade," while real social and trading activities occur in the underlying social network layer.

This also explains a common misconception: "Crypto Twitter is declining" usually means "Crypto Twitter is no longer the primary place for ordinary participants to make money." Wealth is now more concentrated in places with higher information quality, restricted access, and more private trust mechanisms, rather than through public, noisy trust calculations.

Nevertheless, you can still achieve considerable gains by posting on Crypto Twitter and building a personal brand (some of my friends and nodes have done this and continue to do so). However, true value accumulation comes from building your social graph, becoming a trusted participant, and gaining more access to the "back-end layer."

In other words, surface-level brand building remains important, but the core competitiveness has shifted to building and participating in the "back-end trust network."

I don't know what will happen next

I won't pretend to accurately predict what the next "single culture" (Monoculture) will be. In fact, I am skeptical about whether a "single culture" will form in the same way again, at least under the current market conditions. The key is that the mechanisms that once nurtured the "single culture" have degraded.

My intuition may carry some subjectivity and contextuality, as it is based on the phenomena I currently observe. However, these dynamics began to manifest earlier this year.

There are indeed some active areas, and it is not difficult to list those categories that attract attention. But I will not mention these areas, as it does not substantively help the discussion. Overall, aside from pre-sales and some initial distributions, the trend we see now is that the most overvalued categories are often "adjacent" to Crypto Twitter (CT), rather than directly driven from within Crypto Twitter.

Argument

We have entered the "Post-Crypto Twitter" (Post-CT) era.

This is not because Crypto Twitter is "dead," nor because discussions have lost their meaning, but because the structural conditions supporting the repeated emergence of a systemic "single culture" have been weakened. The game has become more efficient, the value extraction mechanisms have matured, attention has become more dispersed, and the reflexive loop has gradually shifted from systemic to localized.

The crypto industry continues, and Crypto Twitter still exists. My viewpoint is narrower: the era in which Crypto Twitter could reliably coordinate the entire market into a shared meta-narrative and create widespread, low-barrier nonlinear gains has at least currently ended. Moreover, I believe the likelihood of this phenomenon reappearing in the next few years is significantly reduced.

This does not mean you cannot make money, nor does it mean the crypto industry is coming to an end. This is neither a pessimistic viewpoint nor a cynical conclusion. In fact, I have never been as optimistic about the future of this industry as I am now. My point is that the future distribution of markets and salience mechanisms will fundamentally differ from those of the past few years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。